Guidelines for Loading County Tax Card Components

The County Tax card component is used to capture information that impacts county tax calculations for employees. This regional component is defined at the state and county level.

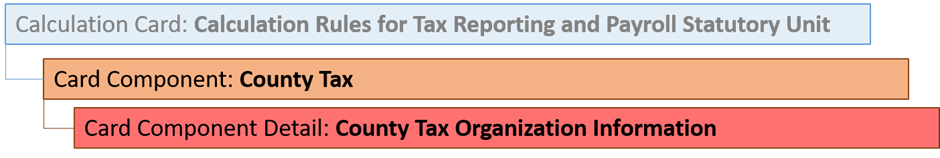

County Tax Card Component Hierarchy

The County Tax card component has this shape:

The County Tax card component uses the County Tax Organization Information flexfield context and data for this is loaded using the Component Detail record type.

Refer to Guidelines for Loading Calculation Rules for Tax Reporting and Payroll Statutory Unit Cards topic for the attributes to supply for each of these record types.

Card Component

When defining the card component, specify a value of ‘County Tax’ for the DirCardCompDefName attribute on the Card Component and Component Detail records.

| HCM Data Loader Attribute | Functional Description |

|---|---|

| Context1 | The geocode number that identifies the US state. |

| Context2 | The geocode number that identifies the US county. |

Component Detail Attributes

In addition to the common attributes for the component details record include the necessary flexfield segment attribute values for the flexfield context: County Tax Organization Information (HRX_US_ORG_COUNTY_TAX)

You can find the flexfield segment attribute name for this flexfield context using the View Business Objects task.