Payroll Calculation Info for the US

When you create an element, the Elements task generates the rules and definitions required to calculate an earnings or deduction amount.

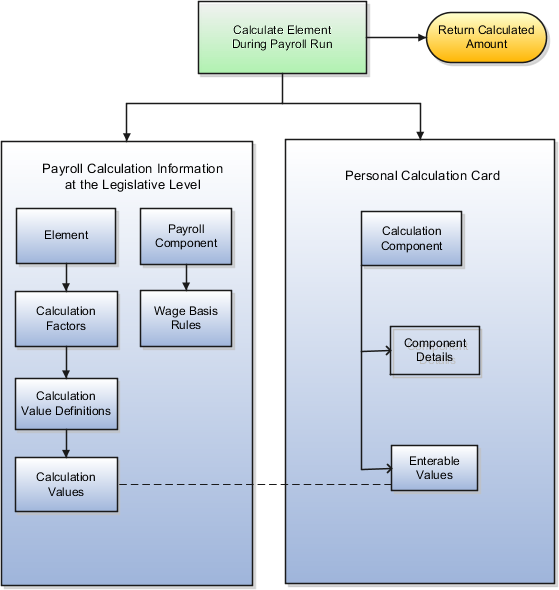

These rules and definitions exist within the following components.

-

Elements

-

Payroll components

-

Wage basis rules

-

Calculation factors

-

Calculation value definitions

-

Calculation components

The following figure shows the relationship between those components held at the legislative data group level and those you can enter on a personal calculation card.

Elements

Elements specify how and when an earnings or deduction should be processed. When you create an element, several related elements are typically created with the same name prefix. You can view the related elements and other generated items on the Element Summary page, including:

-

Status processing rule

Specifies the formula that processes the element entries.

-

Input values

Values that can be entered for, or returned from, the calculation.

Use the Elements task to create elements and to view the generated elements and related items. After creating an element:

-

You must add eligibility rules

-

You may want to add:

-

Input values

-

Status processing rules

-

Frequency rules

-

Subclassifications

-

Balance feeds

-

For further info, see Elements for the US in the Help Center.

Payroll Components

A payroll component is a group of rates and rules that the payroll run uses to calculate values for earnings and deductions.

When you create elements in certain classifications and categories, such as involuntary deductions, the element template creates a payroll component with the same name.

You can manage payroll components using predefined component groups, which vary by country or territory but may include social insurance, taxes, retirement plans, involuntary deductions, and benefits.

Use the Payroll Calculation Information task to view payroll components and their associated rules.

Wage Basis Rules

Wage basis rules determine:

-

The earnings that contribute to a deductible amount

-

For exemptions, the elements that reduce the amount subject to deduction

For example, wage basis rules could define which secondary classifications of standard and supplemental earnings are subject to a particular tax.

Rules may vary based on reference criteria such as a worker's place of residence.

Use the Component Group Rules task to define the rules and references.

Use the Calculation Cards task to enter marital status and exemption values for workers.

For further info, see Tax Wage Basis Rules for the US in the Help Center.

Calculation Factors

Calculation factors indicate which calculation value definition to use when calculating the amount.

If tax rates vary based on a factor, such as a person's filing status, then the filing status is defined as a calculation factor reference. Thus, an element may have multiple calculation factors, one for each unique set of rules and references values.

Use the Component Group Rules task to view calculation factors defined for a component group.

For further info, see Calculation Factors in the Help Center.

Calculation Value Definitions

Calculation value definitions store calculation rates and rules, which may vary based on other criteria.

For example you can use calculation value definitions to calculate regional income tax rates for employees, which vary based on their income levels.

The calculation value definition controls which calculation values are enterable on a calculation card.

Use the Calculation Value Definitions task to view predefined definitions and the definitions that element templates create.

For further info, see Calculation Value Definitions in the Help Center.

Calculation Components

Calculation components are individual calculations captured on a calculation card. When an element template creates a payroll component, it also creates calculation components that you can enter on personal calculation cards to enter specific details for the person.

Use the Calculation Cards task to enter calculation components for a person.