1About This Playbook

Use this playbook to set up and configure Redwood pages for employee self-service and enable your employees to manage their pensions enrolments and new starter declaration.

Employee Self-Service for Pensions Enrolments

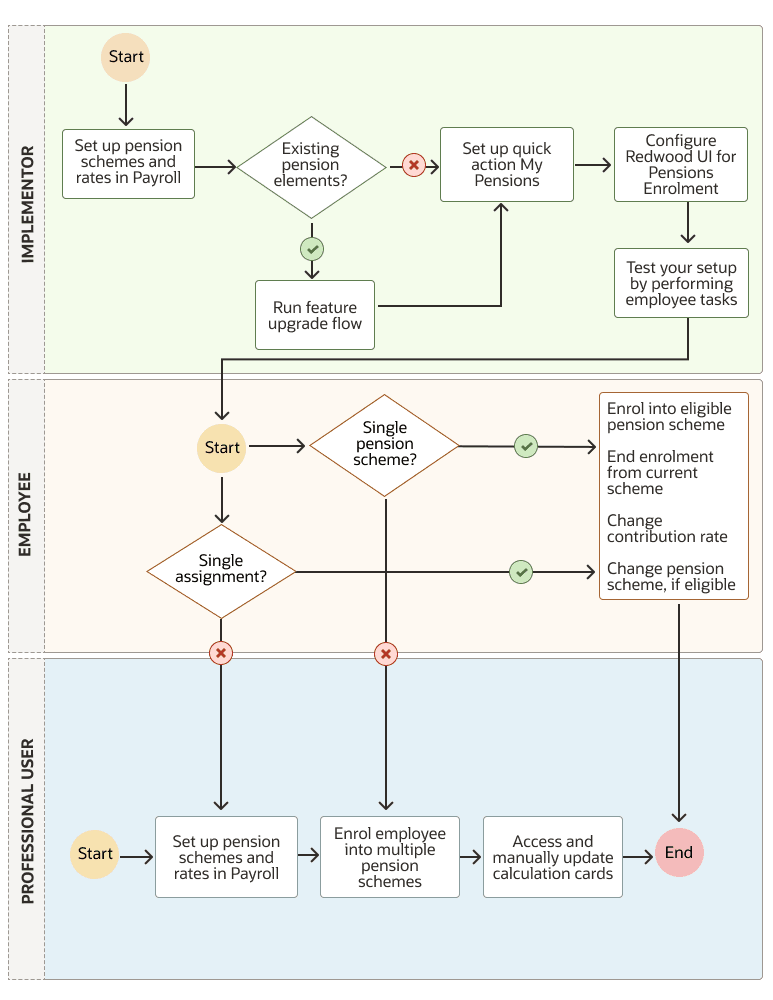

Here's the workflow for different users when you set up the employee self-service for pensions enrolment.

Here are the steps to set up and configure employee self-service pages in Redwood for pensions enrolments:

- Set up pension schemes and rates in Payroll at the legal employer level. Use the existing eligibility profiles to link the profiles with rates.

- If you've created pensions elements before this set up, run the feature upgrade flow.

- Set up the quick action My Pensions for your employees using the predefined roles and privileges.

- Configure the profile options to make the employee self-service pages available in Redwood.

- Create rate validation formulas and add them to pensions scheme definition at the legal employer level.

Your employees can perform these tasks using the self-service pages to manage their

pension enrolments:

- Enrol into an eligible pension scheme

- End enrolment from their current scheme

- Submit changes to their contribution rate

- Change their pension scheme, if they're eligible to do so

Employee Self-Service for New Starter Declaration

Configure the profile options to make the employee self-service pages available in Redwood.

The new starter declaration is a replica of the HMRC paper form. It's an employee statement to their employer regarding their tax and student or postgraduate loan status.