Component Type Changes and Simple Components

When you change from a salary basis with simple components to a salary basis that includes components of the same name and type, the component values carry across the salaries. If the type changes, you don’t see a prior amount.

The salary bases in this example both have five simple components.

- Both bases include the Basic salary, Travel allowance, and Overall salary components and the components have the same type.

- Both bases include the Housing allowance component. But the first basis has the user entering a percentage while the second basis has the user entering an amount.

- Only the first basis includes a City allowance component.

- Only the second basis has a Variable allowance component.

- The first salary basis has an annual frequency and all five components are required.

- The second salary basis has a monthly frequency and three components are required while two components are optional.

Annual Salary Basis with Five Required Components

| Component | Type | Component Percentage Applies To | Affect on Overall Salary | Optional | Default Value |

|---|---|---|---|---|---|

| Basic salary | User enters amount | NA | Add | No | 0 |

| Housing allowance | User enters percentage | Basic salary | Add | No | 50 |

| Travel allowance | Fixed amount | NA | Add | No | 19,200 |

| City allowance | Fixed percentage | Basic salary | Add | No | 10 |

| Overall salary | Overall salary | NA | No effect | No | NA |

Monthly Salary Basis with Three Required Components and Two Optional Components

| Component | Type | Component Percentage Applies To | Affect on Overall Salary | Optional | Default Value |

|---|---|---|---|---|---|

| Basic salary | User enters amount | NA | Add | No | None |

| Housing allowance | User enters amount | NA | Add | No | None |

| Travel allowance | Fixed amount | NA | Add | Yes, don’t carry forward | 1,600 |

| Overall salary | Overall salary | NA | No effect | No | NA |

| Variable allowance | User enters amount | NA | No effect | Yes, don’t carry forward | 0 |

