Define Involuntary Deductions for the US

Involuntary deductions consist of multiple components, each with their own configuration.

You can define these deductions at the federal level, all 50 states, Washington DC, and the territories of Puerto Rico, Guam, and the Virgin Islands.

Defining involuntary deductions involves:

-

Defining third-party payees.

For further info, see Create Third Parties Options in the Help Center.

-

Creating third-party payment methods.

For further info, see Create Third-Party Methods below.

-

Define involuntary deductions elements, including eligibility.

For further info, see Define Involuntary Deduction Elements below.

-

Defining element costing info.

For further info, see Define Element Costing Info below.

-

Creating an Involuntary Deductions card.

For further info, see Involuntary Deductions Card for the US in the Help Center.

-

Creating an Involuntary Deductions card component.

-

Setting calculation values and calculation component details for individual Involuntary Deductions card components.

For further info, see the following in the Help Center.

-

Add Deductions to the Involuntary Deductions Card for the US

-

Overview of Involuntary Deduction Overrides for the US

-

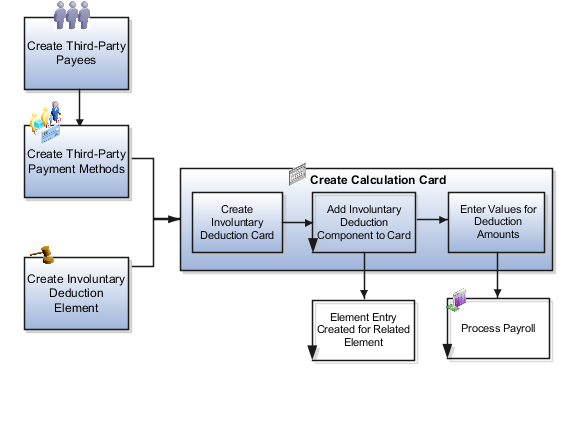

Here's a look at the steps involved in creating an involuntary deduction.

Support for receiving new involuntary deductions through electronic income withholding orders (e-IWO) is available. This requires separate configuration and processing. For further info, see Human Resources Cloud Administering US Electronic Income Withholding Orders on the Help Center.

Create Third-Party Payment Methods

You must identify how your involuntary deductions payments should be made to the third-party payees. The Involuntary Deductions card components link the employee to the payees. You can define payees as either individuals or organizations.

For example, you might set up direct deposit for the payee of a child support deduction.

You must set up the third-party payments before you create the card components. If the payment method doesn't have a start date before the card component date, the payee won't be visible on the card.

You can use these payments and processes with involuntary deductions.

-

Third-Party Check

-

EFT (CCD+ format)

-

Third-Party Involuntary Payment Extract

-

Involuntary payment integrations owned by ADP and Ceridian

For further info, see the following in the Help Center.

-

Create Third-Party Payment Methods

-

Generate Check Payments for Employees and Third Parties for the US

-

Third-Party Payment Register Report for the US

-

Third-Party Rollup Payments for the US

Note: The Oracle HCM Cloud Third-Party Involuntary Payment Extract generates an XML file per ADP specifications. The Third-Party Involuntary Payment Interface technical brief provides a high-level description of this interface. The involuntary payment integrations owned by suppliers like ADP and Ceridian consume the payslip XML. For further info on these processes, refer to their product documentation.For further info see, Oracle Cloud Human Capital Management for the United States: Third-Party Involuntary Payments Interface (2043941.1) on My Oracle Support.

For info on loading third-party organizations, refer to Using Customer Data Management (CDM) for CX Sales and B2B Service in the Help Center. Review the About Import Management Documentation and Import Your Organization Data help topics.

Define Involuntary Deductions Elements

You define an involuntary deduction element for each involuntary deduction type you process.

Secondary element classifications identify the involuntary deduction type. Here are the classifications you can use.

|

This secondary classification |

Works at this level |

This is what it does |

|---|---|---|

|

Alimony |

Regional |

Support payment made according to an involuntary deduction order to the person's former spouse. For further info, see Alimony Deductions for the US in the Help Center. |

|

Bankruptcy Order |

Federal |

Federal court procedure that helps individuals get rid of their debts and repay their creditors. When an individual declares bankruptcy, a trustee of the federal court generally handles the payments to the individual's creditors. For further info, see Bankruptcy Order Deductions for the US in the Help Center. |

|

Child Support |

Regional |

Payment a noncustodial parent makes as a contribution to the cost of raising their child. For further info, see Child Support Deductions for the US in the Help Center. |

|

Creditor Debt |

Regional |

Involuntary deduction ordered against the subject of a successful lawsuit. When a creditor, lender, debt collector, attorney, or other party wins the lawsuit a judgment is made to withhold earnings. Those earnings are used to pay the third party. Note: You can usually use the Garnishment and Creditor

Debt classifications interchangeably. However, there are some exceptions.Some states prohibit multiple involuntary deductions of this secondary

classification to process at the same time. The payroll process

enforces this rule if the employee has multiple components of the same

state and secondary classification on their card.

