Overview of Administering Payroll

This guide helps you manage the multiple payroll tasks for using Oracle Fusion Global Payroll for Canada, from maintaining personal payroll information for your employees to running payroll processes and reports.

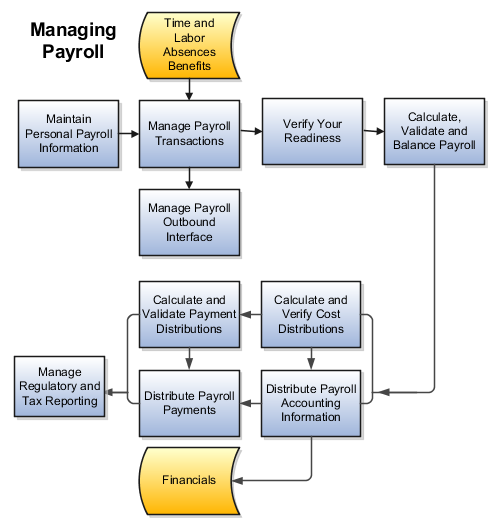

Here's how the payroll cycle process flow works.

This table identifies the payroll tasks you must complete at each stage of the payroll cycle. At each stage of the run, ensure that all the payroll components are complete and the requisite information is available for you to proceed to the next stage of the payroll cycle.

|

Payroll Task |

Tasks you must complete |

|---|---|

|

Maintain Personal Payroll Information |

Before you initiate payroll processing, complete and update the following information for all your employees:

|

|

Manage Payroll Transactions |

Use payroll flows for many of your payroll tasks, such as load data, calculate payroll and payments, run reports, or calculate and distribute cost results. Use the Checklist page to monitor and manage each task and payroll flow. |

|

Verify Payroll Readiness |

A good payroll run depends on many accurate and completed tasks. Before you start your run, check these tasks to ensure your readiness:

|

|

Calculate, Validate, and Balance Payroll |

Once you have verified your payroll readiness, it's time to run payroll and validate the run results.

|

|

Calculate Payment Distributions |

In a typical payroll cycle flow, the Calculate Prepayments process runs automatically when you mark the Verify Reports task as complete within the Calculate and Validate Payroll activity.

|

|

Distribute Payroll Payments |

You have validated payment distribution amount and you're ready to follow these steps to distribute payments:

|

|

Calculate and Verify Cost Distributions |

Calculate Payroll process automatically calculates the costs for the payroll run and it's important for you to review the results. If you have any of the following when you're calculating and distributing cost, run a separate processes for each:

|

|

Distribute Payroll Accounting Information |

Typically you will run the Transfer to Subledger Accounting process to create journal entries for posting to the general ledger. Then submit the Create Accounting process in draft mode to create journal entries for review. Once you're satisfied with the journal entries, run in final mode to create, transfer, and post journal entries. |

|

Manage Regulatory and Tax Reporting |

Run and validate the Canada-specific periodic reports to meet regulatory requirements. |

For more information, refer to these guides in the Help Center.

-

Implementing Global Payroll for Canada

-

Implementing Global Payroll Interface

-

Using Global Payroll Interface

-

Using Payroll Flows

-

Implementing Payroll Costing

-

Implementing Global Payroll