Create and Post Stakeholder Reporting Journals

Create and post stakeholder reporting journals to stakeholder reporting ledgers in the General Ledger.

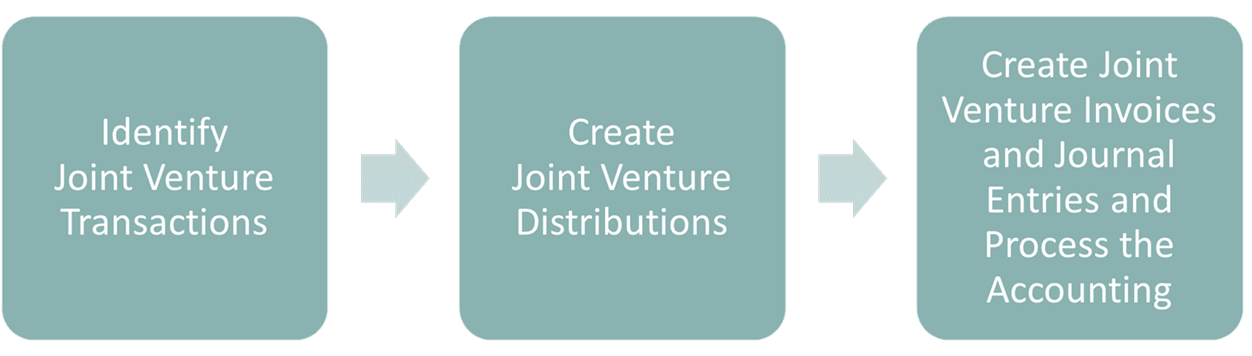

The following illustration and the details that follow describe the processes that you must run before you can create stakeholder reporting journals for stakeholder reporting:

| Process | Results |

|---|---|

| Identify Joint Venture Transactions |

This process identifies the following transactions:

It also identifies transactions created by Joint Venture Management or transactions associated with them:

|

| Create Joint Venture Distributions | This process creates distributions for transactions identified by the preceding process. |

| Create Joint Venture Invoices and Journal Entries (and process the accounting) | The Create Joint Venture Invoices process includes modes for creating invoices and internal transfer journals. You can then process the accounting for each. |

This initial processing generates transactions from the accounting of joint venture invoices and internal transfer journals. These transactions must be processed by Joint Venture Management to create stakeholder reporting journals for posting to a stakeholder reporting ledger in the General Ledger.

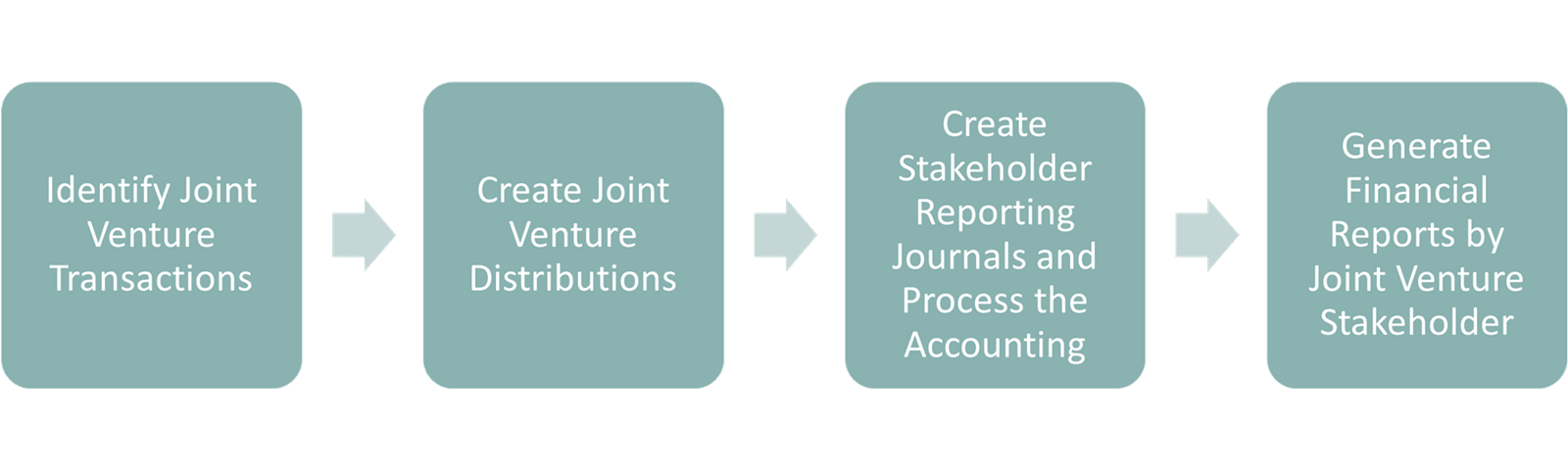

The following illustration and the details that follow describe the processes for creating and posting stakeholder reporting journals. You can run these processes as part of your month-end or period-close activities.

| Process | Results |

|---|---|

| Identify Joint Venture Transactions |

This process identifies the following transactions processed by or created from Joint Venture Management:

In the Joint Venture Transactions work area, you can identify

these transactions by the following attributes:

|

| Create Joint Venture Distributions | This process creates distributions for each transaction identified by the preceding process. |

| Create Stakeholder Reporting Journals and Process the Accounting | You run the Create Joint Venture Invoices and Journal Entries in the “Create Stakeholder Reporting Journals” process mode. This process creates stakeholder reporting journals for distributions whose stakeholder reporting status is Available to Process. After the process is run, the stakeholder reporting status changes to Accounting in Progress. Next, you run the Create Accounting for Joint Ventures process with “Stakeholder Reporting” for the process category. This creates accounting entries for stakeholder reporting journals in the stakeholder reporting ledger. Lastly, you run the Create Joint Venture Invoices and Journal Entries process in the “Update Accounting for Journals” process mode. This process updates the stakeholder reporting status of distributions to Process Complete and updates the accounting header on the distribution details page to Final Accounted. |

In the Joint Venture Distributions work area, you can find stakeholder reporting information for processed distributions on the distribution details page. The “Stakeholder reporting book information” on this page shows the stakeholder reporting ledger, accounting header ID, date, and status.