Introduction

This tutorial is the fourth in a series on how to configure Predictive Cash Forecasting (PCF) and expects the application to be in the state as the preceding tutorial. This tutorial shows you how to configure Driver Methods in Predictive Cash Forecasting (PCF). You will be introduced to all the eleven Driver Methods. You will understand the steps to configure the eleven Driver Methods. The sections build on each other and should be completed sequentially.

Background

Predictive Cash Forecasting provides eleven driver-based forecast methods. Depending on how your application is enabled, driver methods and their associated calculations, along with example line items, are populated in the application.

Prerequisites

Cloud EPM Hands-on Tutorials may require you to import a snapshot into your Cloud EPM Enterprise Service instance. Before you can import a tutorial snapshot, you must request another Cloud EPM Enterprise Service instance or remove your current application and business process. The tutorial snapshot will not import over your existing application or business process, nor will it automatically replace or restore the application or business process you are currently working with.

Before starting this tutorial, you must:

- Have Service Administrator access to a Cloud EPM Enterprise Service instance.

- Download the LCM snapshot from here - for fourth tutorial.zip. Upload and import this LCM snapshot into your Planning instance.

- Use the Cash Manager Navigation Flow and associated access for the tutorial.

- Have Microsoft Excel installed.

- Have Smart View installed and configured to connect to your instance.

The Rule (Reset Dates) will have to be run once the AMW (Daily Maintenance) runs in your environment. You can schedule to run it daily after your AMW (Daily Maintenance).

Note:

If you run into migration errors importing the snapshot, re-run the migration excluding the HSS-Shared Services component, as well as the Security and User Preferences artifacts in the Core component. For more information on uploading and importing snapshots, refer to the Administering Migration for Oracle Enterprise Performance Management Cloud documentation.Setup Forecast Methods

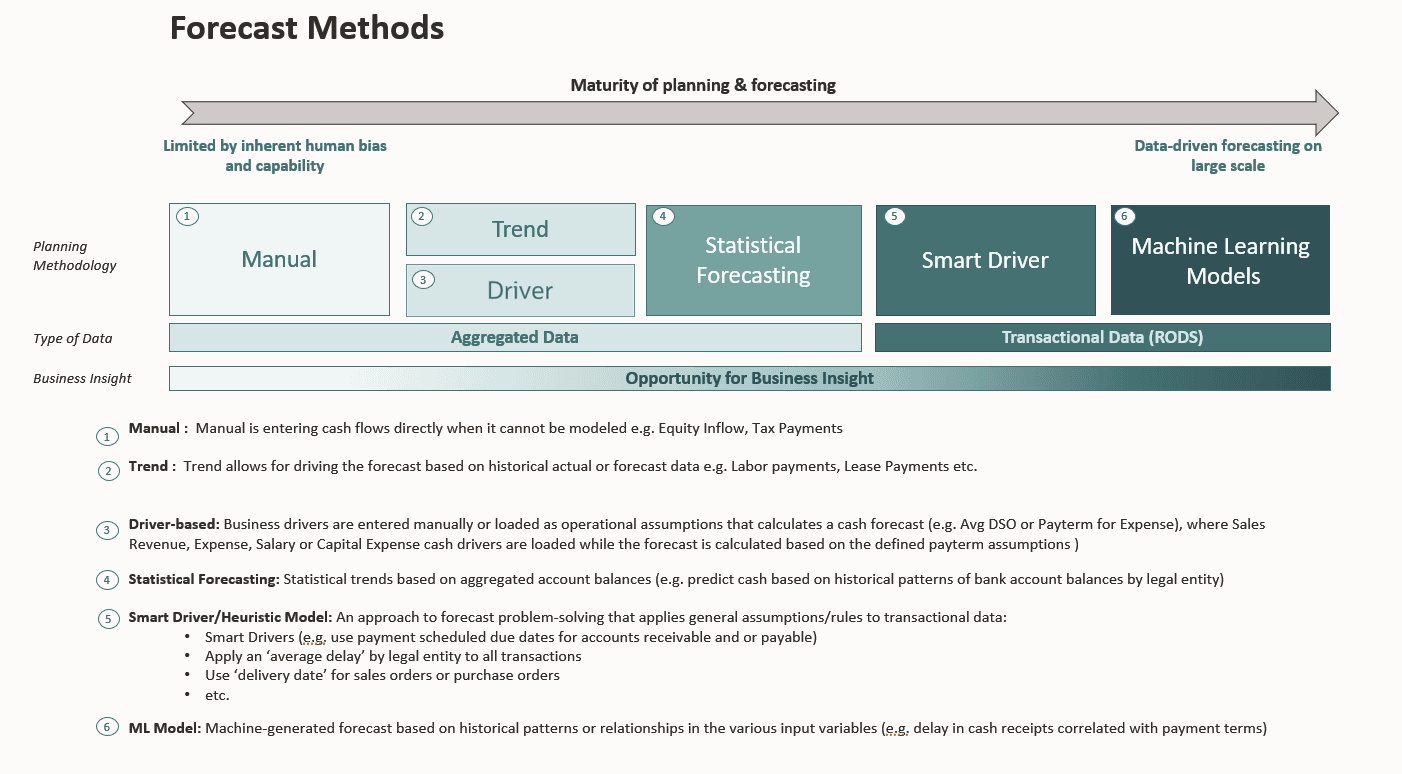

Forecast Methods

Forecast methods are different approaches to arriving at cash forecasts. Predictive Cash Forecasting supports various forecast methods for each cash line item, providing you with the flexibility to choose the appropriate method. You can define the default forecast methods to use for each line item and entity combination based on the data source available, the maturity of planning and forecasting, and the time horizons for the forecast. You can also define period-based forecast methods where you can use different forecast methods for different time frames.

Details for each of the forecast methods:

Manual

This is the most basic method, where for certain line items it may be difficult to apply specific logic and hence you just enter the cash forecast numbers manually. This could be for certain continent liabilities or equity inflows where it would be hard to determine the cash inflows or outflows through any automated logic.

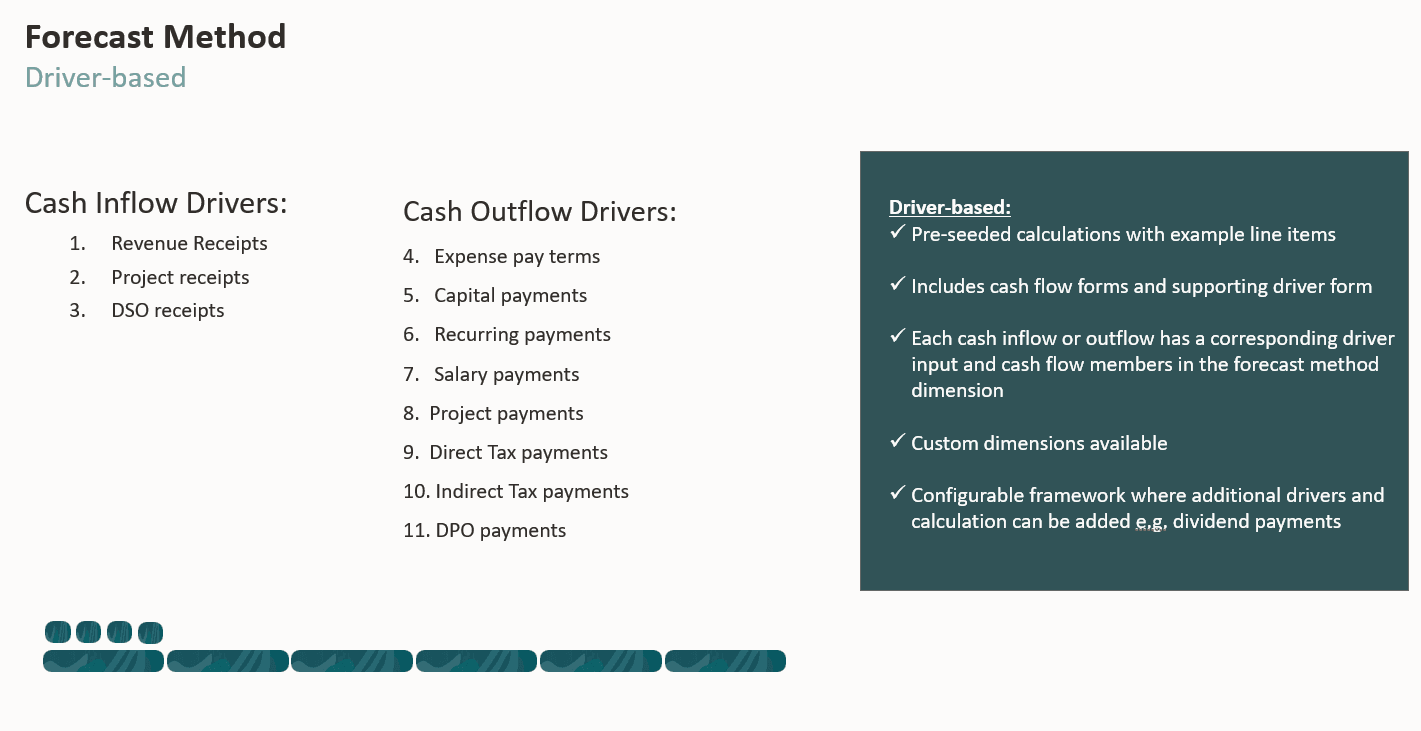

Driver Based Method

This is a calculated method where different drivers are used to drive cash forecast for certain line items. In Predictive Cash Forecasting, there are 11 different driver-based methods that can be used for different cash inflows and outflows.

- Each method is a driver category with pre-seeded calculations.

- Example line items will be seeded without prefix, can be used by customers or removed.

- You can add line items for each of the driver category.

- Comes with the cash flow form and in most cases a supporting driver form.

- Each cash inflow or outflow has a corresponding driver input and cash flow members in the forecast method dimension.

- Custom dimensions relevant for drivers can be assigned in Enable features.

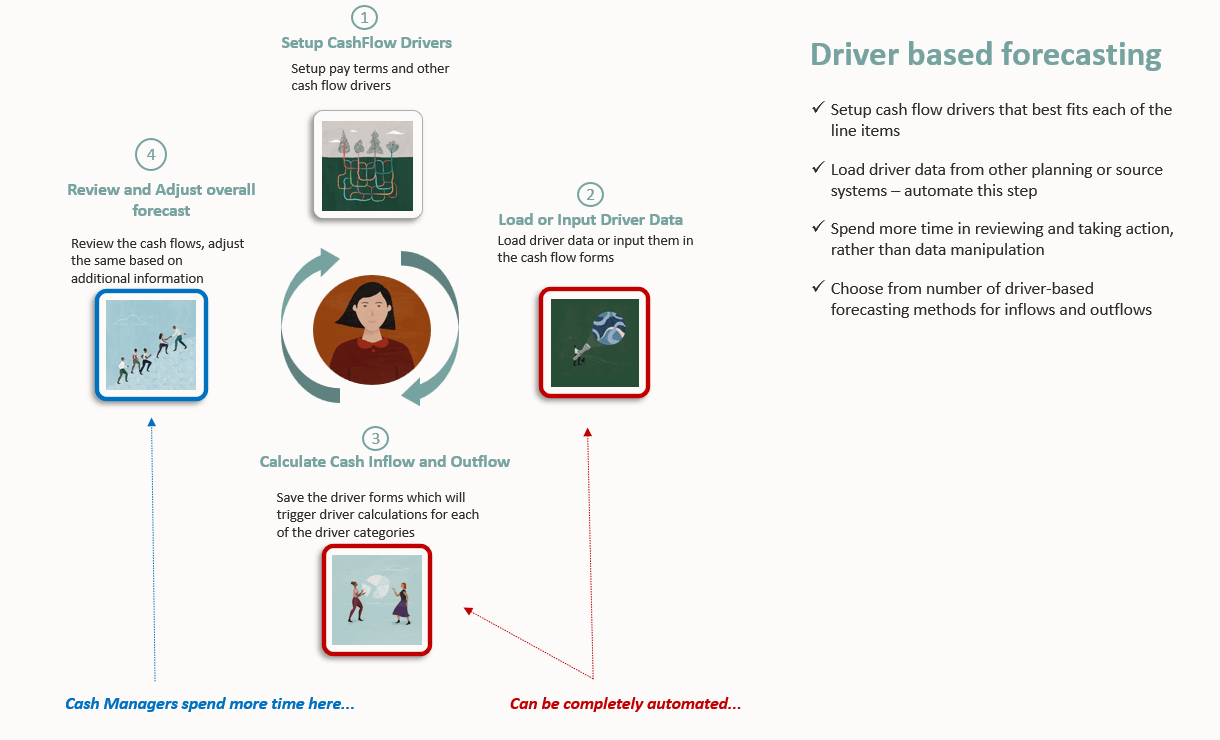

Your administrators can enable Driver Based Forecasting when enabling the application. Your Cash Managers set the assumptions for the driver-based forecasting methods.

Process for working with Driver-Based Forecasting Methods:

- Set up the assumptions (such as Pay Terms, Due Dates, and so on) by entity, line item, and other custom dimensions.

- Load or input the data used to drive the cash forecast.

For Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO), load or input the average DSO or DPO and the outstanding revenue or expense to drive the cash forecast.

- Run the rules to calculate the cash flows.

- When you load or save the cash inflow or cash outflow driver form, Predictive Cash Forecasting calculates the cash inflows or outflows based on the driver amount and driver assumptions, and posts them into the appropriate periods.

For DSO and DPO, Predictive Cash Forecasting calculates the cash flows based on the Average DSO or DPO and outstanding revenue or expense.

- The cash inflow or outflow is automatically populated in the Rolling Forecast form.

Trend Based Method

Trend Methods can be used for any Line items where the cash forecast can be determined based on historical trends. Trend based methods are only considered for Periodic forecasts. Trend based method may not be ideal for forecasting cash as they are dependent on the underlying cash drivers such as revenue, expenses or others, but if the cash inflows and outflows use a standard pattern, this could be used.

- Trend Methods can be used for any Line items where the cash forecast can be determined based on historical trends.

- Trend based methods are only considered for Periodic forecast.

- As you select the trend, the data seeds based on the logic of the method. You can apply an increase or decrease on top of that to determine the future forecast.

Here are some of the trend-based methods that are supported in Predictive Cash Forecasting.

| # | Trend based method | Description | Example |

|---|---|---|---|

| 1 | Current Year Actual Average | Calculates the average for cash line item for the Current Fiscal Year | Bank charges |

| 2 | Current Period Actual | Last period Actuals is taken for the forecast periods | Utilities |

| 3 | Prior Year Actual | Takes the prior year actual for corresponding periods | Marketing or Service Revenue |

| 4 | Prior Year Actual Average | Calculates the average for a cash line item for the year prior to the Current Fiscal Year. For example, if the Current Fiscal Year is FY22, the prior year is FY21. | Travel |

| 5 | Forecast Average | Calculates the average of forecast for the current fiscal year | Labor |

| 6 | Seasonalization | Applies the seasonality of last year actual for forecast periods to current year actual average In this methodology, current year actual average rate is calculated first. Thereafter, forecast is calculated as per following formula. Forecast = Prior year actual amount for the period * sum of forecast amount (as per Current Year Actual Average method) for remaining periods of current year or the sum of prior year actual data for the same remaining periods. |

Trade Spends |

| 7 | Year over Year Inc/Dec | Applies a % increase or decrease to the prior year’s value. | Rent |

| 8 | Periodic Growth | Calculates year over year change for a line item using current year and prior year as the basis to calculate the growth. | Variable Compensation |

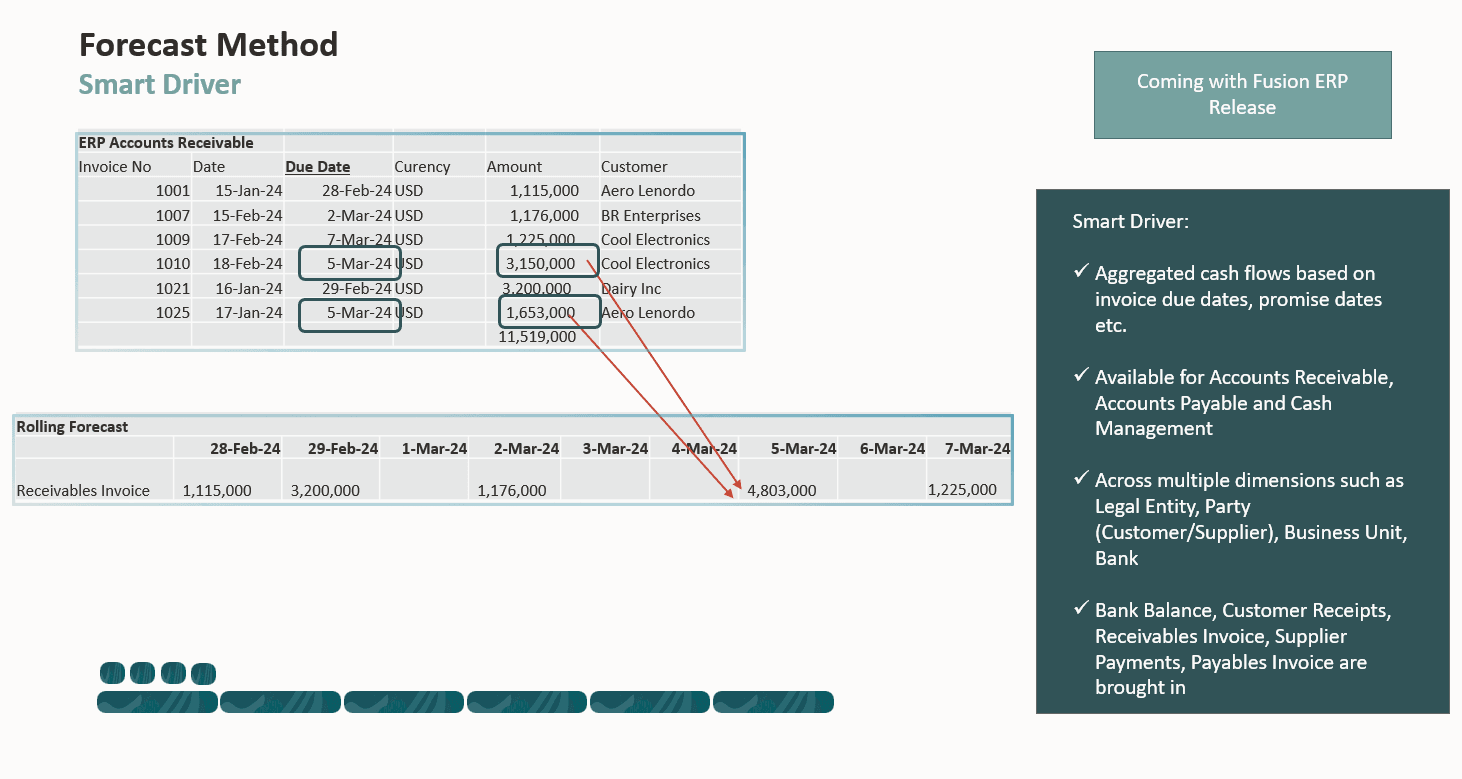

Smart Drivers Method

This is a forecast method that will be driven by the underlying data in Fusion ERP. Smart drivers allow for seeding the cash forecast based on data coming in from Fusion ERP and it’s driven by the transaction installments for customer, supplier transactions and payments in ERP. Cash forecasts are determined by the due dates of the invoice at a minimum and gets aggregated for period as Receivable Invoice, Receivable Overdue Invoice, Payable Invoice, Payable Overdue Invoice. The period may further be influenced by the availability of other dates beyond due date like the promise date, expected collection date, discount due date. Also, actual Customer receipts and Supplier Payments are also pulled in from Fusion ERP. In addition, cash inflows and outflows through cash management and General Ledger also are pulled in for cash forecasts. Smart drivers can be important for the short-term forecasts as it is based on underlying supported data.

- Forecasting based on underlying connected ERP operational data – Fusion ERP AR(Accounts Receivable) and AP(Accounts Payable).

- Combination of Due Dates, Promise Dates, Discounts and other important information that drives the cash forecast data.

- Automated flow of data to derive reliable cash forecast accuracy.

Statistical Prediction Method

This is the inbuilt predictive planning capability available that can be used for some of the line items. Statistical predictions are timeseries algorithms that is available, and it helps forecasts cash based on historical data for the line item. Statistical predictions are available for the user to run for any line item that has a regular historical pattern, with both seasonality and without seasonality. The application picks the best method based on the data available and with the best accuracy. Here are the prediction methods that are used based on the nature of the data. The prediction methods get picked automatically based on the best accuracy amongst all the methods.

- Predictive Planning can be used for any line items based on the data available for certain line items.

- Predictive forecasting uses time series based algorithms to predict future forecast.

- Predictive forecasting based on ML Regression and Classification Models using operational AR and AP data.

- This capability is built in the application and customers can do this through the UI or using Auto Predict.

| Best Use Data | Method | Seasonal |

|---|---|---|

| Volatile data with no trend or seasonality. | Simple Moving Average | No |

| Data with trend but no seasonality. | Double Moving Average | No |

| Volatile data with no trend or seasonality. | Single Exponential Smoothing | No |

| Data with a trend but no seasonality | Double Exponential Smoothing | No |

| Data with a trend but no seasonality | Damped Trend Smoothing non-seasonal method | No |

| Data without trend but with seasonality that does not increase over time. | Seasonal Additive | Yes |

| Data without trend but with seasonality that increases or decreases over time. | Seasonal Multiplicative | Yes |

| Data with trend and seasonality that does not increase over time | Holt-Winters’ Additive | Yes |

| Data with trend and with seasonality that increase over time | Holt-Winters’ Multiplicative | Yes |

| Data with a trend and seasonality. | Damped Trend Additive Seasonal Method | Yes |

| Data with a trend and with seasonality | Damped Trend Multiplicative Seasonal Method | Yes |

| Data with minimum of 40 historical data points, limited number of outliers and no seasonality | Arima | No |

| Data with minimum of 40 historical data points, limited number of outliers and seasonality | SArima | Yes |

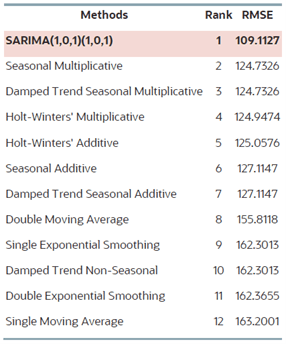

Automatically selecting the best-performing forecasting model

The forecasting method with the lowest error measure (RMSE) is used to forecast the data. RMSE (root mean squared error) is an absolute error measure that squares the deviations to keep the positive and negative deviations from cancelling out one another. This measure also tends to exaggerate large errors, which can help eliminate methods with large errors. For instance, the forecasts from multiple algorithms are compared against each other based on the RMSE. The forecasting model with the lowest error, i.e., RMSE is chosen the best by default.

Auto Predict in Periodic Cash Forecast Model

Note:

Auto Predict is a platform level feature and this section is not PCF specific. You can decide to jump to the next section. You will need Administrator access for this section.With Auto Predict, administrators can define a prediction to predict future performance based on historical data and schedule a job to run that prediction definition, automating the prediction process.

Auto Predict uses the same forecasting and statistical methods as Predictive Planning, but unlike Predictive Planning, you aren’t limited to running a prediction on a form. You can predict values for thousands of cells at once, when needed, by scheduling a job, and automatically write prediction results to a scenario/version—in the same cube or in a different cube from the historical data. You can also include Best and Worst Case prediction results. When you run the prediction, historical data for each member in the Auto Predict definition is retrieved and then analyzed using time series forecasting techniques to predict the future performance for these members.

Auto Predict is useful:

- When you have large amounts of data to predict.

- To jumpstart the forecasting process by pre-filling a prediction scenario with predictions based on historical data. Then, planners can compare predictions to forecasts.

- For variance analysis. Seed a prediction scenario with prediction results, and compare predictions to forecast. To incorporate variance thresholds, you can define a groovy rule that requires planners to add explanatory commentary at a defined threshold, for example if the forecast is 5% greater than the prediction.

- To pre-populate your Forecast or Plan scenarios before starting a forecast or planning cycle. Planners can use these prediction results as a starting point for their forecasts, and make adjustments as needed.

- To keep predictions up-to-date as actuals come in by scheduling Auto Predict jobs. When new actuals come in, the job can run automatically to populate the cube; planners can see updated predictions and compare to forecast and plan.

In this section, you will load historical actual data for some of the line items. Attached Smart View excel sheet contains historical actual data by weeks for 4 line items – Receivables invoices, Payables invoices, Travel spends and Opex payments. Load this data by opening the Smart View excel sheet, then connecting to your application through shared connection or private connection and submitting the actual data in the sheet.

- Open Smart View in Excel and connect to your Cloud EPM Enterprise instance.

Tip:

For more information on connecting to your instance, see the Connecting Using a Shared Connection section in the Working with Oracle Smart View for Office documentation. - In Smart View for Excel, open the Attached Smart View excel sheet.

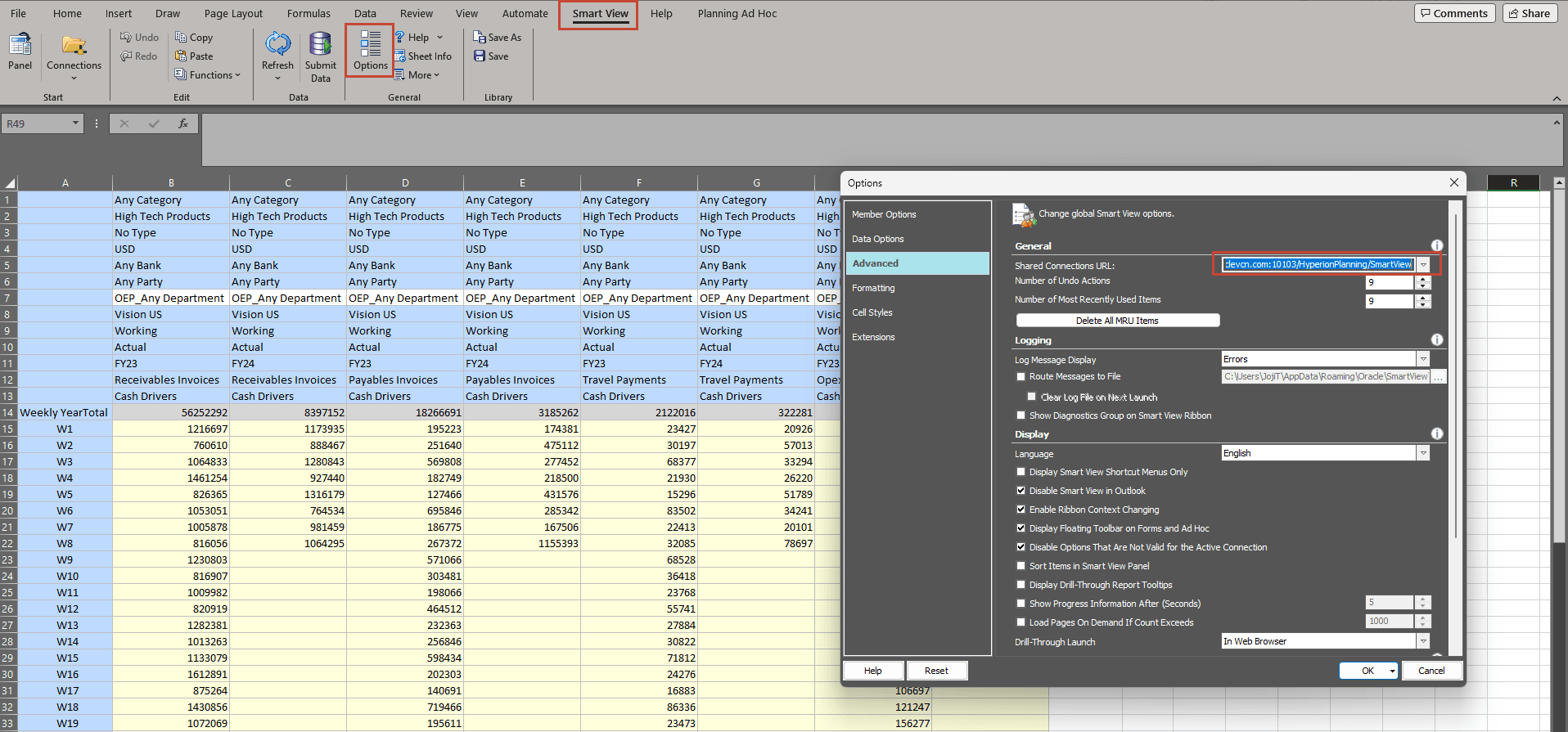

- From the top menu, click Smart View, then Options and then Advanced.

Ensure the correct URL for your PCF application.

Note:

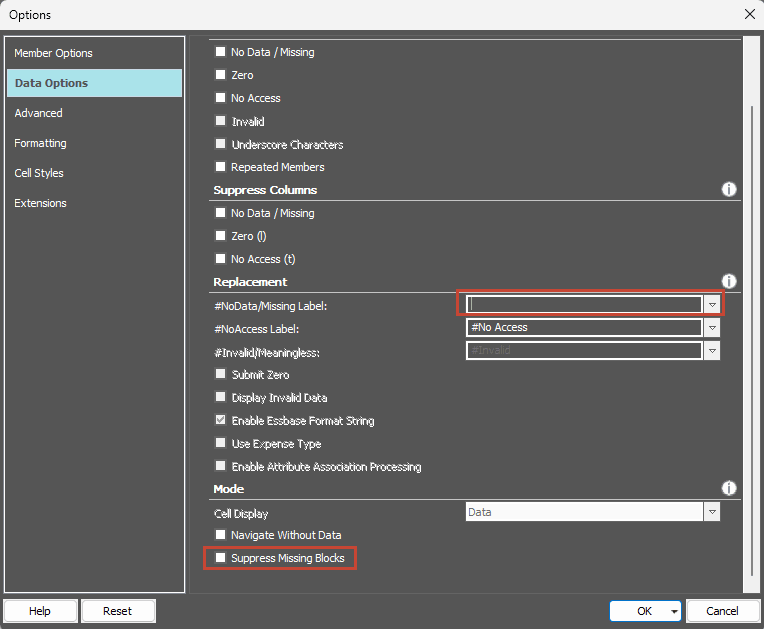

URL Syntax for Smart View Connections: https://<serviceURL>/HyperionPlanning/SmartView - Click Data Options and verify:

Optional: Choose Replacement for #NoData/Missing Label:

Ensure Suppress Missing Blocks is disabled.

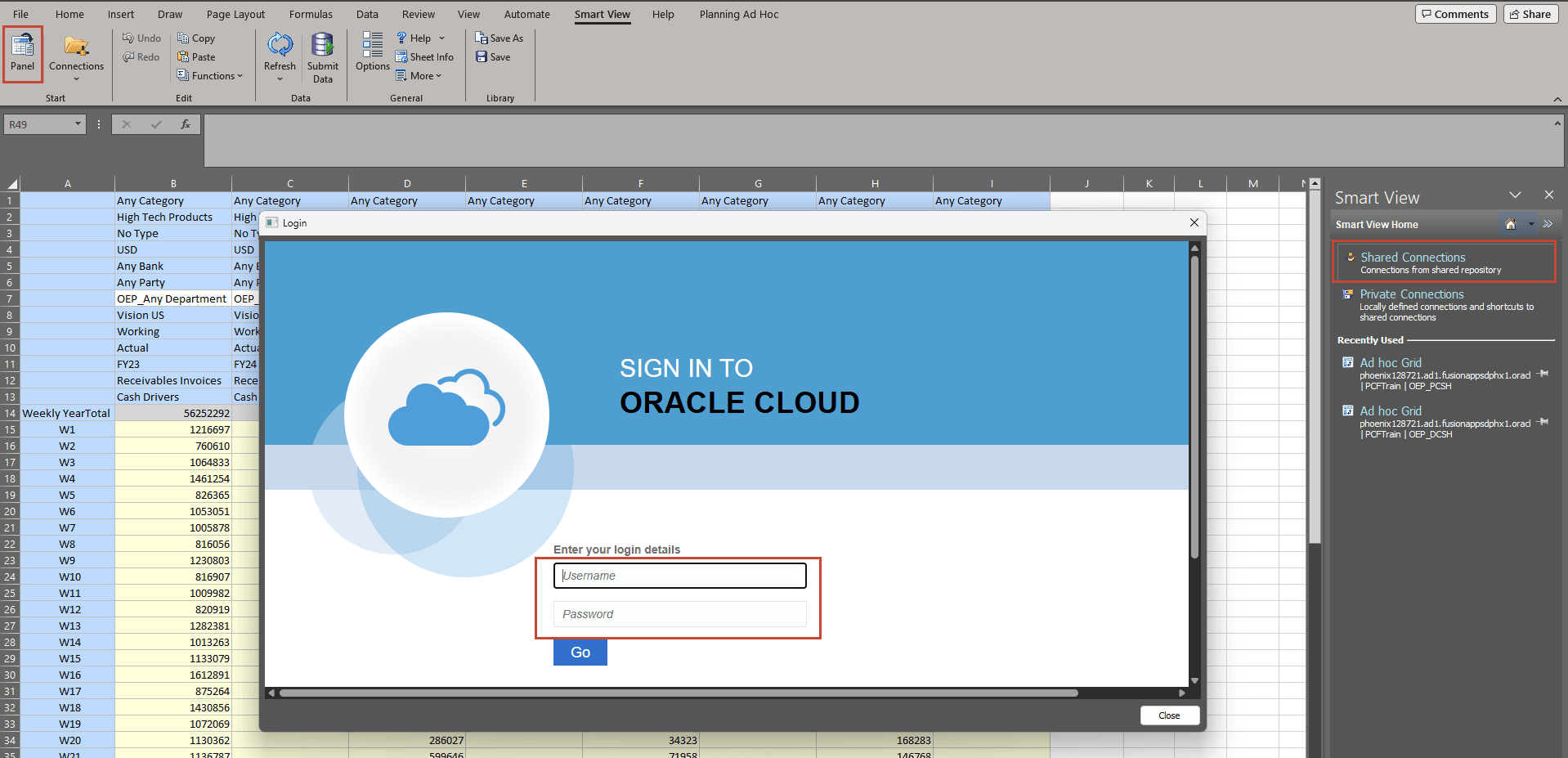

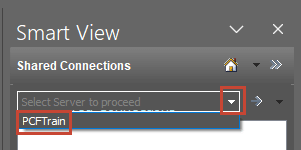

- From the top menu, click Panel, then on the right click Shared Connections and if prompted for credentials then input the Administrator credentials for your PCF application.

