Example of Loading Child Support, Spousal Support and Alimony Involuntary Deductions for US Employees

Child support orders are for payments a noncustodial parent makes as a contribution to the cost of raising their child.

Spousal support orders are for payments for support of an ex-spouse (or a spouse while a divorce is pending) as ordered by the court. Alimony orders are for payments for support made to a divorced person by the former spouse.

Involuntary deduction elements using these secondary classifications need to be configured prior to creating the card components.

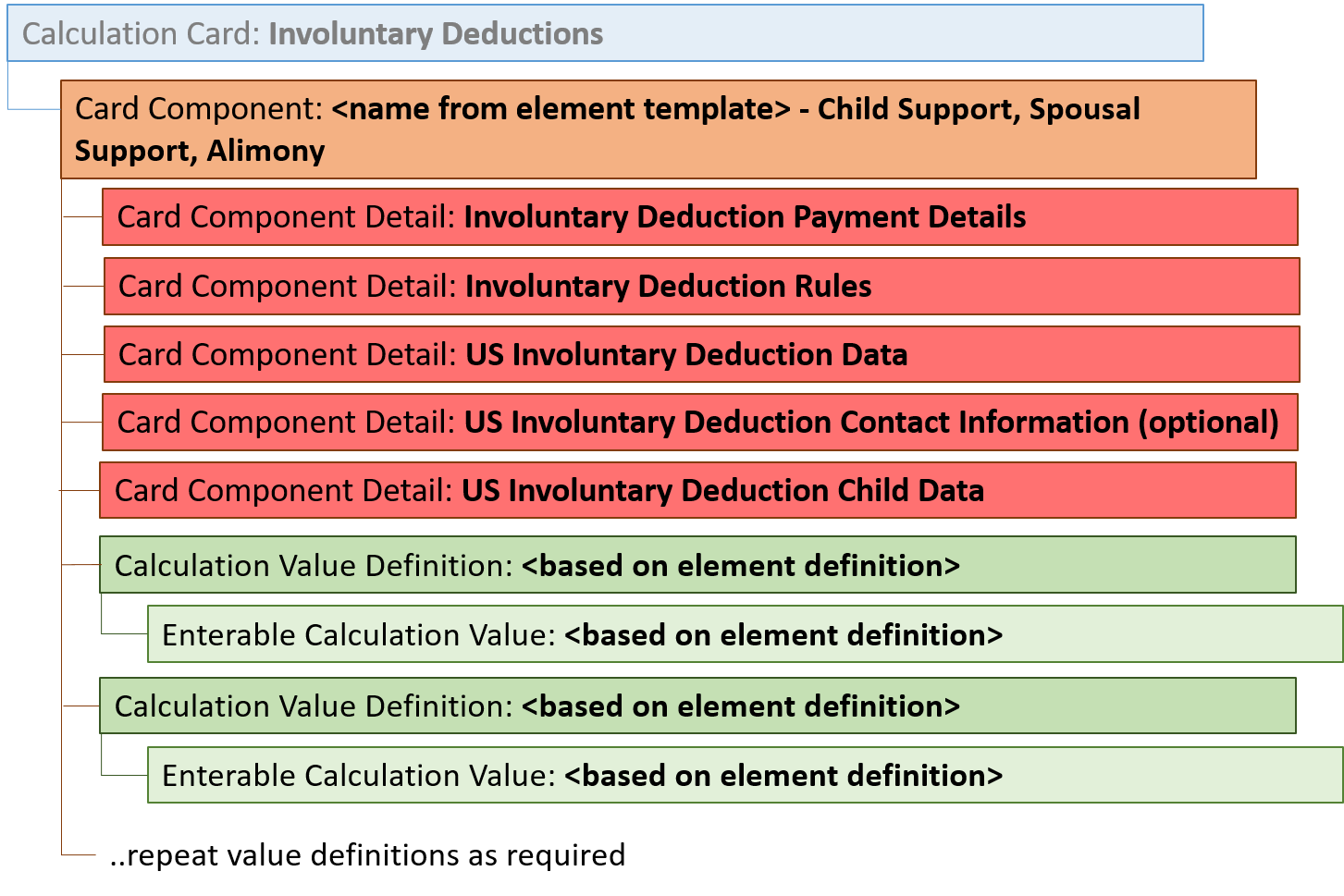

Child Support, Spousal Support, Alimony Involuntary Deduction Hierarchy

The card component name is defined by the element configuration, as are the value definitions which are supplied using the Calculation Value Definition and Enterable Calculation Value record types.

Refer to the Loading a Card Component for an Involuntary Deduction for details of each of the record types and attributes you need to supply for an involuntary deduction.

The example file lines in the section below are always supplied together in the same CalculationCard.dat file.

Calculation Card

Always supply the CalculationCard record for the Involuntary Deduction, even if the calculation card already exists for the employee.

METADATA|CalculationCard|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|DirCardDefinitionName|EffectiveStartDate|EffectiveEndDate|CardSequence|PayrollRelationshipNumber

MERGE|CalculationCard|VISION|ID_8193987|USA LDG|Involuntary Deductions|2022/01/03|||8193987Card Component

Define the type of Involuntary Deduction using the CardComponent record type.

| Attribute Name | Value |

|---|---|

| Context1 | The geocode of the state. Refer to the Cloud Customer Connect topic Template: BI Publisher Report: United States - State, County and City Geography Codes. |

| Context2 | Supply a reference code. This value must be unique by deduction type and state. |

METADATA|CardComponent|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|DirCardId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|DirCardCompDefName|Context1|Context2|Subpriority

MERGE|CardComponent|VISION|ID_CS_8193987|USA LDG|ID_8193987|2022/01/03||Vision Child Support|5|CA-34567|The parent Involuntary Deduction Calculation Card is identified by the DirCardId(SourceSystemId) attribute which has a value that match the SourceSystemId attribute on the CalculationCard record.

