Examples of HCM Organization Models for India

Let's look at examples of different models for organizations in India for Human Capital Management (HCM). Each example comprises of an enterprise, legal entity – legal employer / PSU and TRU, department, etc.

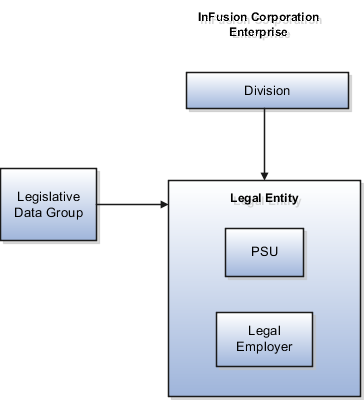

Single Company with Single Payroll Statutory Unit and Single Tax Reporting Unit

Let's look at an example of InFusion India, a registered company as per Registrar of Companies Act at New Delhi, with a head office and multiple departments (HR, Marketing & Finance) in New Delhi. The company is registered with income tax with a single permanent account number (PAN) and tax account number (TAN). It has separate (single) registration with Professional Tax, Provident Fund, Employee State Insurance Shops/Establishment acts and submits separate statutory reports at the end of the year. The company has a single payroll, with full time employees.

Setup for this organizational model involves these steps:

-

Define the Enterprise and Business Unit classification for InFusion India.

-

Define a single Legislative Data Group for InFusion India.

-

Define the Legal Entity, Legal Employer Check the legal employer attribute in Legal Entity (Registered company is the legal entity and hence the legal employer.)

- Create Reporting Establishment – InFusion India and its attributes (for Establishment) in Legal Entities form (XLE).

- Department: Set up Head Office, HR, Marketing/Sales and Finance using Department Classification in the Business Unit.

- Set the Legal Reporting Unit Classification to Tax Reporting Unit on the Manage Legal Reporting Unit HCM Information page.

- Set the Payroll Statutory Unit attribute in Legal Entity. (In case of IN, PSU is equivalent to Legal Employer).

- Define separate tax reporting units needed to calculate payroll deductions, such

as:

Tax Reporting Units Description Income Tax (IT) Required for calculating and reporting the employee's income tax Provident Fund (PF) Required for calculating and reporting the employee's provident fund contribution Professional Tax (PT) Required for calculating and reporting the professional tax contribution Employee State Insurance (ESI) Required for calculating and reporting the employee state insurance contribution Labour Welfare Fund (LWF) Required for calculating and reporting the labour welfare fund contribution National Pension Scheme (NPS) Required for calculating and reporting the contribution towards the national pension scheme.

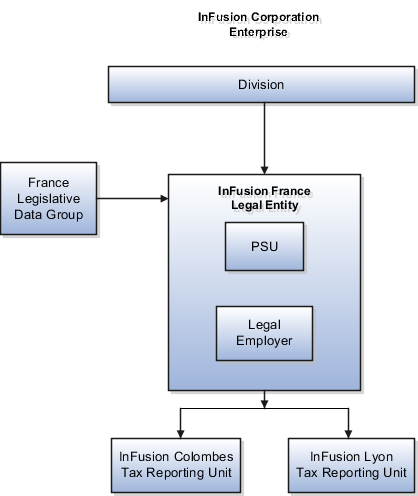

Single Company with Single Payroll Statutory Unit and Multiple Tax Reporting Units

Let's look at an example of InFusion Mumbai, a registered company as per Registrar of Companies Act at Mumbai, with a head office at Mumbai. The company has multiple reporting establishments in different states with separate TRUs; sales division at Mumbai, Maharashtra state, and operations department at Hyderabad, Telangana state. The company is registered with income tax with a permanent account number (PAN). It has two separate registrations with Professional Tax, Provident Fund, Employee State Insurance Shops/Establishment acts for each of the sales and operations division.

The setup for this organizational model involves the same steps as in the previous example. In addition, you must create TRUs for the Mumbai and Hyderabad and set up registration information. Each TRU should have a set of registrations for each type of deduction that reports to a different authority. For example, the Mumbai, and Hyderabad TRUs would each have separate registrations for income tax, PF, PT, ESI, LWF, and so on.

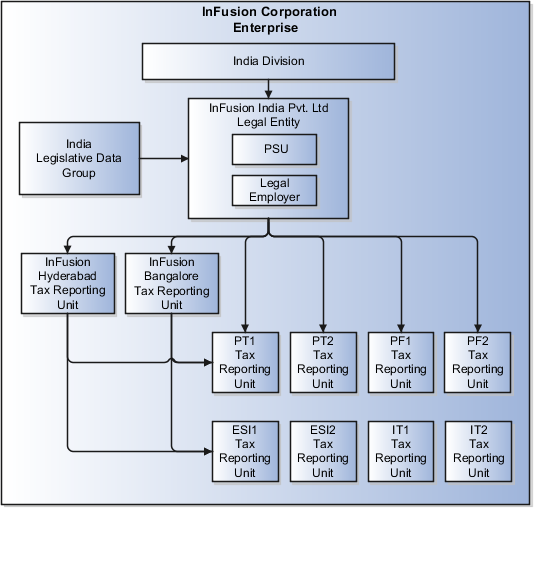

Group Company with Single PSU and Multiple TRUs

Let's look at an example of InFusion Delhi with multiple legal employers under a single PSU. The payroll data is under one PSU, but tax, PHF, and social insurance registrations are at multiple locations. InFusion Delhi comprises three legal entities: the main company in New Delhi, a sales and marketing company in Mumbai, and a development and support company in Hyderabad. The main New Delhi office is also a PSU. The Mumbai and Hyderabad companies handle IT, PF, PT, ESI, LWF, and NPS independently, and each reports to its local income tax office, PF, PT, ESI, LWF, and NPS authorities separately.

When an employee is transferred from InFusion Mumbai to InFusion Delhi , they are terminated in InFusion Mumbai and rehired in InFusion Delhi.