- After successful login, click the dropdown under Shared Connections and select your PCF Application.

Your PCF application structure can be seen by expanding +.

- Within the open Excel sheet click on any cell, press Ctrl+A(Select all), then press Ctrl+C(Copy).

- Add a new sheet, press Ctrl+V(Paste) to paste all the contents to the new sheet.

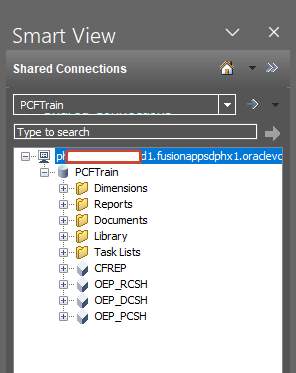

- From the top menu, click Smart View, then Submit Data.

The historical actual data in the Excel sheet should get submitted successfully to your PCF application.

In this section, you will setup Auto predict for the same 4 line items and period range:

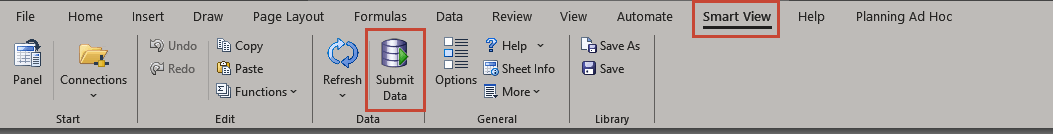

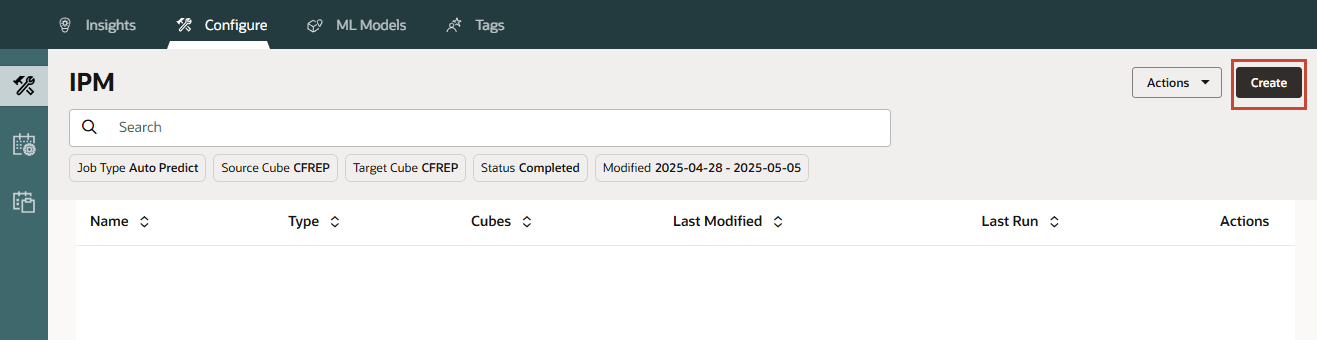

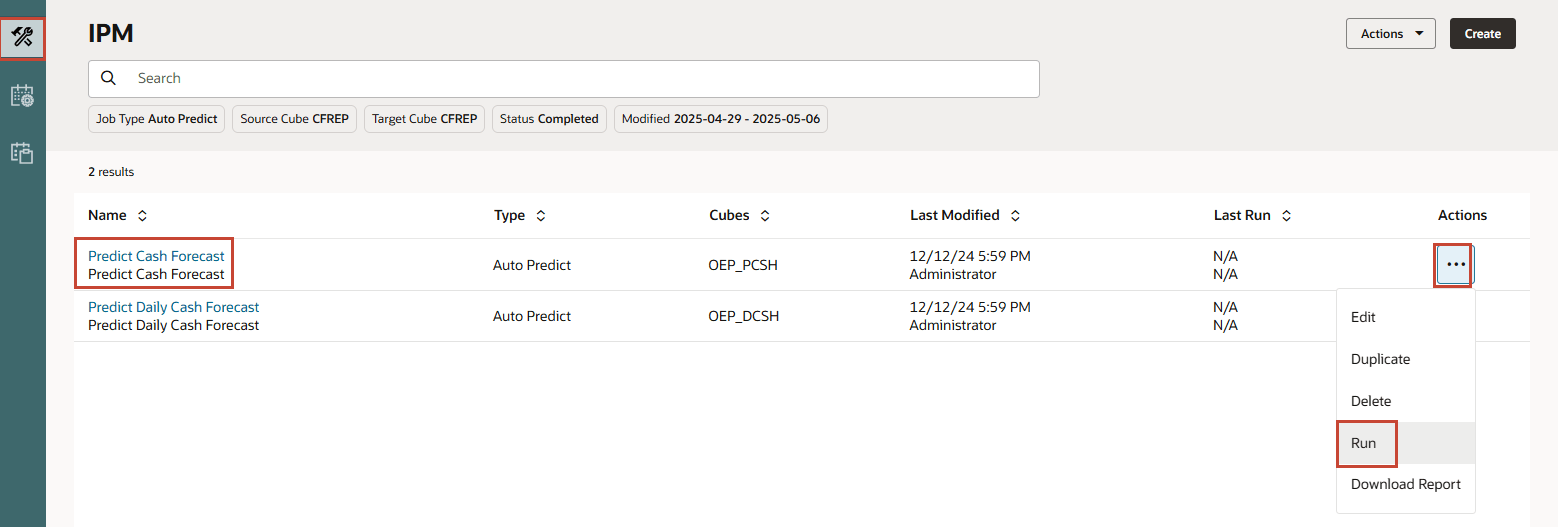

- Go to Admin Navigation flow and selection IPM, click Configure.

- Click Create to configure Auto Predict.

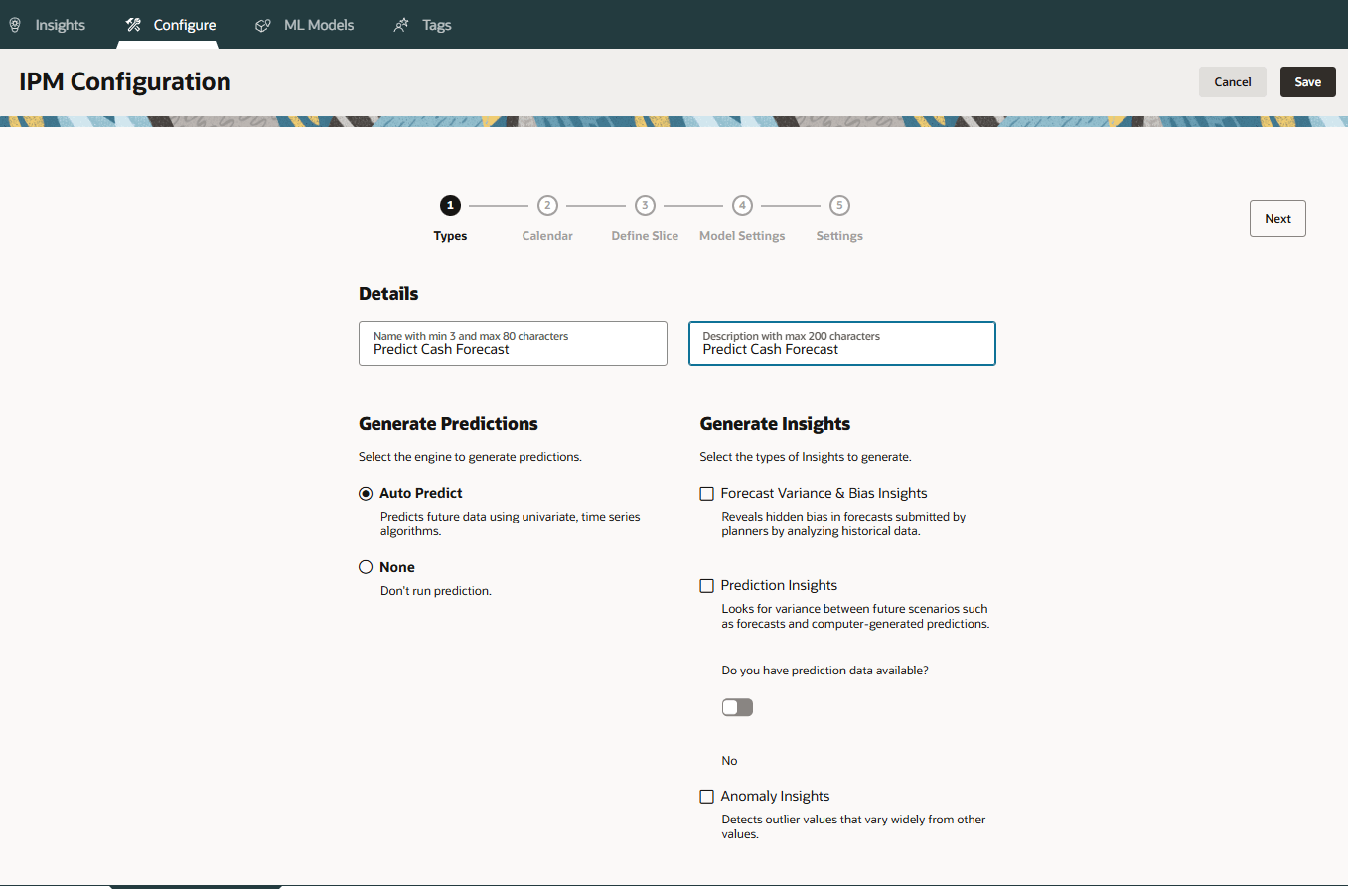

- Provide a name “Predict Cash Forecast” and select Auto Predict then click Next.

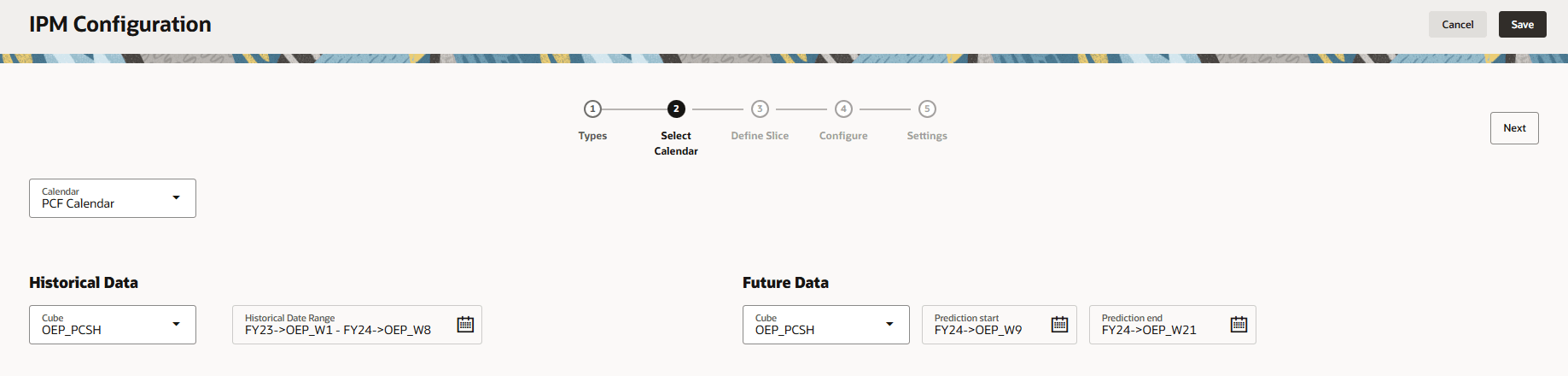

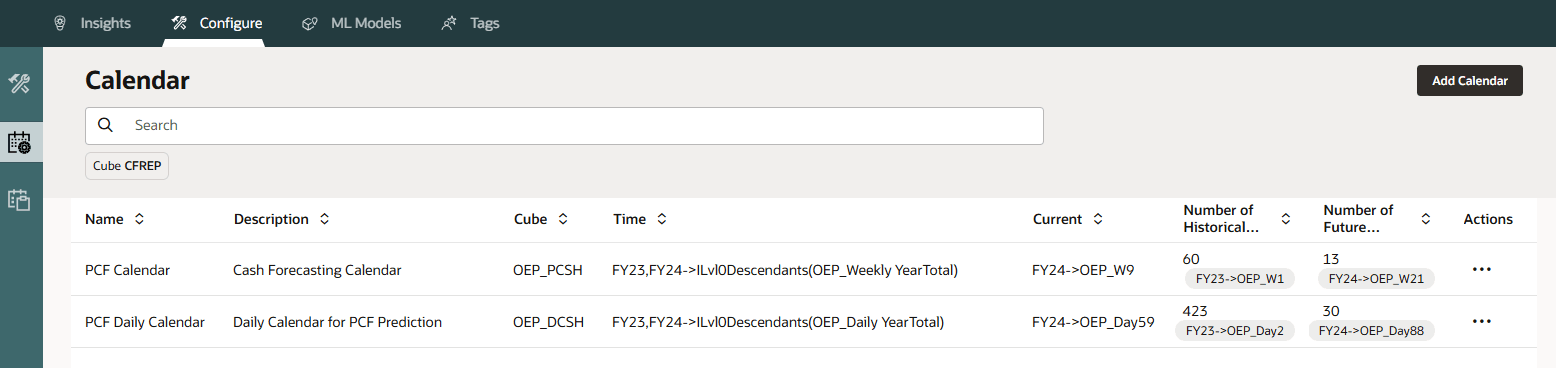

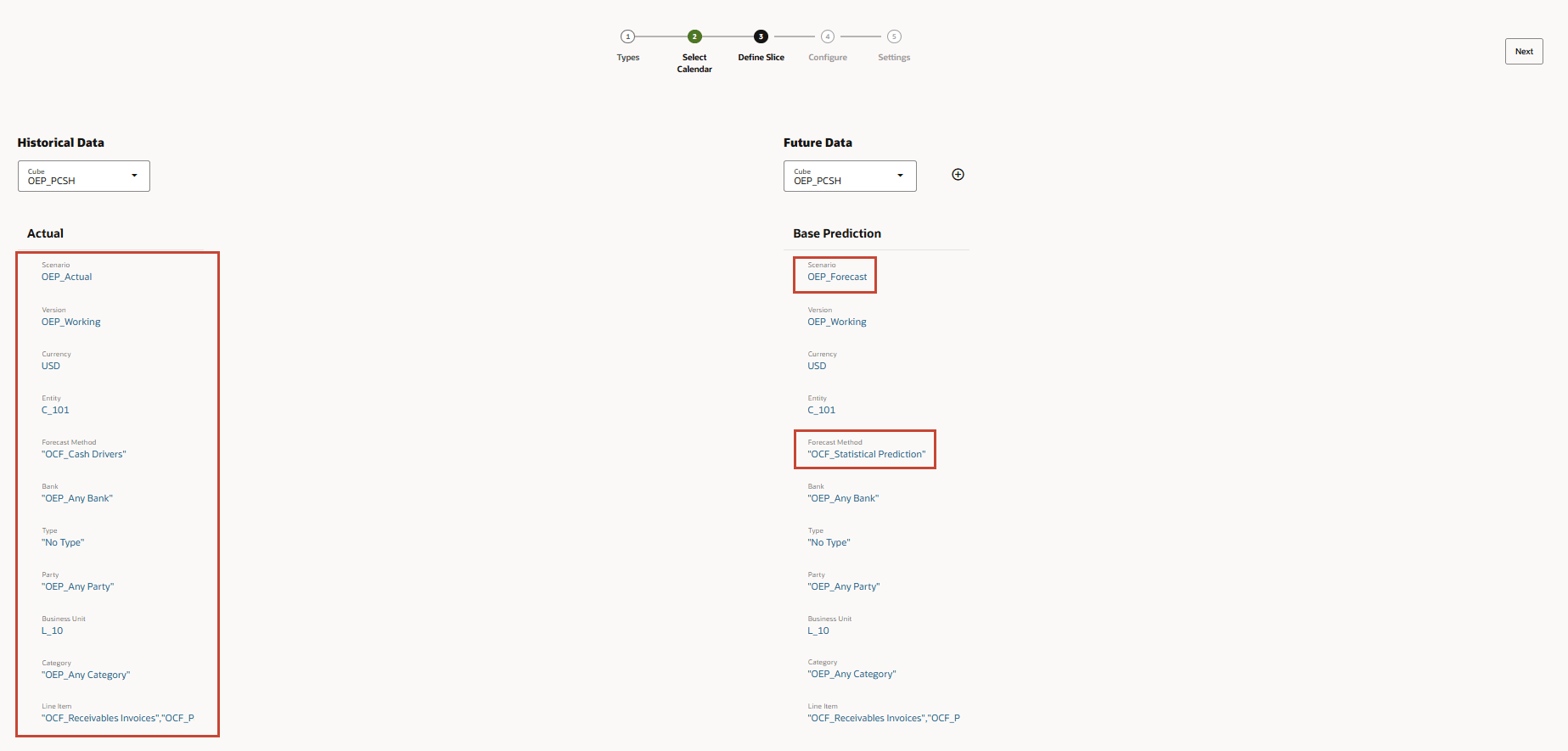

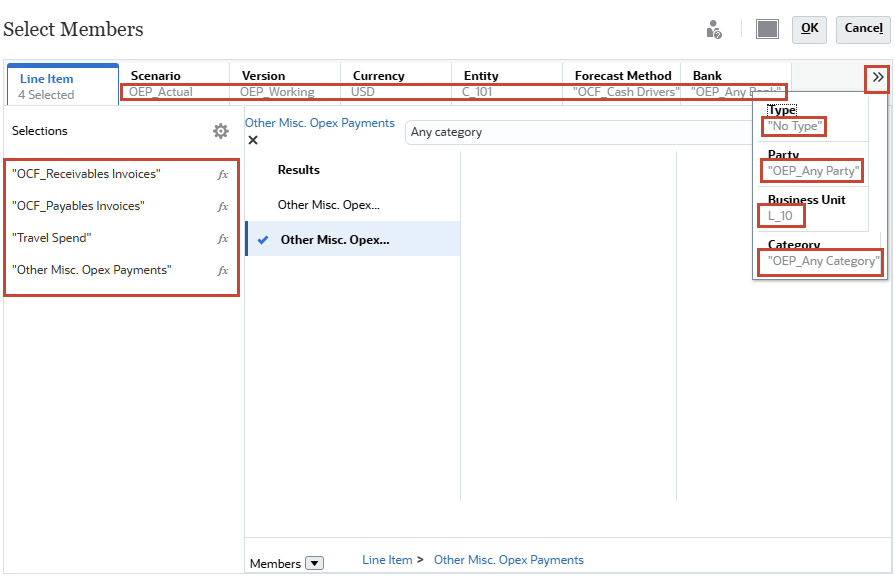

- Select the cube OEP_PCSH and provide Historical data range and Future data range. In our use case, we’ve loaded historical data from FY23 all the weeks(Week 1 to Week 52) and FY24 – Week 1 to Week 8. You can either select the date range manually or alternatively you can create a calendar and select that calendar as shown below. Once you select the calendar, it will automatically populate all the details in this screen. Click Next to select the Slice definition.

- Select Historical data slice and Future data slice. Historical data slice will be based on the actual data intersection where you have loaded the data. Future data slice is where the prediction results will get generated and saved automatically when you run the job. In this example, we’ve loaded actual data in OCF_Cash Drivers Forecast method and saving prediction results in OCF_Statistical Prediction Forecast method. Click Save once you complete the slice definition for Historical and Future data.

- Once you save the job, you should get the message - Predict Cash Forecast has been saved.

- Once the prediction job is saved, go back to Configure page and run the Prediction job by clicking on 3 dots (…). Select Run from the drop down menu.

Tip:

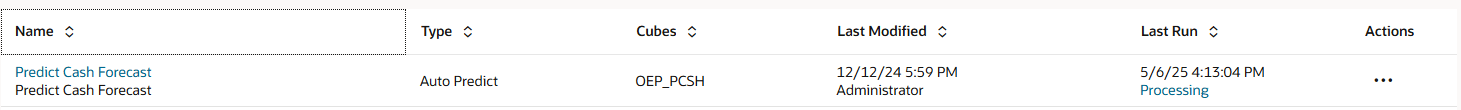

You may have to close the tab corresponding to the job created in previous step to see the Configure page again. - Prediction job will start running(Processing) in the background. You can click on Action and select Refresh to review the status of the job.

Once the job completes, you should see the status Completed.

Tip:

You can click Completed to see the job status. - The application will generate prediction results for all the 4 line items based on historical data slice defined. You can also schedule this prediction job to run periodically from job scheduler.

You can also click on those 3 dots(…) and select Download Report to review the statistical method used for each line item, accuracy level, smart view slice definition, etc. This report should be very useful to review how application has generated the prediction and you can also use the smart view slice to connect and refresh the data from cube.

Attached is a sample downloaded prediction report that you should be able to generate.

Auto Predict in Daily Cash Forecast Model

The steps for the Daily Cash Forecast Model are similar to previous section - Auto Predict in Periodic Cash Forecast Model.

Note:

You will need the data file that contains historical actual data. You will need to setup IPM configurations specific to your Daily Cash Forecast Model while working with the cube OEP_DCSH.Set Forecast Methods by Line Item & Period range

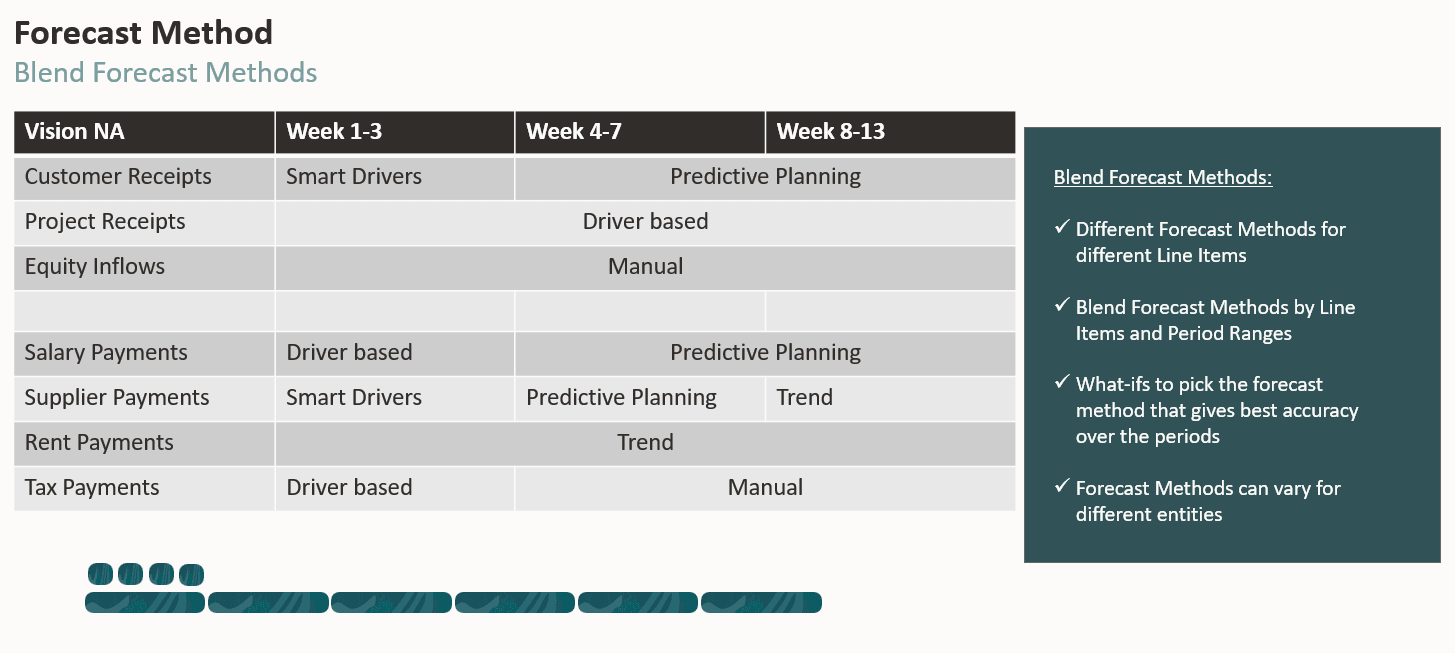

Blending Forecast Methods

With Predictive Cash Forecasting, you can blend forecast methods by using different forecast methods for different line items, different forecast methods for different period ranges, or different forecast methods for different entities. You can also perform what-if planning using different forecast methods, and then select the best forecast method to use for a particular line item, entity, or period range.

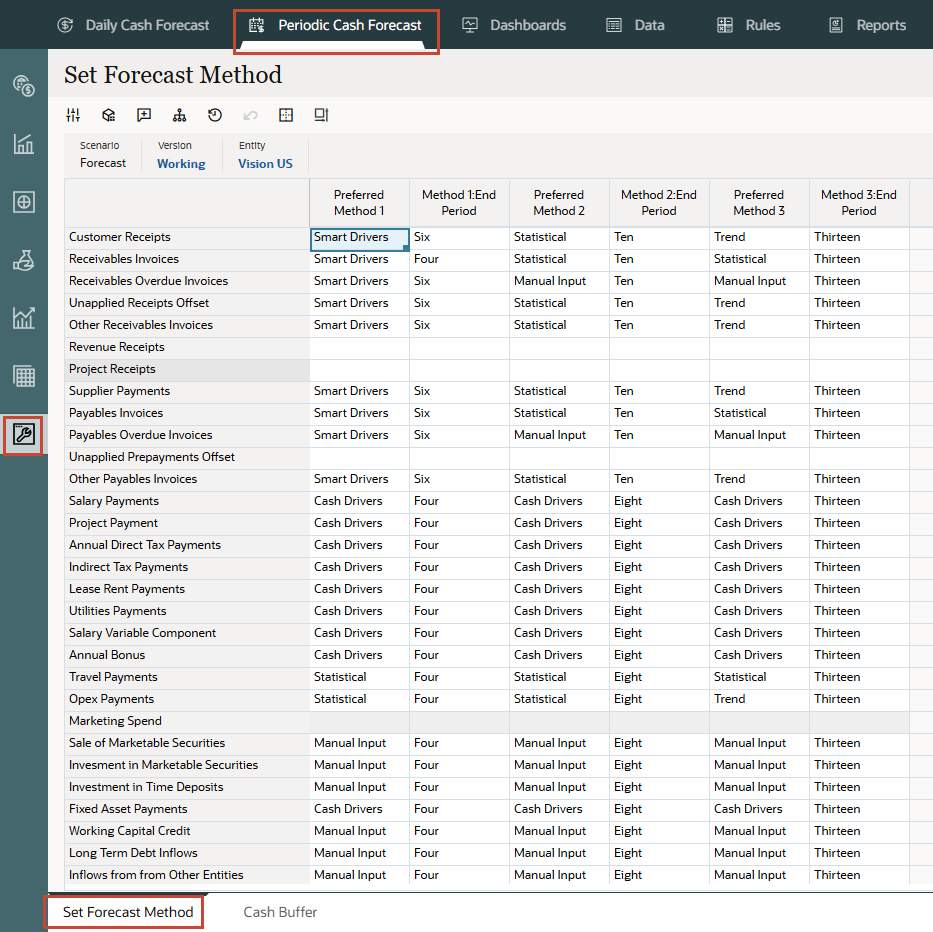

In this section, you will explore how to setup the forecast method for entity, line item and period ranges.

Select the default forecast method to use for each line item to drive cash forecasts. Line items forecasts are calculated based on the default forecast method for that line item. Your Administrator typically will perform this one-time setup task. Then your Cash managers can make changes for their entity any time if needed. Setting forecast methods by period range can be useful as it allows to pick the best methods for the short term vs medium term forecast horizons. For example, the nearer periods could follow a smart driver method based on underlying ERP Fusion data and the farther period could follow a driver-based method using Financial Planning data. Predictive Cash Forecasting allows for specifying different forecast methods by periods.

Note: Use the Cash Manager Flow navigation flow to set forecast methods.

