Predictive Cash Forecasting Overview

Predictive Cash Forecasting enables companies to make better use of their cash with data-driven continuous cash forecasting.

Note:

Predictive Cash Forecasting is a Planning application type designed to help treasurers and cash managers perform short-term tactical (rolling ~10 days) or mid-term operational (~3-6 months /~12-26 weeks) cash forecasting. It allows for daily, weekly, or monthly rolling forecasts that can be generated for operational, financial, and investing cash flow line items. It is built using a direct cash flow method and enables decision-making and actions for cash optimization across multiple legal entities within the business. Additionally, it provides an overview of the organization's overall cash position at each level of the legal hierarchy. With Predictive Cash Forecasting, you can:

-

Optimize cash by finding problems and opportunities earlier with increased automation and more frequent cash forecast updates.

- Take action faster by aligning stakeholders and unifying scenario planning with corrective actions.

- Enable operational improvements through deeper insights into order-to-cash and procure-to-pay.

Predictive Cash Forecasting provides pre-built, best practice out-of-box content including a dimensional model, line items, forecast methods, forms, dashboards, rules, and role-based navigation flows.

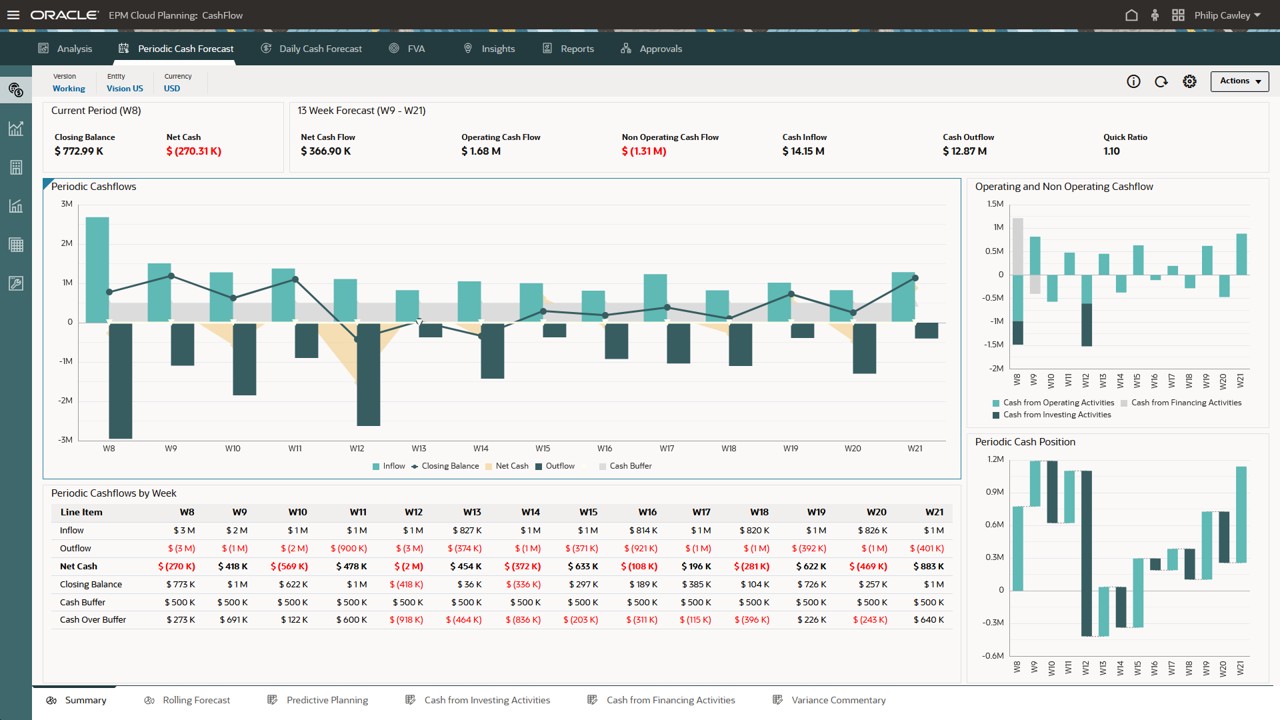

Cash Managers use the Summary dashboard to review continuous rolling cash forecast, operating and non operating cashflow, and daily or periodic cash position by entity, along with KPIs:

