Overview of Using Global Payroll for Saudi Arabia

Using Payroll for Saudi Arabia involves managing multiple payroll cycle tasks. This guide helps you manage relevant payroll cycle tasks, from maintaining personal payroll information for your employees to running payroll processes and reports.

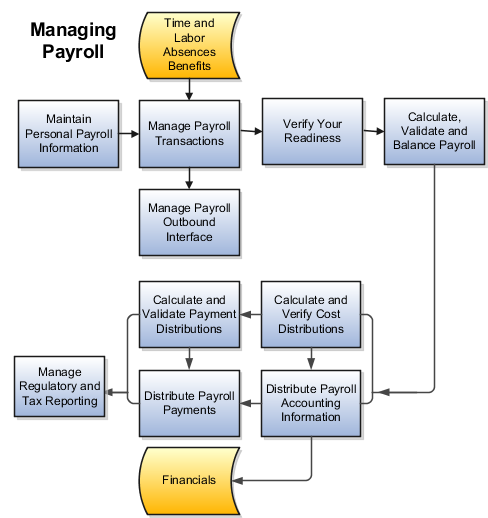

Here's how the payroll cycle process works.

This table identifies the payroll work areas for each payroll cycle task.

| Payroll Task | Work Area |

|---|---|

| Maintain Personal Payroll Information |

Payroll Calculation Payroll Administration Payment Distribution |

| Manage Payroll Transactions | Payroll Administration |

| Verify Payroll Readiness | Payroll Dashboard |

| Calculate, Validate, and Balance Payroll | Payroll Calculation |

| Calculate Payment Distributions | Payment Distribution |

| Distribute Payroll Payments | Payment Distribution |

| Calculate and Verify Cost Distributions | Accounting Distribution |

| Distribute Payroll Accounting Information | Accounting Distribution |

| Manage Regulatory and Tax Reporting | Regulatory and Tax Reporting |

| Monitor and update the status of your flows | Payroll Checklist |

Maintain Personal Payroll Information

To prepare for payroll processing, make sure the payroll info for your employees is up-to-date. This includes these areas:

-

Manage payroll relationships for your employees

-

Ensure you have enables time cards for eligible employees

-

Manage element entries

-

Define and manage information required for statutory deductions and personal calculation cards

-

Enter final processing dates for terminations

-

Update person-level details during individual or mass transfer of employees to a different payroll

Manage Payroll Transactions

Payroll flows are used for many of your payroll tasks. If you load data, calculate payroll and payments, run reports, or calculate and distribute cost results, you submit payroll flows. Use your Payroll Checklist work area to monitor and manage each task and overall payroll flow.

Verify Your Readiness

A good payroll run depends on many accurate and completed tasks. It's important for you to confirm you're ready to continue to the next task. Before you start your run, you can use this checklist to verify your readiness:

-

Review the Payroll Dashboard for notifications and take any actions requiring your attention.

-

Confirm completion of all payroll preprocessing.

-

Run the Payroll Data Validation Report to identify noncompliant or missing statutory information for people in a payroll statutory unit.

-

Check retroactive notifications and handle retroactive changes.

Calculate, Validate, and Balance Payroll

Run the Calculate Payroll process and validate results. Make corrections, retry results and, if needed, remove employees from the main payroll flow to handle them separately using QuickPay at a later time. You can merge their records into the main payroll flow before calculating payments. Be sure you use the payroll calculation reports to view balances and payroll run results before continuing. Calculating, validating and balancing as you go are key to a successful payroll..

Use the payroll calculation reports to view balances and run results before proceeding to the next activity.

Calculate and Validate Payment Distributions

In a typical payroll cycle flow, the Calculate Prepayments process runs automatically when you mark the Verify Reports task as complete within the Calculate and Validate Payroll activity.

Review the distribution of payments across employee personal payment methods in the Calculate Prepayments process results.

If you find issues, fix the data and retry the action or roll back the record to remove them from the run. Once you fix the data in the removed record, run the prepayments process. The payroll register validates payment distribution amounts by payment category, type, and method.

Distribute Payroll Payments

You have validated payment distribution amount and you're ready to follow these steps to distribute payments:

-

Generate the payments to your employees and third parties.

-

Archive the payroll results.

-

Run the payroll register.

-

Generate check payments, if required.

-

Generate payslips.

-

Run the payment register.

Calculate and Verify Cost Distributions

Calculate Payroll process automatically calculates the costs for the payroll run and it's important for you to review the results. If you have any of the following when you're calculating and distributing cost, run a separate processes for each:

-

Retroactive costs

-

Payments

-

Cost adjustments

-

Balance adjustments

-

Partial period accruals

Distribute Payroll Accounting Information

Typically you will run the Transfer to Subledger Accounting process to create journal entries for posting to the general ledger. Then submit the Create Accounting process in draft mode to create journal entries for review. Once you're satisfied with the journal entries, run in final mode to create, transfer, and post journal entries. Create Accounting process is run from the Scheduled Processes work area.

Manage Regulatory and Tax Reporting

You run and validate specific periodic reports required to meet regulatory and tax reporting requirements for HMRC.