Options to Reevaluate Eligibility of Designees for Enrollment

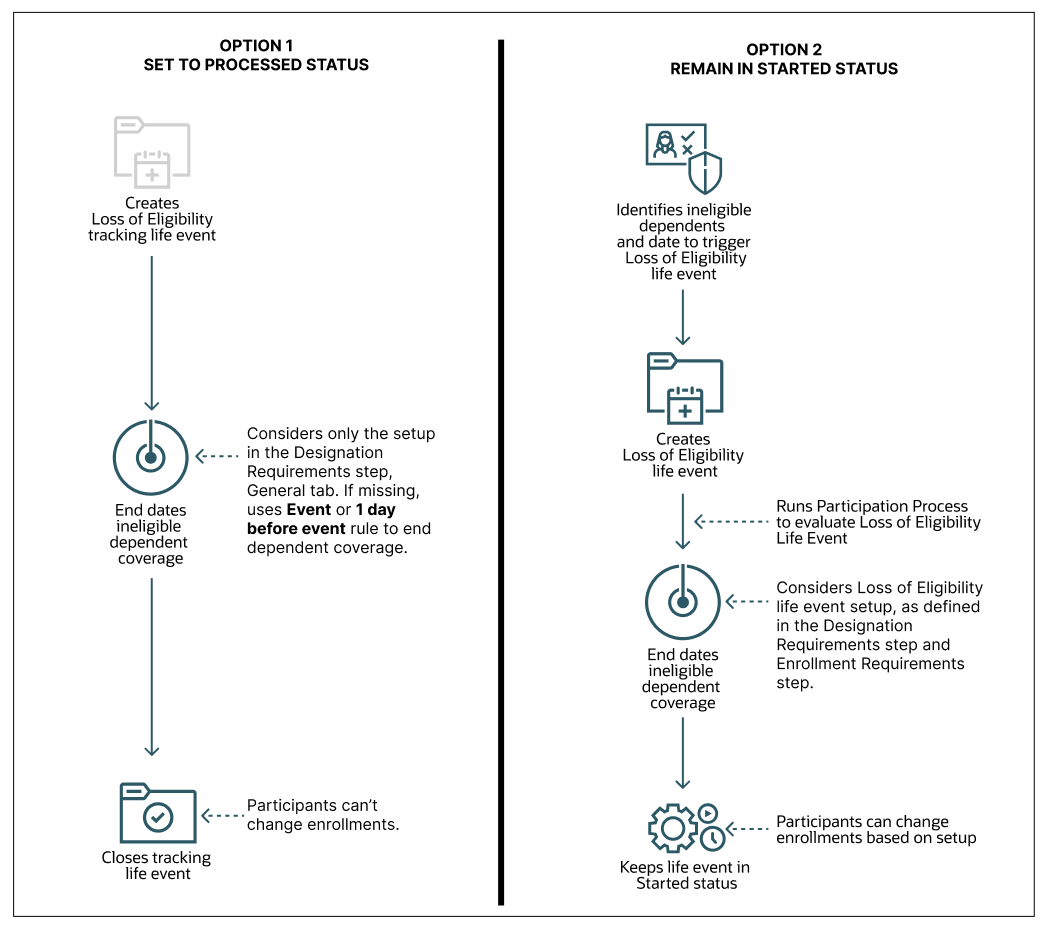

When a dependent is found ineligible by the Reevaluate Designee Eligibility process, it creates a Loss of Eligibility tracking life event for the participant. You can determine how you want to evaluate the Loss of Eligibility life event; select one of these life event statuses on the Process Details page:

- Set to Processed status

- Remain in Started status

Here’s a diagram that illustrates, at a high level, how you can configure the Reevaluate

Designee Eligibility process to handle Loss of Eligibility tracking life event:

Option 1: Set to Processed Status

You select this option if you don’t want to provide participants the ability to change their benefits due to loss of eligibility, and you want them to continue with the same rate-level deductions. You select this option from the Loss of Eligibility Tracking life Event list on the Process Details page.

No processing happens on the Loss of Eligibility tracking event. The process end dates only the dependent coverage record that was found ineligible. Other than the ineligible dependent coverage record, nothing else is changed. For example, the participant doesn’t get unenrolled from any offerings.

When the Reevaluate Designee Eligibility process end dates the ineligible dependent coverage record, it considers only the effective end date, and not the end-date rule specific to the Loss of Eligibility life event. The process considers the setup in the Designation Requirements train stop, General tab for the plan, or plan type in program. If the end date rule isn’t specified in the General tab, the process considers the Event date or One day before the event date, as the end date.

When the Reevaluate Designee Eligibility process end dates the ineligible dependent coverage, it closes the tracking life event and sets its status to Processed. The life event only indicates the occurrence of the loss of eligibility, but it doesn’t evaluate for any enrollment opportunities. The participant’s coverage in the same plan or option continues.

Option 2: Remain in Started Status

If you want to evaluate the Loss of Eligibility tracking event for enrollment opportunities, select Remain in Started Status from the Loss of Eligibility Tracking Life Event list on the Process Details page.

The Loss of Eligibility tracking life event is created as a regular life event. The process doesn’t end date the dependent coverage record that was found ineligible. It only identifies the ineligible dependent and the date to create the Loss of Eligibility tracking life event.

As the dependent has already lost further eligibility, the coverage needs to be end dated. Note that the participant's eligibility into the various plans gets reevaluated and there will be impact if family member code rules exist. So, along with the dependent coverage, the participant coverage needs to be end dated. The end dates are calculated based on the Loss of Eligibility Life Event setup defined in the Designation Requirements and Enrollment train stops in the plan configuration work area.

Based on how frequently you run the Reevaluate Designee Eligibility process, you need to decide whether you want to change the derived factor setup, or the coverage end date setup. If you run the process daily, you can set up the event to be triggered based on the date of birth. The coverage dates are processed accordingly. If you run the process monthly, you can set up the event to be triggered at the end of the month or on the first day of the next month so that all the ineligible dependents lose their coverage in the current month.

Impact of Derived Factors on Option 2 (Remain in Started Status)

Suppose you’re using a derived factor for a person’s age. If the derived factor is set to the As of Event rule, then the Loss of Eligibility life event will use the date of birth as the end date for the coverage. But if you want the coverage to end on the last day of the month, then you have 2 options. You can change the Previous Dependent Coverage End Date rule to End of Month, and the Start date rule, to First of Next Month.

The other option is to continue with the Participant enrollment coverage end date rule, but make sure you define the date rules for enrollment specific to the Loss Of Eligibility event in the Life event tab. Note that the change might impact the employee’s coverage start and dates.

If the derived factor is set to End of month or First of next month, you can use that setup for ending the dependent coverage, but the life event will trigger not on the date of birth, but will be based on the derived factor's determination rule.

The way you set up the derived factors or the coverage end date should be on the basis of how frequently you run the Reevaluate Designee Eligibility process. If it’s daily, then we recommend you get the event triggered on the date of birth and get the coverage dates processed accordingly.

If the frequency is monthly, then we recommend you use the End of Month rule or First of next month rule in the derived factor. This way, all the dependents losing eligibility in the current month can be detected and processed in a single run per month.