Guidelines for Loading US Federal Tax for Pension and Annuity Payments

The Federal Tax card component is used to capture information that will impact Federal Tax calculations for the retiree.

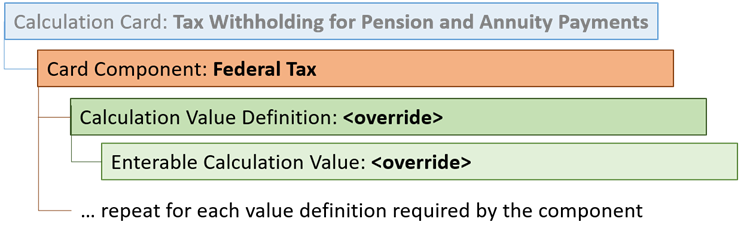

Each Tax Withholding for Pension and Annuity Payments calculation card should have one Federal Tax card component.

Federal Tax Card Component Hierarchy for Tax Withholding for Pension and Annuity Payments

The Federal Tax card component uses value definitions to capture override values. Value definitions are supplied using the Calculation Value Definition and Enterable Calculation Value record types.

The following sections describe how to supply valid file lines for these record types.

Card Component Attributes for Federal Tax

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the Federal Tax card component. For new card components supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | TThe name of the legislative data group for the card component definition. |

| DirCardId(SourceSystemId) | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName | The parent Tax Withholding for Pension and Annuity Payments calculation card should be identified by using the same key type used to identify the calculation card. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card |

| EffectiveStartDate | N/A | The start date of the Federal Tax card component, typically the

employee’s retirement date. This must be the same as the

EffectiveStartDate on the Tax Withholding for Pension and Annuity

Payments calculation card. If updating an existing Federal Tax card component, the effective start date must be original start date of the component. |

| EffectiveEndDate | N/A | The end date is optional for the card component. |

| DirCardCompDefName | The component definition name. Specify ‘Federal Tax’. | |

| ComponentSequence | The number to uniquely identify this card component when multiple card components with the same DirCardCompDefName exist. Not required when source keys are used. |

These attributes are supplied against the CardComponent file discriminator and must be supplied along with a CalculationCard record for the parent Tax Withholding card.

Federal Tax Value Definitions

The Federal Tax card component uses value definitions to supply override values.

| Value Definition Name | Functional Description |

|---|---|

| Filing Status | Determines which tax chart to use when calculating the Federal Tax to be deducted from the retiree’s pay. |

| Allowances | An exemption that reduces how much Federal Income Tax is deducted from the retiree’s pension and annuity payments. |

| Additional Tax Amount | Additional tax amount to withhold for the employee’s Federal Tax. |

| Exempt from Federal Income Tax | To indicate no Federal Income Tax withholding. Specify Y or N. |

| Exempt from Wage Accumulation | To indicate no Federal Income Tax withholding and no Federal Income Tax wage accumulation. Specify Y or N. |

| Regular Amount | Used to indicate a flat withholding amount for Regular pay runs. |

| Regular Rate | Used to indicate a percentage withholding for Regular pay runs. |

| Supplemental Amount | Used to indicate a flat withholding amount for Supplemental pay runs. |

| Supplemental Rate | Used to indicate a percentage withholding for Supplemental pay runs. |

| IRS Lock in Date | Date when IRS lock-in letter is effective. |

Calculation Value Definition Attributes for Federal Tax for Retirees

The Calculation Value Definition record type specifies the name of the value definition you are supplying an override value for.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the calculation value definition record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition.. |

| SourceId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Federal Tax card component should be referenced by using the same key type used to identify the card component. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the parent Federal Tax card component or the date the calculation value definition starts, if later. |

| DirCardCompDefName | N/A | The definition name of the parent Federal Tax card component. Specify the same value as provided on the parent card component record. |

| ValueDefinitionName | N/A | The name of the value being overridden. The list of value definitions applicable to this card component are listed above. |

These attributes are supplied against the CalculationValueDefinition file discriminator and must be supplied along with a CardComponent record for the parent Federal Tax card component and a CalculationCard record for the owning Tax Withholding for Pension and Annuity Payments card.

Enterable Calculation Value Attributes for Federal Tax

The Enterable Calculation Value provides the override value for the value definition. It references the Calculation Value Definition record which defines the Value Definition being overridden.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the enterable calculation value record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the override value. |

| ValueDefnIdSourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName, ValueDefinitionName | Identify the parent Calculation Value Definition record using the same key type used to identify the calculation value definition. When using source keys, supply this attribute with the value supplied for the calculation value definition’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent record. |

| EffectiveStartDate | N/A | The effective start date of the parent calculation value definition record, or the update to the override value if supplying date-effective history. |

| EffectiveEndDate | N/A | The optional end date of the override value, or if you are providing date-effective history, the last day of the date-effective changes. |

| Value1 | N/A | The value for the value definition identified by the parent calculation value definition record. Unlike other calculation cards, if you supply a value definition but have no value for it supply ‘-999999999’ to indicate a null value. |

These attributes are supplied against the EnterableValueDefinition file discriminator. You must supply an EnterableValueDefinition record for each CalculationValueDefinition record supplied.