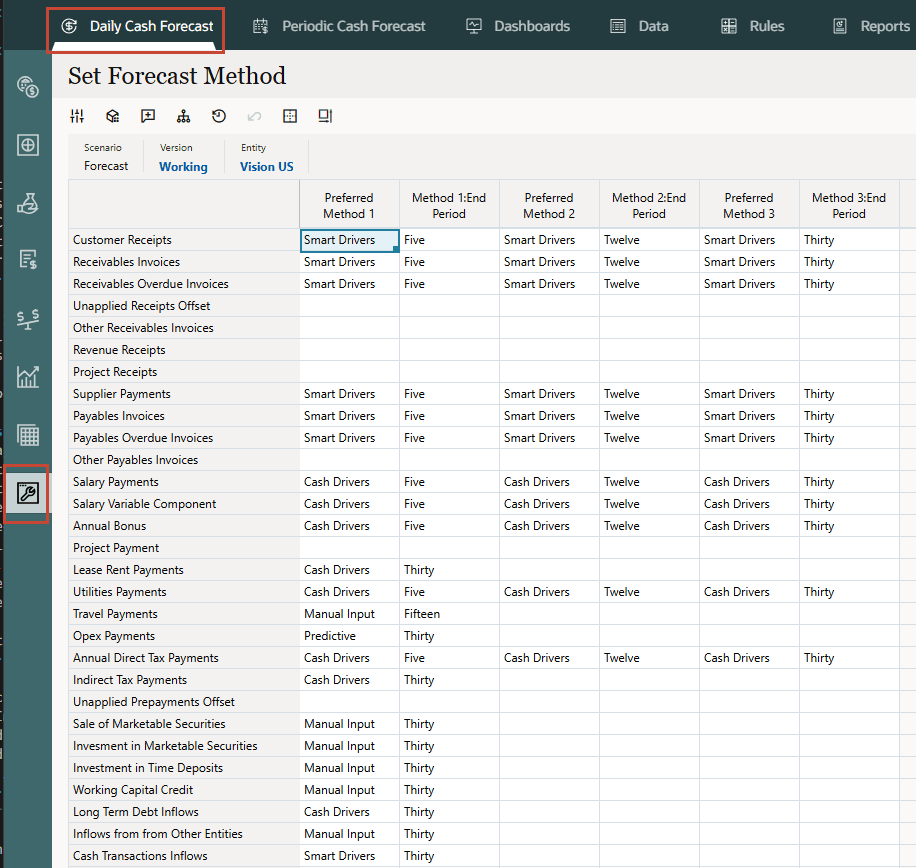

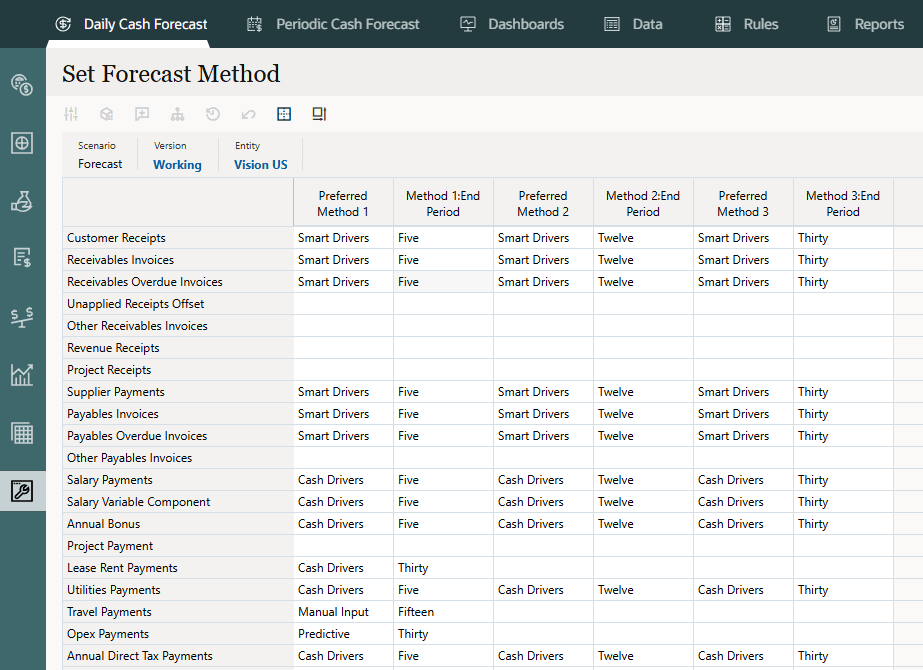

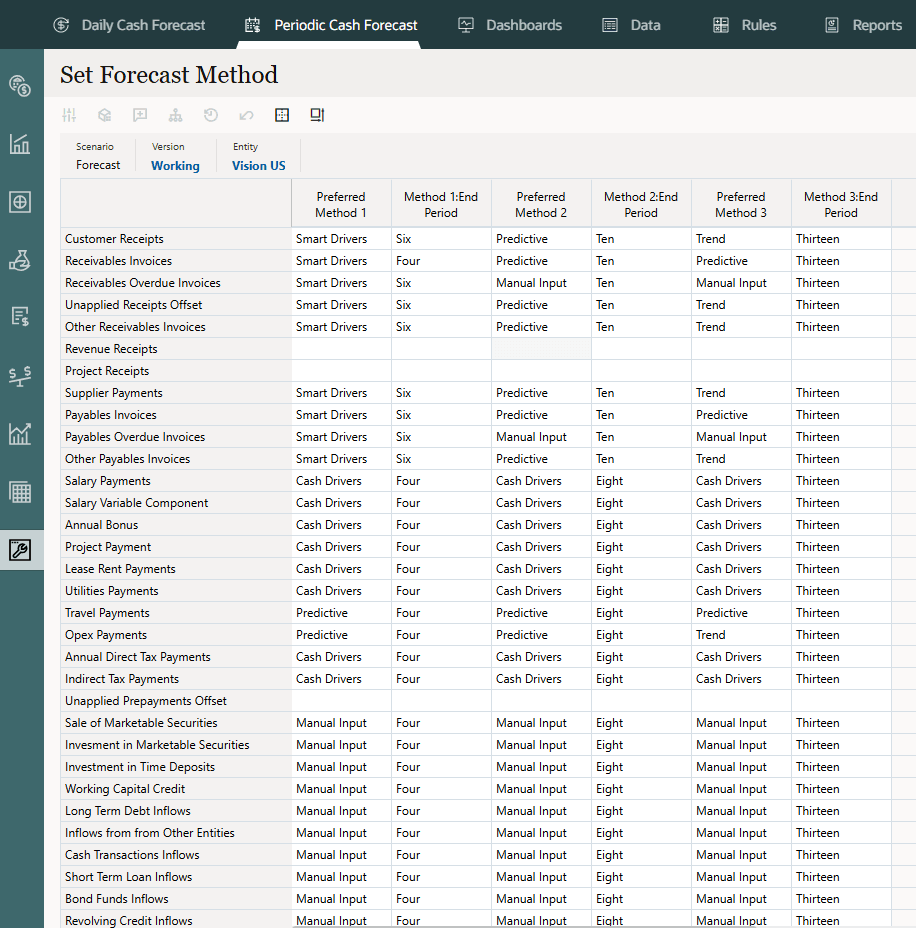

- From the Home page, click Daily Cash Forecast, and then click Assumptions (Set Forecast Method).

Note:

Refer the sample image above here and manually update the values in the upcoming steps for your application. - Select the entity from the POV. You must set forecast methods for every entity.

- For each line item, select the default forecast methods to use for different time periods of the rolling forecast range:

Tip:

You can also open the form in Oracle Smart View for Office to quickly update all the line items. - Preferred Method 1 - Select the preferred default forecast method.

- Method 1: End Period - Select the last period of the rolling forecast range to use the preferred method 1 you selected. (In a daily model, the period is days. In a periodic model, the period is monthly or weekly.)

- Repeat these steps for Method 2 and Method 3. Note that every end period following the first end period has be greater than the first end period.

- Repeat these steps for each entity.

Tip:

You can use the rule Daily / Periodic Push Assumptions to Entities to copy assumptions from one entity to one or more entities. - You can calculate forecasts for line items using any method, but the method you select here becomes the default.

In summary, forecast methods help in getting the best cash forecasts depending on the nature of the line item and available data source.

Creating & Importing Data File for Set Forecast Method

Optional - You can also load the Set Forecast method through a .csv file. For each entity, You need to set the forecast method by line item and by period before starting with cash flow forecasting. Instead of manual input in Set Forecast Method form, you can prepare a flat file as attached and load it into the system. Attached are the data load templates to load Set Forecast Method Assumptions:

Set Forecast Method Daily and Set Forecast Method Periodic.

Note:

You have to be in Administrator login and Navigation Flow to upload these files into EPM outbox folder. Your Administrator can go to Application >> Overview >> Import Data and select the data load files from Inbox.This can be saved as a job so that it can imported through a job schedule or can also be used by Integration Pipeline.

Once the forecast methods are updated (either manually or using the upload file), you should see the below assumptions updated in Daily Set Forecast Method form.

Below is the Set Forecast Method assumption form for Periodic cash forecast based on file based integration.

Configuring Cash Inflow Drivers

Cash Inflow Drivers:

- Revenue Receipts - Drive cash inflow from product or service revenue using pay terms, for example, revenue from retail stores in retail might have a fixed pattern of 70% cash received in three days and 30% cash received in five days.

- Project Receipts - Drive cash inflow from projects revenue, milestone dates, and pay terms. For example, cash receipts from contracts or IT projects is driven by milestones and pay terms. Useful for project-based contract companies.

- Days Sales Outstanding (DSO) - Receipts - Drive cash inflow considering the average Days Outstanding on the Revenue, at the party or entity level. Useful when pay terms are very dynamic.

In this section, you will configure all the Cash Inflow Drivers.

Note:

If you want to review the driver based results in the Rolling forecast form, you need to ensure that you have updated Set Forecast Method form (covered in the previous section) for each of the 11 driver methods. Verify that the right entity is selected.Configuring Revenue Receipts (Based on Revenue and Pay Terms)

Description

Drive cash inflow from product or service revenue using pay terms.

Use the Revenue Receipts driver method when product or service revenue is based on pay terms, for example, retail customers and direct channel customers. Typically overall stores revenue has a set pattern of receipts that you can model using this method. You can also use this if you want to drive your cash forecast based on direct revenue coming from ERP or Planning and a specified pay term.

You can use this driver method for line items in the Revenue Receipts category, where you can add line items such as product revenue receipts or service revenue receipts.

Example: Revenue from retail stores in retail might have a fixed pattern of 70% cash received in three days and 30% cash received in five days.

Drivers: Specify for entity and line items. Additional custom dimensions can be considered if they are enabled.

Pay Terms:

- Percentage: Percentage expected for each pay term

- Due Period: Payment days, weeks, months

Driver Input

Product or service revenue or other customer-defined line items.

Driver inputs can be extracted from source systems such as a POS system or ERP, loaded through a .csv file, brought in from Planning, or you can manually enter them on the Driver Assumptions form.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic: Based on payment term assumptions, including percentage input and due period, Predictive Cash Forecasting calculates the cash inflow amount considering the revenue amount. It calculates the cash inflow if the due period falls within the cash forecast period range and it posts the inflow amount in the respective periods based on the assumptions entered for percentage and due period.

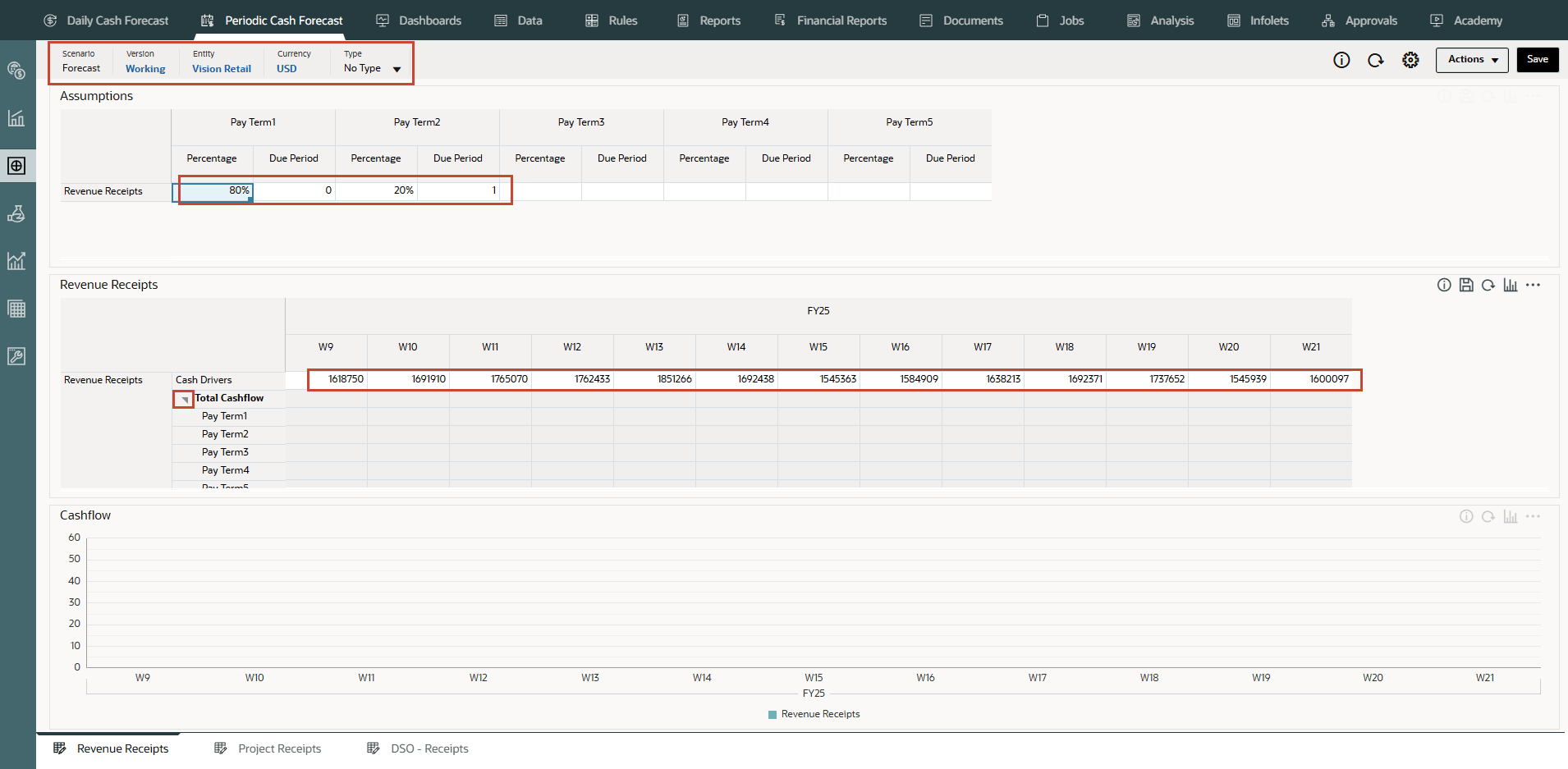

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Inflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

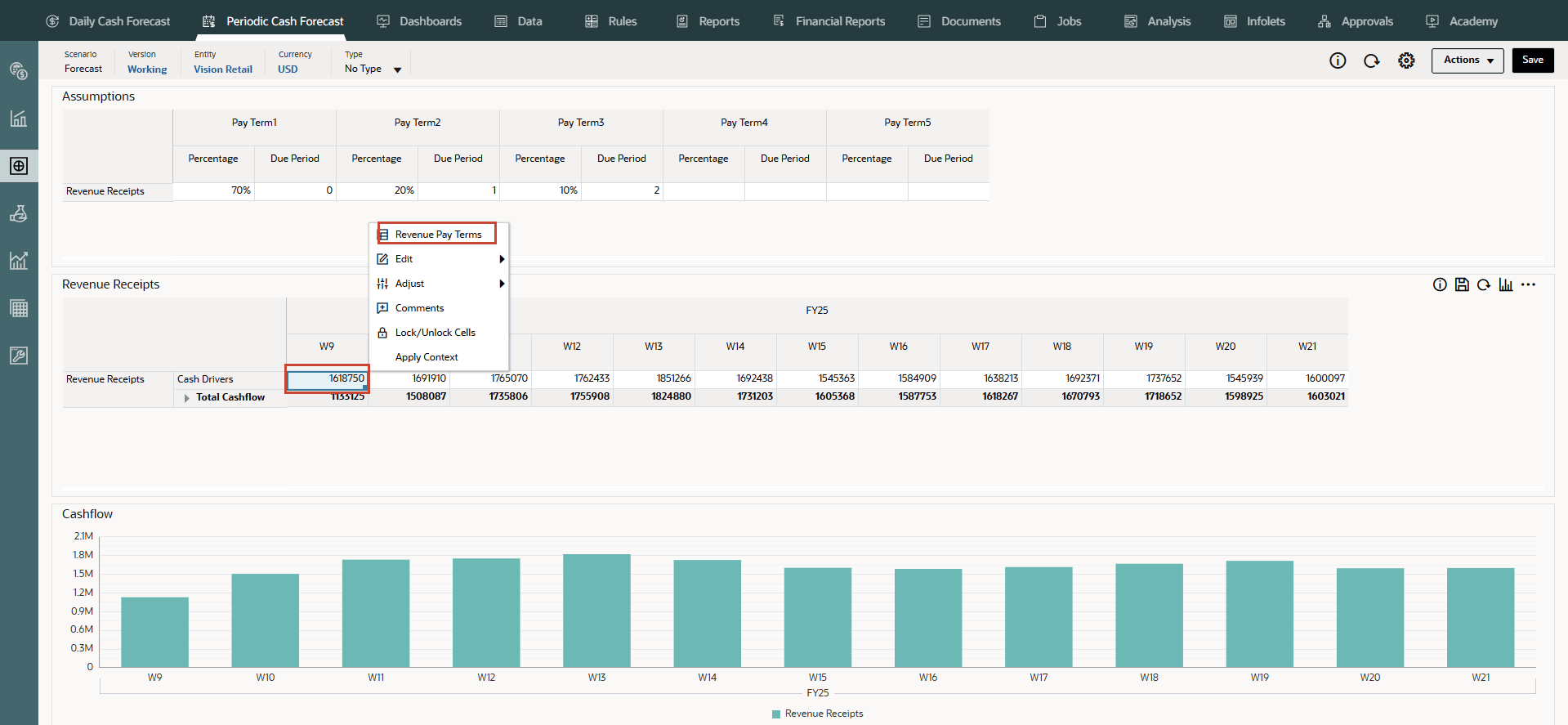

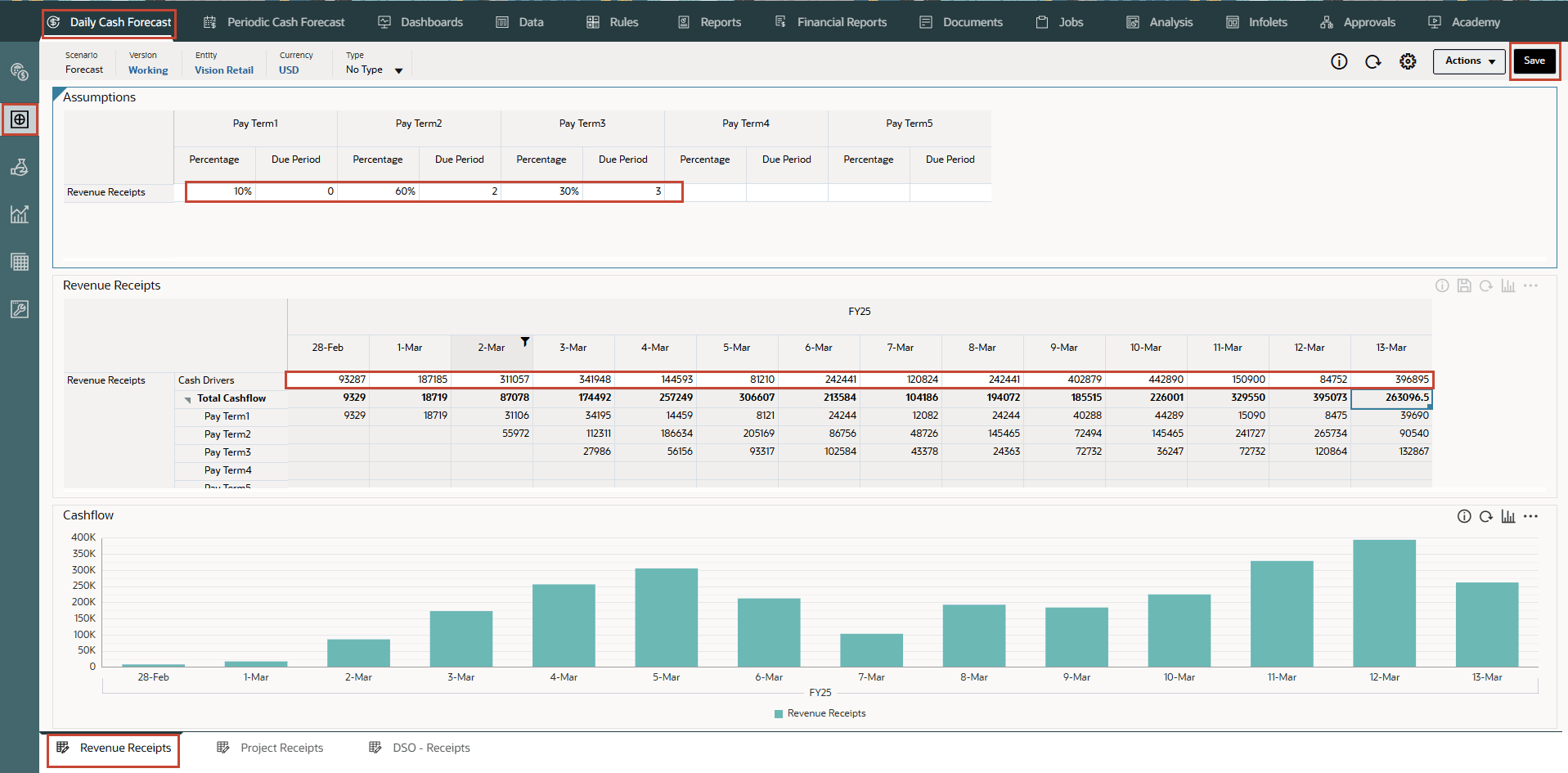

- From the bottom tabs, click the Revenue Receipts form.

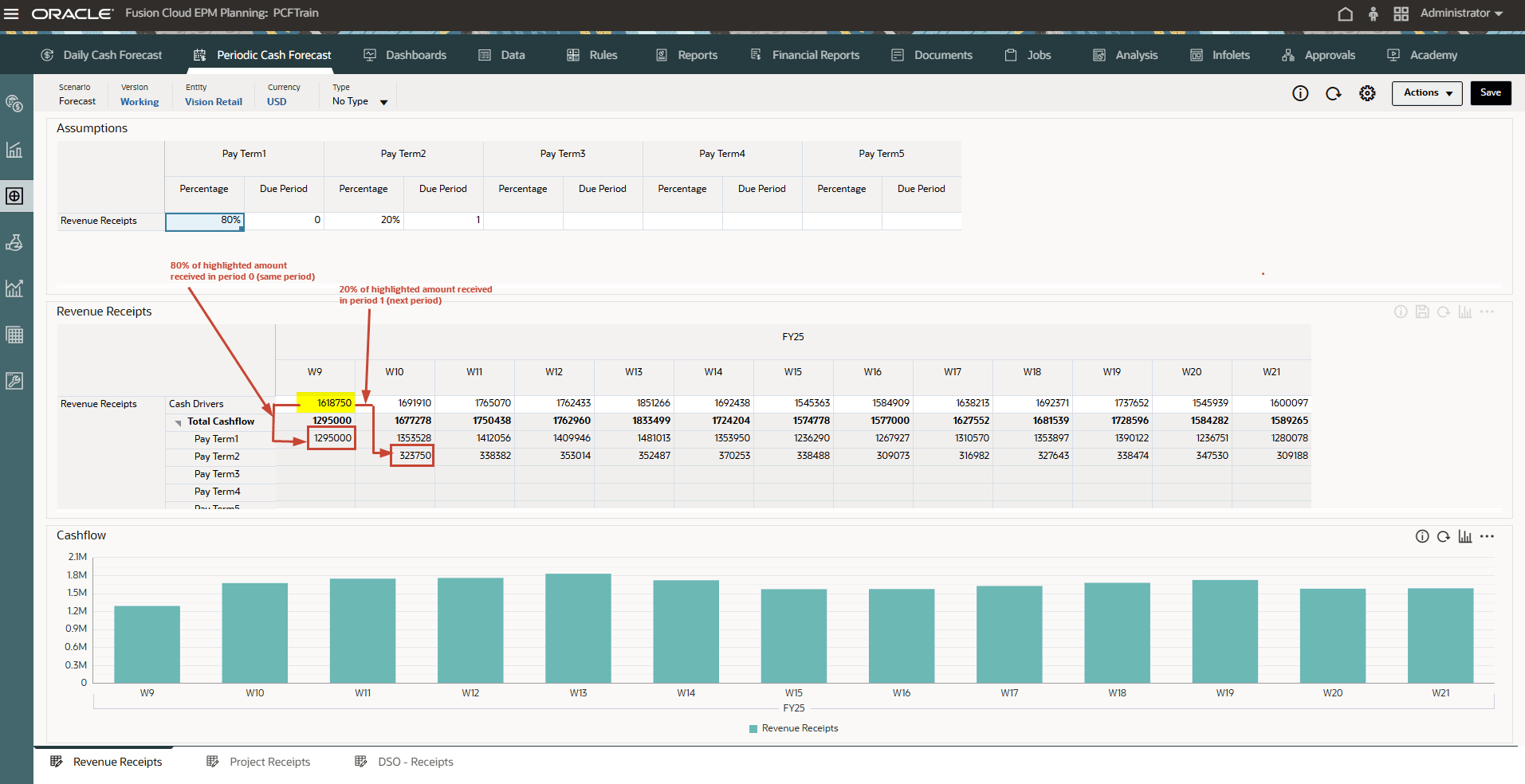

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

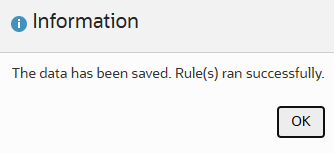

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

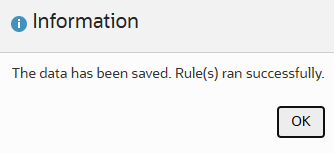

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash inflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Revenue Receipts form and click on “Revenue Pay Terms” to invoke the pay term assumptions form.

