Overview of Canadian Tax Credit Information Cards

Tax Credit Information calculation cards store the information required to accurately calculate federal and provincial taxes for an employee.

Considerations and Prerequisites

If the product license is set to Payroll or Payroll Interface, Tax Credit Information calculation cards are auto-generated for your Canadian new hires. You then need to:

- Update the Canadian Taxation, Federal Tax, Employment Insurance, and Canada Pension Plan card components, if applicable.

- Create a Provincial Tax card component, if applicable.

- Create a Payroll Tax card component, if applicable.

- Create a Quebec Tax card component, if applicable.

- Create a tax reporting unit association for the Canadian Taxation card component.

If your employees were created in the Oracle Human Capital Management Cloud without a Payroll or Payroll Interface license then you need to create the complete Tax Credit Information calculation card.

Generating the Surrogate ID of the Tax Reporting Unit

The component sequence for the Canadian Taxation card component is the surrogate ID of the employee's tax reporting unit. It is an application-generated value to uniquely identify the tax reporting unit. You may use the Tax Reporting Unit BI Publisher report to extract your tax reporting units and their surrogate ID values. Refer to the Cloud Customer Connect topic Report: Tax Reporting Unit.

Example Files

In addition to the example files provided in topics within this section, refer to Cloud Customer Connect’s HCM Integration resource sharing center for examples of how to create complete Tax Credit Information calculation cards.

Tax Credit Information Card Record Types

The Tax Credit Information card is bulk-loaded using the Global Payroll Calculation Card business object. This generic object hierarchy provides record types to support the various localization requirements.

| Component | Functional Description | File Discriminator |

|---|---|---|

| Calculation Card | Defines the calculation card type and the employee assignment that it captures information for. | CalculationCard |

| Card Component | Used to group and segregate data required by the calculation card. The following sections describe the card components applicable to this calculation card and the child records that are required for each card component. | CardComponent |

| Component Detail | Supply a component detail record for each flexfield context required by each card component. | ComponentDetail |

| Calculation Value Definition | Allows the creation of value definitions so that overriding values can be specified on the card component. Details of the specific value definitions are provided in the following sections. | CalculationValueDefinition |

| Enterable Calculation Value | Used to specify an overriding value for each calculation value definition. | EnterableCalculationValue |

| Component Association | Associates the Canadian Taxation component with the Tax Reporting Unit the employee reports to. | ComponentAssociation |

| Component Association Detail | Associates the Canadian Taxation component with the employee’s assignments. | ComponentAssociationDetails |

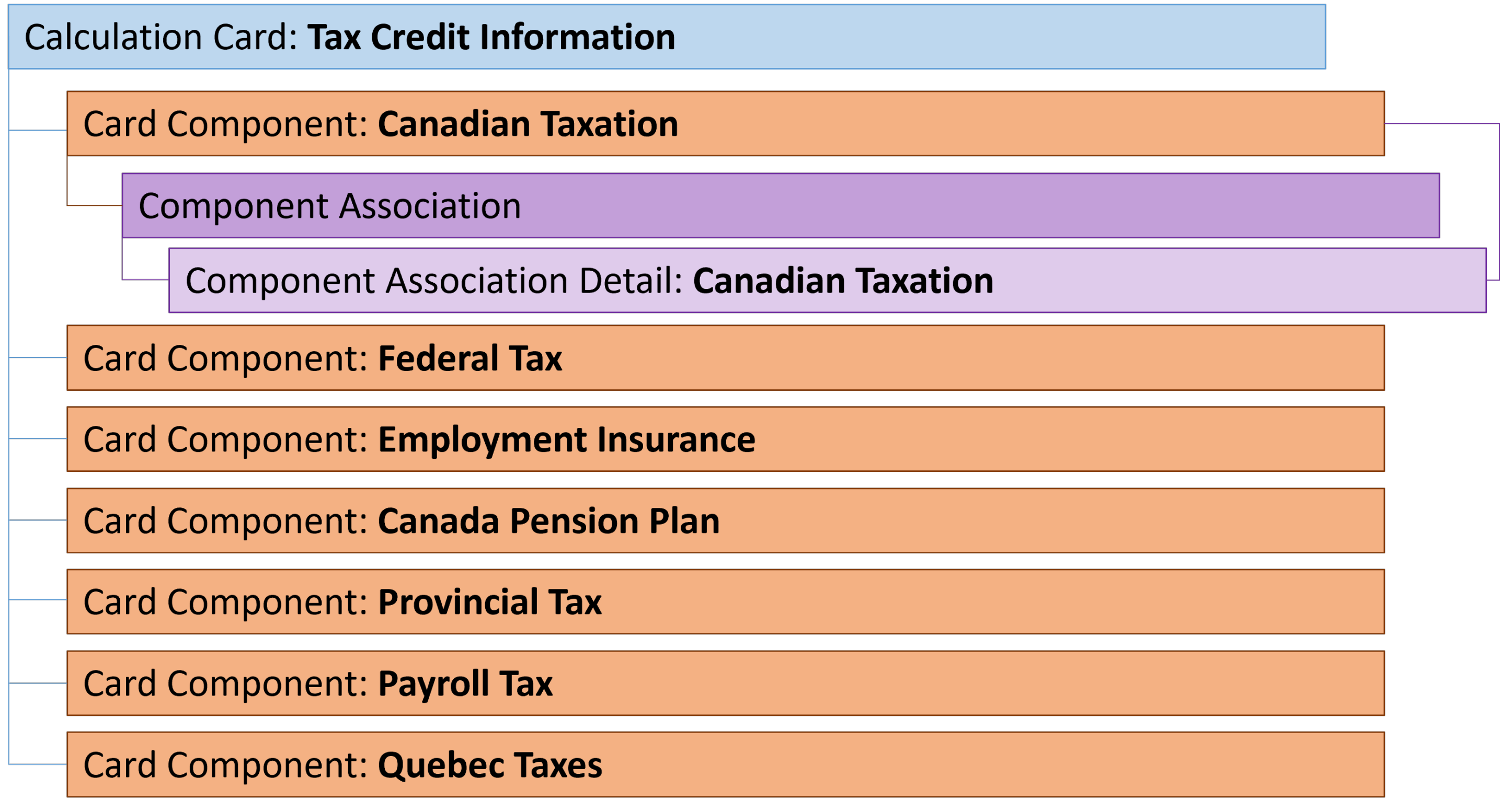

Tax Credit Information Calculation Card Hierarchy

The hierarchy of Calculation Card components applicable to Tax Credit Information are described in this diagram:

The card components can have flexfield segments and override values. This section has topics that describe how to provide data for each card component and the component association.