Third Parties Overview

You create third parties to process payments to external organizations and to people who aren't on the payroll. Use the Third Parties task to create third-party persons or organizations, such as pension providers, professional bodies, or disability organizations.

When you create third-party persons and organizations, they're also defined as trading community members in the Trading Community Architecture (TCA), to allow use in other products.

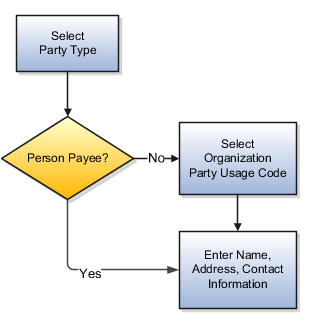

This shows you the decision steps to create third parties.

Party Usage Codes

For third-party persons, the application automatically assigns a party usage code of External Payee. For third-party organizations, you assign a party usage code.

This table describes the party usage codes for third-party organizations.

|

Party Usage Code |

Use For |

Examples |

|---|---|---|

|

External Payee |

Organizations when the others party usage codes don't apply. |

State Disbursement Unit for child support payments |

|

Payment Issuing Authority |

Organizations responsible for issuing instructions for involuntary deductions, such as a tax levy or bankruptcy payment order. Payment issuing authorities don't receive payments. |

Court, agency, or government official |

|

Pension Provider |

Organizations that provide pension administration for employee pension deductions. |

Stock broker, investment company, benefit administrator, labor union |

|

Professional Body |

Organizations entrusted with maintaining oversight of the legitimate practice of a professional occupation. |

The American Society for Mechanical Engineers in the US |

|

Bargaining Association |

Organizations that represent employees in negotiations. Bargaining associations associated with trade unions may receive payments for union fees deducted from an employee's pay. |

The Air Line Pilots Association International (ALPA) in Canada and the US |

|

Disability Organization |

Organizations that are authorized to make disability assessments. Disability organizations don't receive payments. |

The Royal National Institute of Blind People in the UK |