Introduction

This playbook provides a sample solution to administer salary sacrifice for employees who might want to use it partially, fully, or abstain from it.

-

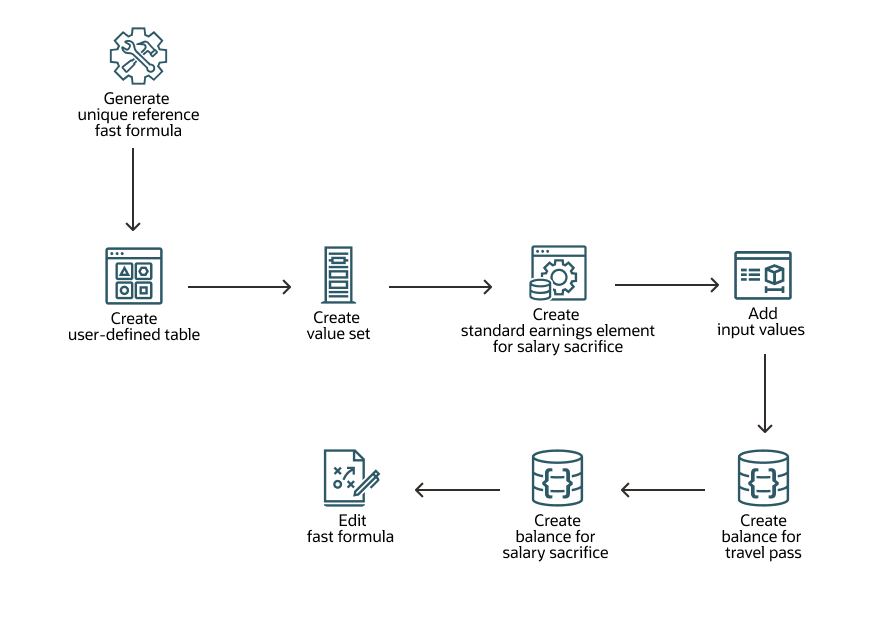

Set up fast formulas to generate unique reference.

-

Create user-defined table and value set.

-

Create the required salary sacrifice element using the earnings element template.

-

Ensure that it contains an input value of Amount (or similar) and Unique Reference.

-

The priority of the salary sacrifice earnings element should be such that it runs after all other earnings elements.

-

Even though the element is an earnings element, it’s behavior is like a Loan element. You need to track the opening balance, partial recoveries (in case of insufficient earnings), recovery total earnings from a termination period and STOP rule when the total amount is paid off.

-

Use the sample changes recommended to the template generated fast formulas while creating the element.

-

It handles overlapping salary sacrifice elements in a given period.

-

The Pay Value must be negative.

-

This element doesn’t feed the Gross Pay balance. This element feeds these balances:

- Gross Taxable Pay

- Pay for Employee PRSI

- Pay for Employer PRSI

- USC Pay

- Own primary balance, which is referenced by the corresponding earning element’s fast formula.