Component Details

Use the ComponentDetail record type to provide flexfield segment values.

In this example let's load the details of a single child. There are additional attributes available if the details of multiple children need to be loaded.

METADATA|ComponentDetail|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|DirCardCompId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|DirCardCompDefName|DirInformationCategory|FLEX:Deduction Developer DF|orderAmtPayee_Display(Deduction Developer DF=INVLN_DEDN_PAYEE_DETAILS)|receivedDate(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|startDate(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|description(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|issuingAuthorityName(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|initialFeeTaken(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|issuingJurisdictionName(Deduction Developer DF=INVLN_DEDN_SUPPORT_DATA)|_CSE_AGENCY_CASE_IDENTIFIER(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|remittanceIdentifier(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_Issuing_State_Display(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_FIPS_Code(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_Support_Other_Family(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_Medical_Support_Indicator(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_PAYMENTS_IN_ARREARS(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_Arrears_Overdue_More_Than_12_W(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_Filing_Status(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|third2dpartyInvoluntaryDe(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|documentTrackingNumber(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|involDedEarnType(Deduction Developer DF=HRX_US_INV_DEDN_DATA)|_Name_of_Child(Deduction Developer DF=HRX_US_INV_DEDN_CHILD_DATA)|_Date_of_Birth_of_Child(Deduction Developer DF=HRX_US_INV_DEDN_CHILD_DATA)|lastNameOfChild1(Deduction Developer DF=HRX_US_INV_DEDN_CHILD_DATA)|firstNameOfChild1(Deduction Developer DF=HRX_US_INV_DEDN_CHILD_DATA)|middleNameOfChild1(Deduction Developer DF=HRX_US_INV_DEDN_CHILD_DATA)

MERGE|ComponentDetail|VISION|ID_CD_IDPD_8193987|USA LDG|ID_CS_8193987|2022/01/03||Vision Child Support|INVLN_DEDN_PAYEE_DETAILS|INVLN_DEDN_PAYEE_DETAILS|Child Support SDU|||||||||||||||||||||||

MERGE|ComponentDetail|VISION|ID_CD_IDSD_8193987|USA LDG|ID_CS_8193987|2022/01/03||Vision Child Support|INVLN_DEDN_SUPPORT_DATA|INVLN_DEDN_SUPPORT_DATA||2022/01/03|2022/01/10|California Child Support Order|California SDU|Y|California|||||||||||||||||

MERGE|ComponentDetail|VISION|ID_CD_IDD_8193987|USA LDG|ID_CS_8193987|2022/01/03||Vision Child Support|HRX_US_INV_DEDN_DATA|HRX_US_INV_DEDN_DATA||||||||CSE-12345|8883346|CA|06000|Y|Y|Y|N||1|DocID12345||||||

MERGE|ComponentDetail|VISION|ID_CD_IDCD_955160008193987|USA LDG|ID_CS_8193987|2022/01/03||Vision Child Support|HRX_US_INV_DEDN_CHILD_DATA|HRX_US_INV_DEDN_CHILD_DATA|||||||||||||||||||||2015/06/03|Child1 Last Name|Child1 First Name|Child1 Middle Name

The parent Card Component is identified on the ComponentDetails records by the DirCardCompId(SourceSystemId) attribute, which has a value that matches the SourceSystemId on the CardComponent record.

Value Definitions

Use the CalculationValueDefinition and EnterableValueDefinition record types to provide override values for the value definitions.

| Value Definition | Value |

|---|---|

| California Child Support Total Withholding Amount | 230.77 |

| Proration Child Support Arrears Amount | 130.77 |

| Proration Child Support Current Amount | 100.00 |

METADATA|CalculationValueDefinition|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|SourceId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|DirCardCompDefName|ValueDefinitionName

MERGE|CalculationValueDefinition|VISION|ID_CS_VD1_8193987|USA LDG|ID_CS_8193987|2022/01/03||Vision Child Support|California Child Support Total Withholding Amount

MERGE|CalculationValueDefinition|VISION|ID_CS_VD2_8193987|USA LDG|ID_CS_8193987|2022/01/03||Vision Child Support|Proration Child Support Arrears Amount

MERGE|CalculationValueDefinition|VISION|ID_CS_VD3_8193987|USA LDG|ID_CS_8193987|2022/01/03||Vision Child Support|Proration Child Support Current Amount

METADATA|EnterableCalculationValue|SourceSystemOwner|SourceSystemId|LegislativeDataGroupName|ValueDefnId(SourceSystemId)|EffectiveStartDate|EffectiveEndDate|Value1

MERGE|EnterableCalculationValue|VISION|ID_CS_VD1_ECV_8193987|USA LDG|ID_CS_VD1_8193987|2022/01/03||230.77

MERGE|EnterableCalculationValue|VISION|ID_CS_VD2_ECV_8193987|USA LDG|ID_CS_VD2_8193987|2022/01/03||130.77

MERGE|EnterableCalculationValue|VISION|ID_CS_VD3_ECV_8193987|USA LDG|ID_CS_VD3_8193987|2022/01/03||100The parent Card Component is identified on the CalculationValueDefinitions records by the SourceId(SourceSystemId) attribute which has a value that matches the SourceSystemId on the CardComponent record.

The parent for each Calculation Value Definition is identified on each EnterableCalculationValue record using the ValueDefnId(SourceSystemId) attribute, which has a value that matches the SourceSystemID attribute on the parent CalculationValueDefinition record.