Overview of Define Earning and Deduction Definitions

The Define Earning and Deduction Definitions task list in Setup and Maintenance contains the tasks required to set up elements and payroll components.

Your implementation may include a few predefined elements, usually for legislative tax deductions. Use the Elements task to create additional elements and the associated objects required to support their processing. The objects vary depending on the element classification and category.

Manage Element Classifications

Elements are grouped into primary classifications that control their sequence of processing and the balances they feed. Secondary classifications are subsets of the primary classifications, which you may use to manage wage basis rules for deductions and taxes.

The primary classifications and some secondary classifications are predefined. You can't remove or change predefined classifications.

What you can do:

-

Create additional balances that the primary classifications feed.

-

Create secondary classifications, if required.

-

Specify costing setup options and frequency rules for element classifications. The default frequency rule is always each period.

Manage Elements

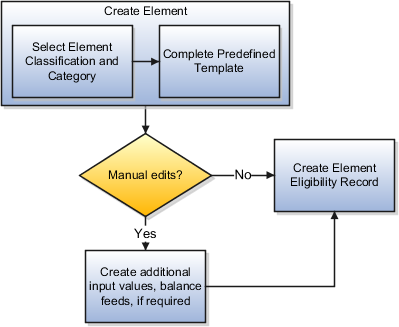

Use the Elements task to review elements and to create new ones. When you create an element, your selection of the element classification and category determines the questions on a predefined template. Submitting the template generates an element, which you can edit, as required.

You must create at least one element eligibility record for all predefined and newly created elements.

The following figure shows the tasks involved.

Make sure you set the country extension to Payroll using the Features by Country or Territory task before you create elements for payroll processing. This setting ensures that you use the appropriate element templates.

Creating certain elements also creates component groups, calculation value definitions, and other calculation information. For example, creating involuntary deductions and pension deductions may create these additional objects. Use the relevant tasks in the Define Earning and Deduction Definitions task list to review the objects generated for each element.

Payroll components are associated with a set of rates and rules used for calculation or reporting. These components conform to manage calculation value definitions

What you can do:

-

Review the tables that hold the rates and other values used to calculate deduction and exemption amounts.

-

Modify some value definitions. For example, you might enter a default payee for pension payments.

-

Create new calculation ranges, if required

Manage the calculation information for elements that generate payroll components, such as involuntary deductions and statutory deductions.

What you can do:

-

Review the calculation information supplied for your country or territory, such as the wage basis rules and calculation factors

-

Create new calculation factors, if required.

Component groups are predefined categories of calculation components managed by component group rules.

What you can do:

-

View rules for component groups.

-

Modify the rules, such as wage basis rules, for some deductions

After setup, you add calculation components to personal calculation cards by loading data, such as time cards, or using the Calculation Cards task. In most cases, hiring a worker creates a statutory deduction card automatically.

Add Eligibility Rules For Predefined Elements

The task list includes this task as a reminder. Use the Elements task to define at least one element eligibility record for every predefined and newly created element.

Make sure you create an eligibility record for the statutory deduction elements like Tax, before you start hiring workers.

Element eligibility determines who can receive entries of the element. Do the following:

-

Create a name for the element eligibility record. Use a naming convention similar to the element's to easily identify the record, for example, when you set up costing for the element's eligibility record.

-

Restrict who can receive entries of the element by specifying eligibility criteria. For elements applicable to all workers, create eligibility without specifying any criteria.

Manage Rate Definitions

Define any rates that are based on calculated payroll balances, such as an employee's average salary during the last three months. You can use rate definitions in absence plans and formulas.

You can define rates to be:

-

Monetary, such as a pay rate, or non-monetary, such as an absence accrual rate defined in days or hours

-

Based on a combination of elements, or a single element