Overview of Involuntary Deductions for US Employees

This guide describes the guidelines and examples for loading cards and components for processing involuntary deductions in payroll and subsequent post processes.

The Involuntary Deductions card stores information for the processing of involuntary deductions in payroll and subsequent post processes.

Considerations and Prerequisites

A number of prerequisites must be configured prior to loading the Involuntary Deductions card or the card components:

-

Involuntary deduction elements

-

Element eligibility

-

Third-party payees

-

Third-party payment methods

Create a card component for each involuntary deduction an employee has, with the appropriate values provided. The component detail and enterable calculation values can vary by involuntary deduction type and state.

The Involuntary Deduction Common Calculation Rules card component is not created by default when the Involuntary Deductions card is initially created through the HCM Data Loader as this component is no longer used.

Involuntary Deductions Card Record Types

The Involuntary Deduction card is bulk-loaded using the Global Payroll Calculation Card business object. This generic object hierarchy provides record types to support the various localization requirements.

| Component | Functional Description | File Discriminator |

|---|---|---|

| Calculation Card | Defines the calculation card type and the employee payroll relationship that it captures information for. | CalculationCard |

| Card Component |

A card component is required for each involuntary deduction. The Load a Card Component for US Involuntary Deduction topic describes how to create a card component. |

CardComponent |

| Component Detail | Supplies a component detail record for each flexfield context required by each card component. | ComponentDetail |

| Calculation Value Definition | Allows the creation of value definitions so that overriding values can be specified on the card component. Details of the specific value definitions are provided in the following sections. | CalculationValueDefinition |

| Enterable Calculation Value | Specifies an overriding value for each calculation value definition. | EnterableCalculationValue |

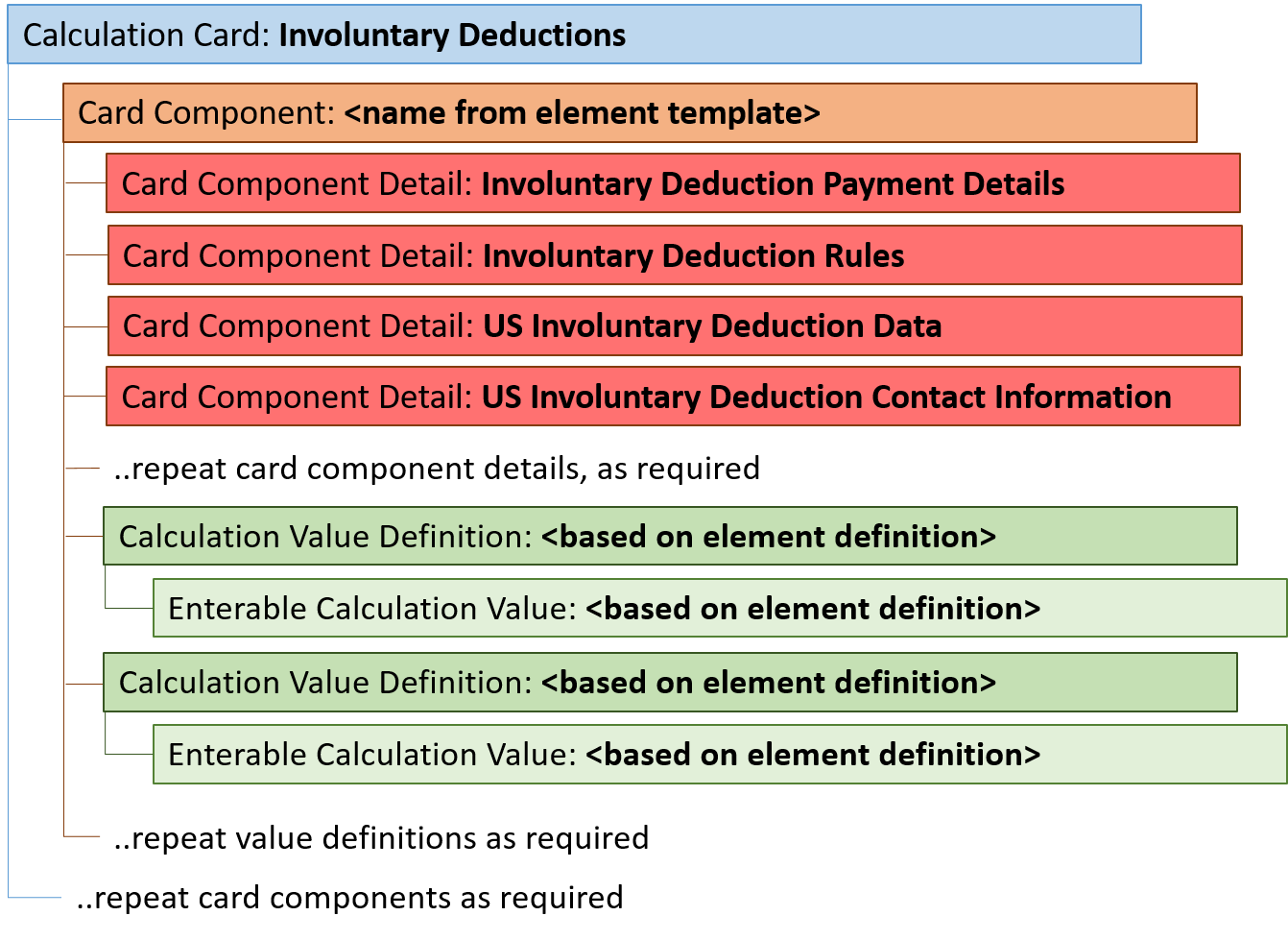

Involuntary Deduction Calculation Card Hierarchy

The hierarchy of Calculation Card components applicable to Involuntary Deductions is

dependent upon the type of involuntary deduction being reported, but generally has

this shape:

A separate card component is required for each involuntary deduction type. There is only one Involuntary Deduction card for an employee.

The card component name is defined by the element configuration, as are the value definitions which are supplied using the Calculation Value Definition and Enterable Calculation Value record types.

There are five flexfield contexts available, of which the US Involuntary Deduction Contact Information context is optional. Data for these is loaded using the Component Detail record type. When loading child support orders, when you include these component details, if you exceed the character limit, you may receive a warning that says:

"Data line in file CalculationCard.dat is more than 4000 characters. For reporting purposes the data line will be truncated, but all data will be transferred."

You can ignore this message or remove unnecessary fields from the component detail metadata row.

- Loading Involuntary Deduction Calculation Cards for US Employees

- Example of Loading Bankruptcy Involuntary Deductions for US Employees

- Example of Loading Child Support, Spousal Support and Alimony Involuntary Deductions for US Employees

- Example of Loading Education Loan and DCIA Involuntary Deductions for US Employees

- Example of Loading Federal Tax Levy Involuntary Deductions for US Employees

- Example of Loading Regional Tax Levy Involuntary Deductions for US Employees

- Example of Loading Garnishment and Creditor Debt Involuntary Deductions for US Employees