Guidelines for Updating Special-Rate Tax for Dutch Statutory Deductions and Reporting

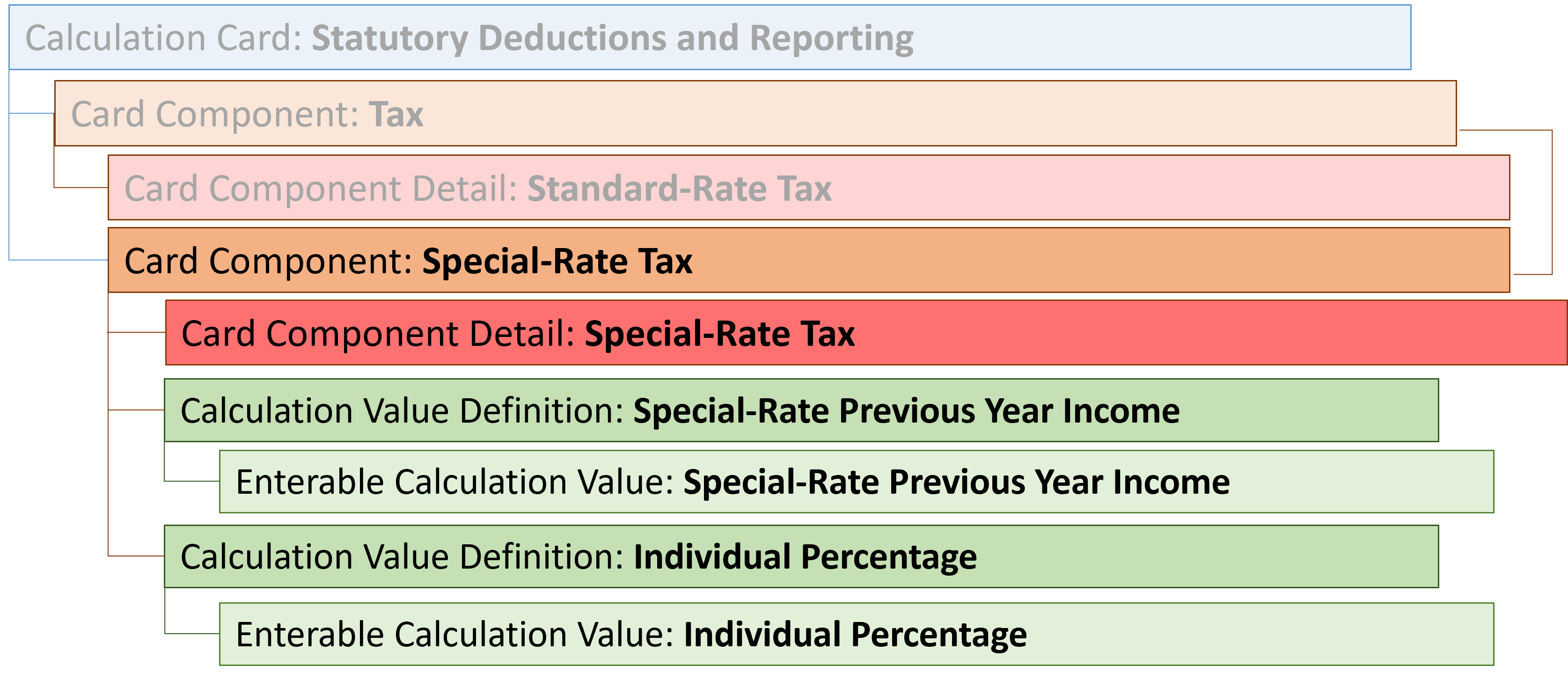

The Special-Rate Tax card component records all additional tax relevant information, including the previous year’s special-rate income on which the special-rate percentage is based and an individual special-rate tax rate, if appropriate.

The Special-Rate Tax card component uses a single flexfield context which is supplied using the the Component Detail record. There are two value definitions supported which are loaded using the Calculation Value Definition and Enterable Calculation Value record types.

The Special-Rate Tax card component references the Tax card component as its parent.

