Typical Setup Tasks for Temporal Event Processing

This table describes related implementation steps for the predefined temporal life event types.

|

Setup Step |

Task in the Plan Configuration work area |

|---|---|

|

Define derived eligibility factors |

Manage Derived Factors |

|

Use derived factors in eligibility profiles |

Manage Eligibility Profiles |

|

Attach eligibility profiles to benefits offerings, variable rates, and variable coverages. |

Manage Program and Plan Configuration Details: Eligibility step Manage Variable Rate Profiles Manage Variable Coverage Profiles |

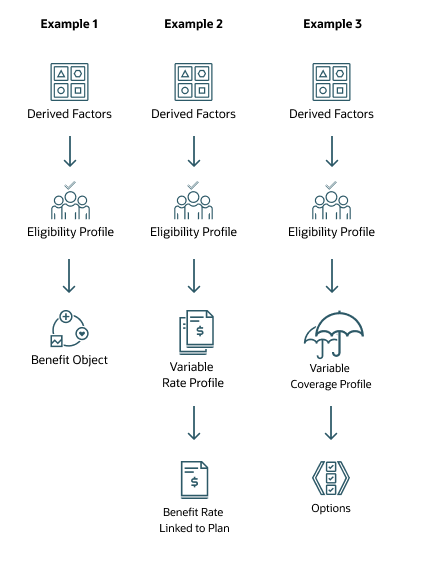

Here's a diagram that illustrates typical setup configurations for temporal life events.

An eligibility profile makes an employee eligible or ineligible for a benefits offering. For example, if a person should be eligible for a benefit when they’ve worked for the organization for 90 days, you use a regular eligibility profile and include the appropriate derived factors.

If you want to use a temporal life event to change a rate or coverage when an age or length of service is reached, along with from an eligibility profile to determine eligibility, you need to create a variable rate or variable coverage profile too. For example, you use a variable rate profile where the cost of life insurance increases or decreases when the participant reaches a certain age. Alternatively, you use a variable coverage profile where you want to adjust or replace the standard coverage calculation when age or length of service changes. For example, you want to reduce coverage by 0.5% when the participant reaches the age of 65.

You also need to configure the application to determine what the change to the coverage or rate is, and how to apply that change. You do this by applying a calculation method to change the rate or coverage. You also need to define a treatment rule that tells the variable coverage or variable rate amount to add to, multiply by, subtract from, or replace the coverage or rate amount.

For example, if you want to reduce coverage by 65 percent at the age of 65 for participants who elected the 2x compensation option, you need to configure the calculation method accordingly. For example, you need to specify in the calculation method that it's a plan contribution that is going to be affected. You can also specify that you want to subtract the amount from the 2x compensation coverage using a multiplier and the appropriate coverage profile to use.