About Maximum Value Type

The available options for Maximum Value Type are based on whether the component is an Additional Earning, Benefit, or a Tax.

Value Type and Max Value Type must match when using FTE Ratio. To ensure that either the FTE Ratio or FTE value is applied consistently, the Benefits and Taxes wizard does not allow a mismatch of methodologies for FTE Ratio.

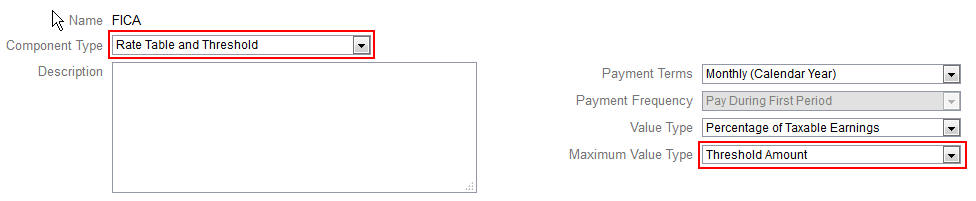

Setting the Maximum Value Type to Threshold Amount is available only for Taxes (not for Additional Earnings or Benefits). If the Maximum Value Type is set to Threshold Amount, then the threshold of each tier drives the tiered calculations. The application applies all tiers to the default assignment, as appropriate, regardless of the tier assigned as a default. If you need to apply a tiered tax with multiple tier rates, then select Component Type as Rate Table and Threshold with Maximum Value Type as Threshold Amount.

If you select the Component type as Simple, then you provide rates in No Tier. In this case, tiered calculation logic isn't applied even if Maximum Value Type is Threshold Amount.

You set the Maximum Value Type on the Details page of the wizard.

If the Maximum Value Type isn't set to Threshold Amount, then the assignment of each option or tier row is relevant and needs to be assigned appropriately.

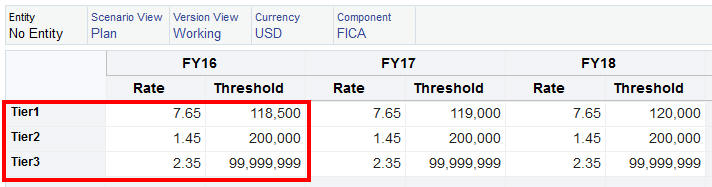

For example, let’s use US FICA tax as an example of setting the Maximum Value Type to Threshold Amount. No one row will be assigned as a default because all rows apply. So the tax rate is 7.65% of salary for the first $118,500, then 1.45% of salary over $118,500 up to $200,000. Then 2.35% tax is applied to salaries over $200,00. (You still have to select an option or tier when assigning the default; it is just ignored in the calculation.)

Example:

Table 6-6 Maximum Value Type Options

| Value Type | Description |

|---|---|

| Flat Amount |

Available for:

|

| Percentage of Salary |

Available for:

|

| Percentage of Taxable Earnings |

Available for: Taxes |

| Percentage of Overall Earnings |

Available for:

|

| Threshold Amount |

Available for: Taxes |

| Flat Amount FTE Ratio |

For use with split-funded FTE. Takes the FTE for the current intersection of data and divides it by the Master FTE, and multiplies by the Flat Amount. Available for:

|

| Threshold Amount FTE Ratio |

For use with split-funded FTE. Takes the FTE for the current intersection of data and divides it by the Master FTE, and multiplies by the Threshold Amount. Available for: Taxes |