Guidelines for Loading Federal Income Tax Card Components

The Federal Income Tax card component is used to capture information that impacts Federal Income Tax calculations for employees.

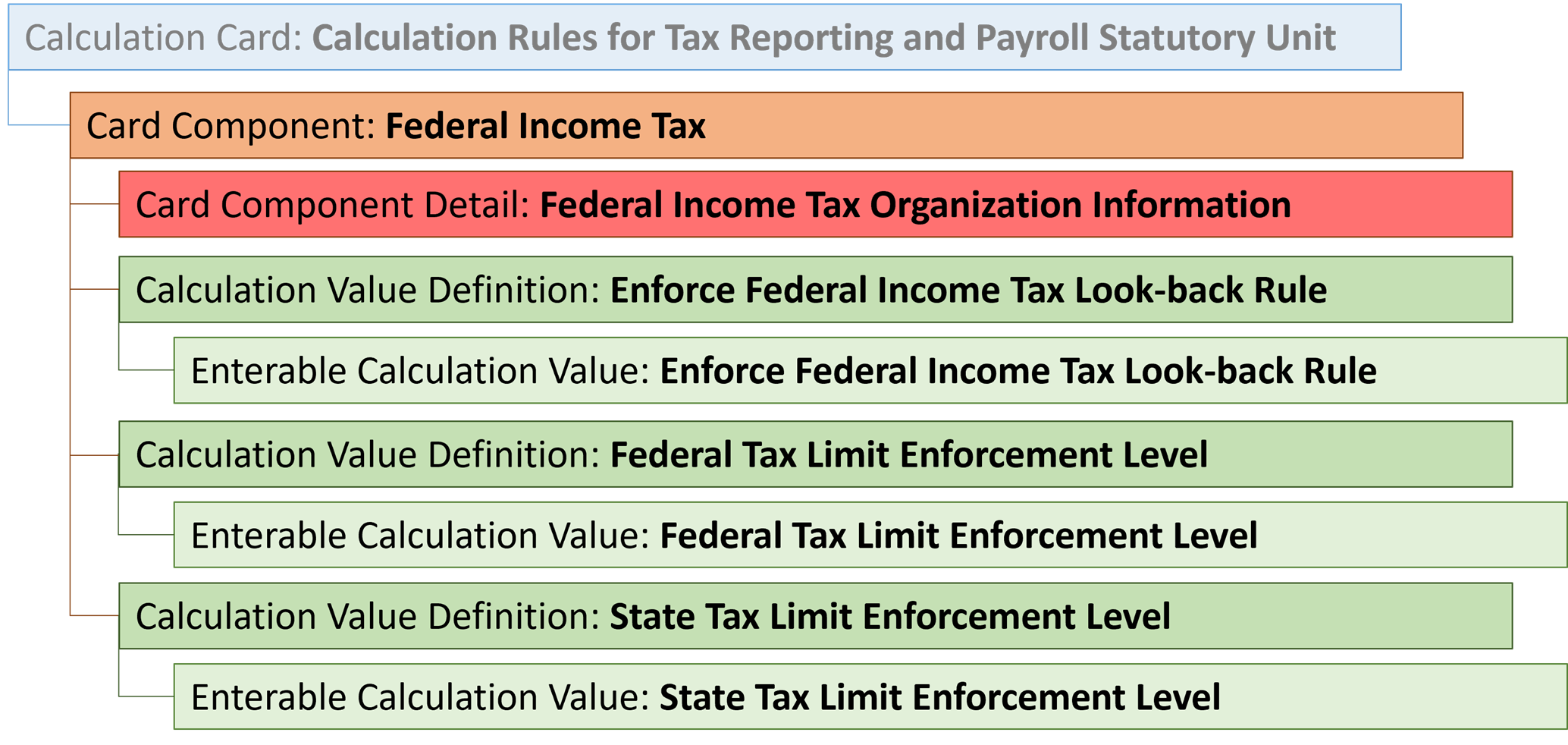

Federal Income Tax Card Component Hierarchy

The Federal Income Tax card component has this shape:

The Federal Income Tax card component uses the Federal Income Tax Organization Information flexfield context. Data for this is loaded using the Component Detail record type. The card component also has one override, which is supplied using the Calculation Value Definition and Enterable Calculation Value record types.

Refer to Guidelines for Loading Calculation Rules for Tax Reporting and Payroll Statutory Unit Cards topic for the attributes to supply for each of these record types.

Card Component Name

When defining the card component, specify a value of ‘Federal Income Tax’ for the DirCardCompDefName attribute on the Card Component, Component Detail and Calculation Value Definition records.

Component Detail Attributes

In addition to the common attributes for the component details record include the necessary flexfield segment attribute values for the flexfield context: Federal Income Tax Organization Information (HRX_US_ORG_FEDERAL_INCOME_TAX)

You can find the flexfield segment attribute name for this flexfield context using the View Business Objects task.

Federal Income Tax Value Definition

| Value Definition Name | Functional Description |

|---|---|

| Enforce Federal Income Tax Look-back Rule | For enforcing the look-back rule from the previous and current year to determine proper withholding for supplemental earnings. |

| Federal Tax Limit Enforcement Level | Define how the payroll process tracks limits for federal taxes. |

| State Tax Limit Enforcement Level | Define how the payroll process tracks limits for state taxes. |