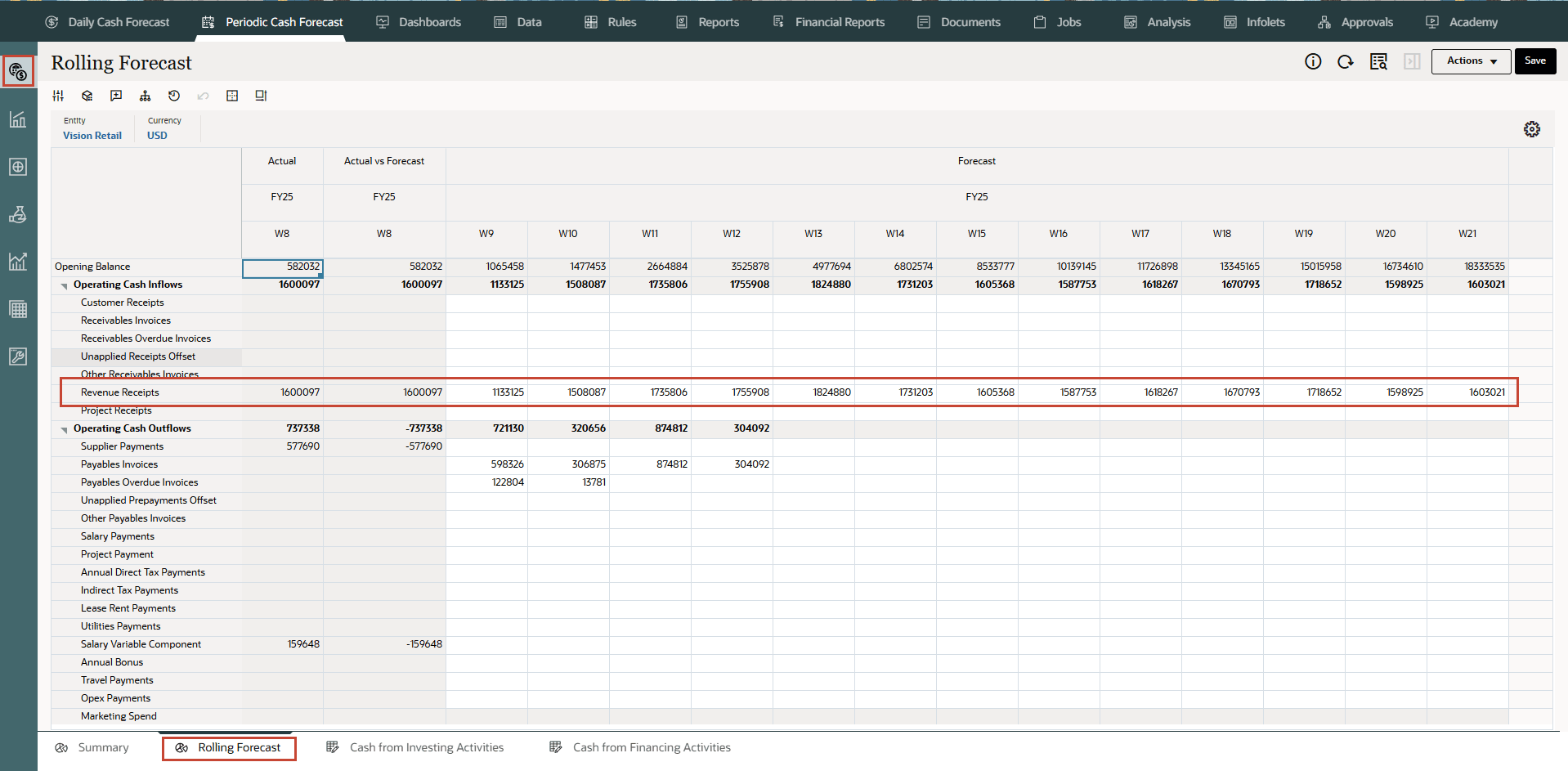

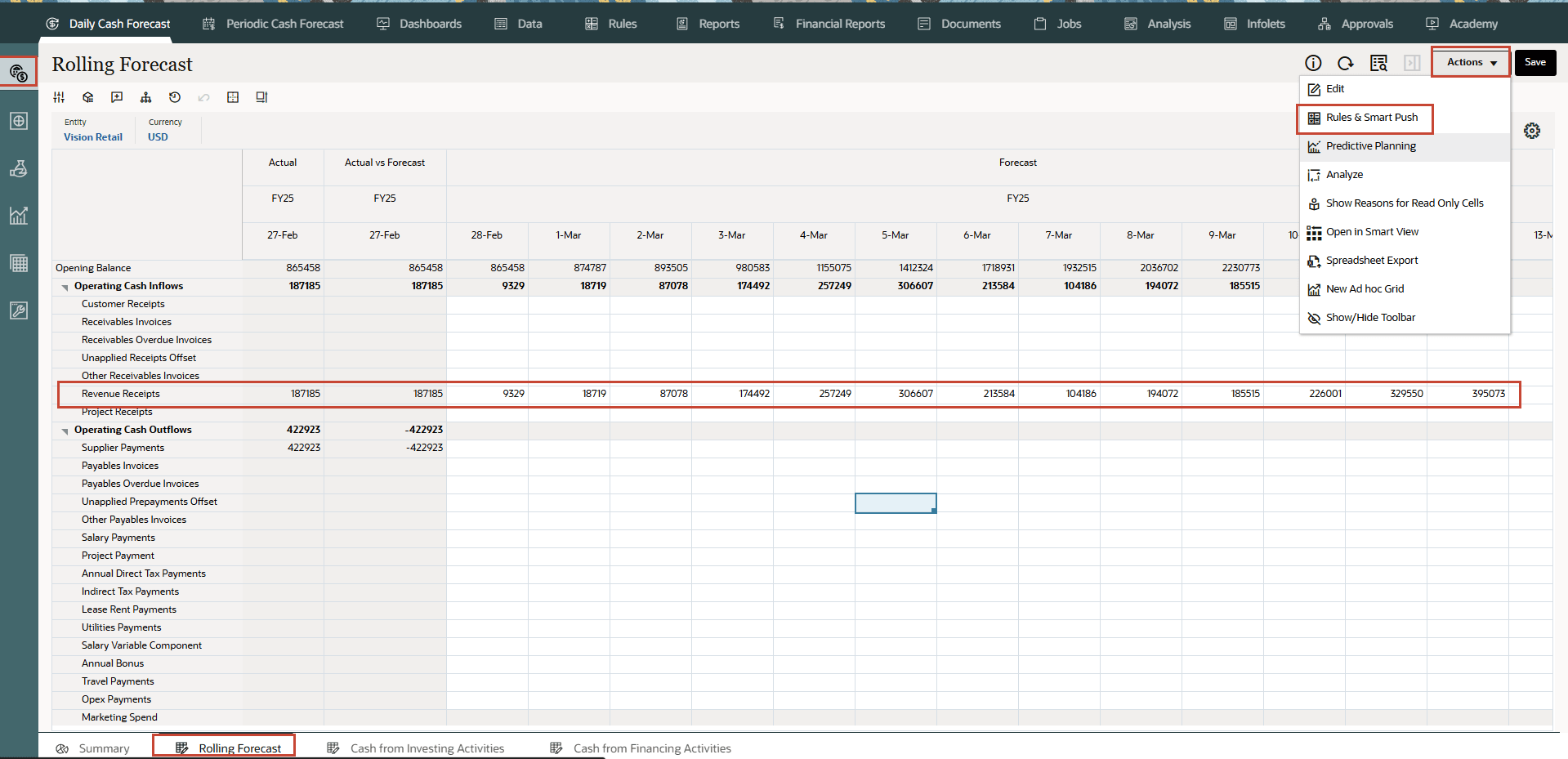

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

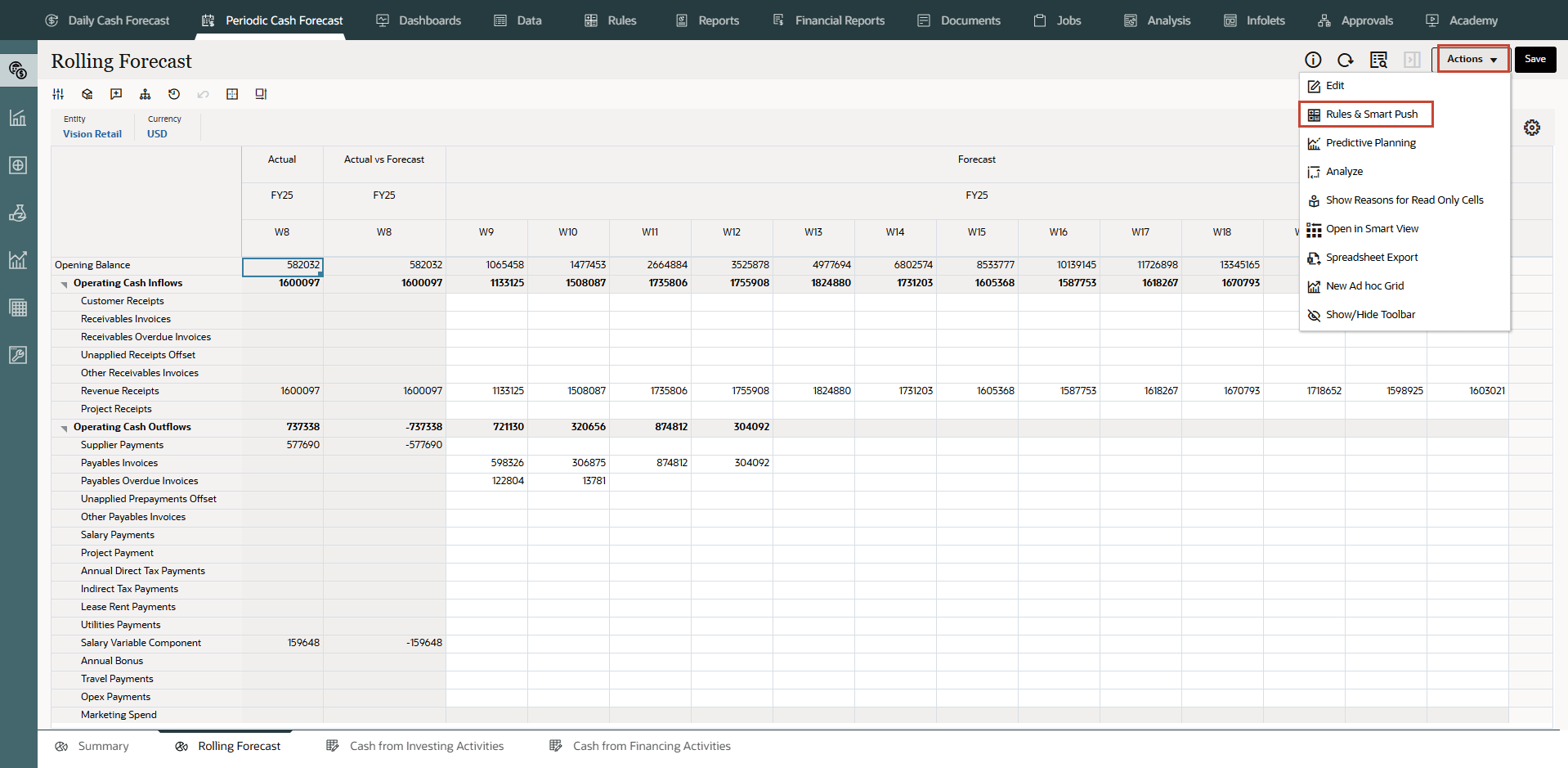

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

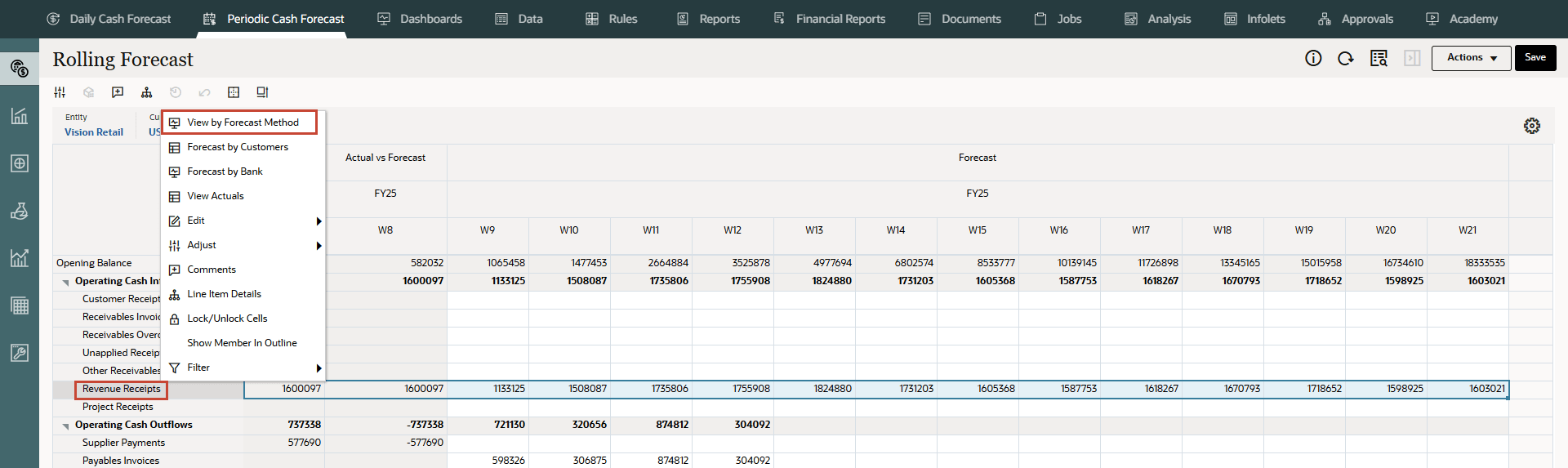

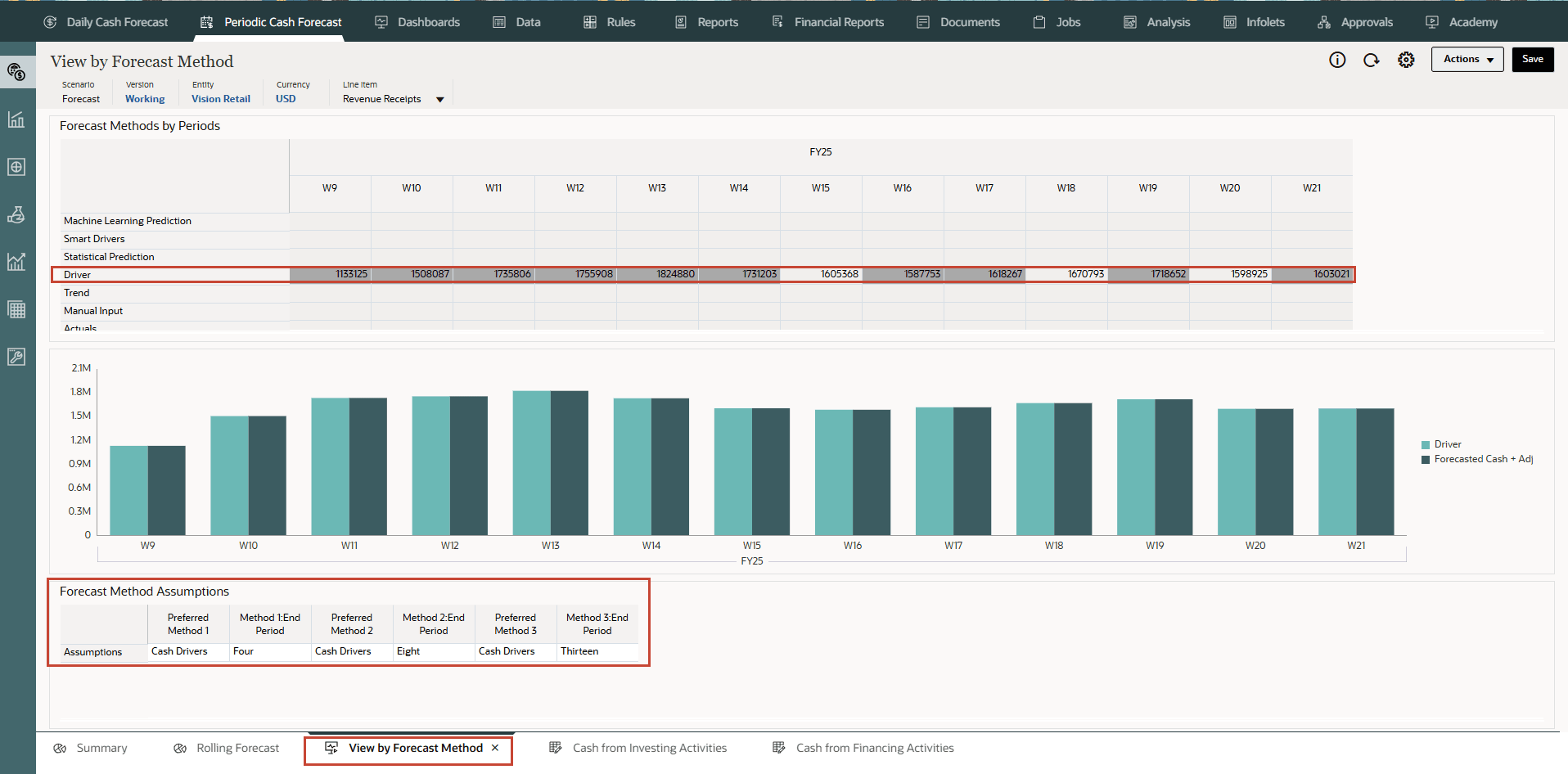

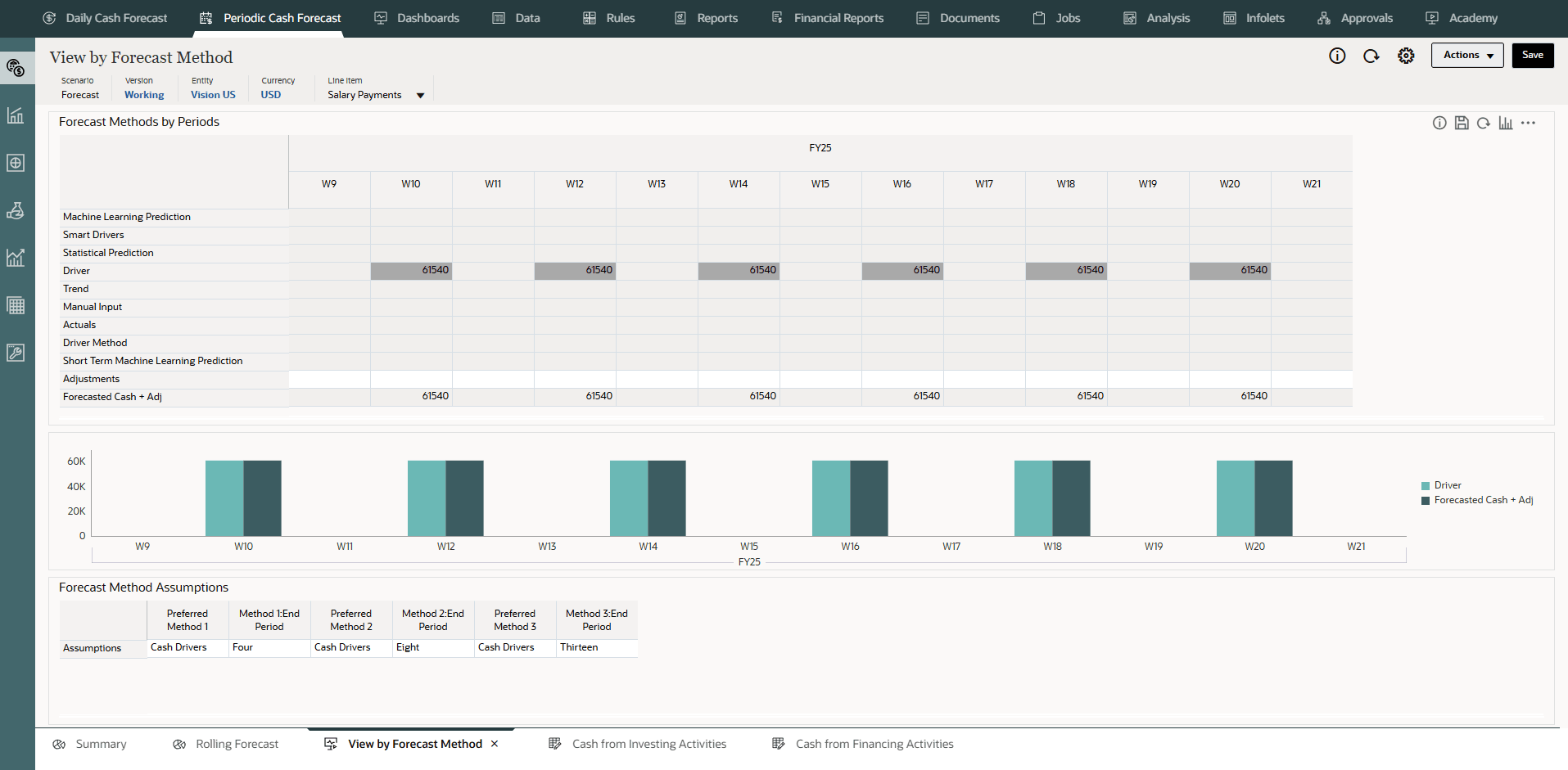

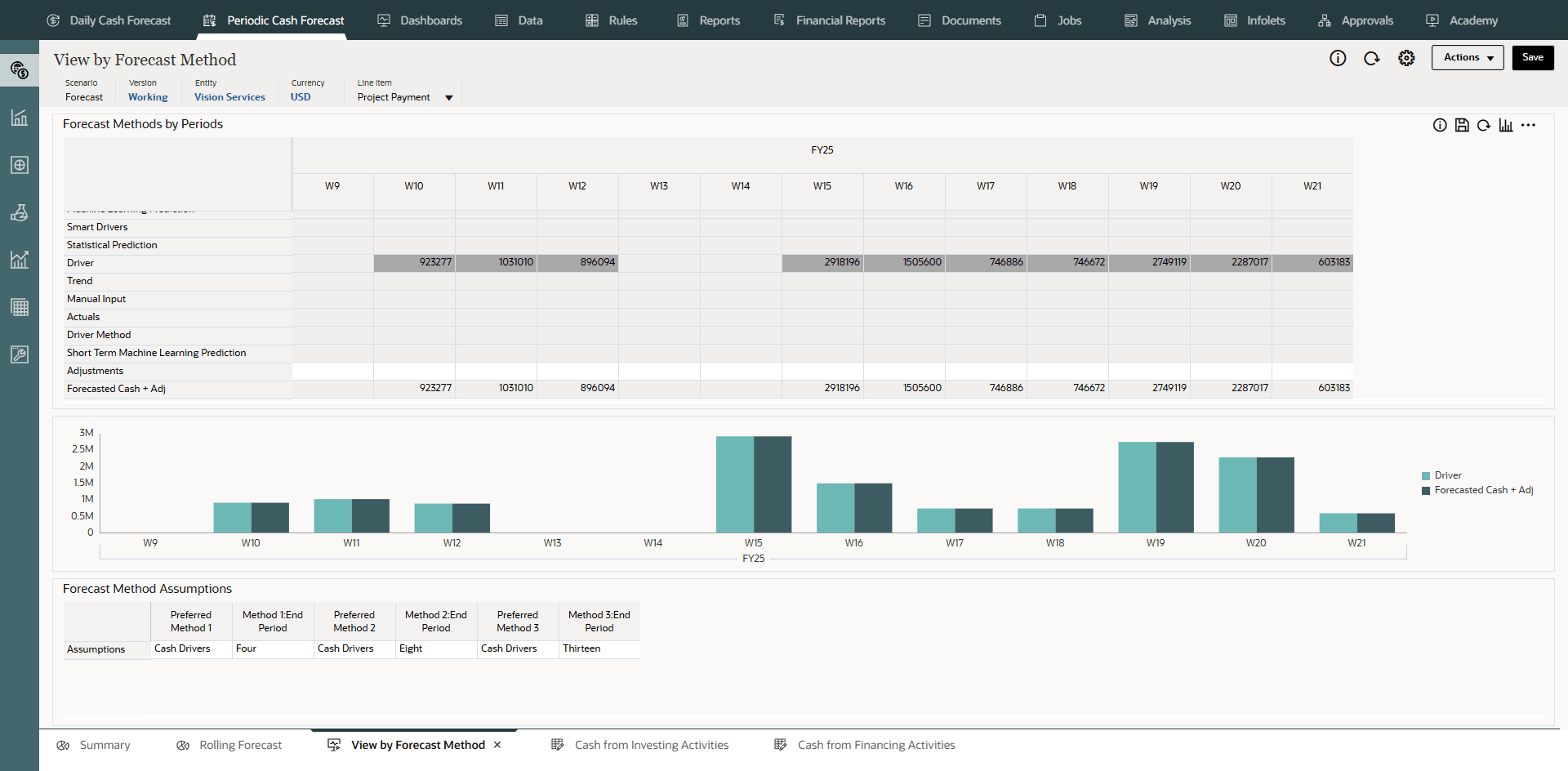

- You can also right click on Revenue Receipts line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

You can now see that Revenue Receipts cash forecast amount for different weeks are derived using Cash driver method.

- Optional - You can repeat the above steps for Daily Cash Forecast. Sample image:

Rolling Forecast form example:

Note:

Examples for Daily Cash Forecast are shown in this step as reference. For all the 11 drivers both Daily Cash Forecast and Periodic Cash Forecast will be similar to each other. We will cover only Periodic Cash Forecast for the next drivers.

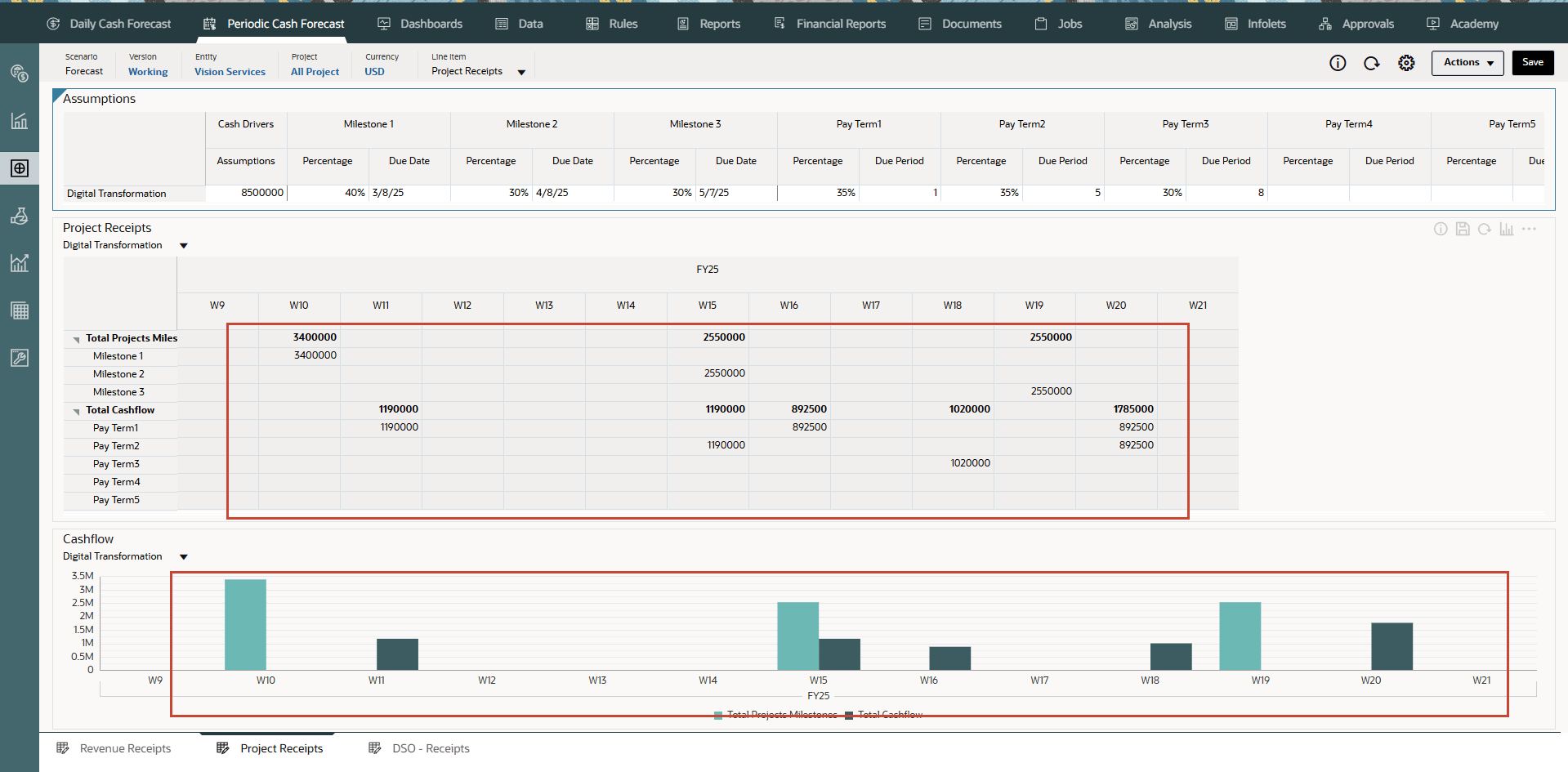

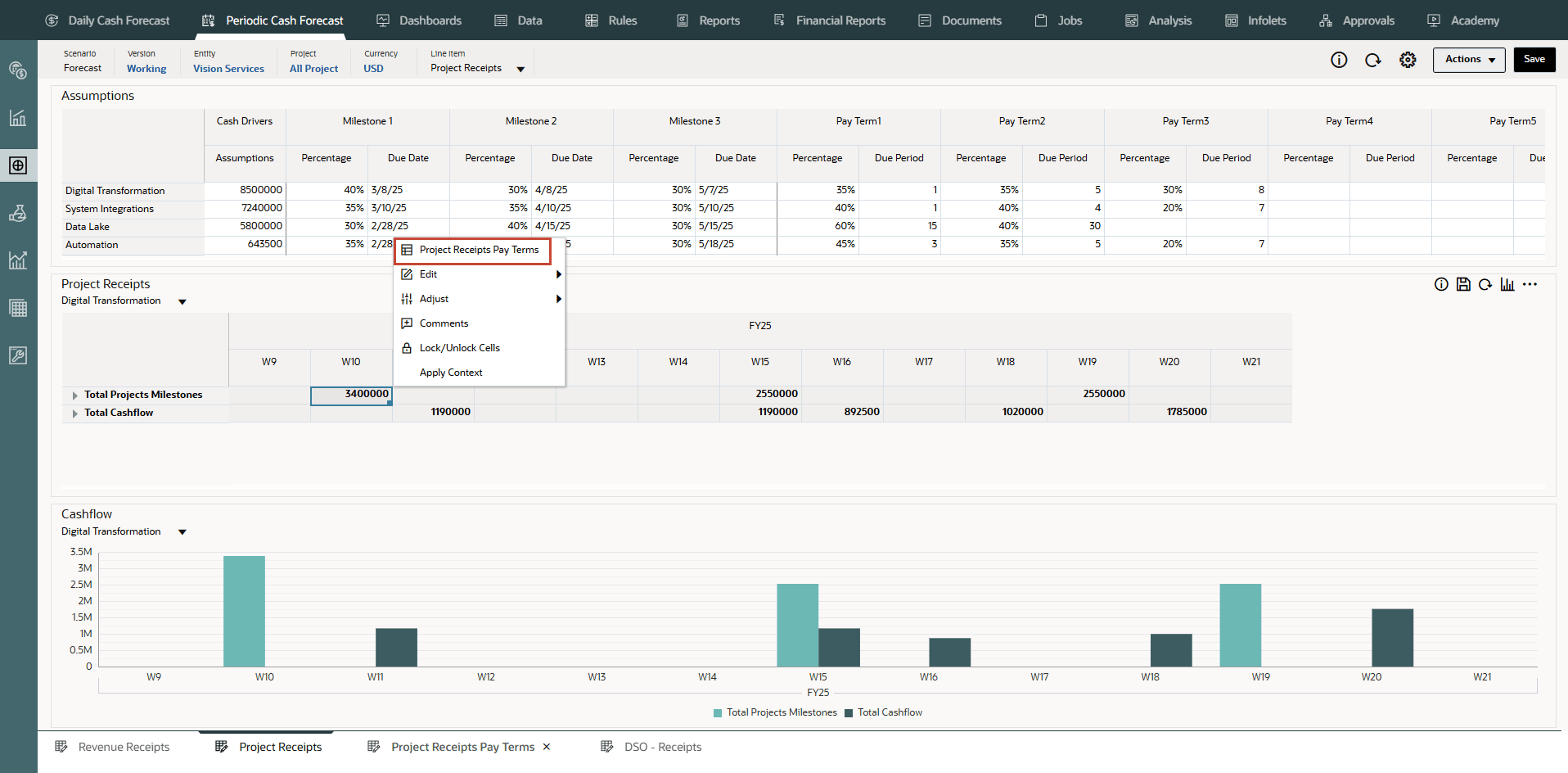

Configuring Project Receipts (Based on Project Revenue, Milestones, and Pay Terms)

Description: Drive cash inflow from projects revenue, milestone dates, and pay terms, and calculate the milestone amounts based on contract value. This method is useful for project-based contract companies, engineering and construction companies, real estate companies, and project-based consulting service companies.

Example: Revenue (cash receipts) from contracts or IT projects driven by milestones and pay terms.

Drivers: Specify at the entity, project, line item level. Additional custom dimensions can be considered if they are enabled.

Milestones for the project

- Percentage - Percent completion

- Due Date

Pay Terms for the project

- Percentage

- Due Period

Driver Input

Project revenue by project.

Driver inputs can be extracted from systems such as the ERP Project Management module, the Planning, Projects module, or can be loaded through a .csv file.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic

Cash flow is calculated by applying the pay term on the milestone amount for the project. Milestone amounts are derived from the milestone percentage for each project. The drivers are captured by project and the cash flow is calculated on the project.

Predictive Cash Forecasting calculates the project milestone amount based on total contract amount * the milestone percentage and populates the result in the respective milestone day/periods. Once the milestones are derived in respective periods, Predictive Cash Forecasting applies the pay terms logic on the milestones to calculate the cash inflow amount and populates it in the respective day or period of the cash forecast. In case the due date or due period falls outside the cash forecasting period range, Predictive Cash Forecasting does not post that milestone / cash inflow amount.

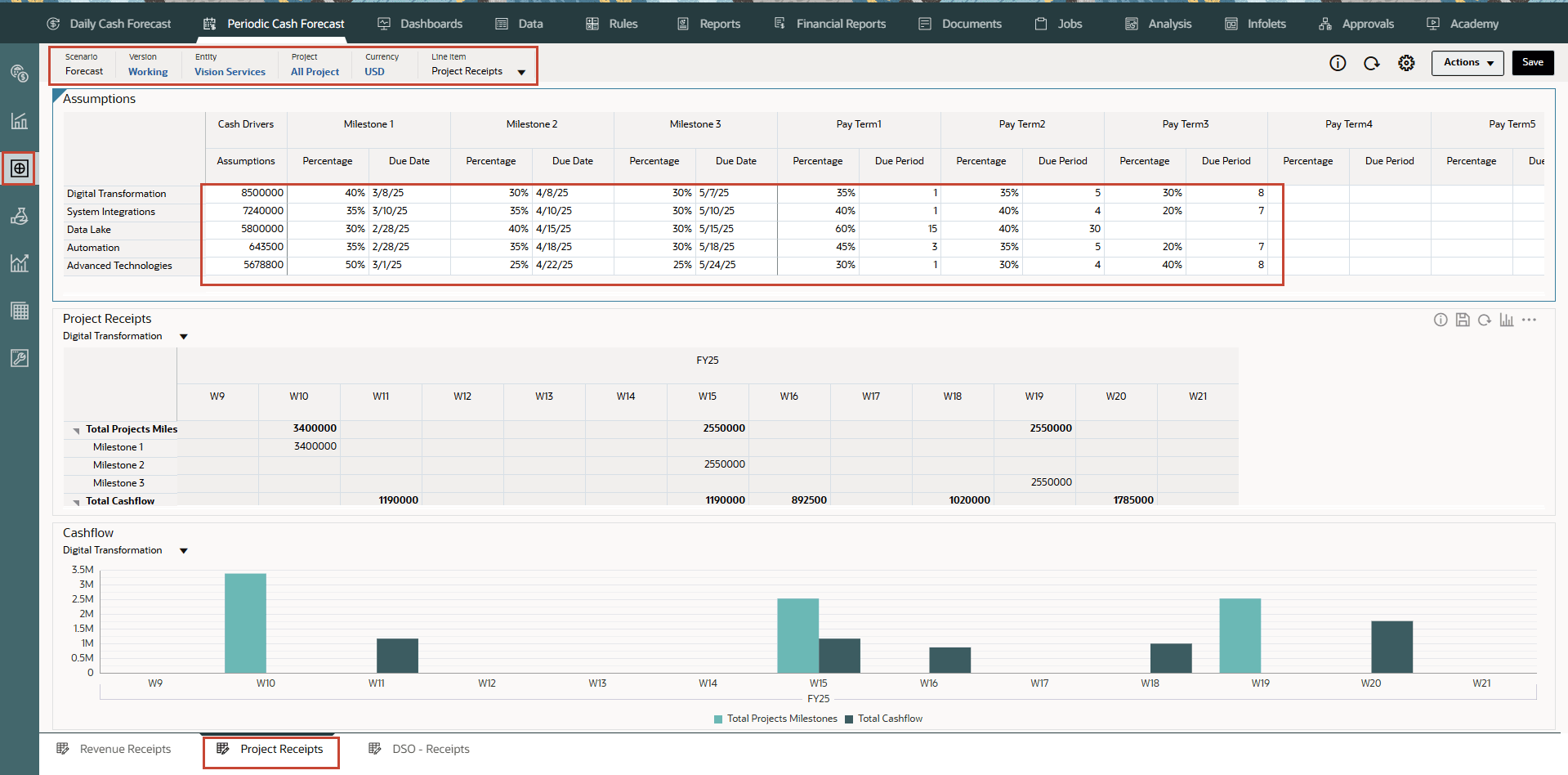

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Inflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

- From the bottom tabs, click the Project Receipts form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash inflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Project Receipts form and click on “Project Receipts Pay Terms” to invoke the pay term assumptions form.

