Examples of HCM Organization Models

This topic explains the different models you can use for setting up organizations for Canada.

The setup procedure for each model is the same, but the jurisdictions and registrations differ depending on the payroll statutory unit (PSU) and the tax reporting units (TRUs) of each model.

The organization model for Canada has these characteristics:

-

The legal entity is usually the legal employer and PSU.

-

TRUs are defined in relation to a legal employer.

-

It is common for employers to have multiple TRUs in a single PSU as in the case of employers with multiple employment insurance rates.

These examples show how to partition payroll data within a legislative data group.

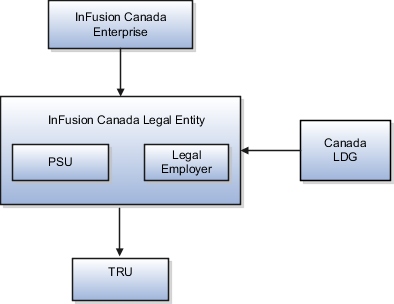

Single PSU with Single Legal Employer and Single TRU

This example illustrates the basic model for setting up a single location organization. InFusion Canada is a legal entity registered with the Canada Revenue Agency.

Setup for this model involves these basic steps:

-

Create a Canadian Enterprise in the Enterprise Structures Configurator (ESC). The Enterprise classification represents the top most structure of the organization.

-

Use the Functional Setup Manager (FSM), to create a Canadian LDG.

-

In the Setup and Maintenance area, go to the following:

-

Offering: Workforce Deployment

-

Functional Area: Legal Structures

-

Task: Define Enterprise Structures for Human Capital Management.

Expand the task to display a set of related tasks. Use the Manage Legal Entities task to create a legal entity. You can define it as a legal employer and a PSU, or as a legal employer with another PSU from the list of values.

When you define the legal entity, enter the registration information required by Canada Revenue Agency for employers to remit and report Canada Pension Plan, Employment Insurance, and Federal Tax deductions.

A legal reporting unit (LRU) is created automatically when a legal entity is created. In HCM payroll, it's referred as a TRU. The registration information of the Canada Federal Tax jurisdiction defaults to the TRU.

-

-

If you operate in the province of Quebec, set up the registration for the Quebec Provincial Tax jurisdiction. This is where you set the Quebec Identification Number (QIN) as the Legal Reporting Unit Registration Number. Set up this registration at the PSU or TRU, depending on your requirements. When it's set up at the PSU level, the information defaults to each TRU under that PSU. If a different registration information is required for one of the TRUs, use the Manage Legal Reporting Unit Registrations task to enter the appropriate information for the Quebec Provincial Tax jurisdiction for that TRU. This information overrides the registration information defaulted from the PSU.

Enter the QIN and optionally, the Quebec Enterprise Number. The QIN is the payroll registration number under which an employer remits and reports the Quebec Pension Plan, Quebec Parental Insurance Plan, and Provincial Tax deductions.

-

Enter the LRU information. Set the Legal Reporting Unit Classification to Tax Reporting Unit on the Manage Legal Reporting Unit HCM Information page.

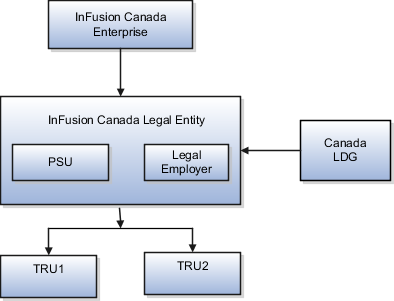

Single PSU with Single Legal Employer and Multiple TRUs

In this example, InFusion Canada has locations in Ontario and Quebec and they have a wage loss replacement plan for some of their employees. The employer has two employment insurance rates. The setup procedure for this model is the same as above, except that you create an additional TRU under the PSU.

Use the Manage Legal Reporting Unit task to create a new LRU tied to the main legal entity. Enter the necessary details for the new LRU.

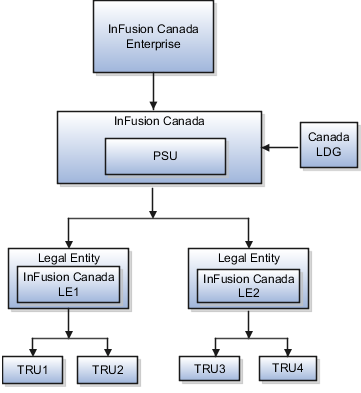

Single PSU with Multiple Legal Employers and Multiple TRUs

You can have two different types of setup for this model:

-

Single PSU with multiple legal employers and multiple TRUs where each legal employer is associated with a single TRU.

-

Single PSU with multiple legal employers and multiple TRUs, where each legal employer is associated with multiple TRUs.

In this example, InFusion Canada has two legal employers, InFusion Canada LE1 and InFusion Canada LE2, both belonging to the same PSU.

The setup procedure for this model is the same, except that you create two separate legal entities and designate them as legal employers. The first legal entity, InFusion Canada LE1, is designated as a PSU, For InFusion Canada LE2, you must select the PSU as InFusion Canada LE1. Every legal employer under the same PSU must be configured similarly.

Capture the jurisdictions and registrations as required.