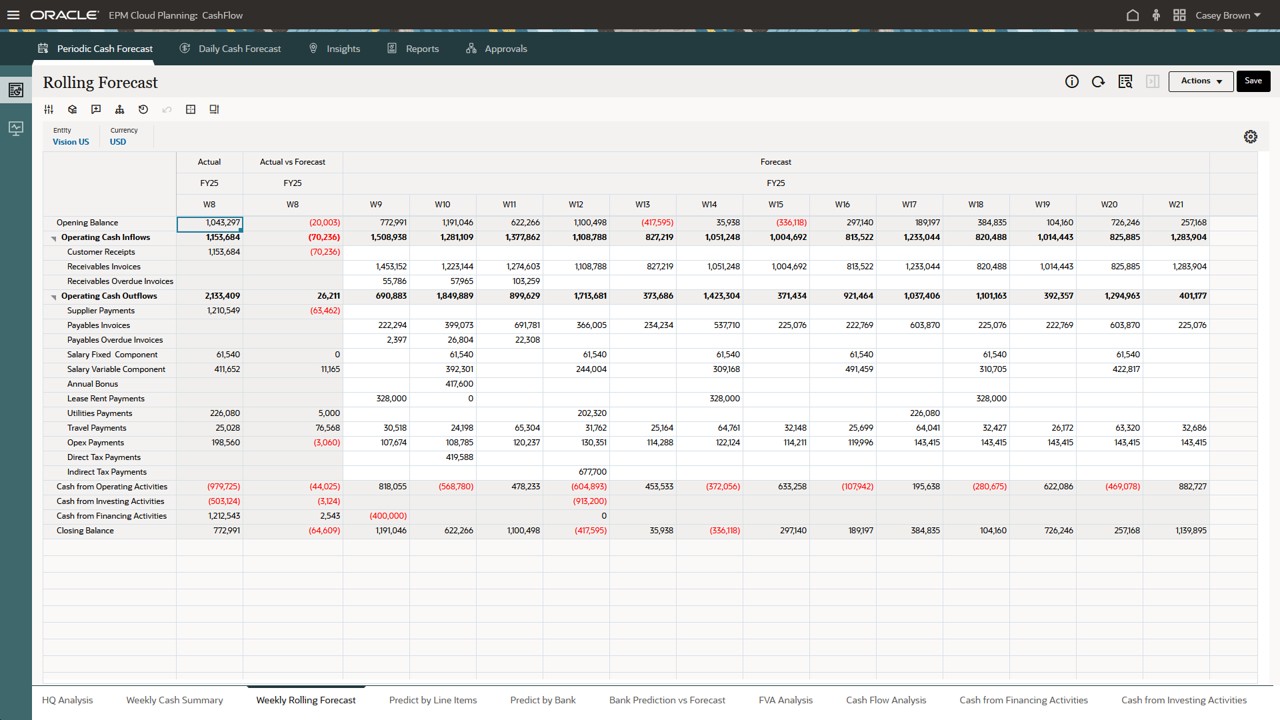

Predictive Cash Forecasting allows for daily, weekly, or monthly rolling forecasts. Cash Managers use the Rolling Forecast form to review and modify the forecast for cash inflows and cash outflows for their entity. They can review actuals, the rolling forecast, and actuals versus daily/periodic forecast:

Controllers can see an overview of the organization's overall cash position at each level of the legal hierarchy.

