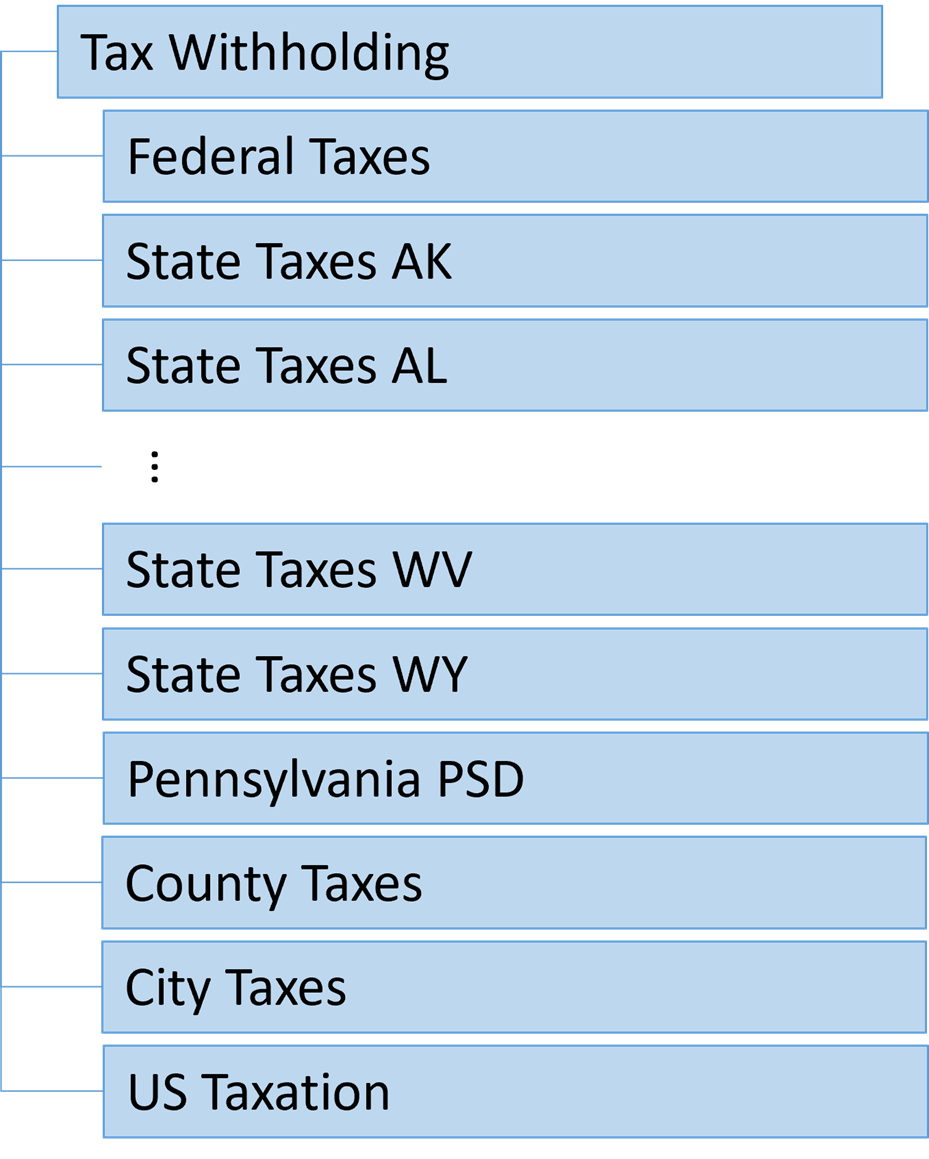

Overview of US Tax Withholding Information - Dynamic Card

Tax Withholding calculation cards store component information for employee federal, state, and local tax forms supported, and calculation overrides for the United States.

Calculation card components are not needed to calculate taxes. If a card component has not been created, or the component was created with no values or missing values, default values will be used for tax calculation.

The Tax Withholding HCM Data Loader object hides the complexity of the underlying calculation card structure. You’ll find a single Tax Withholding business object for the different types of tax: federal, county, city etc. There are separate components for Federal, each State, and Local Tax in the Tax Withholding business object, ensuring each tax card component only includes attributes relevant to that component.

Tax Withholding

The Tax Withholding component is used to identify who the card is for. It should always be supplied when creating or maintaining existing cards.

Federal Taxes

The Federal Taxes card component is used to capture information that will impact Federal Tax calculations for the employee.

Each Tax Withholding calculation card should have one Federal Taxes card component.

State Taxes

The State Taxes components are used to capture information that will impact State Tax calculations for the employee.

A State Tax card component may be used for each US state that has a resident tax or work tax.

Pennsylvania PSD

The Pennsylvania PSD card component is used to capture information specific to Pennsylvania PSD. When a Pennsylvania residency certificate is received from an employee, create a single Pennsylvania PSD for the employee.

County Taxes

The County Taxes card component is used to capture information for the related resident or work County Tax calculations for the employee. A County Tax card component may be used for each US County that has a resident tax or work tax and requires an override. There is only one County Taxes component in the Tax Withholding object hierarchy, you specify the state and county for the attributes you are updating on the County Taxes component.

City Taxes

The City Taxes card component is used to capture information that impacts city tax calculations for the employee. A City Tax card component may be used for each US City that has a resident tax or work tax and requires and override.

There is only one City Taxes component in the Tax Withholding object hierarchy, you specify the state, county, and city for the attributes you are updating on the City Taxes component.

US Taxation

You should create a US Taxation card component for each tax reporting unit for the employee.

Considerations and Prerequisites

When you create your employees with the product license set to Payroll or Payroll Interface, Tax Withholding calculation cards are auto-generated for your US new hires with an association to their (Tax Reporting Unit) TRU, if the employee is only assigned to only one TRU. In other cases, the Tax Withholding card association may need to be created manually. A Federal component is also auto-generated for new hires. You then need to do one of the following:

- Allow employees to update their components using self-service

- Enter the updates manually based on the forms received from the employee

- Load the information using HDL based on the forms received from the employee.

For guidance on maintaining autogenerated cards refer to the Guidelines for Maintaining Tax Withholding Cards for the United States topic.

If your employees were created in the Oracle Human Capital Management Cloud without a Payroll or Payroll Interface license, then you need to create the complete Tax Withholding card. Refer to the Guidelines for Creating a Tax Withholding Card for the United States topic.