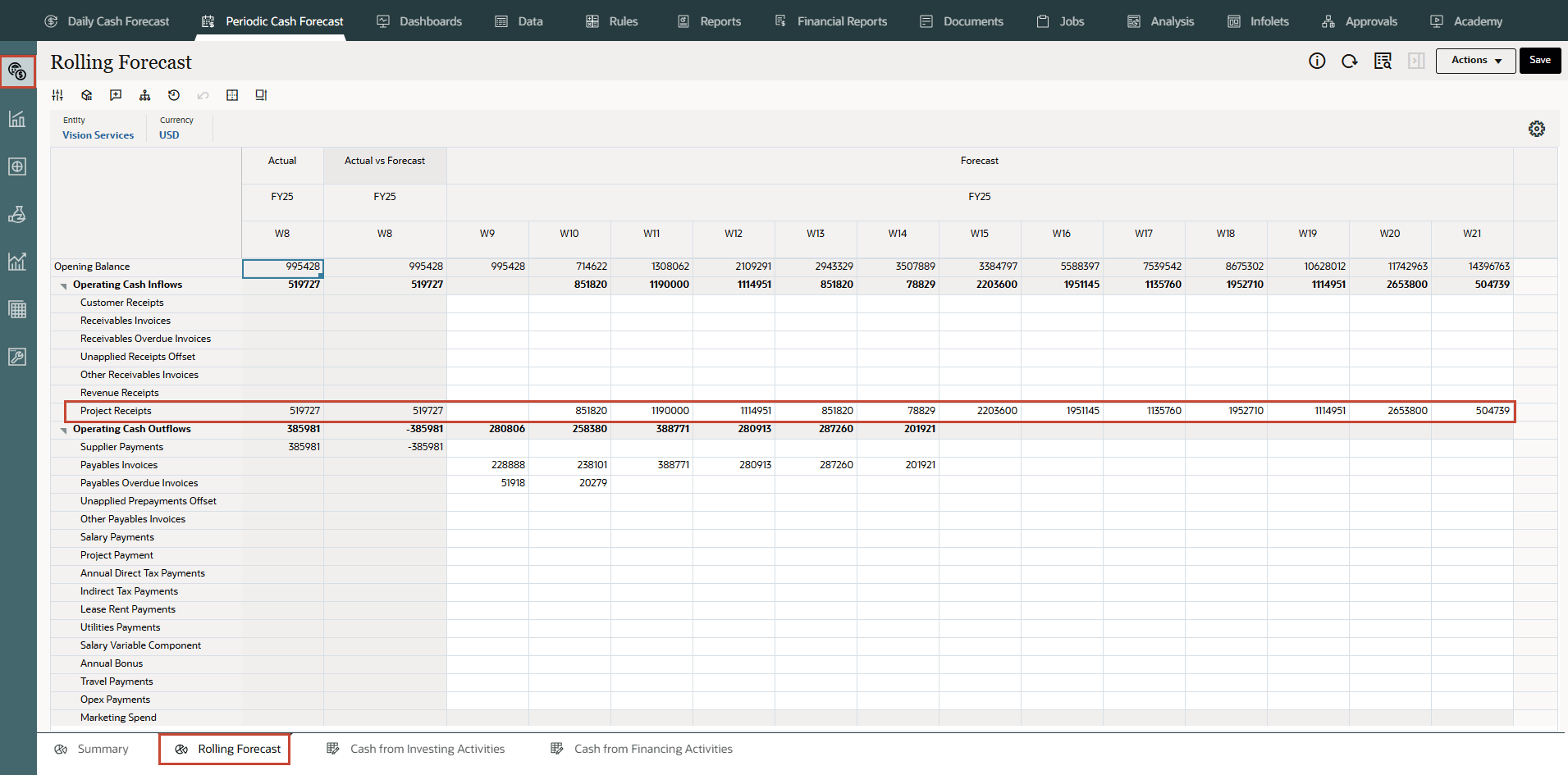

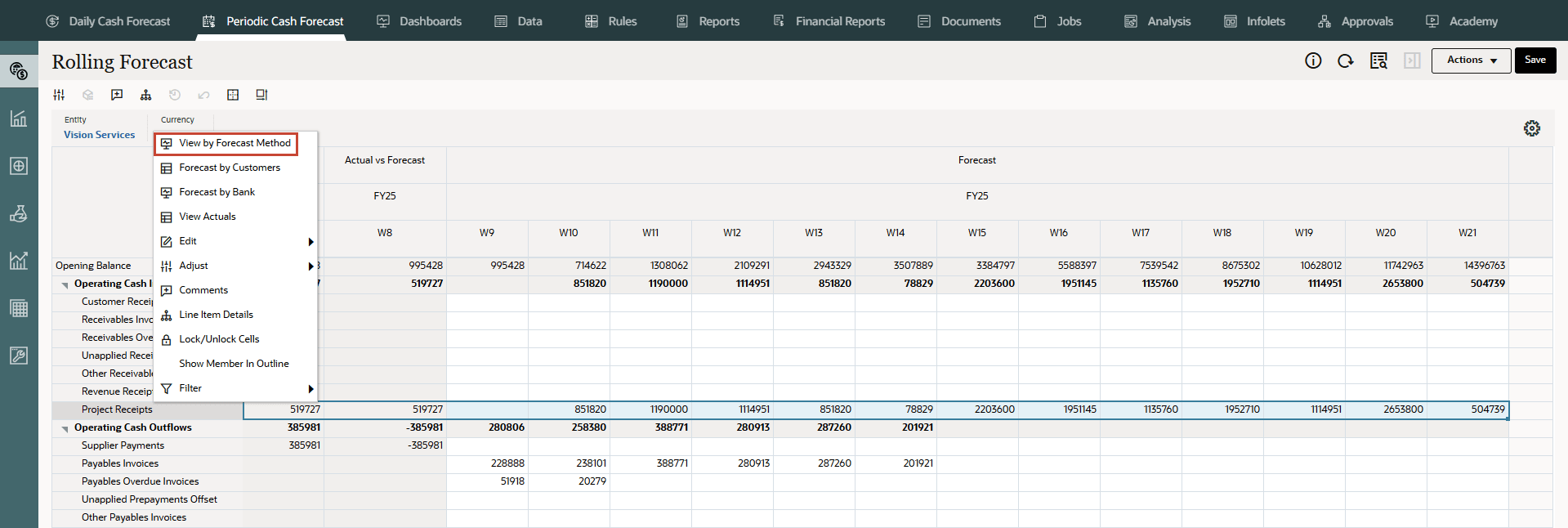

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

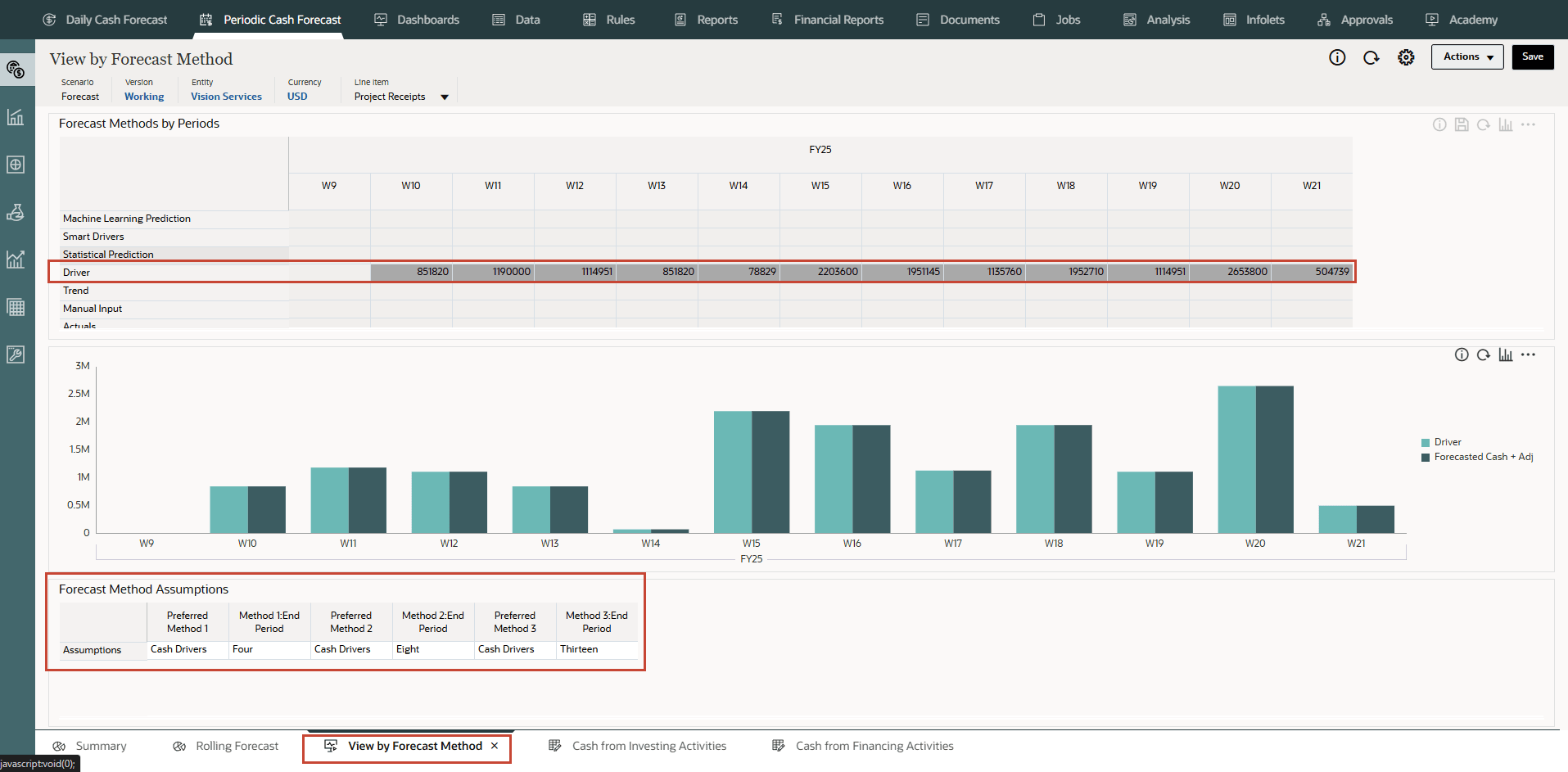

- You can also right click on Project Receipts line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

You can now see that Project Receipts cash forecast amount for different weeks are derived using Cash driver method.

Configuring Days Sales Outstanding (DSO) Receipts (Based on Average DSO and Outstanding Receivables)

Description

Drive cash inflow considering the average days outstanding on the revenue at the party or entity level. This method is useful when pay terms are very dynamic.

Days sales outstanding (DSO) is a driver measure of the average number of days that it takes a company to collect payment for a sale. DSO is often determined on a monthly, quarterly, or annual basis. Based on the DSO driver, Predictive Cash Forecasting determines the cash inflow by applying it to the Outstanding Revenue.

This method can be useful for customers who want to forecast cash when they don’t have corresponding source data yet, especially for periods further out in the cash forecast.

Example: You can use DSO when pay terms are very dynamic, for example, for revenue line items such as revenue not yet booked, or future projected revenue, such as indirect channel revenue cash inflow.

Drivers

Average DSO

- Assumptions, average across year

- Period buckets, average for the period

Driver Input: Adjusted DSO days can be used as driver input for calculating the cash inflow in the forecast, and can be loaded or input either at the Entity level or based on the dimension (for example, Party) that this method is applicable for. DSO can be loaded as an overall assumption or by period. Additionally, Outstanding Revenue is available as the driver. Outstanding Revenue is usually the opening Accounts Receivable + Credit Sales for the period.

Calculation Logic: Cash inflow is calculated based on the Outstanding Revenue (future revenue) and the Average DSO. Predictive Cash Forecasting considers the appropriate periods' average DSO or it takes the overall assumption. The cash inflow is determined based on the Average DSO applied on the driver input amount and posted to the period based on the number of DSO days.

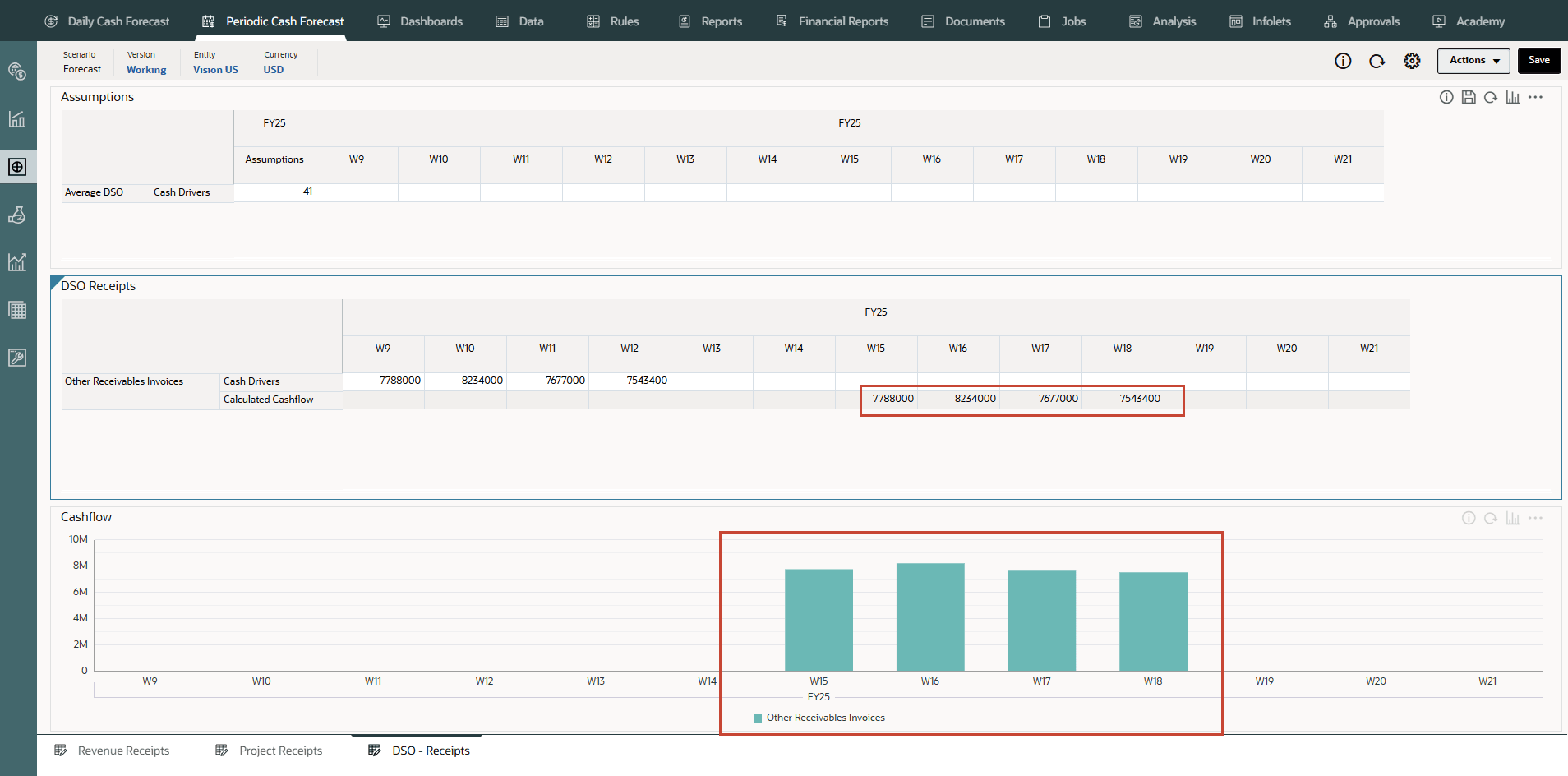

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Inflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

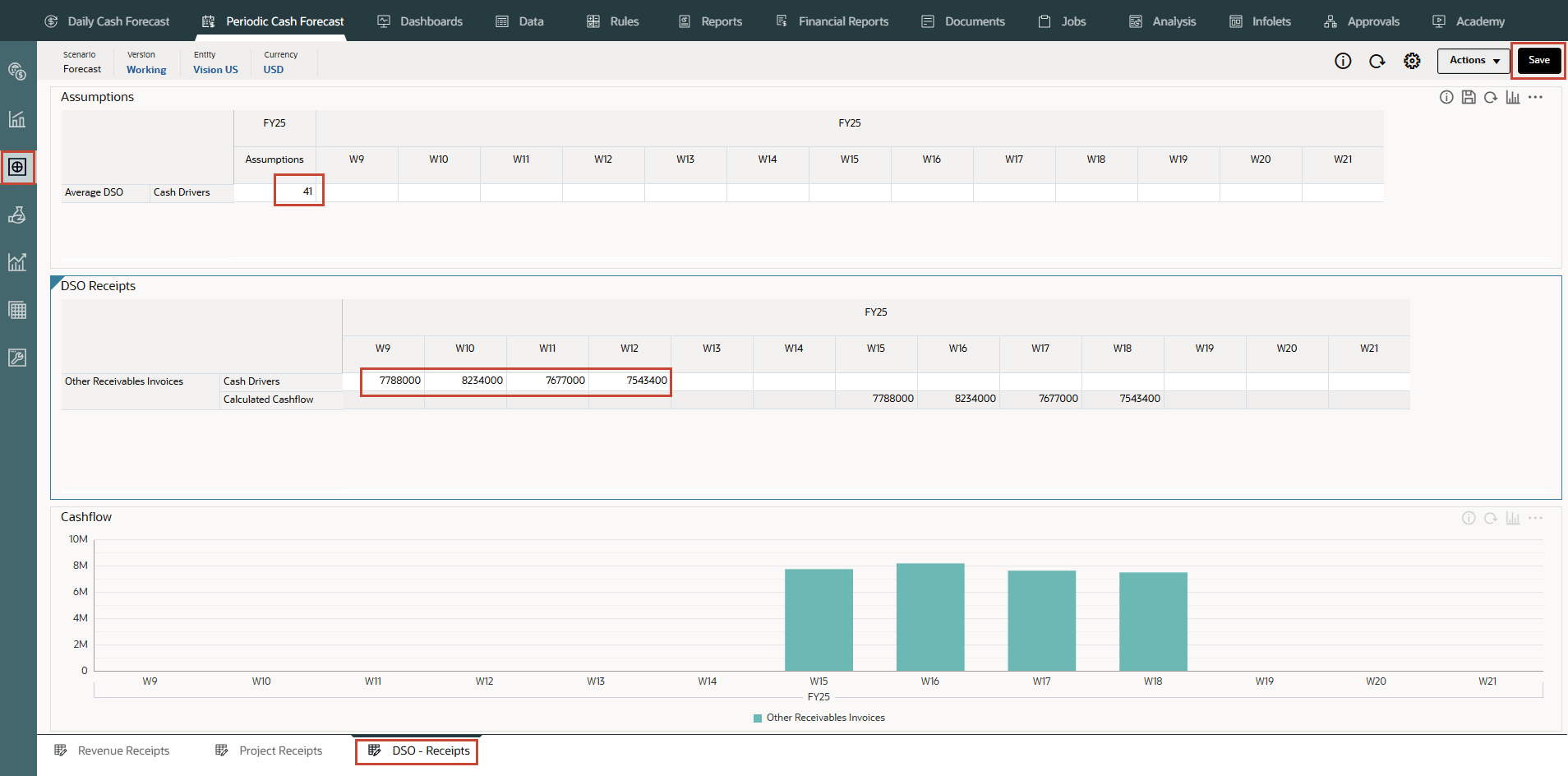

- From the bottom tabs, click the DSO - Receipts form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Upon save, application runs “Periodic Sales Outstanding – Receipts” rule and populates the calculated cash inflow in respective weeks as shown below.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash inflow to the period buckets based on the due date.

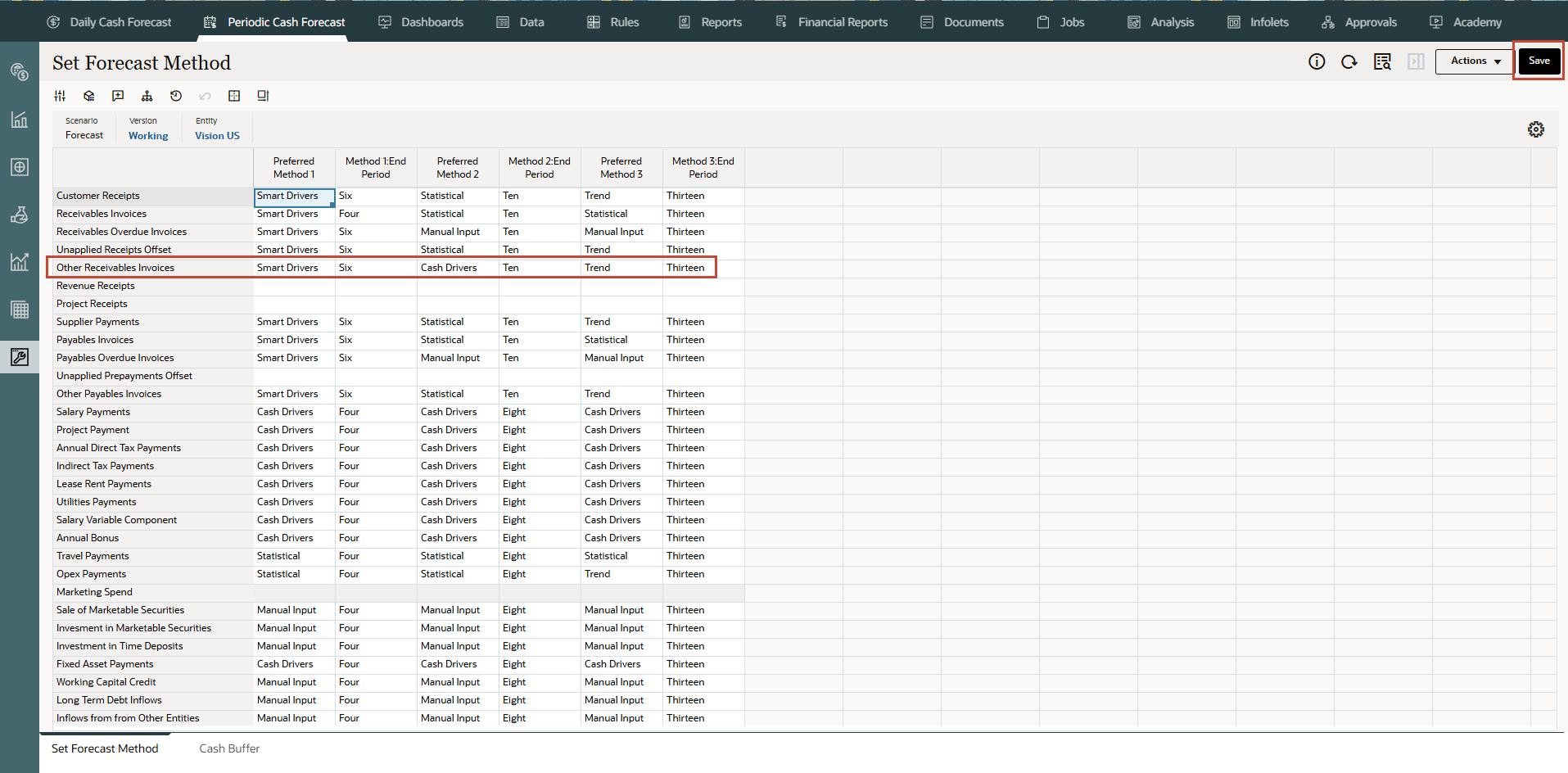

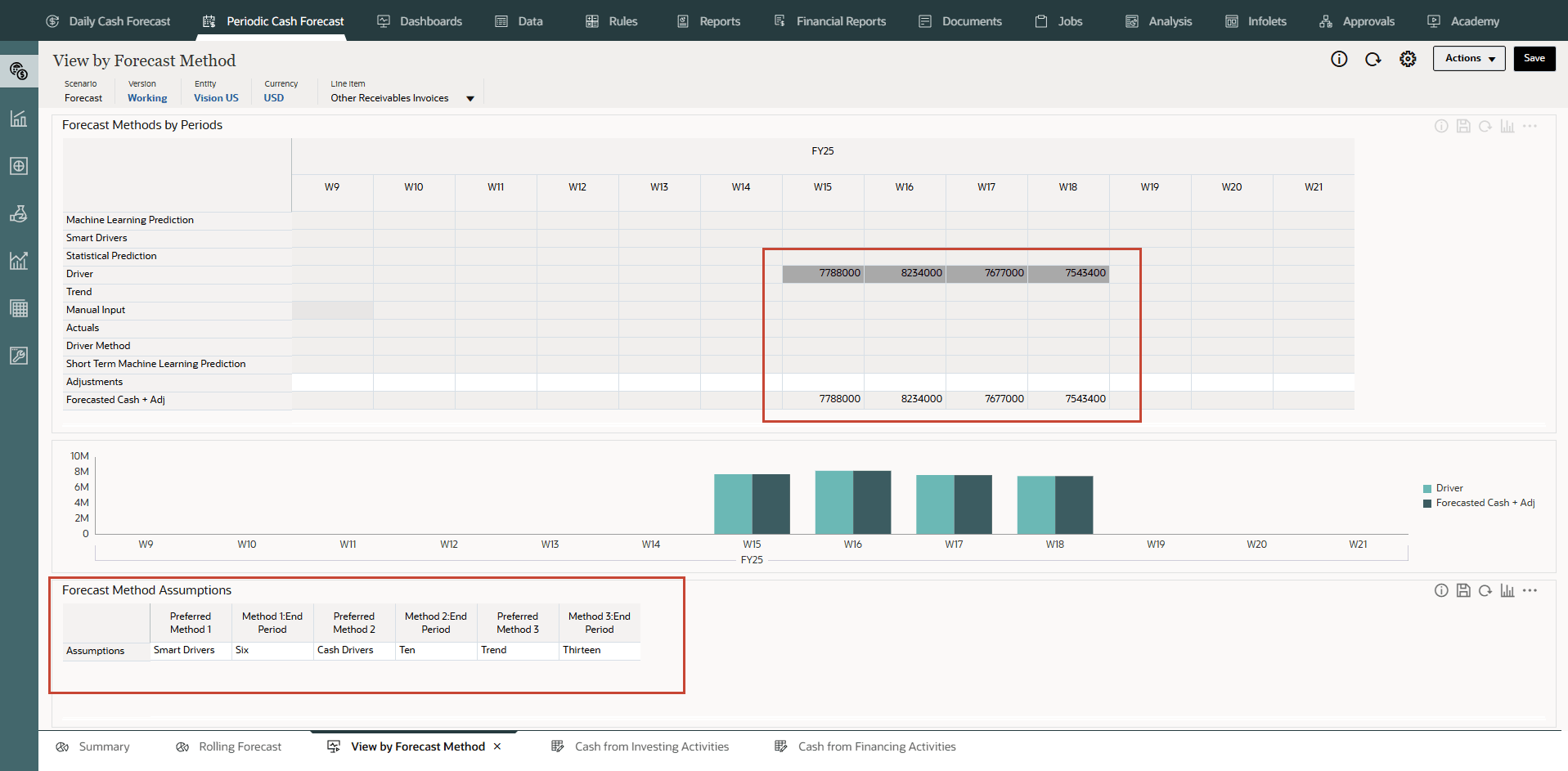

- On the left vertical tabs, select Assumptions (Set Forecast Method).

- Change the Set Forecast method to use Smart Drivers method until Period 6, Cash Drivers method until Period 10 and then Trend method until Period 13 as shown below:

- Click Save.

- In Set Forecast Method, click Actions >> Rules & Smart Push and run Periodic Process forecast rule .

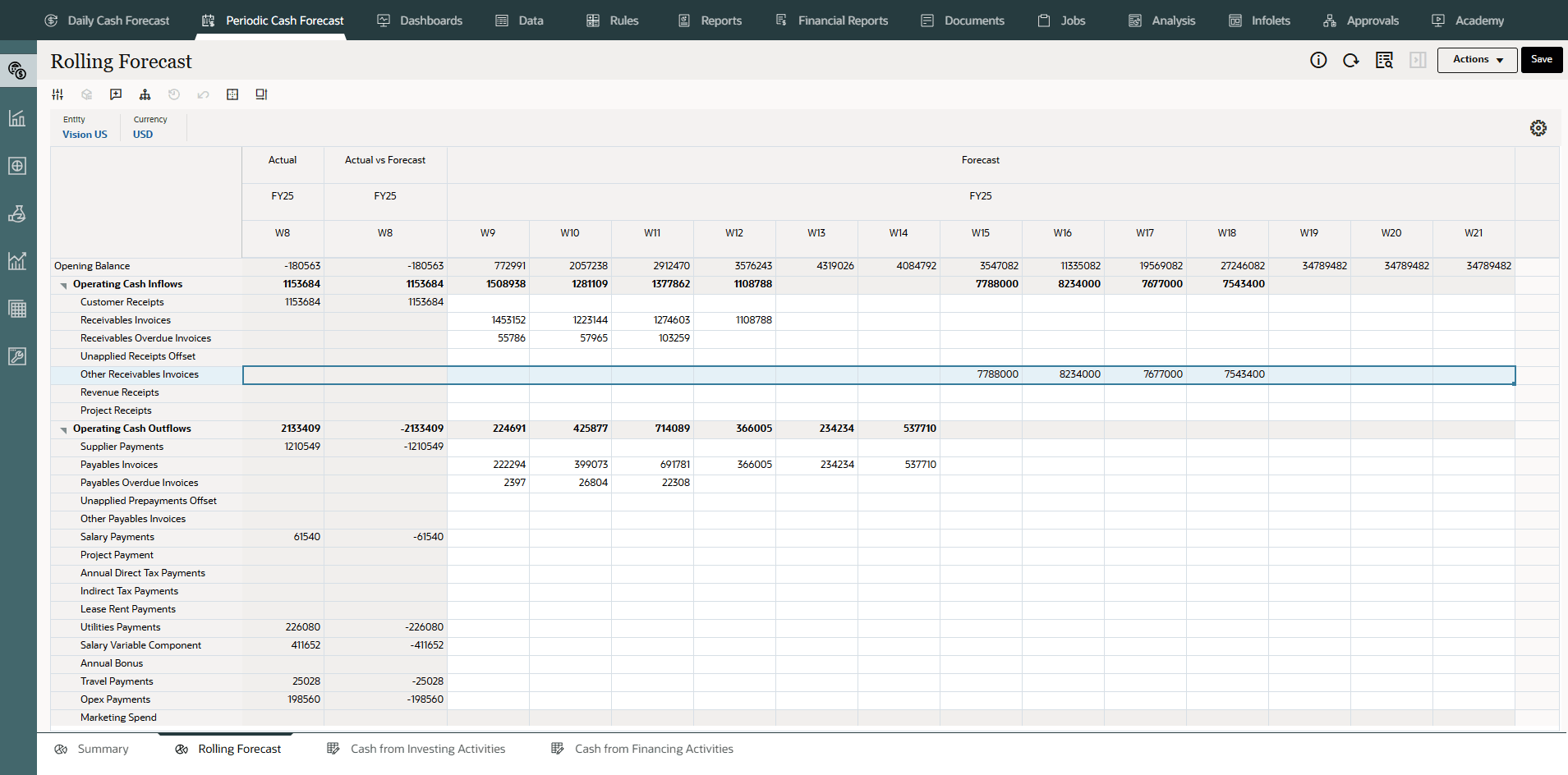

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- You can also right click on Other Receivables Invoices line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

You can now see that Other payables invoices amount for Week 15 to Week 18 are derived using Cash driver method – DSO as driver.

Configuring Cash Outflow Drivers

Cash Outflow Drivers:

- Expense Payments - Drive cash outflow considering the expense and the pay terms. For example, for some Operational expenses such as travel and utilities, cash outflows can be determined based on a regular pay term.

- Fixed Asset Payments - Drive cash outflow considering the fixed asset spends and pay terms. Fixed assets payments are determined based on pay terms, which can be set by asset class. Data for fixed asset payments could come from the Planning, Capital module or other source.

- Recurring Payments - Drive cash outflow for ongoing expenses that have payments on a recurring basis, such as lease or rental payments.

- Salary Payments - Drive cash outflow for salary and payroll-related payments based on salary expenses, salary basis, and timing of the pay-outs, such as annually, monthly, or weekly, and salary incidence such as beginning of period, end of period, bi-monthly, or a specific due date. Data for salary payments could come from the Planning, Workforce module or a payroll system.

- Project Payments - Drive cash outflow from project expenses and pay terms. Project expense cash outflow for material, labor, or other project related costs can be modeled based on milestones and pay terms. Data for project payments could come from the Planning, Projects module or other source.

- Direct Tax Payments - Drive cash outflow for direct tax payments based on tax liability, installment percentage, and due dates. Used for any direct tax payment, for example to government or regulators.

- Indirect Tax Payments - Drive cash outflow for indirect tax payments based on tax liability and pay terms. For example, indirect tax payments such as GST or Sales Tax that are payable to regulatory agencies.

- Days Payables Outstanding (DPO) - Payments - Drive cash outflow considering the average days outstanding on the expense, typically by supplier or at the entity level. Useful when pay terms are very dynamic.

In this section, you will configure all the Cash Outflow Drivers.

Configuring Expense Payments (Based on Expense and Pay Terms)

Description: Drive cash outflow considering the expense and the pay terms. This driver method is applicable for operating cash outflow line items such as labor payments, travel payments, or hotel payments. This driver method is used to derive the cash outflows based on standard pay terms for that expense applied on the expense.

Example: For example, cash outflows for some operational expenses such as travel and utilities can be determined based on a regular pay term.

Drivers: Specify at the entity, line item level.

Pay Terms

- Percentage - Percentage expected for each pay term

- Due Period - payment days, weeks, or months

Driver Input

Any expenses such as travel, hotel, or utilities.

You can extract driver inputs from various sources such as the Planning, Financials module, ERP, or you can load purchase orders through a .csv file.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic: Predictive Cash Forecasting calculates the cash outflow amount based on the pay term assumptions. There can be multiple pay terms for certain expenses. Predictive Cash Forecasting calculates the cashout flow amount considering the expense amount (driver input) * percentage input for each pay term. The calculated amount is then posted in the respective day or period as per the due period defined in the pay terms assumptions. If there are multiple pay terms, Predictive Cash Forecasting posts the outflow in the respective pay term and period according to the driver assumptions.

