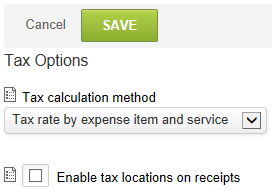

Tax Options

Tax Options provide the ability to select and create various taxation scenarios within OpenAir. These are available in the Invoices and Expenses applications.

To create or edit Tax options:

-

Go to Administration > Global Settings > Organization > Tax Options.

-

Select the Tax calculation method. Three main methods exist for tax calculation.

-

Tax locations — allow the creation of individual tax settings, which consider taxation on a geographic basis. See Tax Locations.

-

Tax rate by expense item and service — permits the tax settings, which are based on individual expense items and services, to be applied when generating customer billings. See Expense Items in Expenses Settings and Expense Items and Service in Invoices Settings.

-

Federal/State tax by project and vendor — permits the entry of a tax location/rate directly on a project or vendor, which will be applied to customer billings.

-

-

Check the Enable tax locations on receipts box.

-

Click Save.

Enable tax locations on receipts — By default, taxes may be handled on invoices and taxable information will be computed based on associated services with timesheet hours, that is, the service is set up as taxable.

Expense Items and Products may also be set up as taxable. The tax calculation is applied based on the tax location set on the project, which is passed to the invoice, or set directly on the invoice. Optionally, receipts within an expense report may have unique taxes related to the location of where the expense was incurred. Select this option to display the tax location field on receipts for the entry of specific tax handling.

Other considerations when selecting this option are as follows:

-

When you rebill expenses, do you remove the tax amount of the location where the expense was incurred and apply a standard tax rate, an option on the expense billing rule?

-

Do you apply taxes in addition to the taxes captured for the receipt?

-

Do you pass taxes directly through to the customer?