Overview

Use the concepts and tasks provided in this playbook to set up and allocate court orders (also known as attachment of earnings and notice of attachments) to make required deductions from your employees.

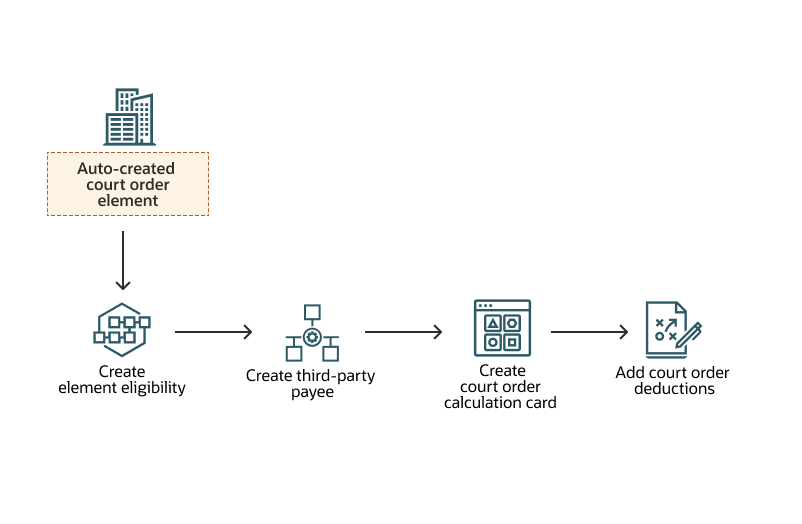

The application automatically provides all court order elements in the primary classification Involuntary Deductions with the fast formulas, lookups, value setup, value group, value definition, and range. Each type of court order is a predefined secondary classification. These are used when the court order element is processed for an employee.

These are the types of court orders:

- Attachment of Earnings Maintenance

- Attachment of Earnings Fines

- Notice of Attachment Revenue

- Notice of Attachment Department of Social Protection

These are the key tasks you need to perform while setting up elements for court orders:

- Create the eligibility for a court order element.

- Set up a third-party payee.

- Create a court order calculation card.

- Add a court order deduction.