Payroll Relationship Rules

Canada supports the Lifetime Rule for payroll relationships. When you create a work assignment, the application looks for an active payroll relationship of the same payroll relationship type and payroll statutory unit.

If a payroll relationship exists, the new work assignment is attached to it; otherwise, a new payroll relationship is created.

When you terminate a work assignment, the associated payroll relationship remains active even though it doesn't have a work assignment associated with it. In the case of a rehire, the new work assignment is attached to an existing active payroll relationship and the existing balances are updated.

Payroll Relationship and Termination Dates

When you terminate an employee or end an assignment record, the Payroll Relationship page displays the corresponding dates. These dates control how earnings and deductions are processed for the terminated employment record.

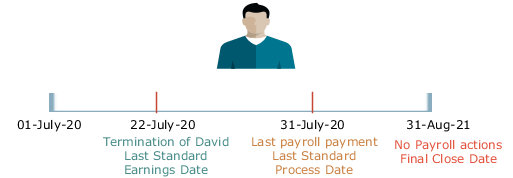

For example, David Ellis resigned from his teaching post at Royal High School, and his line manager enters a termination date of 22-July-2020. The application will process David's last payroll payment for 31-July-2020. You can view these termination dates on the payroll relationship page for David. These dates show up at all the employment levels of David, such as assignment, associated payroll, and payroll relationship.

This image shows David's Ellis payroll processing dates and the behavior of the application for handling the payroll records:

|

Name |

Date |

Application Behavior |

|---|---|---|

|

Last Standard Earnings Date |

22-JUL-2020 |

Sets the Last Standard Earnings Date as David's termination date. |

|

Last Standard Process Date |

31-JULY-2020 |

Sets the Last Standard Process Date as the process date of the payroll period in which David's termination occurred. |

|

Final Close Date |

31-AUG-2021 |

Enter a Final Close Date on David's assignment. This date will carry over to David's payroll and payroll relationship records. The Final Close Date ends the payroll records. You can't perform any payroll actions for David after this date, such as calculate payroll, make retro payments, or balance adjustments. The date you provide would depend on your business requirements, such as when your company makes commission payments to terminated employees. However, the best approach is to enter a Final Close date that falls after tax year-end. You can perform any balance adjustments as part of your year-end processing. Note: If you enter a Final Close date for a person who

has other active assignments, the payroll relationship still remains

active.

|

|

End Date |

31-AUG-2021 |

This date is defaulted when you enter the Final Close Date. |