View Calculated Cards

Upon hiring a France employee, the system will automatically create a calculation card meant to act as container for the tax rates present in the CRM Nominatif file.

To view the created calculated card the following steps are needed.

- Select the employee.

- Select the Calculation Card: Withholding Tax and view the details.

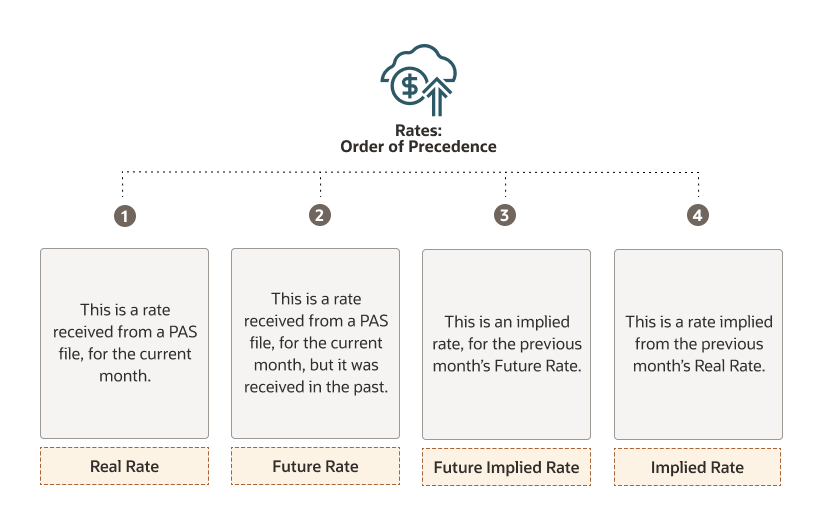

Further, the PAS file may also contain future rates. The Load Inbound PAS File process will also load these rates, as at the respective future date given in the file. Additionally, it will also load a future implied rate, for the month immediately following the future month, with the same future rate value, referred to as, future implied rate.

The hierarchy of the rates is as follows:

When the tax calculation runs, it takes the highest precedence of tax rate from the set available on the calculation date.