Guidelines for Loading Federal Income Tax for 1099-R Card Components

The Federal Income Tax for 1099-R card component is used to capture information that impacts Federal Income Tax calculations for the 1099-R for employees.

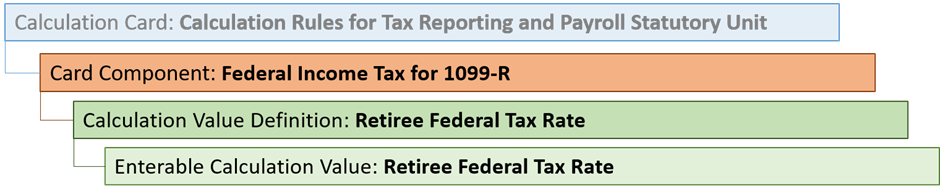

Federal Income Tax for 1099-R Card Component Hierarchy

The Federal Income Tax for 1099-R card component has this shape:

The Federal Income Tax for 1099-R card component uses value definitions to capture override values. Value definitions are supplied using the Calculation Value Definition and Enterable Calculation Value record types.

Refer to Guidelines for Loading Calculation Rules for Tax Reporting and Payroll Statutory Unit Cards topic for the attributes to supply for each of these record types.

Card Component Name

When defining the card component, specify a value of ‘Federal Income Tax for 1099-R’ for the DirCardCompDefName attribute on the Card Component and Calculation Value Definition records.

Federal Income Tax for 1099-R Value Definition

| Value Definition Name | Functional Description |

|---|---|

| Retiree Federal Tax Rate | An override of the standard Retiree Federal Income Tax rate at the PSU or TRU level. |