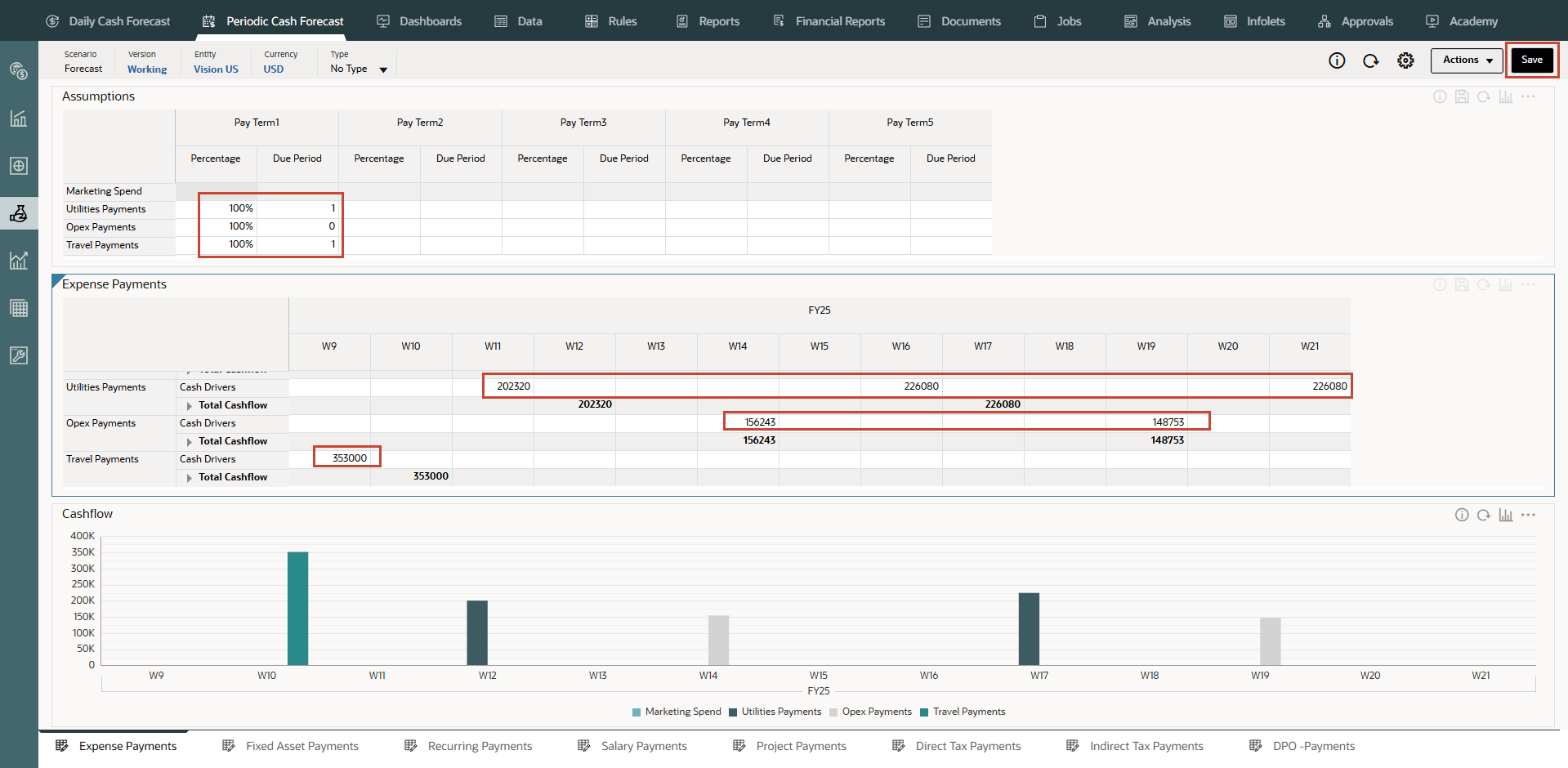

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

- From the bottom tabs, click the Expense Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

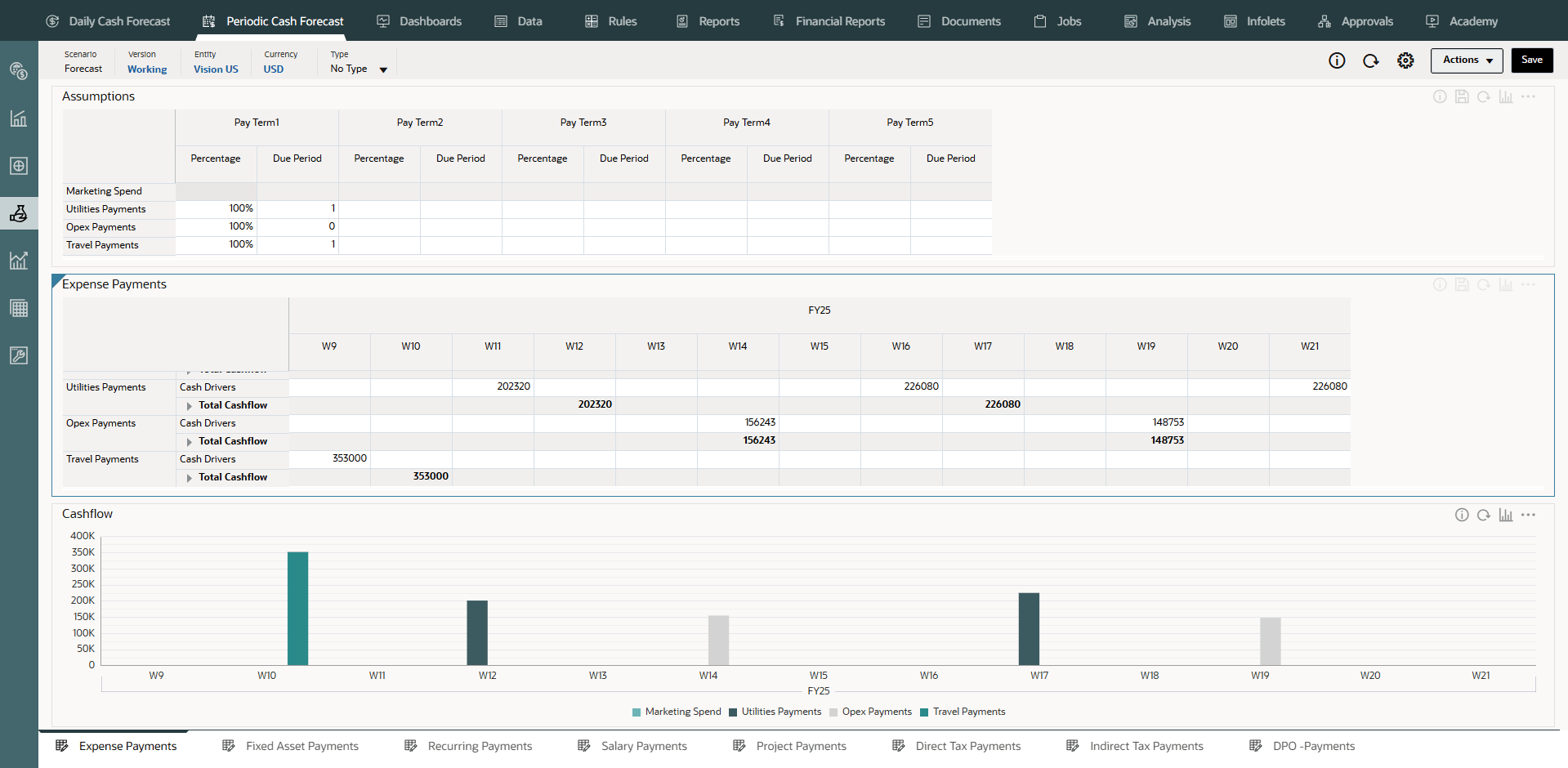

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Expense Payments form and click on “Expense Pay Terms” to invoke the pay term assumptions form.

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

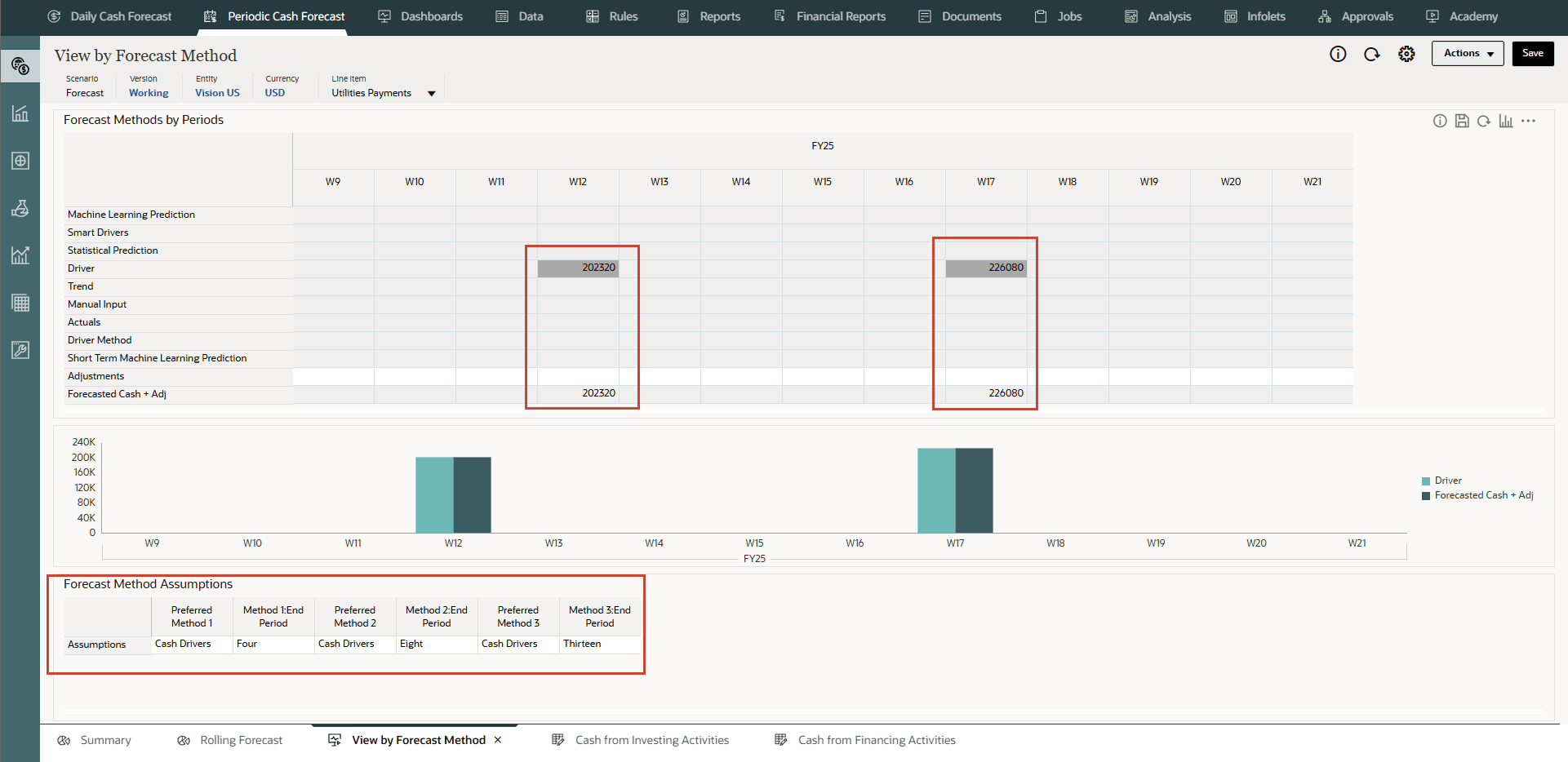

- You can also right click on any one of the Expense Payments (Utilities payments, Travel payments, Opex payments) line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

In this example, you can see that Utilities payments cash forecast amount for different weeks are derived using Cash driver method.

Configuring Fixed Asset Payments (Based on Fixed Asset Spends and Pay Terms)

Description

Drive cash outflow considering the fixed asset spends and pay terms. Fixed asset payments are determined based on pay terms that can be set by asset class.

The Fixed Asset Payments driver method is applicable for capital payments (fixed assets payments) line items in the cash forecast.

Cash outflow from this method writes into Cash from Investing Activities, as opposed to Cash from Operating Activities.

Example: This driver method can be used by companies where they are fixed asset purchases booked in the Payables Fixed Assets module and the supplier payment happens on a periodic basis based on pay terms with the asset supplier.

Drivers

Pay Terms:

Specify at the entity, capital payments line item level. Additional custom dimensions, such as Party, Asset Class or Project, can be considered if they are enabled.

- Percentage - Percentage expected for each pay term

- Due Period - payment days, weeks, or months

Driver Input

Fixed Asset Spends.

Driver inputs can be extracted from the Planning, Capital module or other source, such as the ERP Order module, or can be loaded through a .csv file.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic

Cash outflow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

Predictive Cash Forecasting calculates the cash out flow amount considering the Fixed Assets spends (the driver input) * percentage input for each pay term. The calculated cash outflow amount is then posted in the respective day or period as per the due period defined in the pay terms assumption form.

In case the due date or due period falls outside the cash forecasting period range, Predictive Cash Forecasting does not post that cash outflow amount. If there are multiple pay terms, Predictive Cash Forecasting posts the outflow in the respective pay term and period according to the driver assumptions.

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

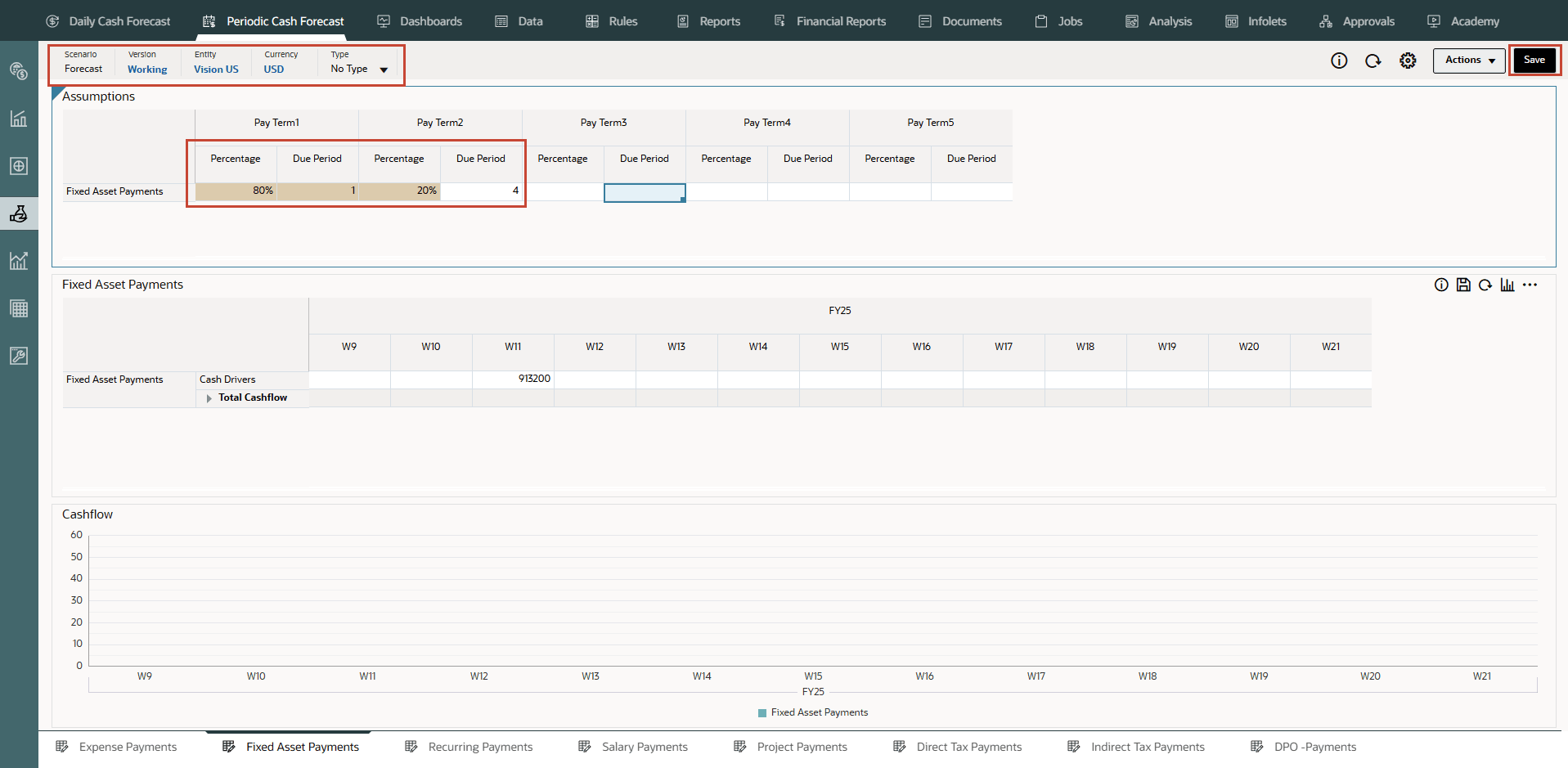

- From the bottom tabs, click the Fixed Asset Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

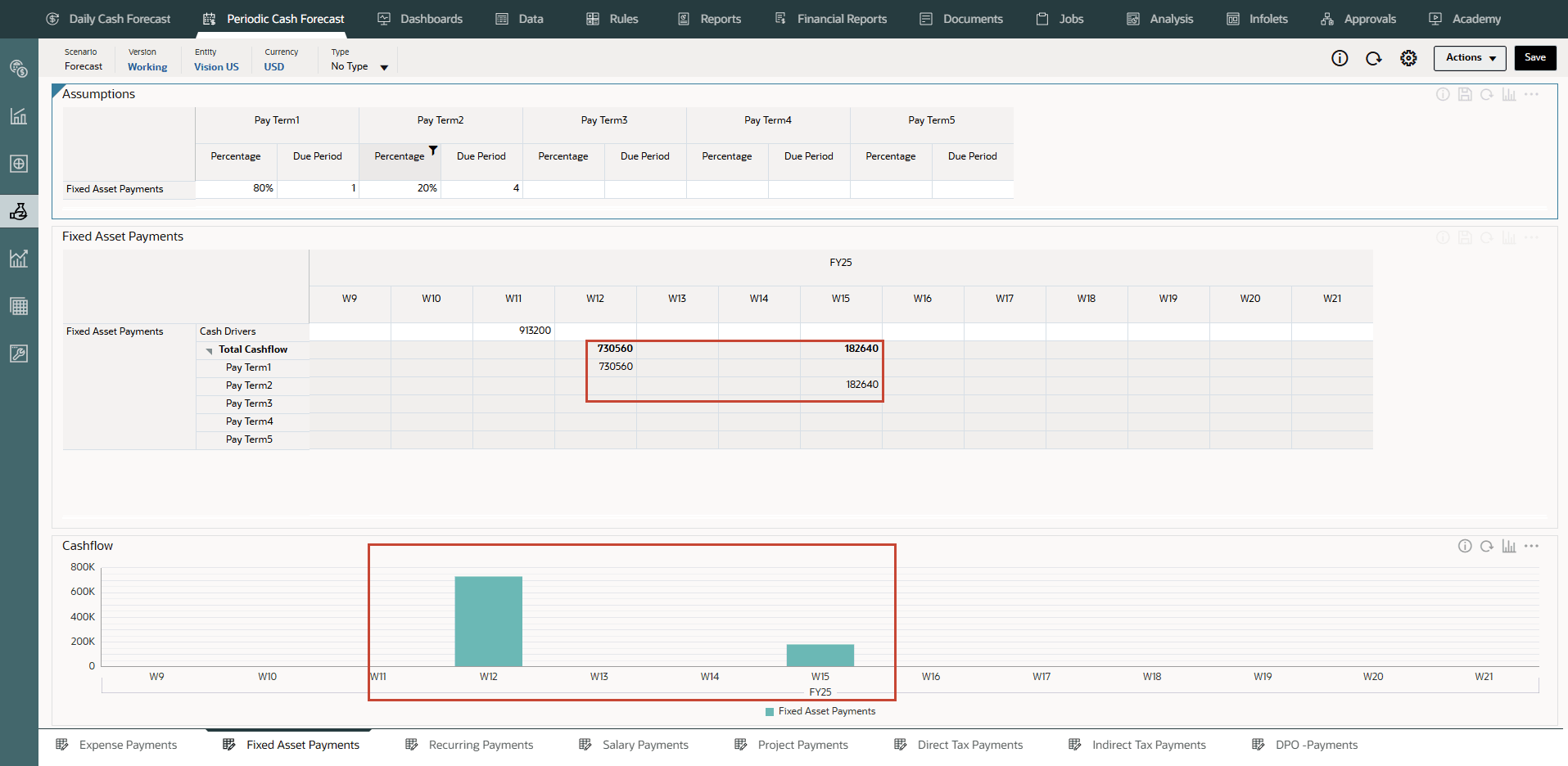

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Fixed Asset Payments form and click on “Fixed Asset Pay Terms” to invoke the pay term assumptions form.

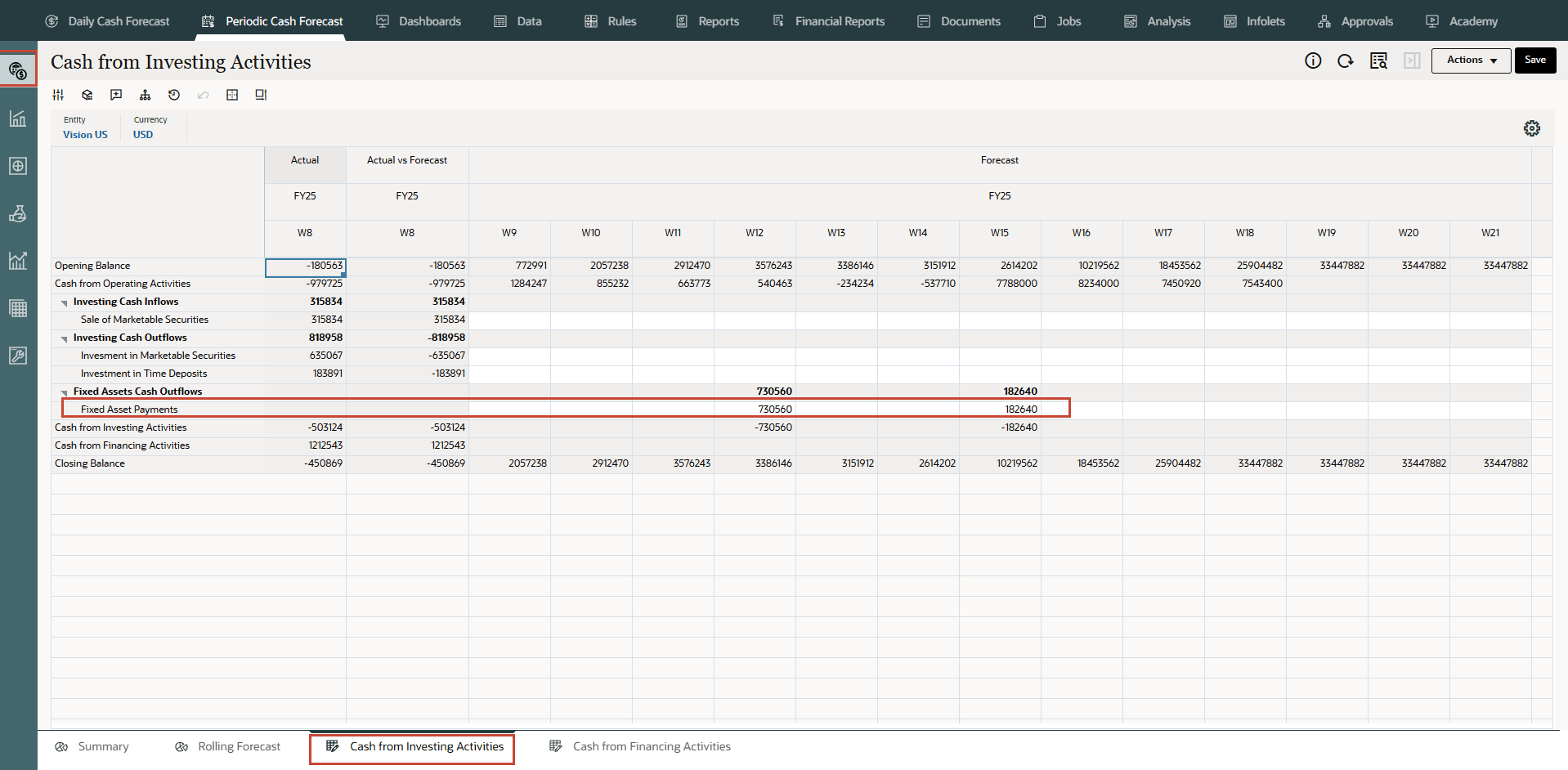

- From the vertical tabs click Periodic Cash Forecast >> Cash from Investing Activities.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Cash from Investing Activities, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

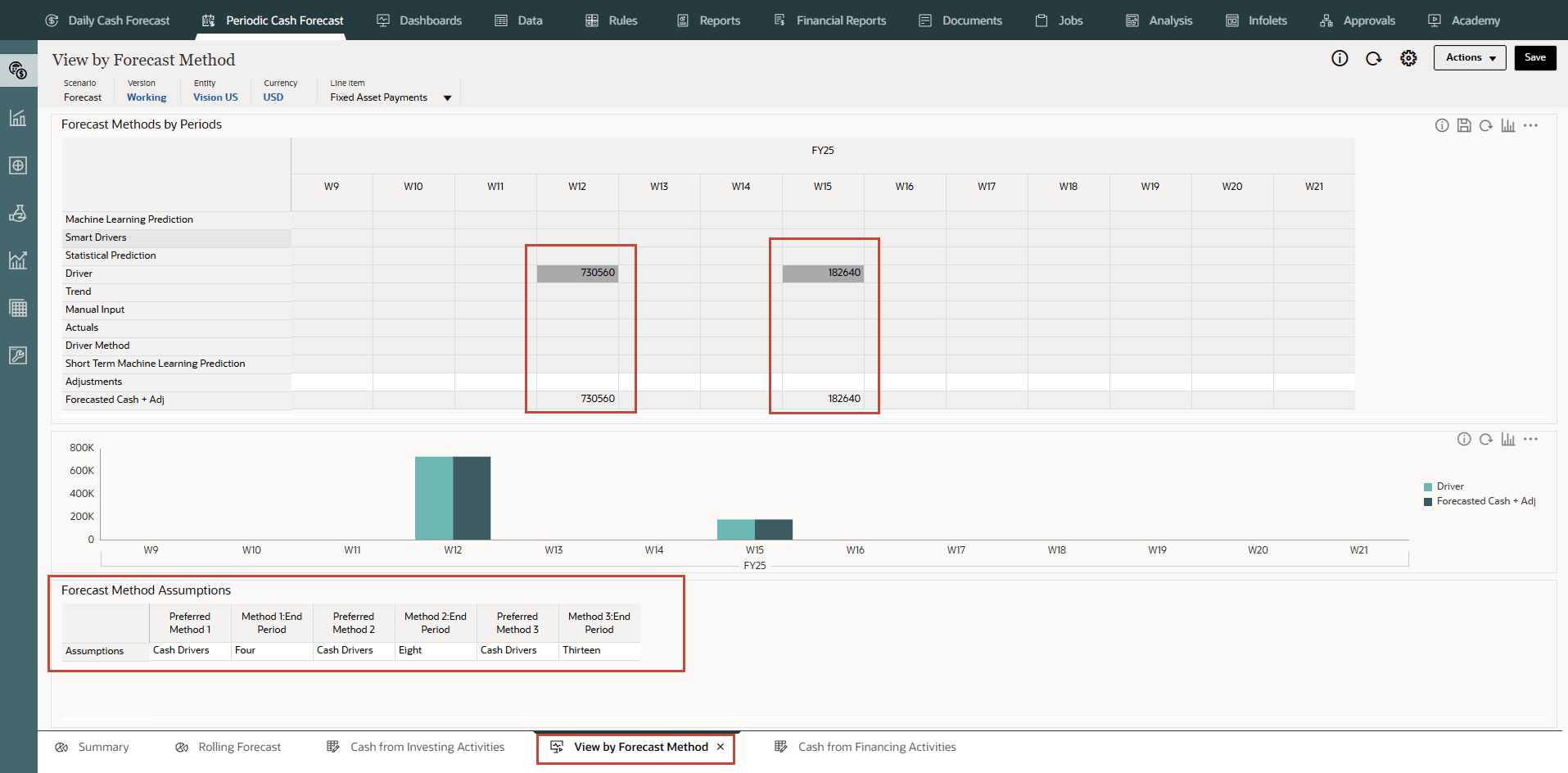

- You can also right click on any one of the Fixed Asset Payments line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

In this example, you can see that Fixed Asset Payments cash forecast amount for different weeks are derived using Cash driver method.

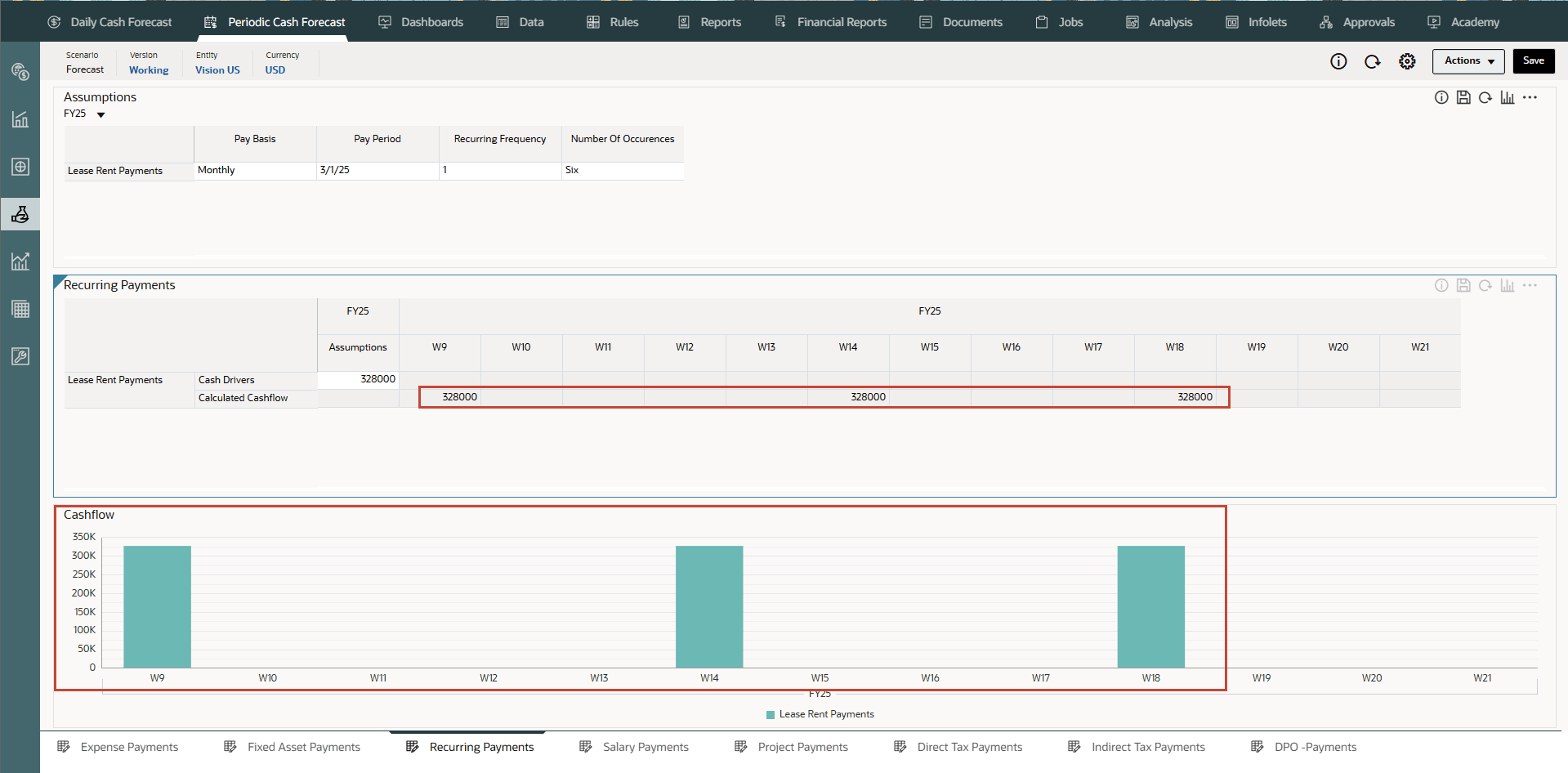

Configuring Recurring Payments (Based on Recurring Pay Terms)

Description: Drive cash outflow for ongoing expenses that have payments on a recurring basis, such as lease or rental payments.

Example: The Recurring Payments driver method is applicable for recurring expense line items such as Lease or Rent payments or Insurance payments. This driver method can be used by companies for recurring expenses that are paid to suppliers on a contracted periodic basis.

Drivers: Specify at the entity, line item level.

- Pay Basis: Annual, Monthly, or Weekly

- Pay Period: The starting period from when recurring payments should begin

- Recurring Frequency: The recurring frequency, for example, every pay cycle or every 3 pay cycles

- Number of Occurrences: The number of recurring payments to be posted

Driver Input

Any expense that has a recurring pattern.