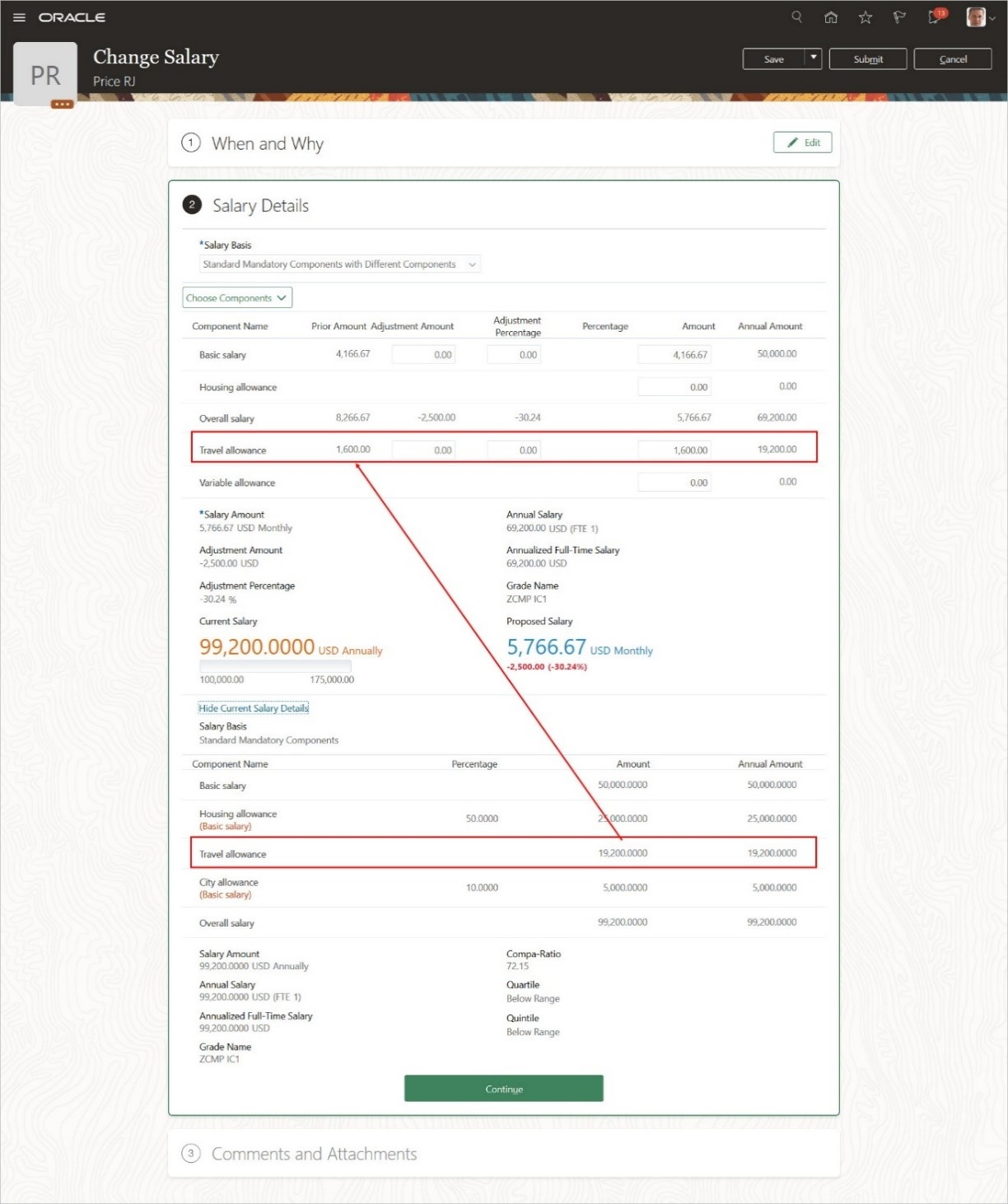

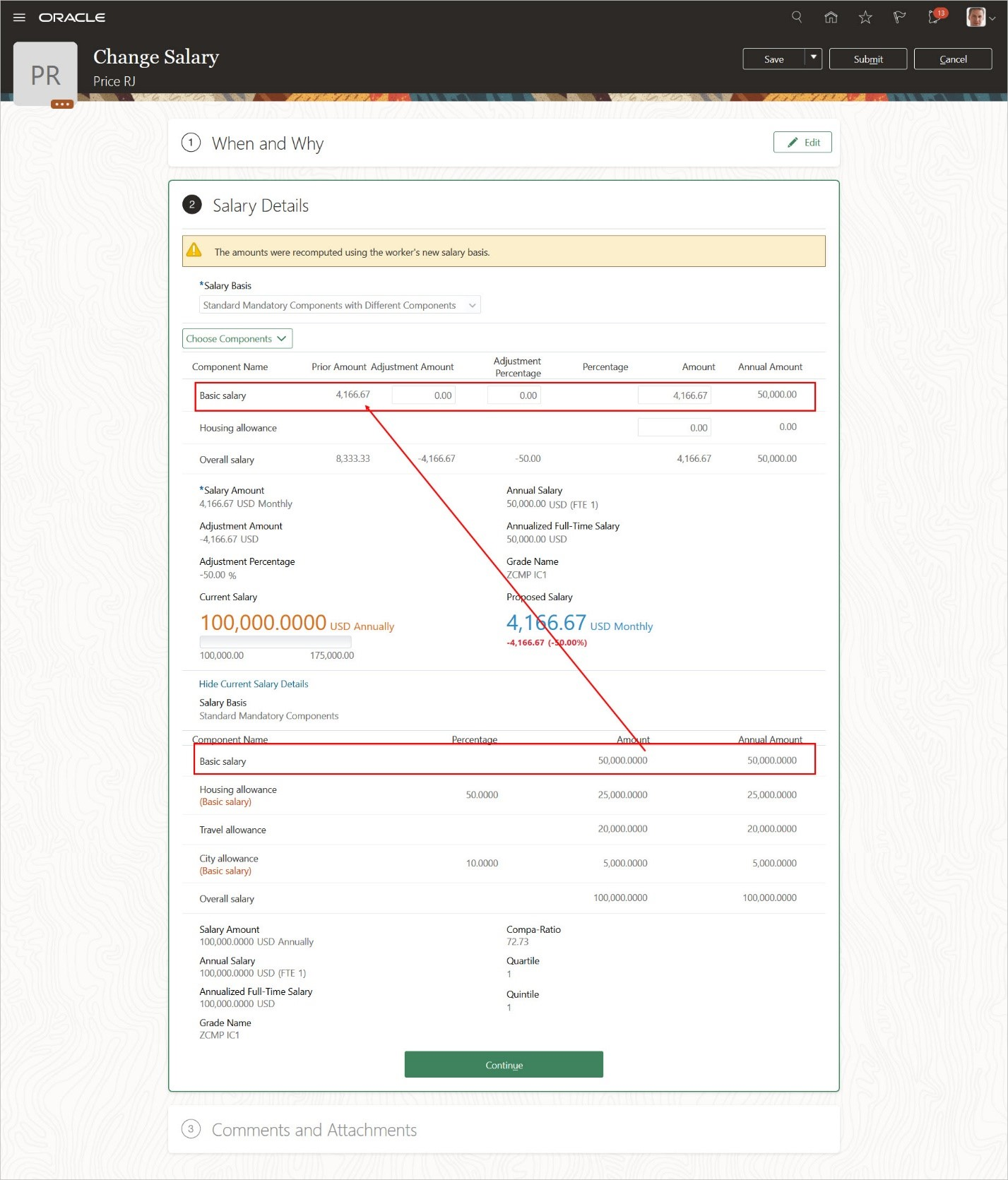

You start proposing a salary change and select the second salary basis. You can see that only the prior Basic salary amount adjusted for the new frequency, from 50,000 to 4,166.67. Even though the Housing allowance exists in the second salary basis, you don't see a prior amount because the component types are different.

Next, you include the optional components, which appear in the last rows of the table, below the Overall salary component. You can see that the prior Travel allowance amount automatically adjusted from 19,200 to 1,600 because of the new frequency.