Guidelines for Loading Canadian Federal Tax Card Components

The Federal Tax card component is used to capture information that will impact Federal Tax calculations for the employee.

Each Tax Credit Information calculation card should have one Federal Tax card component.

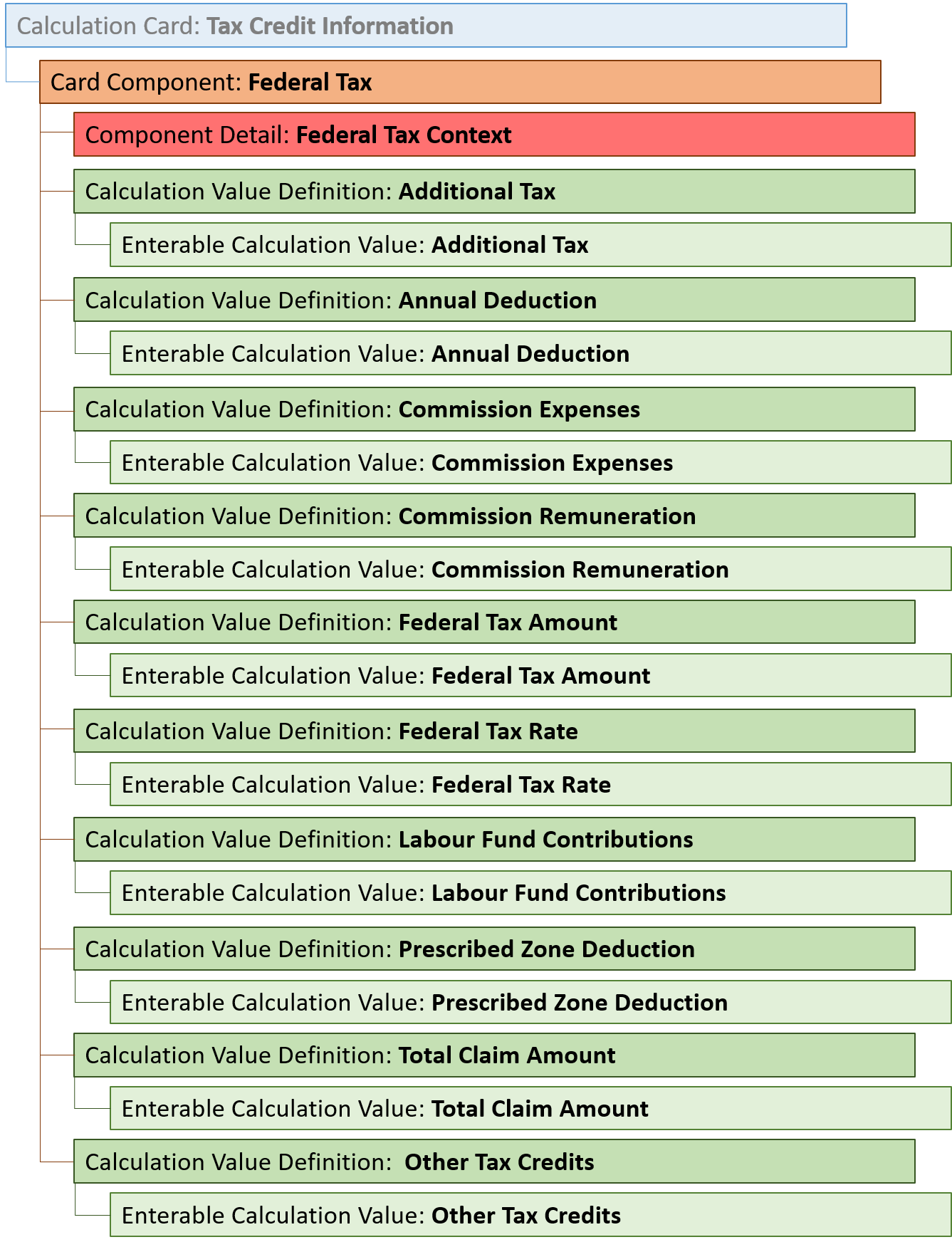

Federal Tax Card Component Hierarchy

The Federal Tax card component uses the Federal Tax Context flexfield context and data for this is loaded using the Component Detail record type. The Federal Tax card component has multiple value definitions, override values are supplied using the Calculation Value Definition and Enterable Calculation Value record types.

Card Component Attributes for Federal Tax

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the Federal Tax card component. For new card components supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardId(SourceSystemId) | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName | The parent Tax Credit Information calculation card should be

identified by using the same key type used to identify the

calculation card. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card |

| EffectiveStartDate | N/A | The start date of the Federal Tax card component. This must be

the same as the EffectiveStartDate on the Tax Credit Information

calculation card. If updating an existing Federal Tax card component, the effective start date must be original start date of the component. |

| EffectiveEndDate | N/A | The end date is optional for the card component |

| DirCardCompDefName | N/A | The component definition name. Specify ‘Federal Tax’. |

| ComponentSequence | N/A | A number to uniquely identify this card component when multiple card components for the same card component definition exist on the same card. Not required when source keys are used. |

