Overview of Statutory Deductions for the UK

Statutory Deduction cards store all the information required to accurately compute Tax and National Insurance (NI) contributions for an employee, such as tax code, NI category and pension basis.

It also includes information required for the Real Time Information (RTI) reports. A default card is automatically generated when an employee record is created by the New Hire flow and the license is set to Payroll, or Payroll Interface.

One Statutory Deduction card must be created for each employee and the Tax Reporting Unit (TRU) that the employee reports to.

Considerations and Prerequisites

If the product license is set to Payroll or Payroll Interface, Statutory Deduction cards are automatically created when a new employee is entered using the New Hire task with a set of default values specified at the PSU or the TRU level.

However, there may be cases where this information must be loaded in bulk:

During Data Migration:

Employee PAYE and NI information must be uploaded into Oracle Fusion Payroll, in order to ensure that contributions are calculated correctly. If HCM Data Loader is used to migrate employee records, a default statutory deduction card is automatically created. In most cases, the default won’t reflect the employee’s actual tax and NI information, and therefore the card must be updated.

A number of information fields must be provided for RTI purposes such as:

- Previous HMRC Payroll ID from your legacy system to inform HMRC of the change in

Payroll ID. Note: The new Oracle Cloud HRMC Payroll ID is automatically generated when a new Statutory Deduction card is created for the person. When the Full Payment Submission (FPS) is submitted for the first time from Oracle Cloud Payroll, it contains the mapping between the new and old HMRC Payroll ID. If the employment has already been filed with HMRC, it won’t be reported as a new one.

- Information such as Late Hire Reason, Number of Hours Worked, New Hire Declaration, Pensioner Notification, or Expatriate Notification, if required.

Ongoing bulk updates:

Bulk loading of new hire data: If you have to do a mass upload of New Hire information, a default Statutory Deduction card and Pensions Automatic Enrolment card may be automatically generated (if the new hire records are created through HCM Data Loader or the interface with Taleo). In this case, you need to update the default card with the correct tax and NI information and create a component detail to store new hire information as requested for RTI reporting.

Statutory Deduction Card Record Types

The Statutory Deduction card is uploaded with HCM Data Loader using the Global Payroll Calculation Card business object. This generic object hierarchy provides record types to support the various country-specific requirements.

| Component | Functional Description | File Discriminator |

|---|---|---|

| Calculation Card | Defines the calculation card type and the employee assignment that it captures information for. | CalculationCard |

| Card Component | Used to group and segregate data required by the calculation card. The following sections describe the card components applicable to this calculation card and the child records that are required for each card component. | CardComponent |

| Component Detail | Provide a component detail record for each flexfield context required by each card component. | ComponentDetail |

| Card Association | Associates the calculation card with the Tax Reporting Unit the employee reports to. | CardAssociation |

| Card Association Detail | Associates card components with the employee’s assignments. | CardAssociationDetails |

