Using Global Payroll

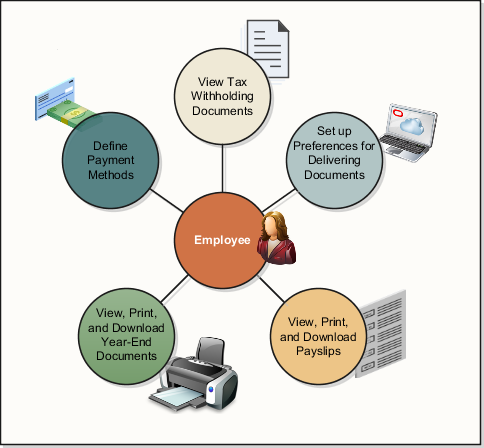

You can manage your payroll information, which, depending on access, may include viewing payslips, defining payment methods, and setting up document delivery preferences, from the payroll work area on your Home page.

This graphic shows you the different tasks that you can do in the application:

Payslips

A payslip provides a record of the individual payroll payments you have received, including pay amounts, deductions taken, and accruals.

Use the My Payslips task to view the summary of a payslip, such as the earnings and deductions. You can also preview the full payslip document, held in document of records, embedded on the page.

Payment Methods

Payment methods define how you want to be paid your payroll payments. If you want to be paid by direct deposit, you must create your bank accounts before creating your payment methods.

Use the redesigned Payment Methods task in your Pay work area to create bank accounts and define payment method details.

The payment method overview displays in a card layout. Each card contains a summary of the payment method info, such as payment method name, payment amount, and bank details if applicable. You can drill down into the payment method details, such as bank information, when applicable.

You can do the following on the Payment Methods page:

- Create a payment method and associated bank account in the same transaction.

- View and update bank accounts, such as to inactivate bank accounts that are no longer in use.

- Reorder payment methods to change the order of processing when they start and end on the same date.

- Create exception payment methods to have certain earnings paid to a different bank account is available by extending the functionality of this page.

- Enforce double entry of bank account information to verify the details are correct and prevent keying errors is available by extending the functionality of this page.

You need to create bank accounts and associate them to payment methods to be paid with direct deposit. Or, if your company allows, by international transfer. However, if you want to be paid by check, you can skip this and go directly to set up your payment methods.

Here are some important things to know about managing your bank accounts:

-

When you create a bank account, it's automatically created with an active status.

-

When you create a bank account for an international payment, you must select a country to continue.

-

When you make a bank account inactive because you have closed it or no longer want to receive payments there, you can make it inactive. This action is effective tomorrow, which means your bank account will remain active until the end of today, the day you make it inactive.

-

Once you have received a payment into your bank account, the only action you can take is to make it inactive.

-

Be sure to create and edit your payment methods to match your bank accounts updates. For example, if you make a bank account inactive, update the payment method to associate it to an active bank account.

You need to create payment methods and associate to your bank accounts to be paid with direct deposit. Here are some other important things to know about payment methods:

-

When you create your payment methods, uniquely name them to describe the type or reason for the payment method. For example, Pay Myself First Savings Account or Direct Deposit to Checking Account.

-

If your company allows, you can split your payroll payment across multiple payment methods.

-

When you create your first payment method, it will automatically default to receive 100% of your earnings. However, when you create more than one payment method, you can allocate a percentage of payment or an amount per payment method.

This table explains the data items to enter when you create your payment methods:

|

Option |

What To Do |

|---|---|

|

What do you want to call this payment method? |

Enter a name to describe this payment method. |

|

Payment Type |

Select one of the payment types supported by your company. Such as direct deposit, check, cash, or international transfer. |

|

Payment Amount |

Select Amount or Percentage to specify how you want to allocate your funds. |

|

Bank Account Details |

Select the bank account to be associated for this payment method. |

Payment Method Processing Order

Reorder your payment methods to define them to be processed in a certain order. When you define multiple payment methods with the same effective date, you can use the reorder button to change the processing order of the payment method. For example, if you have a payment method set up that total less than your net payroll, the priority order of processing may be important.

Exception Payment Methods

Define exception payment method to deposit payments into different bank account based on type of payment. For example, if you want your regular salary to be paid to your checking account but your bonus payment to be paid to your savings account, define an exception for your bonus. Be sure to define your regular bank account and payment method before you define an exception to it.

Payroll Relationship Switcher

Payroll relationship switcher on the payment methods page lets you to move from one payment method details to another when you have multiple payroll relationships. This only appears if you have multiple payroll relationships. For example, if you're going through a global transfer, you may have multiple payroll relationships. Because payment methods are created at the payroll relationship level, use the payroll relationship switcher at the top of the payment method page to navigate from one to another.

Prenote Process

The prenote process, also referred to as a prenotification, is a process your company uses to verify your bank account details before sending you a payment. If you work for a company that runs the prenote process, which are typically companies in the US, you may see a prenotification status banner message at the top of the bank account region.

This table explains the prenotification status banners you may see:

|

Prenotification Banner Message |

Banner Shows on Page |

|---|---|

|

This bank account will be used once the prenote process is complete. |

From the time the bank account is first created and attached to a payment method until the prenote process is complete. |

|

This bank account was rejected during the prenote process and won't be used. |

When the bank account has been marked as rejected. |

Year-End Documents

A year-end document provides you with a record of your earning and deductions for a given fiscal year.

Use the Year-End Documents task to view your year-end documents. You see a list of recent year-end documents, use the drop-down list to view older payslips.

Document Delivery Preferences

On the Payroll page, click Document Delivery Preferences to define preferences for delivering your documents, such as payslips or year-end tax statement.

On the Document Delivery Preferences page, you can select the default delivery methods, such as online and paper, for your documents.

To view your year-end document,s click the hyperlink. Once open, you can save or print for your records.

To view your forms online, configure these settings:

-

In the Delivery Method field, select Online.

-

In the Online Delivery Consent field, select Granted.