Card Component Detail Attributes for Federal Tax

In addition to the attributes defined here, include the necessary flexfield segment attribute values for the flexfield context:

- Federal Tax Context (HRX_CA_WTH_FEDERAL_INCOME_TAX)

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, DirInformationCategory, LegislativeDataGroupName, AssignmentNumber, DirCardDefinitionName, DirCardCompDefName | A unique identifier for the component detail. For new component detail records supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardCompId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Federal Tax card component should be referenced using

the same key type used to identify the parent record. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the component detail, or update to the component detail if you are providing date-effective history. This must be after or equal to the EffectiveStartDate provided for the Federal Tax card component. |

| EffectiveEndDate | N/A | The optional end date of the component detail, or if you are providing date-effective history the last day of the date-effective changes. |

| DirCardCompDefName | N/A | The name of the card component this detail is for. This is used to identify the flexfield context and should be supplied even when a source key is used to identify the parent card component. |

| DirInformationCategory | N/A | The code for the flexfield context, such as ‘HRX_CA_WTH_FEDERAL_INCOME_TAX’. Flexfield context codes are visible on the Flexfield Attributes tab of the View Business Objects task. |

| FLEX:Deduction DeveloperDF | N/A | Supply the same value as for the DirInformationCategory attribute. |

Federal Tax Value Definitions

| Value Definition Name | Functional Description |

|---|---|

| Total Claim Amount | The federal tax exemption amount. Note: This value defaults to the

basic amount populated from the Load Payroll Tax Information

process. For employees with the basic amount, do not populate

the Total Claim Amount, as the value will be read as an override

and will not be updated by the Load Payroll Tax Information

process when the basic amounts change. If the employee has a

total claim amount different than the basic amount, the amount

should be entered here. This override is not reset to the basic

amount or updated at the beginning of the year. It will remain

the same until modified by the user, or reset using the Tax

Overrides Report. |

| Additional Tax | The amount an employee elects to have deducted as extra tax, in addition to the tax calculation. The amount is entered in dollars. |

| Federal Tax Rate | The federal income tax rate. |

| Federal Tax Amount | The federal income tax amount. Note: If an Additional Tax value is

entered for the employee, it is deducted in addition to the

Federal Tax Amount. |

| Federal Lump Sum Rate | An override to the rate used for calculation of taxes for lump sum payments. If you do not override the rate, the deduction calculation uses the prescribed rate. |

| Annual Deduction | The tax reduction relating to child care and alimony expenses that is authorized by a tax services office. |

| Labour Fund Contributions | A tax calculation reduction applicable only when the employee has deductions related to labour sponsored funds. |

| Prescribed Zone Deduction | A federal tax calculation reduction for those employees that live in a prescribed zone. |

| Other Tax Credits | An additional tax credit used to reduce the income tax amount, as authorized by the government. |

| RRSP Limit | The RRSP contribution for the year is capped at an annual limit. This includes both the employee contribution as well as the matched employer contribution taxable benefit This field defaults to the published RRSP annual limit populated from the Load Payroll Tax Information process. However if required, you may override the annual limit for the employee. |

| Annual Income Including Commission | The amount of income a commissioned employee is expected to earn in the calendar year. |

| Commission Expenses | The amount of expenses a commissioned employee is expected to have in the calendar year. |

| Estimated Annual RRSP | The estimated annual amount an employee expects to contribute to RRSP in the calendar year. |

Calculation Value Definition Attributes for Federal Tax

The Calculation Value Definition record type specifies the value definition name for the override value.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the calculation value definition record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| SourceId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Federal Tax card component should be referenced by using the same key type used to identify the card component. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the parent Federal Tax card component or the date the calculation value definition starts, if later. |

| DirCardCompDefName | N/A | The definition name of the parent Federal Tax card component. Specify the same value as provided on the parent card component record. |

| ValueDefinitionName | N/A | The name of the value being overridden. The list of value definitions applicable to this card component are listed above. |

These attributes are supplied against the CalculationValueDefinition file discriminator and must be supplied along with a CardComponent record for the parent Federal Tax card component and a CalculationCard record for the owning Tax Credit Information card.

Enterable Calculation Value Attributes for Federal Tax

The Enterable Calculation Value provides the override value for the value definition. It references the Calculation Value Definition record which defines the Value Definition being overridden.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the enterable calculation value record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the override value. |

| ValueDefnIdSourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName, ValueDefinitionName |

Identify the parent Calculation Value Definition record using the same key type used to identify the calculation value definition. When using source keys, supply this attribute with the value supplied for the calculation value definition’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent record. |

| EffectiveStartDate | N/A | The effective start date of the parent calculation value definition record, or the update to the override value if supplying date-effective history. |

| EffectiveEndDate | N/A | The optional end date of the override value, or if you are providing date-effective history, the last day of the date-effective changes |

| Value1 | N/A |

The value for the value definition identified by the parent calculation value definition record. Note: Supply -999999999 to indicate a null (blank) value.

|

These attributes are supplied against the EnterableValueDefinition file discriminator. You must supply an EnterableValueDefinition record for each CalculationValueDefinition record supplied.