Third Parties Overview

You create third parties to process payments to external organizations and to people who aren't on the payroll. Use the Third Parties task to create third-party persons or organizations, such as pension providers, professional bodies, or disability organizations.

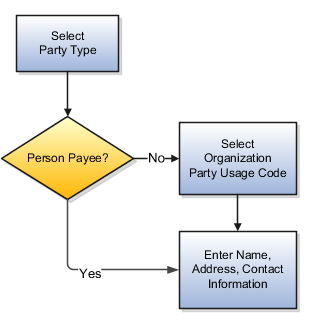

This shows you the decision steps to create third parties.

Party Usage Codes

For third-party persons, the application automatically assigns a party usage code of External Payee. For third-party organizations, you assign a party usage code.

This table describes the party usage codes for third-party organizations.

|

Party Usage Code |

Use For |

Examples |

|---|---|---|

|

External Payee |

Organizations when the others party usage codes don't apply. |

State Disbursement Unit for child support payments |

|

Payment Issuing Authority |

Organizations responsible for issuing instructions for involuntary deductions, such as a tax levy or bankruptcy payment order. Payment issuing authorities don't receive payments. |

Court, agency, or government official |

|

Pension Provider |

Organizations that provide pension administration for employee pension deductions. |

Stock broker, investment company, benefit administrator, labor union |

|

Professional Body |

Organizations entrusted with maintaining oversight of the legitimate practice of a professional occupation. |

The American Society for Mechanical Engineers in the US |

|

Bargaining Association |

Organizations that represent employees in negotiations. Bargaining associations associated with trade unions may receive payments for union fees deducted from an employee's pay. |

The Air Line Pilots Association International (ALPA) in Canada and the US |

|

Disability Organization |

Organizations that are authorized to make disability assessments. Disability organizations don't receive payments. |

The Royal National Institute of Blind People in the UK |