Driver inputs can be extracted from the Planning, Financials or Capital or other source, such as ERP Expense Management, Lease, GL, or can be loaded through a .csv file.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic: Cash outflow is calculated based on the recurring schedule that is defined by the assumptions applied to the driver input amount and posted in respective days or weeks.

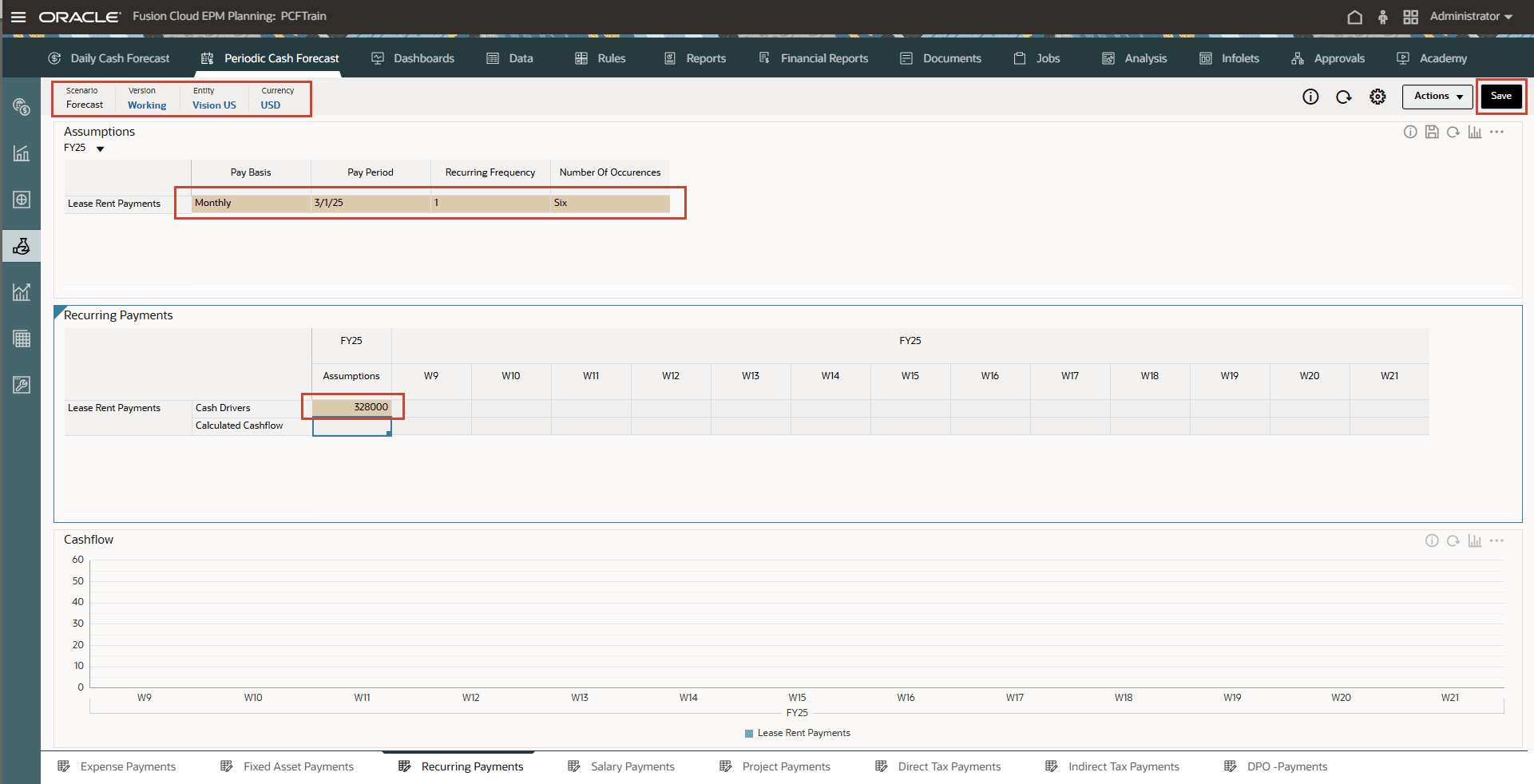

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

- From the bottom tabs, click the Recurring Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Recurring Payments form and click on “Recurring Pay Terms” to invoke the pay term assumptions form.

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

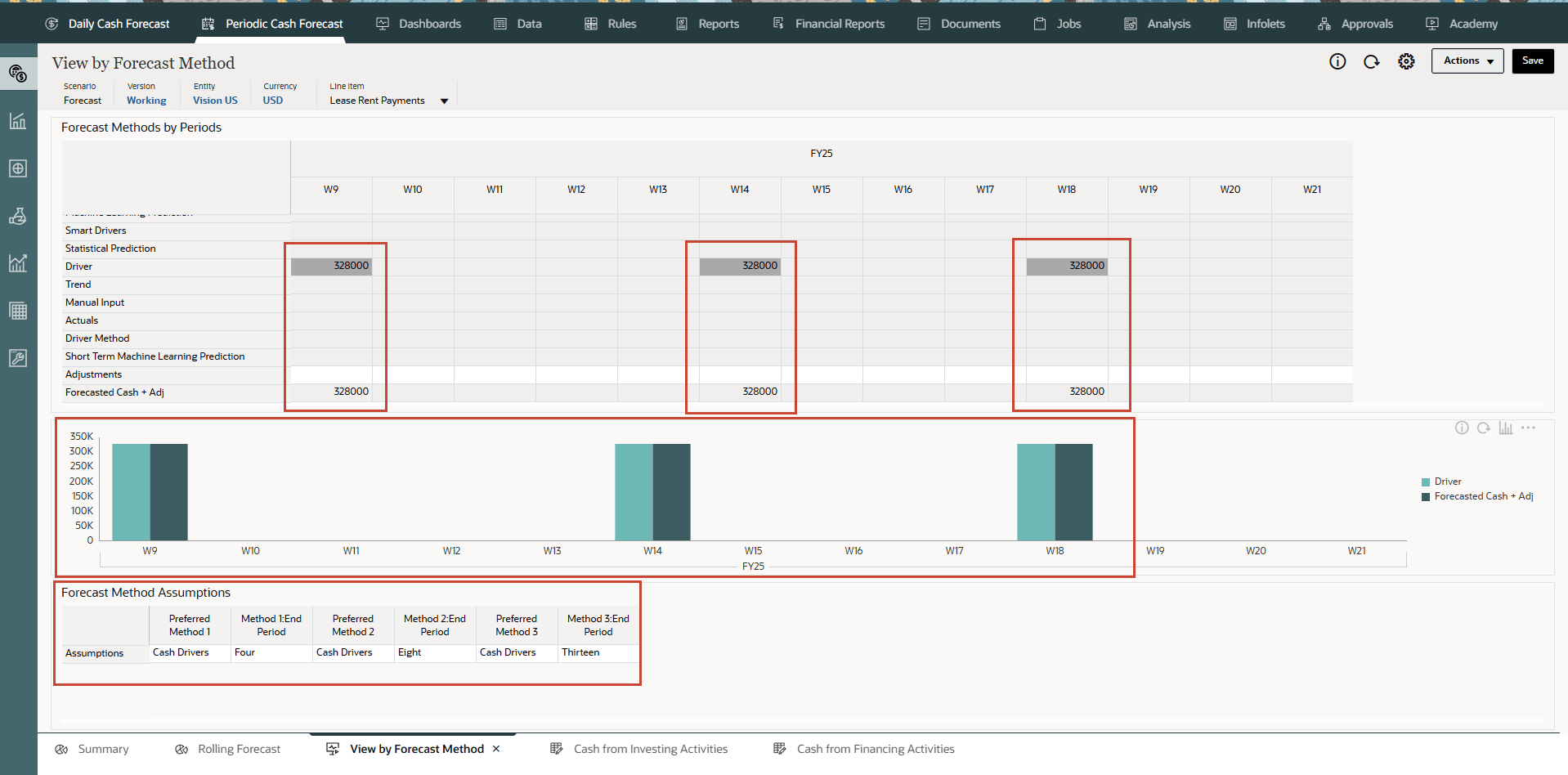

- You can also right click on Lease Rent payments line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

In this example, you can see that Lease Rent payments cash forecast amount for different weeks are derived using Cash driver method.

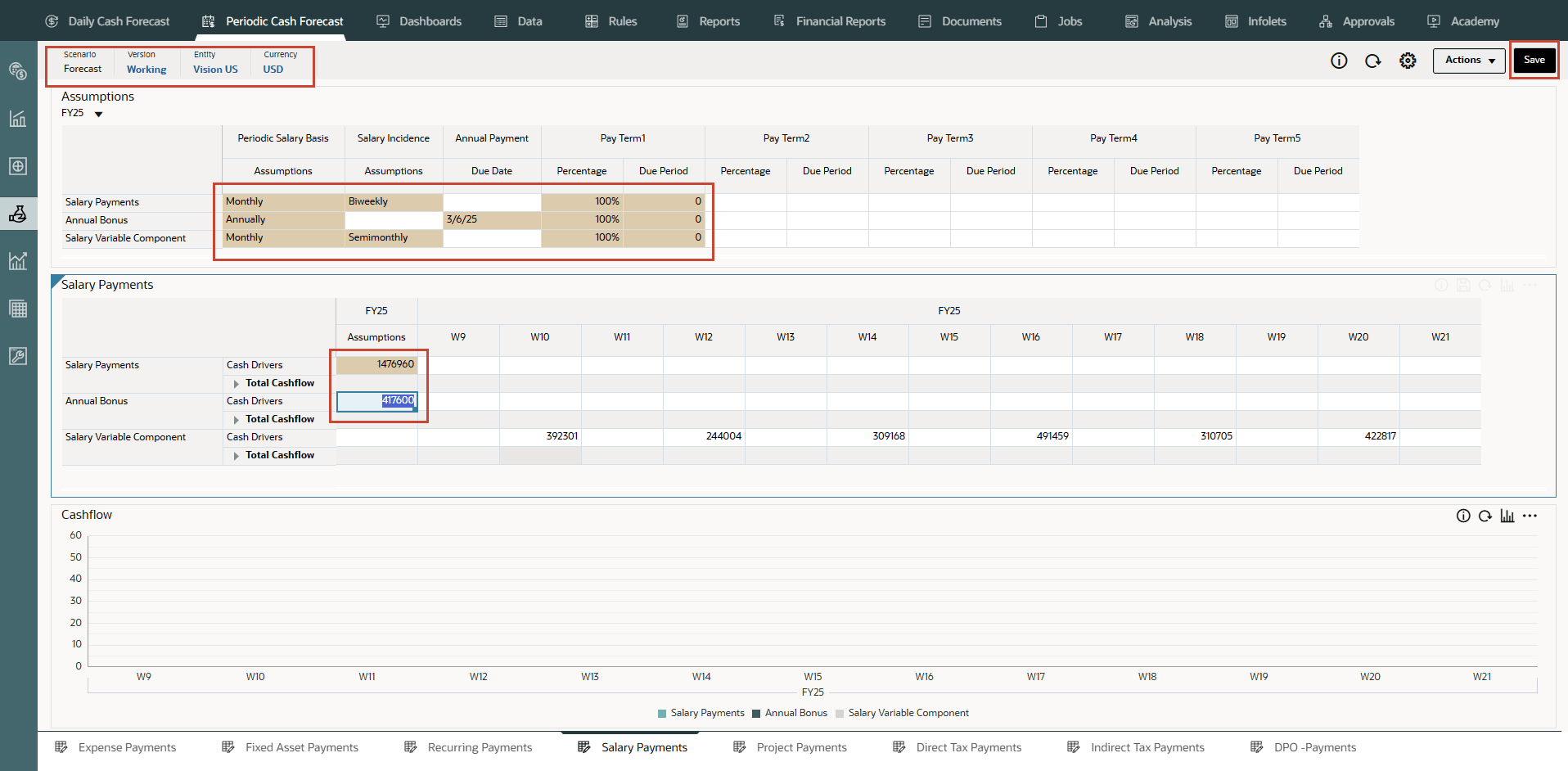

Configuring Salary Payments (Based on Payment Basis and Pay Terms)

Description: Drive cash outflow for all employee-related payments such as salary and other payroll-related payments based on salary expenses, salary basis, and timing of the pay-outs, such as annually, monthly, or weekly, and salary incidence such as beginning of period, end of period, bi-monthly, or a specific due date.

Example: The Salary Payments driver method is applicable for periodic salary and benefit expenses line items and other related expenses such as Earnings and Variable Payments, or other periodic fixed expenses.

Drivers: Specify at the entity, line item level. Additional custom dimensions can be considered if they are enabled.

- Salary Basis: Annual, Monthly

- Salary Incidence: Drives when the cash flow occurs (Begin Period, End Period, Semi-monthly, or Biweekly)

- Annual Payment Due Date: For annual payments, the salary due date

- Pay Terms: Optional. If the payment is in multiple payments, defined by the percentage and due periods

Driver Input

Salary or related expenses.

Data for salary payments could come from the Planning, Workforce module, a payroll or other source system, or can be loaded through a .csv file.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic

Cash outflow is calculated based on salary basis and posted to respective periods based on salary incidence, due date, and pay terms.

The driver input can be provided as an assumption, in which case it is divided by the number of periods and posted to the appropriate periods. Or, the driver input can be loaded into period buckets, in which case the amount for each period is considered.

The salary basis and payment due date determines the cash outflow posting date or period for the salary and earnings expenses. If the salary basis is monthly, Predictive Cash Forecasting divides the annual salary amount by 12 and posts it to the last date of the given month.

In weekly model, Predictive Cash Forecasting posts the salary and earnings amount to the last day of corresponding week. If pay terms are defined for salary and earnings line items, Predictive Cash Forecasting calculates the cash outflow based on the percentage input and the due period for each pay term.

There could be annual expenses such as variable compensation that are an annual payout. In this case, Predictive Cash Forecasting posts the entire amount to the corresponding date based on the defined due date or the period where the date falls into. If the middle of the year salary assumption is changed, Predictive Cash Forecasting reforecasts only for the open periods in the rolling forecast (periods after current period).

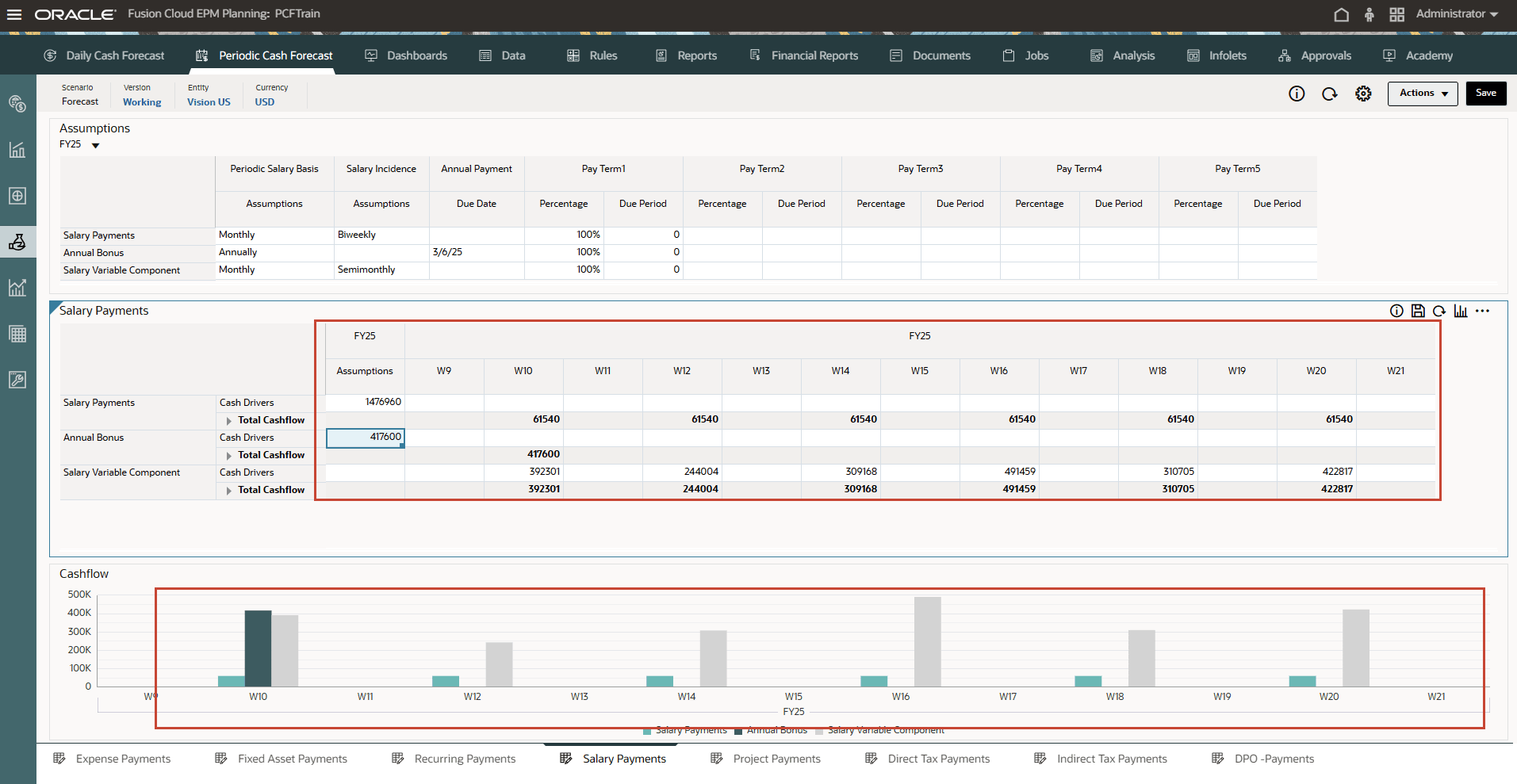

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

- From the bottom tabs, click the Salary Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Salary Payments form and click on “Salary Pay Terms” to invoke the pay term assumptions form.

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

- You can also right click on Salary Payments line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

In this example, you can see that Salary Payments cash forecast amount for different weeks are derived using Cash driver method.

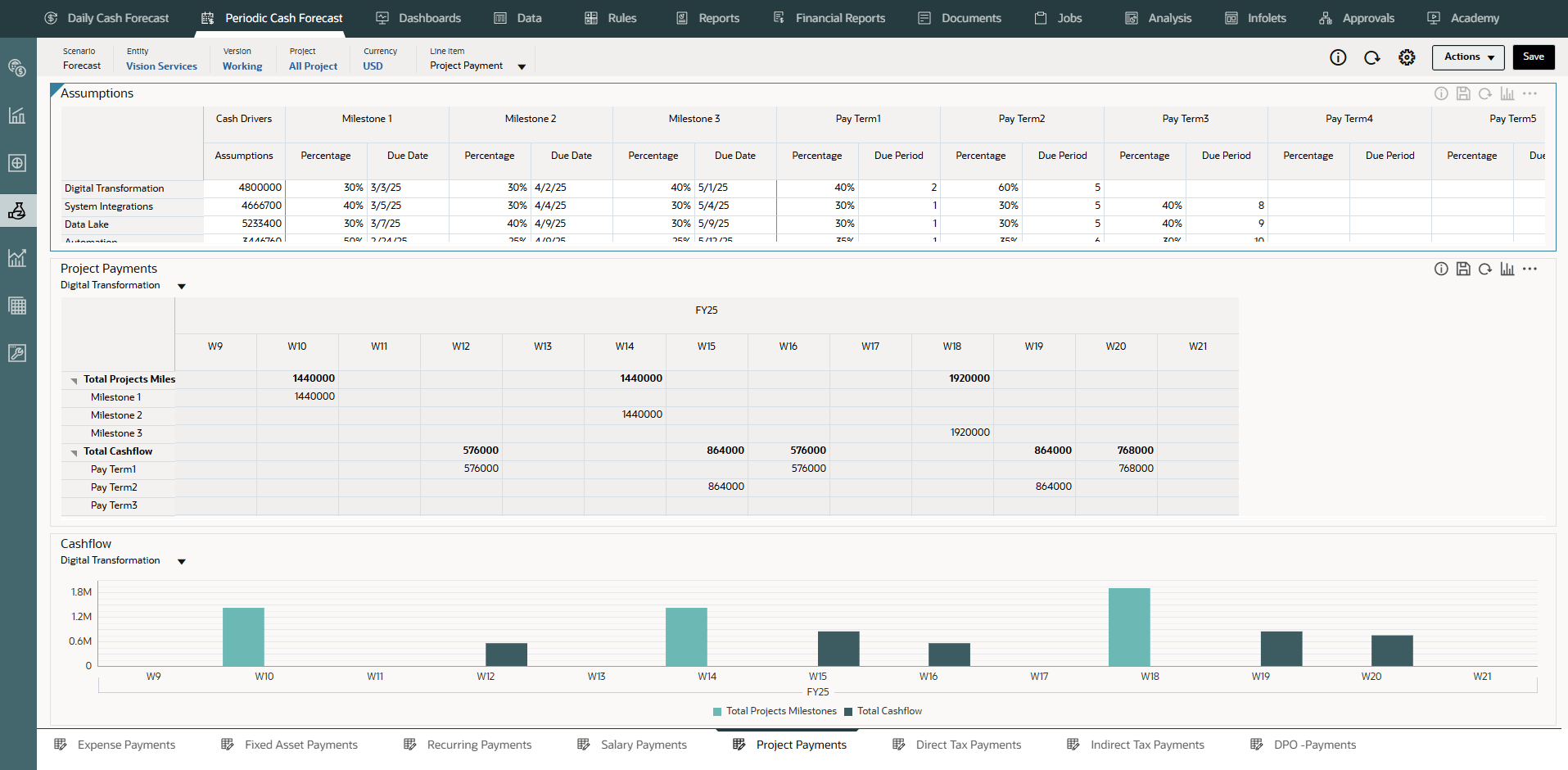

Configuring Project Payments (Based on Project Expense, Milestones and Pay Terms)

Description: Drive cash outflow from project expenses and pay terms. Project expense cash outflow for material, labor, or other project related costs can be modeled based on milestones and pay terms.

Example: Project expense cash outflow for material, labor, or other project-related costs.

Drivers: Specify at the entity, project, line item level.

- Milestones: Percentage, Due Date

- Pay Terms: Percentage, Due Period

Driver Input

Project Expense by Project.

Data for project payments could come from the Planning, Projects module or other source, such as the ERP Projects module, or can be loaded through a .csv file.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic

Cash flow is calculated applying the pay term on the milestone amount for the project. Milestone amounts are derived on milestone percentage for each project. The drivers are captured by project and the cash flow is calculated on the project.

Predictive Cash Forecasting calculates the project milestone amount based on project expense * milestone percentage based on completion of work and populates the result in the respective milestone days or periods. Based on the milestone amount, Predictive Cash Forecasting then applies pay terms logic on each milestone amount to calculate the cash outflow amount and populates it in the respective day or period of the cash forecast.

There can be multiple pay terms for the project. Predictive Cash Forecasting calculates the cash outflow amount considering the project amount per milestone * percentage input for each pay term. The calculated cash out flow amount is then posted in the respective period according to the due period driver defined in the assumptions.

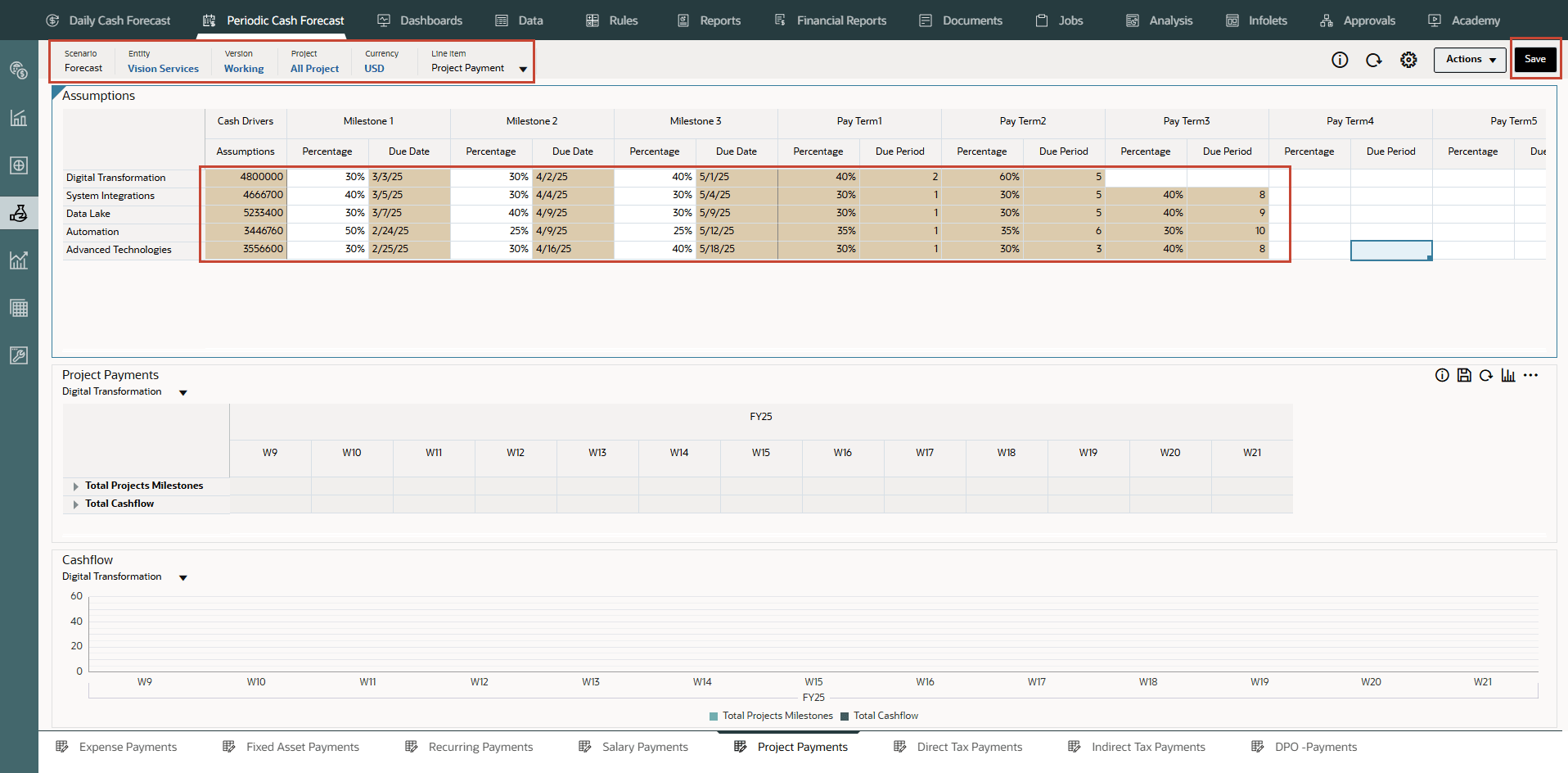

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

- From the bottom tabs, click the Project Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Project Payments form and click on “Project Pay Terms” to invoke the pay term assumptions form.

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the Project Payments line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

- You can also right click on Project Payments line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

In this example, you can see that Project Payments cash forecast amount for different weeks are derived using Cash driver method.

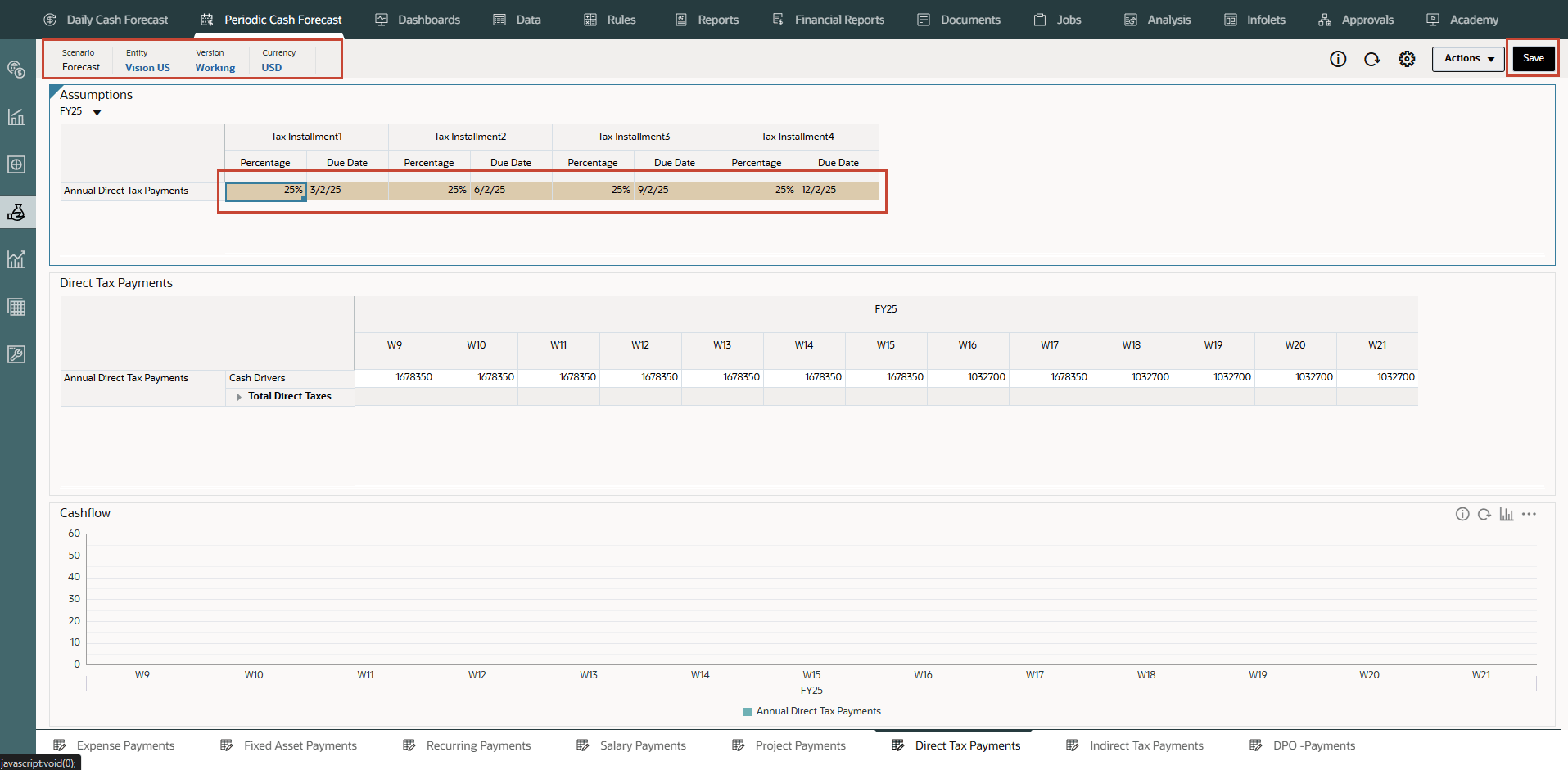

Configuring Direct Tax Payments (Based On Tax Installment and Tax amounts)

Description

Drive cash outflow for direct tax payments based on tax liability, installment percentage, and due dates. Used for any direct tax payment, for example to government or regulators.

The Direct Tax Payments driver method is applicable for the Annual Direct Tax line item in the cash forecast. This driver method can be used by companies that have to pay direct taxes such as income tax, property tax, taxes on assets, and so on as per the due date on a periodic basis based on local laws or statutory compliance.

Example: Direct Tax payments to different regulatory or government agencies based on due dates as per the local government statutory laws and tax compliance regulations.

Drivers: Specify at the entity, annual direct tax line item level.

Tax Installments for every fiscal year—Percentage and Due Date.

Driver Input

Tax Liability value.

If there are multiple tax installments during the year, the percentage and due date driver input should be available for each tax installment.

The driver inputs can be extracted from Tax Reporting, ERP GL, or can be loaded through a .csv file.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic

Cash outflow is calculated based on the annual tax liability and the installment percentage and due dates. The annual tax is cumulative and any change in the annual tax amount is adjusted for considering the incremental / decreased amount posted in the future installments

YTD Annual Direct Taxes Liability are loaded to all the periods. Predictive Cash Forecasting calculates the tax installments based on the following rules:

-

Taxes are calculated based on the percentage input according to the due date assumption for the first installment.

-

The second installment is applied on the latest tax liability. However, if there is a change in the tax liability, Predictive Cash Forecasting calculates the overall tax liability to date by summing the installment percentages, subtracts the previous tax paid, and then posts the remaining tax amount.