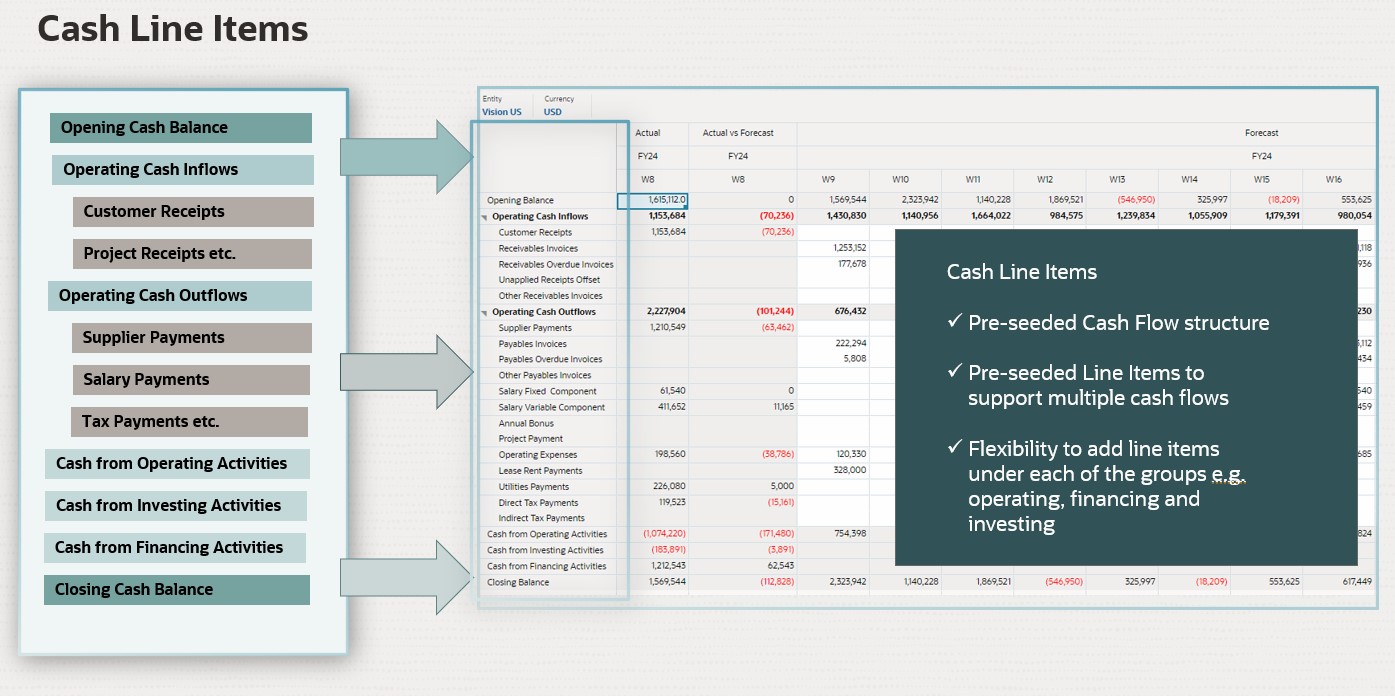

Predictive Cash Forecasting provides line items along with the ability to add any additional line items you require. Cash line items drive the various cash inflows, cash outflows, and the balances for a cash forecast. Line items are organized under the structure of Operating Cash Flows, Investing Cash Flows, and Financing Cash Flows.

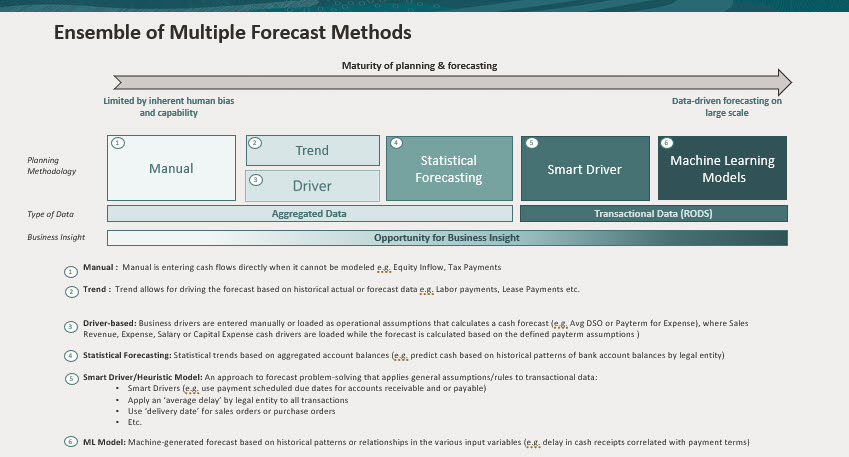

Predictive Cash Forecasting supports various forecast methods, which are different approaches to arriving at the cash forecasts. Forecast methods can be defined for each line item and version/entity combination, based on the data source available and the maturity of planning and forecasting. Methods include driver-based, trend-based, Smart Drivers, prediction-based methods including statistical predictions and machine learning predictions, and manual input. You can also define period-based forecast methods where you can use different forecast methods for different time frames.

Note:

Machine Learning will be supported in a future update.Predictive Cash Forecasting provides role-based navigation flows for Cash Managers, Controllers, and Administrators, to guide users through their process.

Predictive Cash Forecasting offers:

- Integrated and automated process—Predictive Cash Forecasting allows for pulling the

data from external systems to drive the cash forecast based on outstanding invoices

and transactions. For forecasts beyond a certain period or for certain cash line

items, data can be pulled in from any source through Data Integration.

Note:

Integration with Cloud ERP is available only on a limited basis for early adopter customers, and includes seeded integrations from Cloud ERP Accounts Receivable, Accounts Payable, and Cash Management. For customers who are not early adopters, until the feature is generally available, you can load your data from any source and can automate the data load using a Data Integration pipeline. - Real-time and accurate forecasts—Real-time and accurate cash forecasting by applying targeted forecasting models and intelligent predictions. Predictive Cash Forecasting supports multiple cash forecasting process cycles, short-term and medium-term. Both forecasts are rolling forecasts—the periods roll over every day for the daily forecast and roll over by week or month for the periodic forecasts.

- What-if scenarios—What-if planning with the ability to create multiple scenarios that support real-time decision-making.

- Adjustment to forecast—Ability to use direct entry planning for manual adjustments to the forecast based on human judgment.

- Flexible reporting—Multiple views for the data, such as aggregation and grouping, flexible filtering, time periods, view by Region, Legal Entity, Bank, Bank Account, Cash Pools on a daily, weekly, and monthly basis.

Overall, Predictive Cash Forecasting offers a comprehensive solution for cash forecasting that can help businesses make better decisions regarding their cash management strategies. With its advanced features and flexibility, it is a valuable tool for any organization looking to improve its cash forecasting capabilities.

Videos

| Your Goal | Watch This |

|---|---|

|

This overview video introduces Predictive Cash Forecasting in Oracle Cloud EPM. Predictive Cash Forecasting helps you develop data-driven cash forecasting and forecast more accurately, take faster actions with respect to cash, and enables cash flow improvements. Predictive Cash Forecasting supports daily, weekly, or monthly short and medium term forecasting, as well as supports multiple forecast methods such as driver, trend, and predictive modeling. |

|

| This video provides a product tour of Predictive Cash Forecasting. Predictive Cash Forecasting helps you make better use of your cash with data-driven continuous cash forecasting. Depending on how your application is set up, you can perform cash forecasting at the daily, weekly, or monthly level. |