Overview of US Tax Withholding Cards

Tax Withholding calculation cards store all the information required to accurately compute federal, state and local taxes for an employee.

Considerations and Prerequisites

If the product license is set to Payroll or Payroll Interface, Tax Withholding calculation cards are autogenerated for your US new hires. You then need to:

- Update US Taxation and Federal Taxes

- Create State Taxes, including any county, city and school taxes applicable to the state. You need to determine the correct Vertex Geography codes for each component you are creating. For details on how to retrieve the appropriate codes, refer to the BI Publisher Report attachment in My Oracle Support under Document ID: 2558276.1.

- Create a tax reporting unit association for the US Taxation card component.

If your employees were created in the Oracle Human Capital Management Cloud without a Payroll or Payroll Interface license then you need to create the complete Tax Withholding card.

Tax Withholding Card Record Types

The Tax Withholding card is bulk-loaded using the Global Payroll Calculation Card business object. This generic object hierarchy provides record types to support the various localization requirements.

| Component | Functional Description | File Discriminator |

|---|---|---|

| Calculation Card | Defines the calculation card type and the employee assignment that it captures information for. | CalculationCard |

| Card Component | Used to group and segregate data required by the calculation card. The following sections describe the card components applicable to this calculation card and the child records that are required for each card component. | CardComponent |

| Calculation Value Definition | Allows the creation of value definitions so that overriding values can be specified on the card component. Details of the specific value definitions are provided in the following sections. | CalculationValueDefinition |

| Enterable Calculation Value | Used to specify an overriding value for each calculation value definition. | EnterableCalculationValue |

| Card Association | Associates the calculation card with the Tax Reporting Unit the employee reports to. | CardAssociation |

| Card Association Detail | Associates card components with the employee’s assignments. | CardAssociationDetails |

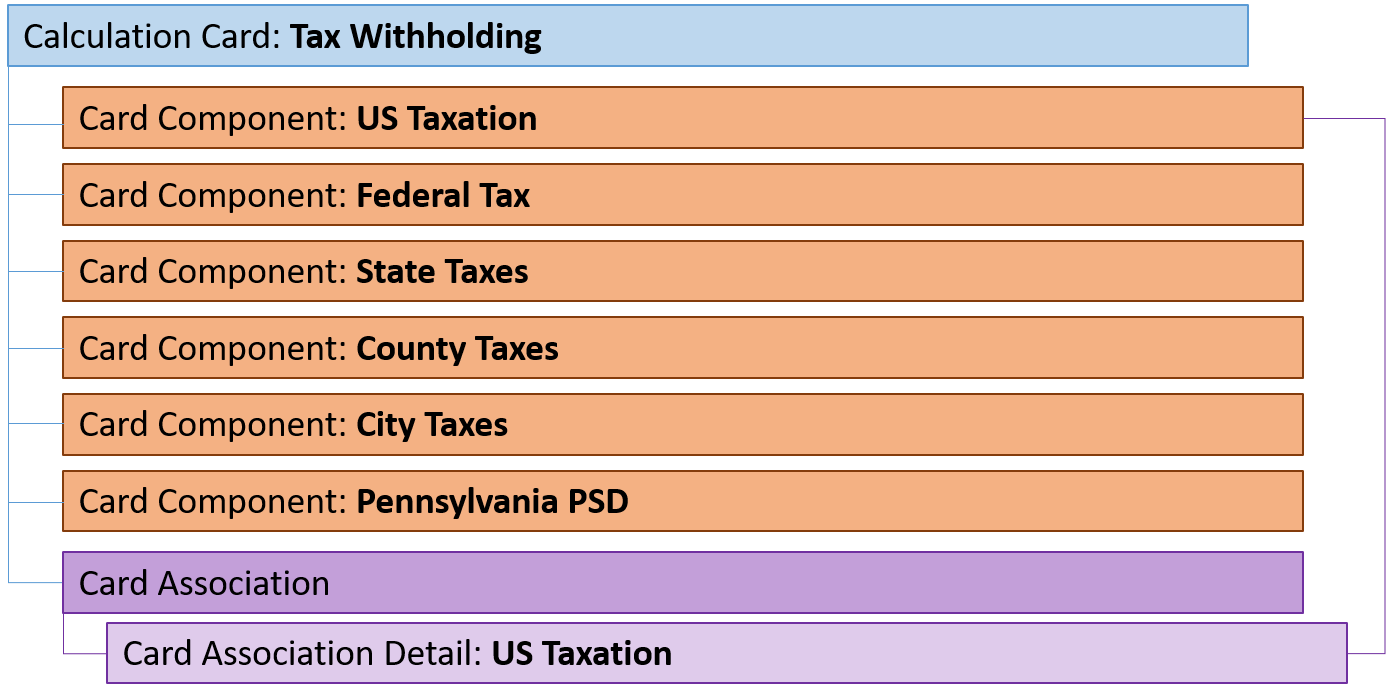

Tax Withholding Calculation Card Hierarchy

The hierarchy of Calculation Card components applicable to Tax Withholding are

described in this diagram:

Each card component has multiple calculation value definitions. A separate section follows to describe how to provide data for each card component and the card association.

Example Files

There are a number of topics in this section which provide example files for each card component. You can also find larger file examples on Cloud Customer Connect. Refer to these topics:

- Example: HCM Data Loader - Create US Tax Withholding Card

- Example: HCM Data Loader - Create US State Taxes for an Existing Tax Withholding Card

- Example: HCM Data Loader - Create US Tax Withholding Card for Pennsylvannia

- Example: HCM Data Loader - Update US Tax Withholding Card for Complex Transfer Scenario

- Guidelines for Loading Calculation Cards

- Guidelines for Loading US Tax Witholding Cards

- Guidelines for Loading US Taxation Card Components

- Guidelines for Loading US Federal Taxes Card Components

For more related help topics, see the related information section.