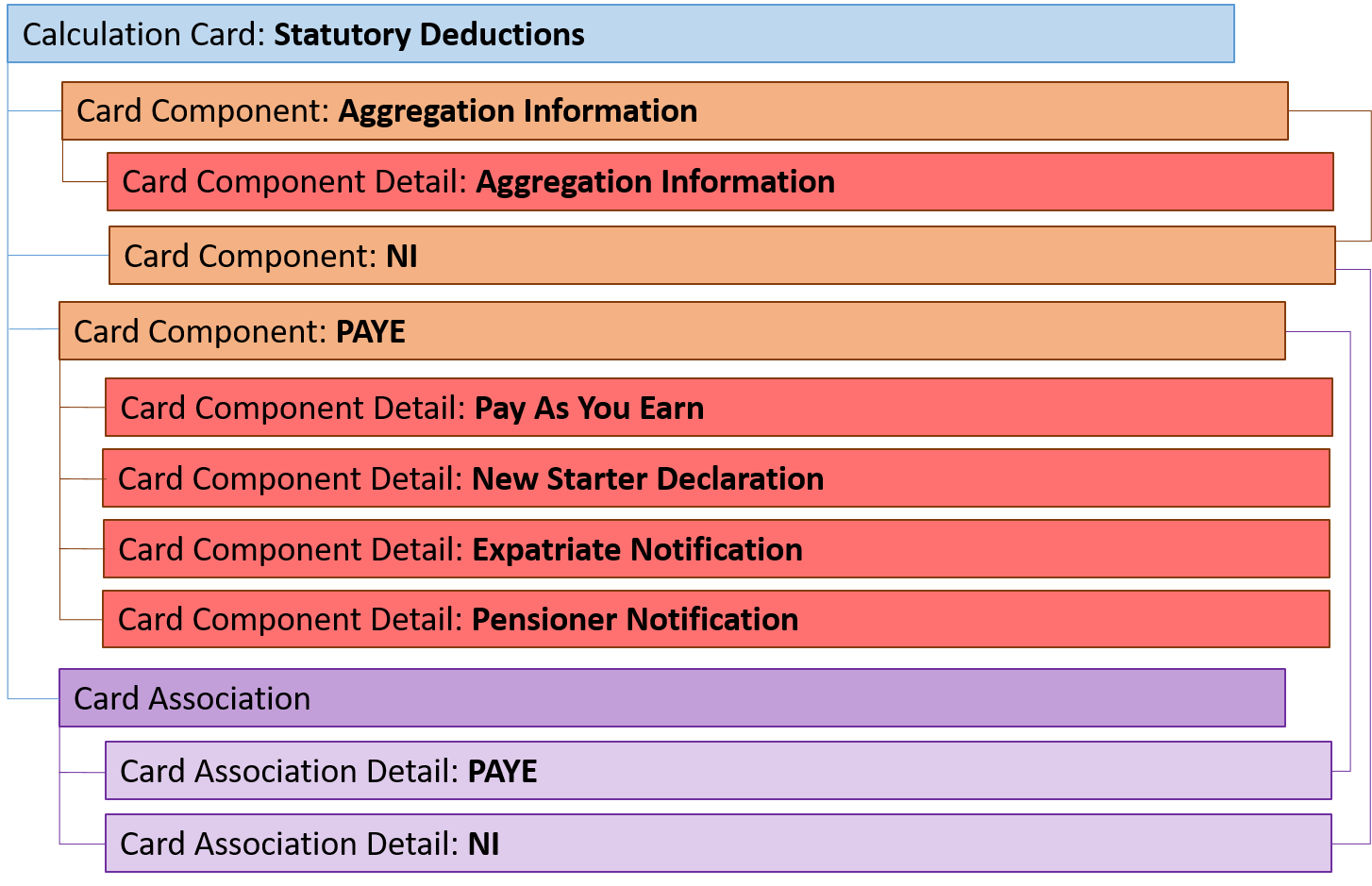

Statutory Deduction Calculation Card Hierarchy

The hierarchy of calculation card components applicable Statutory Deductions are described in this diagram:

A separate topic follows to describe how to provide data for the calculation card record and each card component.

Mapping Calculation card components to the responsive user interface

The TRU information is updated using the card association record.

Paye As You Earn and National Insurance Statutory Deductions summary information is updated using the PAYE and NI card components, with the Assignment information being defined on the card association detail records.

PAYE Details are updated using the Pay As You Earn card component detail record. On the PAYE Details page, you can also create one or more Notifications. The Notification Type enables you to select from one of the three component details: New Starter Declaration, Pensioner Notification or Expatriate Notification. These are updated using the appropriate Card Component Detail records under the PAYE card component.

NI Details are updated using the NI card component. NI Additional Info is updated using the Aggregation Information card component detail under the Aggregation Information card component. The Aggregation Information card component is not displayed on the user interface. However, it is part of the calculation card structure and needs to be supplied when creating a new Statutory Deductions card using HCM Data Loader. If multiple NI components exist, the Aggregation Information will be displayed against each NI component, though only one Aggregation component exists.

Statutory Deductions Validation

Some validation that’s enforced via the user interface can’t be enforced whilst loading records via HCM Data Loader. We would therefore advise that you run either the Payroll Validation Report or the Diagnostic report after loading Statutory Deduction records via HCM Data Loader.

| Message | Resolution |

|---|---|

| An active calculation card of this type for this tax reporting unit already exists. | There can be only one effective Statutory Deductions calculation card related to a specific TRU on any date, for a payroll relationship. |

| An active calculation card of this type, with no associations, already exists. | There can be only one active Statutory Deductions card that’s isn’t associated to a TRU at any one time. |

| The priority period type is invalid for the combination of association details with this calculation card. | A priority period type is entered for the calculation component, but it doesn’t correspond to one of the payroll frequencies assigned to one of the component associations. |

| You must enter a priority period type because there are association details with different payroll frequencies. | If there are multiple component associations with different payroll frequencies, the priority period type must be entered so that the payroll run can process these associations with that same frequency. |

| NI category {NI_CATEGORY} isn’t valid for the current certificate. | The NI category is dependent upon the certificate entered on the Aggregation Information. Select a valid NI Category for the certificate. |

| Pension basis {PENSION_BASIS} isn’t valid for the current NI category {NI_CATEGORY}. | The pension basis field is dependent upon the NI category. |

- Guidelines for Loading Calculation Cards

- Guidelines for Loading Statutory Deductions for the UK

- Guidelines for Updating Aggregation Information for UK Statutory Deductions

- Guidelines for Updating PAYE for UK Statutory Deductions

- Guidelines for Updating NI for UK Statutory Deductions

- Guidelines for Loading UK Statutory Deductions Card Associations