Guidelines for Loading Pension Plan Card Components

The Pension Plan card component is used to capture information that captures details for pension plans.

This component captures details for the following kinds of Pension Types that are defined at the time the Pension Plan component is created:

- 401(k)

- 403(b)

- 457

Pension Plan Card Component Hierarchy

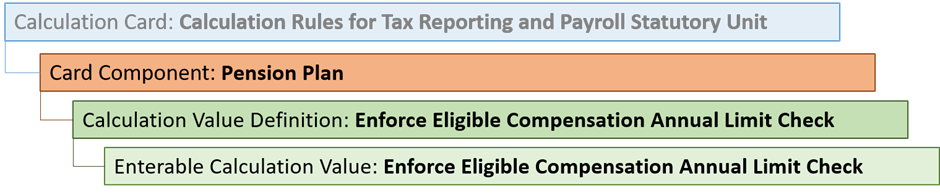

The Pension Plan card component has this shape:

The Pension Plan card component uses value definitions to capture override values. Value definitions are supplied using the Calculation Value Definition and Enterable Calculation Value record types.

Refer to Guidelines for Loading Calculation Rules for Tax Reporting and Payroll Statutory Unit Cards topic for the attributes to supply for each of these record types.

Card Component

When defining the card component, specify a value of ‘Pension Plan’ for the DirCardCompDefName attribute on the Card Component and Calculation Value Definition records.

| HCM Data Loader Attribute | Functional Description |

|---|---|

| Context1 | The Pension Type of the Pension Plan card component. Valid values are 401(k), 403(b), and 457. |

Pension Plan Value Definition

| Value Definition Name | Functional Description |

|---|---|

| Enforce Eligible Compensation Annual Limit Check | Specify whether or not to enforce the compensation annual limit. Enter Y or N. |