Overview of Pensions Automatic Enrolment Cards for the UK

Pension Automatic Enrolment cards store the employee’s situation related to Pension’s Automatic Enrolment process, such as the employee’s eligibility for pension, which qualifying pension scheme they are enrolled into, and opt-in and opt-out details.

A default card is generated automatically when an employee record is created by the New Hire flow and the license is set to Payroll, or Payroll Interface.

Considerations and Prerequisites

By default, an employee’s classification is set to Not Yet Assessed. If a Tax Reporting Unit (TRU) is provided for the employee during the New Hire flow, the Pensions Automatic Enrolment card is associated automatically to that TRU. The Pensions Automatic Enrolment process can then be run on a regular basis to assess the employee’s eligibility to Pensions Automatic Enrolment and make all the relevant updates to the card. If the employee is found eligible, a Benefits and Pensions card is also created automatically by the process for the default Qualifying Pension Scheme.

There may be instances where mass upload is required for the Pensions Automatic Enrolment card:

- Employee’s Pensions Automatic Enrolment must be uploaded to ensure that all relevant information about Pensions Automatic Enrolment is migrated from your legacy system. When you use HCM Data Loader to migrate the employee records a card is generated with the default Not Yet Assessed classification. This needs to be updated to reflect the employee’s current state, or they will be re-enrolled the first time the Pensions Automatic Enrolment process is executed in the Oracle Payroll Cloud.

- Bulk Load of New Hire data:

If you use HCM Data Loader or interface with Taleo to bulk upload new hire information a default Pensions Automatic Enrolment card may be generated automatically. You should update auto-generated cards if the defaulted data isn’t accurate or relevant.

- Bulk Load of Pensions Automatic Enrolment

Information:

If a third-party manages Pension Automatic Enrolment data, such as opt-in, opt-out and notification letters, information obtained from the third party must be uploaded into the Oracle Payroll cloud.

It is recommended that you have a good understanding of the Pensions Automatic Enrolment card and the information it contains before attempting to bulk load data for it. For further information see Oracle Fusion HCM (United Kingdom): Pensions Automatic Enrolment and Functional Considerations (MOS DOC ID: 2006584.1).

- You must have created the element eligibility for the Pensions Automatic Enrolment element.

- You must have created the Pension Deduction elements.

- When uploading Qualifying Pension Scheme via HCM Data Loader, you will need to ensure that the corresponding component exists in the Benefits and Pensions card.

Pensions Automatic Enrolment Card Record Types

| Component | Functional Description | File Discriminator |

|---|---|---|

| Calculation Card | Defines the calculation card type and the employee assignment that it captures information for. | CalculationCard |

| Card Component | Used to group and segregate data required by the calculation card. The following sections describe the card components applicable to this calculation card and the child records that are required for each card component. | CardComponent |

| Component Detail | Provide a component detail record for each flexfield context required by each card component. | ComponentDetail |

| Component Association | Associates the calculation card with the Tax Reporting Unit

the employee reports to. Note: If there is only one TRU in your

organization, the component association isn’t mandatory: by

default it will automatically be associated to the unique

TRU. If you add another component to the card, it must be

associated to a TRU. |

ComponentAssociation |

| Component Association Detail | Associates card components with the employee’s assignments. Note: When there are multiple components on the same card, each component must be associated to a TRU, and to Terms or Assignments. | ComponentAssociationDetails |

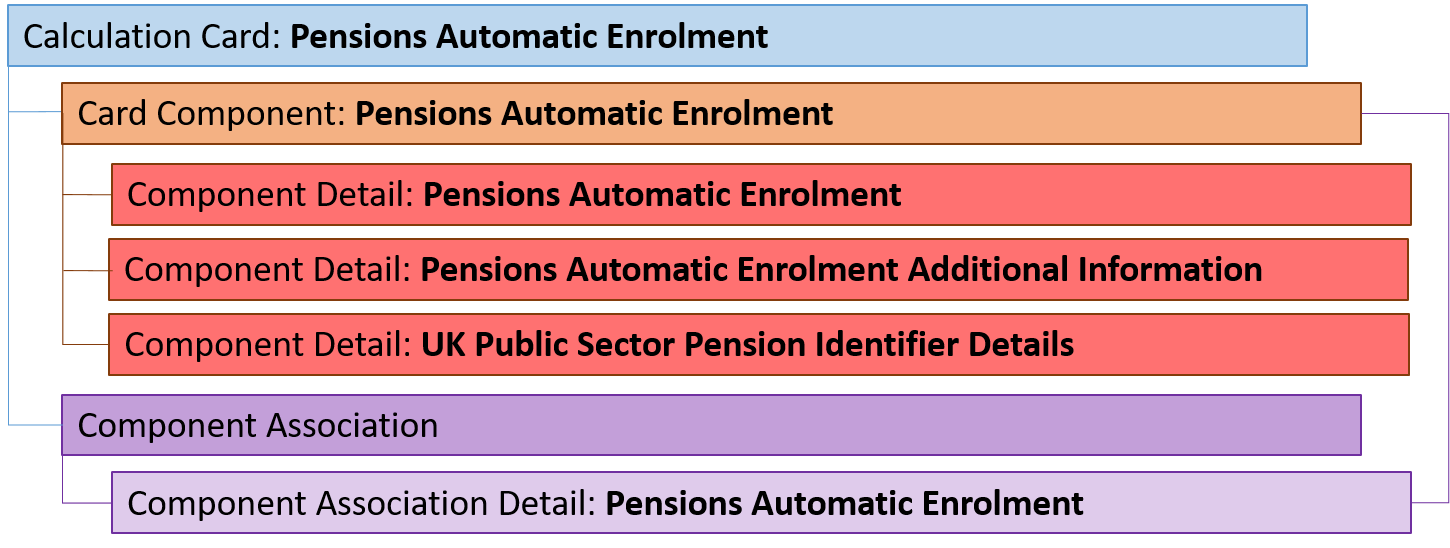

Pensions Automatic Enrolment Calculation Card Hierarchy

The hierarchy of calculation card components applicable Pensions Automatic Enrolment are described in this diagram:

The Pensions Automatic Enrolment component card utilizes three flexfield contexts which are loaded using the Component Detail record type. The component is associated with the employee’s tax reporting unit using the Component Association and Component Association Detail records types.

Mapping Calculation Card Components to the Responsive User Interface

The Pensions Automatic Enrolment Details are maintained using the card component detail records.

The TRU information is updated using the component association record. The Assignments associated with the card are defined using the Component Association Detail record.