For further info, see Creditor Debt Deductions in the Help Center. |

|

Debt Collection Improvement Act (DCIA) |

Federal |

Agencies are given authority to administratively garnish for debts owed to the US government. Examples of federal debts collected according to this federal process are defaulted loans administered by:

For further info, see Debt Collection Improvement Act Deductions in the Help Center. |

|

Educational Loan |

Federal |

Delinquent loan for education granted according to the Federal Direct Loan Program or Federal Family Education Loan Program. For further info, see Educational Loan Deductions in the Help Center. |

|

Employee Requested |

Regional |

Agreement made between the employee and creditor after a debt was incurred. Not all states allow this. For further info, see Employee Requested Deductions for the US in the Help Center. |

|

Garnishment |

Regional |

Wage garnishment occurs when an employer is required to withhold the earnings of an employee for the payment of a debt. The garnishment is in accordance with a court order or other legal or equitable procedure. Note: You can usually use the Garnishment and Creditor

Debt classifications interchangeably. However, there are some exceptions.Some states prohibit multiple involuntary deductions of this secondary

classification to process at the same time. The payroll process

enforces this rule if the employee has multiple components of the same

state and secondary classification on their card.

For further info, see Garnishment Deductions for the US in the Help Center. |

|

Regional Tax Levy |

Regional |

Legal seizure of taxpayers' assets to satisfy back income taxes owed. Not all states allow regional tax levies. For further info, see State Tax Levy Deductions in the Help Center. |

|

Spousal Support |

Regional |

Court-ordered payment for support of a former spouse or a spouse while a divorce is pending. For further info, see Spousal Support Deductions for the US in the Help Center. |

|

Tax Levy |

Federal |

According to federal law, a tax levy is an administrative action by the IRS empowered by statutory authority. This authority permits the IRS, without going to court, to seize property to satisfy a tax liability. For further info, see Federal Tax Levy Deductions in the Help Center. |

To define an involuntary deductions element:

-

From My Client Groups, click Show More.

-

In Payroll, click Elements.

-

Create an element using the Involuntary Deduction primary classification.

-

Select an appropriate secondary classification.

-

Answer the questions on each page of the Create Element flow.

When defining deductions of Tax Levy type, select No for Processing stop when the total is reached. There could be additional penalties and interest due. A federal tax levy should continue to deduct until it has been released.

When selecting the duration rule for the latest entry date, select Final Close. This allows the payroll process to process the deduction for any payments after the employee termination.

-

Define eligibility for the element. To define open eligibility, enter a name for the element eligibility record but don't specify any criteria.

-

Save your work.

The task automatically creates all associated balances, feeds, values, formulas, and related elements required for payroll processing. It also creates a calculation component that you can add to an employee's involuntary deductions card.

Define Element Costing Info

When you define an involuntary deductions element, one or more related indirect elements are also created. For further info, see Indirect Elements for the US in the Help Center.

Create element eligibility records for the base and results elements and cost the values for the results elements.

|

For this deduction type |

Cost these elements' eligibility records |

Cost this Value |

|---|---|---|

|

Fees |

Organization Fee Results Person Fee Results Processing Fee Results |

FeeCalculated |

|

All others |

Results |

DeductionsCalculated |

To cost your involuntary deductions elements:

-

From My Client Groups, click Show More.

-

In Payroll, click Elements.

-

Create element eligibility records for the base element.

-

Search for each results element.

-

<base element name> Organization Fee Results

-

<base element name> Person Fee Results

-

<base element name> Processing Fee Results

-

<base element name> Results

-

-

Select each element, and create eligibility records for it.

-

Click Costing, and set up costing for the element eligibility records.

For further info, see Element Eligibility for the US in the Help Center.

Perform a Mass Load of Involuntary Deduction Data

You can use HCM Data Loader to upload involuntary deduction data. For further info, see Loading US Data Using HCM Data Loader (2558276.1) on My Oracle Support.

For info on loading third-party organizations, refer to Using Customer Data Management (CDM) for CX Sales and B2B Service in the Help Center. Review the About Import Management Documentation and Import Your Organization Data help topics.