Card Component Attributes for Tax

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the Special-Rate Tax card component. For new card components supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardId(SourceSystemId) | CardSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName |

The parent Statutory Deductions and Reporting calculation card should be identified by using the same key type used to identify the calculation card. When using source keys, supply this attribute with the value supplied for the calculation card’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent calculation card. |

| ParentDirCardCompId(Sour ceSystemId) | CardSequence, ParentComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, ParentDirCardCompDefName | Identify the Tax card component for the employee. You can either provide this attribute with the SourceSystemId value supplied for the Tax card component or provide the user key attributes. |

| EffectiveStartDate | N/A | The start date of the Special-Rate Taxcard component, typically the employee’s start date. This must be the same as the EffectiveStartDate on the Statutory Deductions and Reporting calculation card. |

| EffectiveEndDate | N/A | The end date is optional for the card component |

| DirCardCompDefName | N/A | The component definition name. Specify ‘Special-Rate Tax’. |

| ComponentSequence | N/A | A number to uniquely identify this card component when multiple

card components with the same DirCardCompDefName exists. Note: Not

required when source keys are used. |

| Context1 | N/A | The name of the TRU with which the card must be associated. |

Component Detail Attributes for Special-Rate Tax

The Special-Rate Tax card component uses a single flexfield context. In addition to the attributes defined here, include the necessary flexfield segment attribute values for this flexfield context:

- Special-Rate Tax (HRX_NL_SPECIAL_RATE_TAX)

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

| SourceSystemId | CardSequence, ComponentSequence, DirInformationCategory, LegislativeDataGroupName, AssignmentNumber, DirCardDefinitionName, DirCardCompDefName | A unique identifier for the component detail. For new component detail records supply the source key attributes. You can also identify card components with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| DirCardCompId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Special-Rate Tax card component should be referenced

using the same key type used to identify the parent record. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the component detail, or update to the component detail if you are providing date-effective history. This must be after or equal to the EffectiveStartDate provided for the Special-Rate Tax card component. |

| EffectiveEndDate | N/A | The optional end date of the component detail, or if you are providing date-effective history the last day of the date-effective changes. |

| DirCardCompDefName | N/A | The name of the card component this detail is for. This is used to identify the flexfield context and should be supplied even when a source key is used to identify the parent card component. |

| DirInformationCategory | N/A | The code for the flexfield context, such as ‘HRX_NL_SPECIAL_RATE_TAX’. Flexfield context codes are visible on the Flexfield Attributes tab of the View Business Objects task. |

| FLEX:Deduction DeveloperDF | N/A | Supply the same value as for the DirInformationCategory attribute. |

Calculation Value Definition Attributes

The calculation value definition allows the creation of a rate definition so that overriding rates can be provided on the Statutory Deductions and Reporting calculation card.

The discriminator CalculationValueDefinition is used to load calculation value definition records using HCM Data Loader. The following CalculationValueDefinition attributes are commonly provided when loading a new Statutory Deductions and Reporting card.

The Special-Rate Tax card component utilizes two value definitions to supply overrides values; Special-Rate Previous Year Income and Individual Percentage.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

|

SourceSystemId

|

CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the calculation value definition record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the card component definition. |

| SourceId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | The parent Special-Rate Tax card component should be referenced by using the same key type used to identify the card component. When using source keys, supply this attribute with the value supplied for the card component’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent card component. |

| EffectiveStartDate | N/A | The start date of the parent Special-Rate Tax card component or the date the calculation value definition starts, if later. |

| DirCardCompDefName | N/A | The definition name of the parent Special-Rate Tax card component. Specify the same value as provided on the parent card component record. |

| ValueDefinitionName | N/A |

The name of the value being overridden. Supply either of the following:

|

Enterable Calculation Value Attributes

The enterable calculation value allows the creation of the actual value of the calculation value definition created above.

The discriminator EnterableCalculationValue is used to load enterable calculation value records using HCM Data Loader. The following EnterableCalculationValue attributes are commonly provided when loading a new Statutory Deductions and Reporting card.

| HCM Data Loader Attribute | Alternative User Key Attributes | Functional Description |

|---|---|---|

|

SourceSystemId

|

CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName | A unique identifier for the enterable calculation value record. For new records supply the source key attributes. You can also identify calculation value definition records with the user key attributes. |

| SourceSystemOwner | N/A | The name of the source system owner used to generate the source system ID. |

| LegislativeDataGroupName | N/A | The name of the legislative data group for the override value. |

| ValueDefnId(SourceSystemId) | CardSequence, ComponentSequence, AssignmentNumber, DirCardDefinitionName, LegislativeDataGroupName, DirCardCompDefName, ValueDefinitionName |

Identify the parent Calculation Value Definition record using the same key type used to identify the calculation value definition. When using source keys, supply this attribute with the value supplied for the calculation value definition’s SourceSystemId attribute. Otherwise, supply the user key attributes with the same values as the parent record. |

| EffectiveStartDate | N/A | The effective start date of the parent calculation value definition record, or the update to the override value if supplying date-effective history. |

| EffectiveEndDate | N/A | The optional end date of the override value, or if you are providing date-effective history, the last day of the date-effective changes |

| Value1 | N/A |

The value for the value definition identified by the parent calculation value definition record. Supply the value of the rate definition for the Special-Rate Previous Year Income or Individual Percentage Approved Date override. |