-

The same approach is applied to all of the remaining tax installments.

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

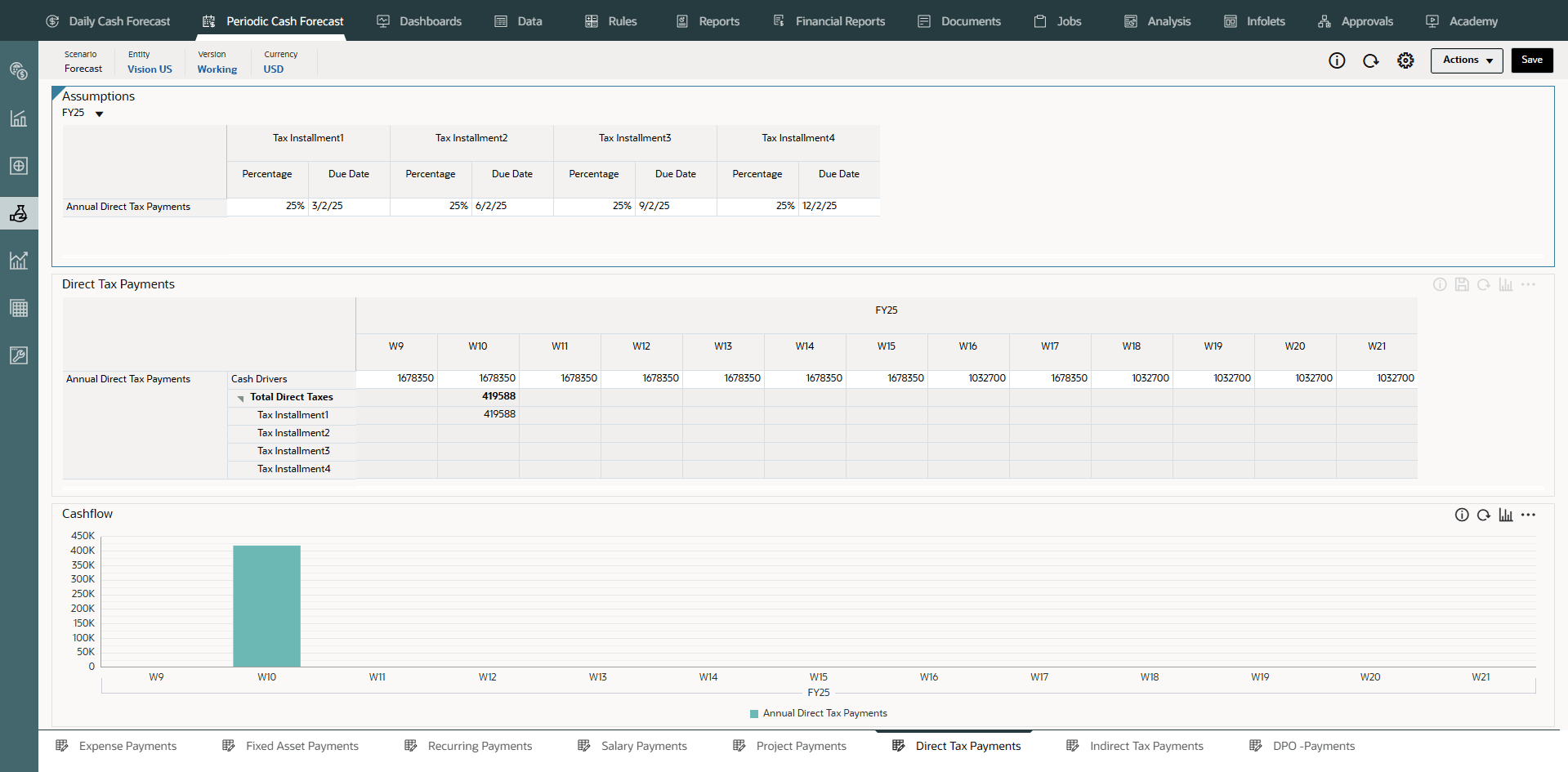

- From the bottom tabs, click the Direct Tax Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Direct Tax Payments form and click on “Direct Tax Installments” to invoke the pay term assumptions form.

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

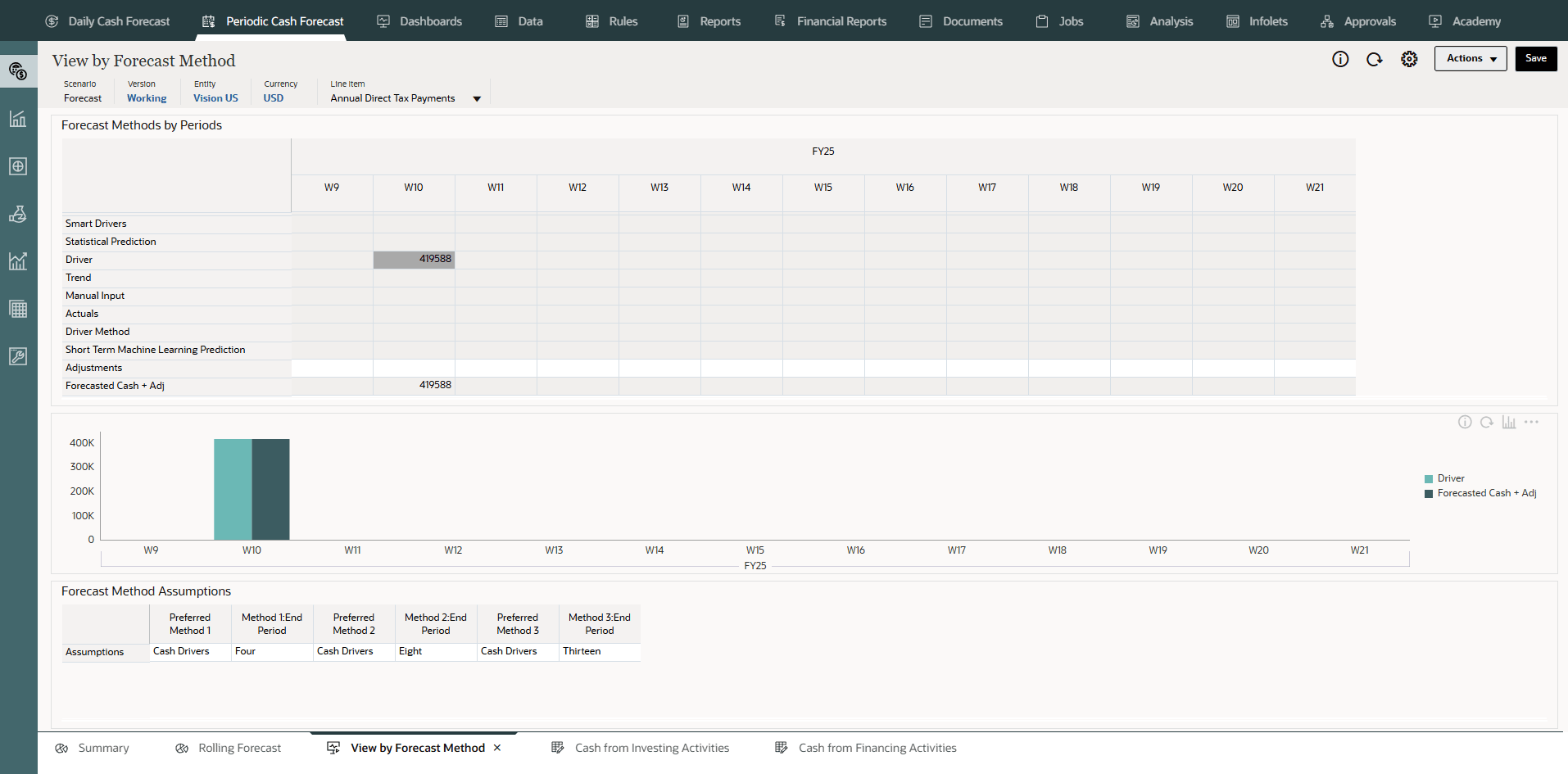

- You can also right click on Annual Direct Tax Payments line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

In this example, you can see that Annual Direct Tax Payments for different weeks are derived using Cash driver method.

Configuring Indirect Tax Payments (Based on Tax Basis, Due Dates and Pay Terms)

Description

Drive cash outflow for indirect tax payments based on tax liability and pay terms.

The Indirect Tax Payments driver method can be used by customers for all indirect tax payments where cash outflow occurs based on due dates as per the government statutory laws and indirect tax compliance regulations.

The Indirect Tax Payments driver method is applicable for the Indirect Tax payments line item.

Example: Indirect tax payments such as GST, Sales Tax, or other Annual Indirect taxes that are payable to regulatory agencies. This driver method can be used by companies that have to pay indirect taxes such as sales tax, excise taxes, value added taxes, and so on as per the due date on a periodic basis based on statutory compliance.

Drivers

-

Tax Basis - Annual, Monthly

-

Indirect Taxes Due Date - Mainly for annual taxes

-

Pay Terms - Percentage and due Period

Driver Input

Indirect tax liability value.

The indirect tax liability value can be loaded from the Planning, Financials module, ERP system, or can be loaded through a .csv file.

If there are multiple tax installments during the year, the percentage and due date driver input should be available for each tax installment.

Once the driver inputs are loaded, Cash Managers can see them reflected in the Assumptions form, and can make manual adjustments to driver inputs based on their best judgment and experience for the line item.

Calculation Logic

Cash outflow is calculated based on the indirect tax liability, tax basis, payment incidence (to be paid in same period or next period), and payment terms based on tax liability value. The driver input is usually recorded in respective periods and cash flow is calculated based on this.

Indirect taxes are calculated as:

-

If the Tax Basis is Annual and the payment incidence is the same period, the Annual Tax amount is posted on the due date.

-

If the Tax Basis is Annual and the payment incidence is the next period, the Annual Tax amount is posted on the next day of the due date.

-

If the Tax Basis is Annual and the payment incidence is same period and Pay Terms are defined, the Annual Tax amount is posted on the due date and pay terms are applied from the due date.

-

If the Tax Basis is Annual and the payment incidence is next period and Pay Terms are defined, the Annual Tax amount is posted on the next day of the due date and pay terms are applied from the next day of the due date.

-

If the Tax Basis is Monthly and the payment incidence is the same period and the amount is loaded on a given date, pay terms are applied from the loaded date.

-

If the Tax Basis is Monthly and the payment incidence is the next period and the amount loaded is on a given date, pay terms are applied from the next day of the loaded date.

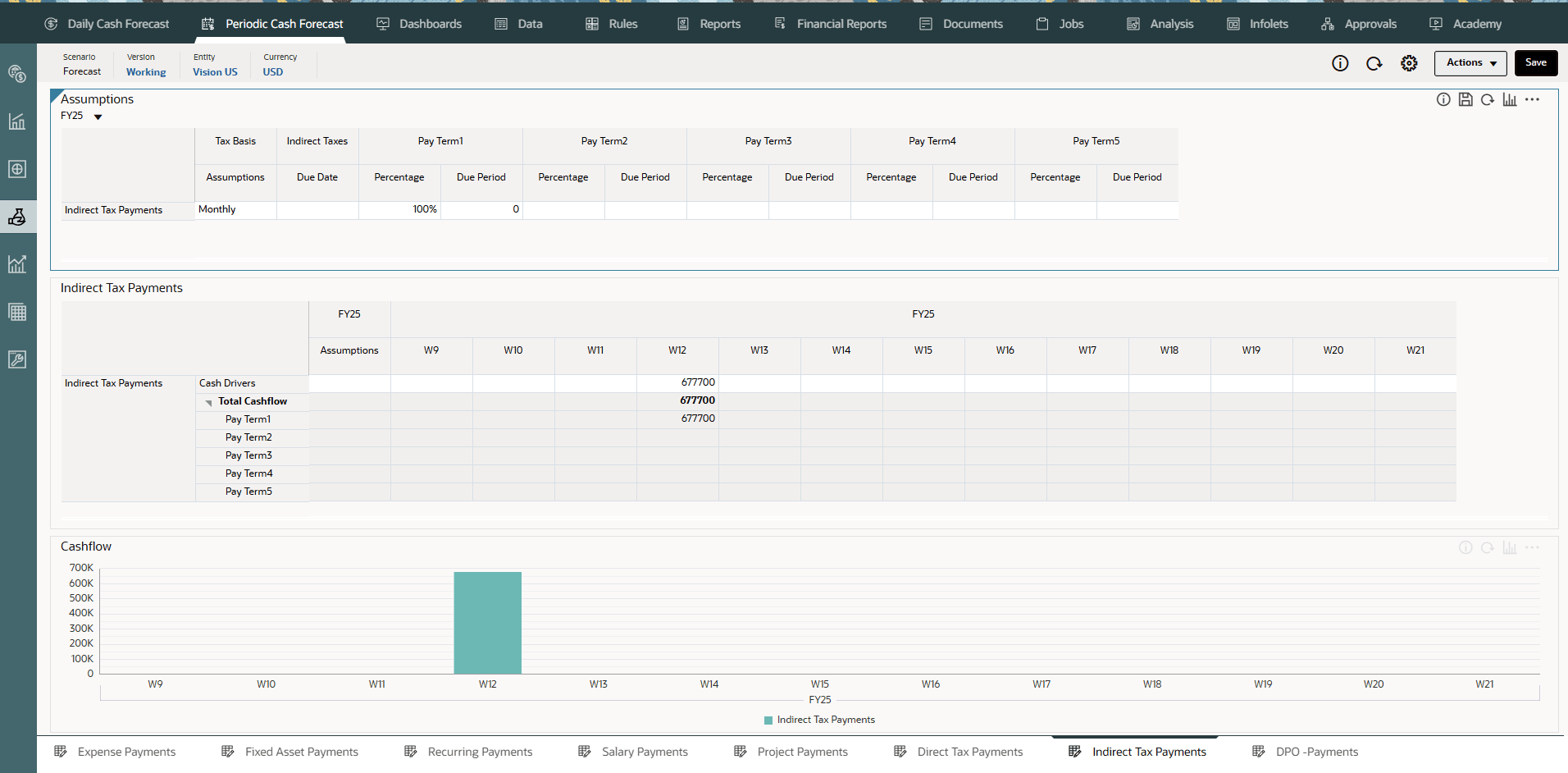

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

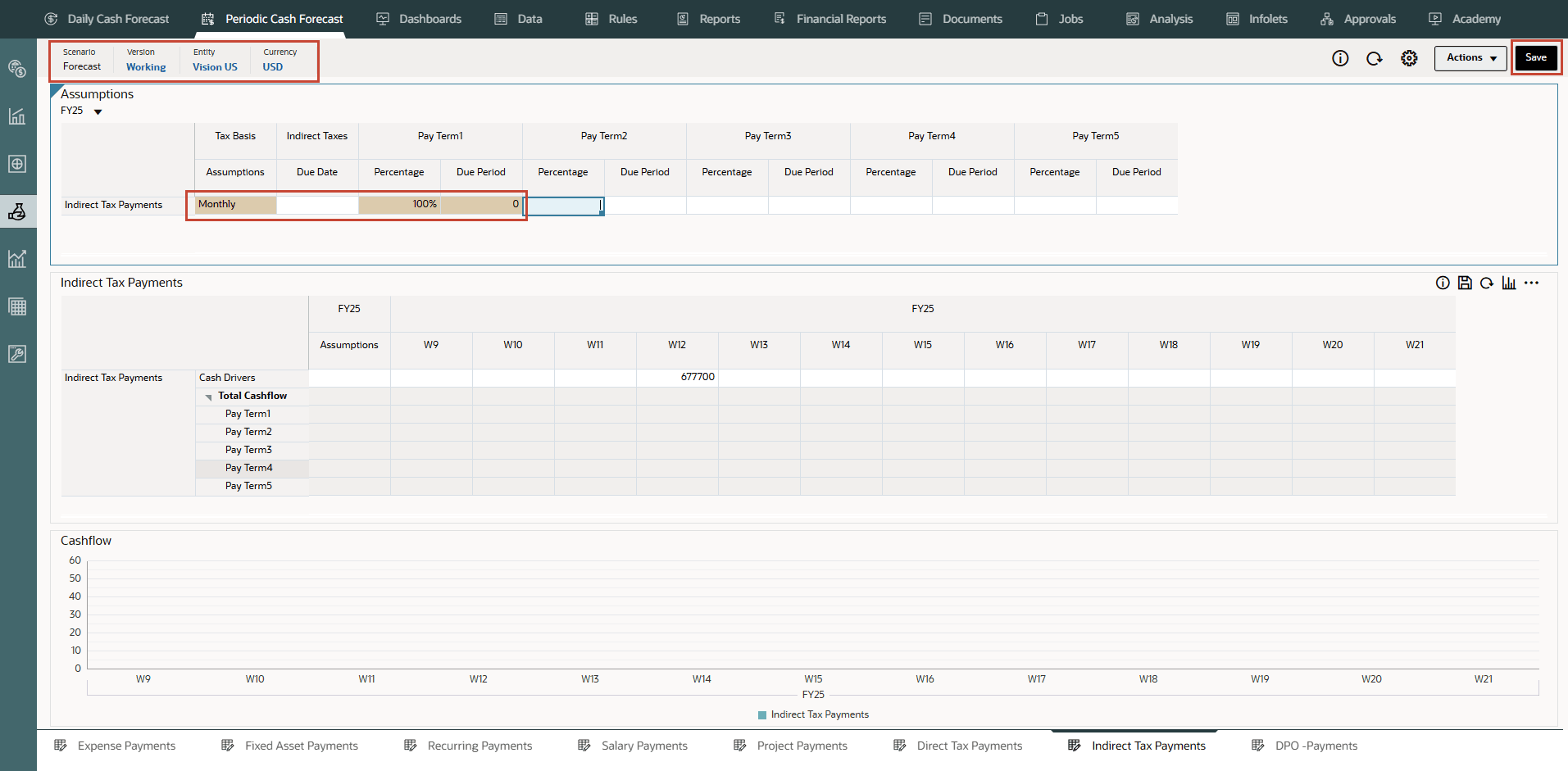

- From the bottom tabs, click the Indirect Tax Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the Indirect Tax Payments form and click on “Indirect Tax Pay Terms” to invoke the pay term assumptions form.

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

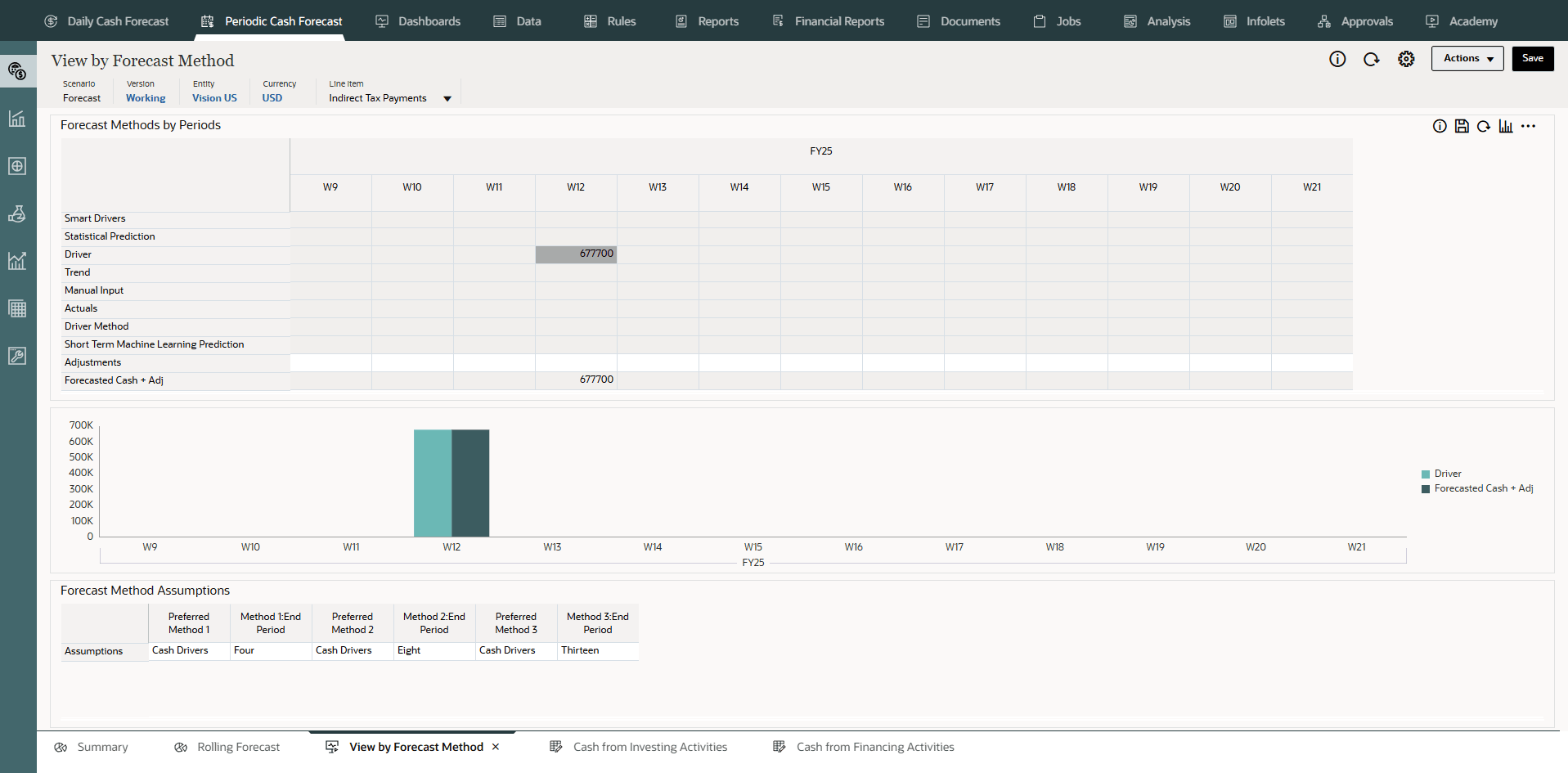

- You can also right click on Indirect Tax Payments line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

In this example, you can see that Indirect Tax Payments for different weeks are derived using Cash driver method.

Configuring DPO Payments (Based on Average DPO and Payables)

Description

Drive cash outflow considering the average days outstanding on the expense, typically by supplier or at the entity level. This method is useful when pay terms are very dynamic.

Days Payable Outstanding (DPO) is a financial ratio that indicates the average time (in days) that a company takes to pay its bills and invoices to its trade creditors, which can include suppliers, vendors, or financiers. The ratio is typically calculated on a quarterly or annual basis, and indicates how well the company’s cash outflows are being managed. Based on the calculated DPO days driver, Predictive Cash Forecasting posts the expense amount in the corresponding day or period based on periodicity.

You can adjust the DPO driver input and based on the adjusted DPO days and outstanding expense, Predictive Cash Forecasting calculates the cash outflow and posts the amount in the corresponding day or period.

Example

You can use this method for line items in the cash forecast where smart driver logic cannot be applied, when pay terms are very dynamic, such as consumables. You can also use this method for future periods that are beyond what is captured through invoices.

Drivers

Average DPO

- Assumptions - Average across the year

- Period buckets - Average for the period

Driver Input

Expense or any line item. The calculated DPO days.

You can load calculated DPO days from ERP as a starting point. Cash Managers can adjust the calculated DPO days based on experience. Adjusted DPO days are used as driver input for calculating the cash outflow in the forecast.

Calculation Logic

Cash flow is calculated applying the average DPO for the period on the period expense or it by applying the average DPO across the year if the DPO by period does not exist.

Cash outflow is calculated based on the Outstanding Expense and the Average DPO. Predictive Cash Forecasting considers the appropriate periods average DPO or it uses the overall assumption. The cash outflow is determined based on the Average DPO applied on the driver input amount and posted to the period based on the number DPO days.

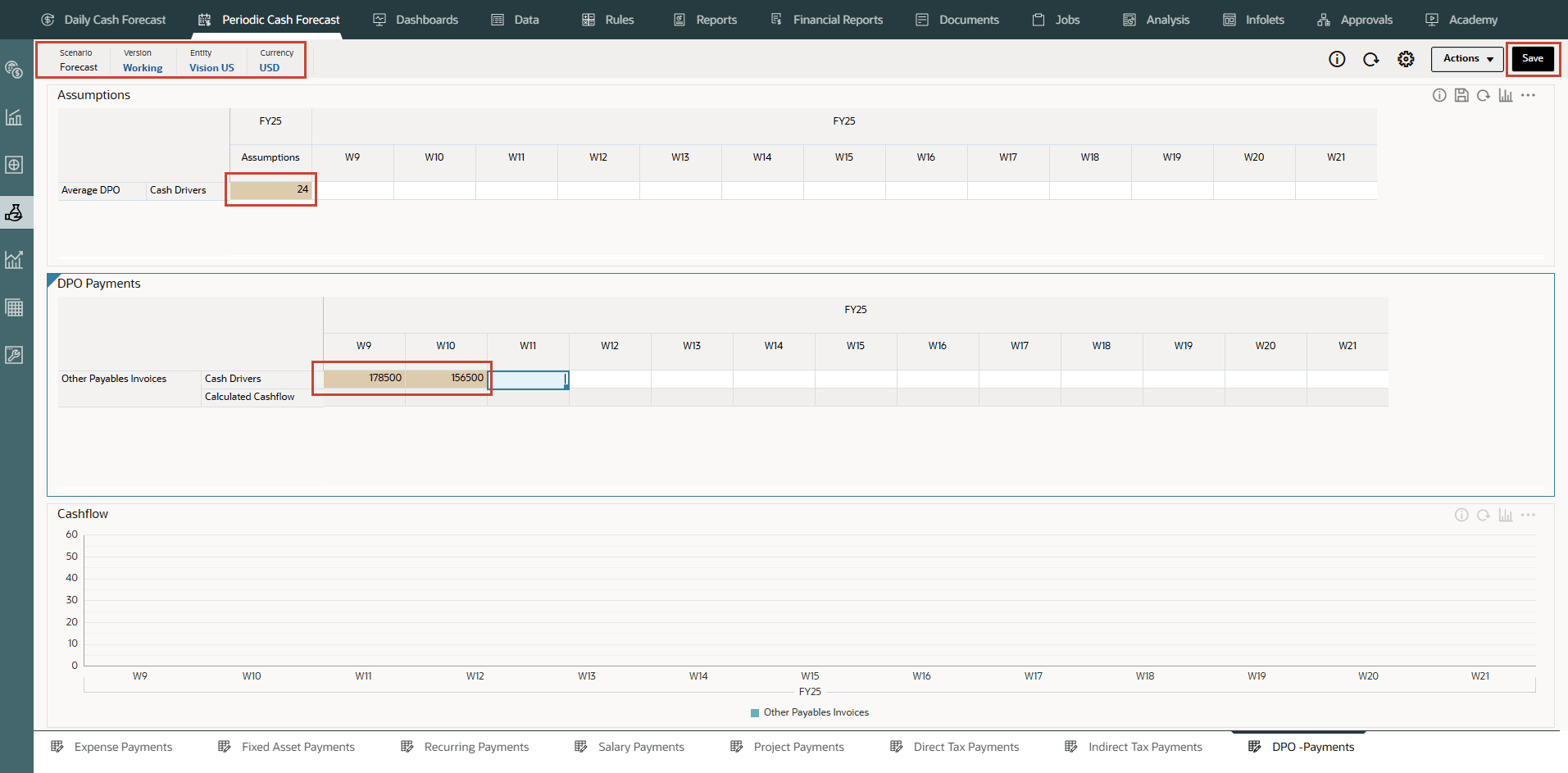

- On the Home page, click Periodic Cash Forecast.

Tip:

When forecasting at the daily level, from the Home page click Daily Cash Forecast. - On the left vertical tabs, click Drivers - Cash Outflow.

Depending on what your administrator enabled for the application, you'll see a form for each driver method that was enabled, along with some sample line items.

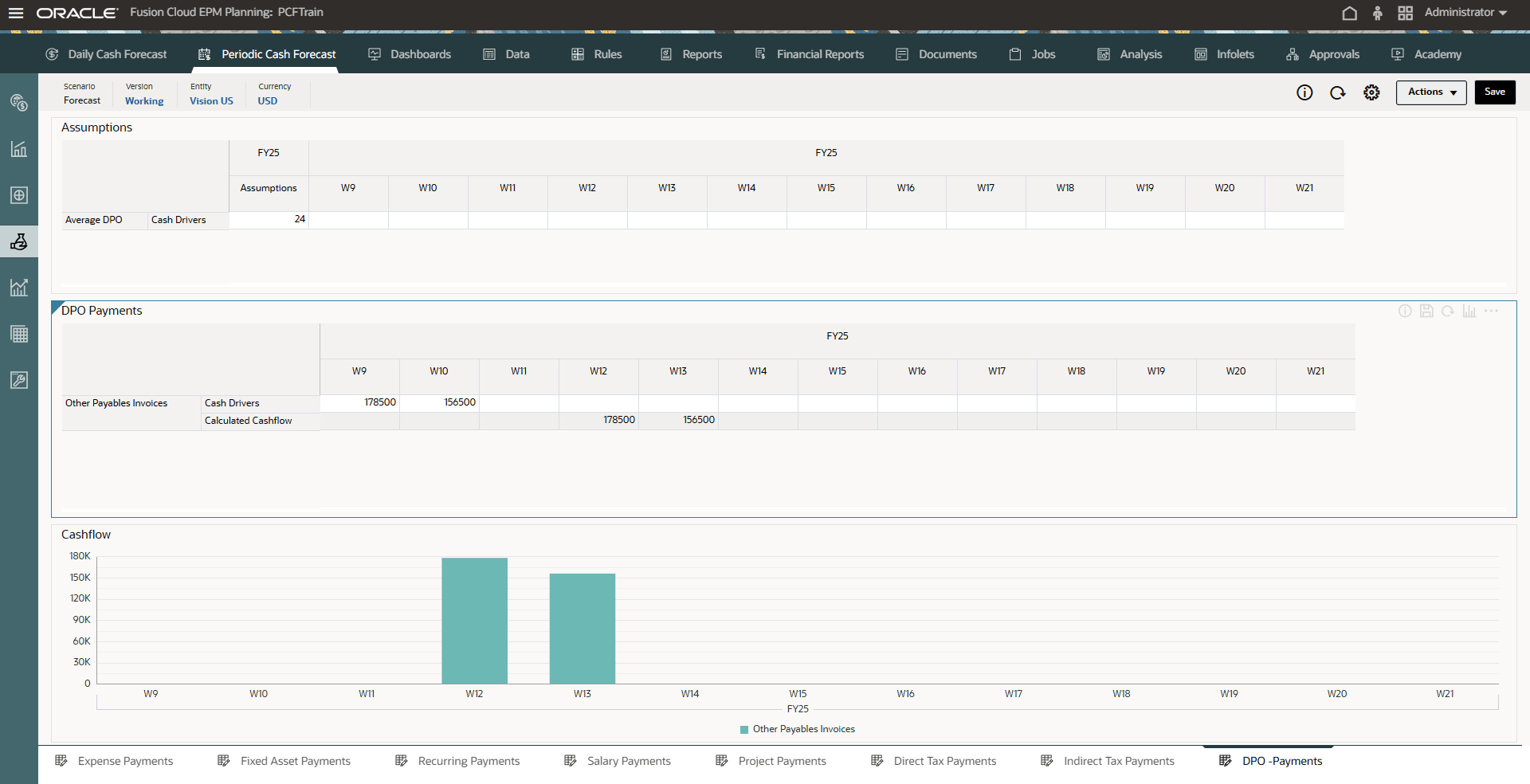

- From the bottom tabs, click the DPO Payments form.

- Ensure the POV is as shown and ensure the values as highlighted:

Note:

You may have to type and enter similar values based on your needs. - Click Save on top right.

Tip:

Saving the form after entering assumptions triggers driver calculations for each of the driver categories and calculates cash inflow. - Click OK.

- Note the calculated values based on the pay terms and duration. The cash flows have been updated for the entire period as well.

The cash flow is calculated by applying the pay term percentage on the driver input and posting the cash outflow to the period buckets based on the due date.

- Optional - Change the Pay Terms and click Save to see new cash flows.

- Optional - You can right click in the DPO Payments form and click on “Indirect Tax Pay Terms” to invoke the pay term assumptions form.

- From the vertical tabs click Periodic Cash Forecast >> Rolling Forecast.

Cash forecasts for the Other Payables Invoices line item have been calculated based on the assumptions you define, applied to the driver input. You can see all of the updated cash inflow forecasts.

- In Rolling Forecast, click Actions >> Rules & Smart Push.

- Run the Rules associated with form.

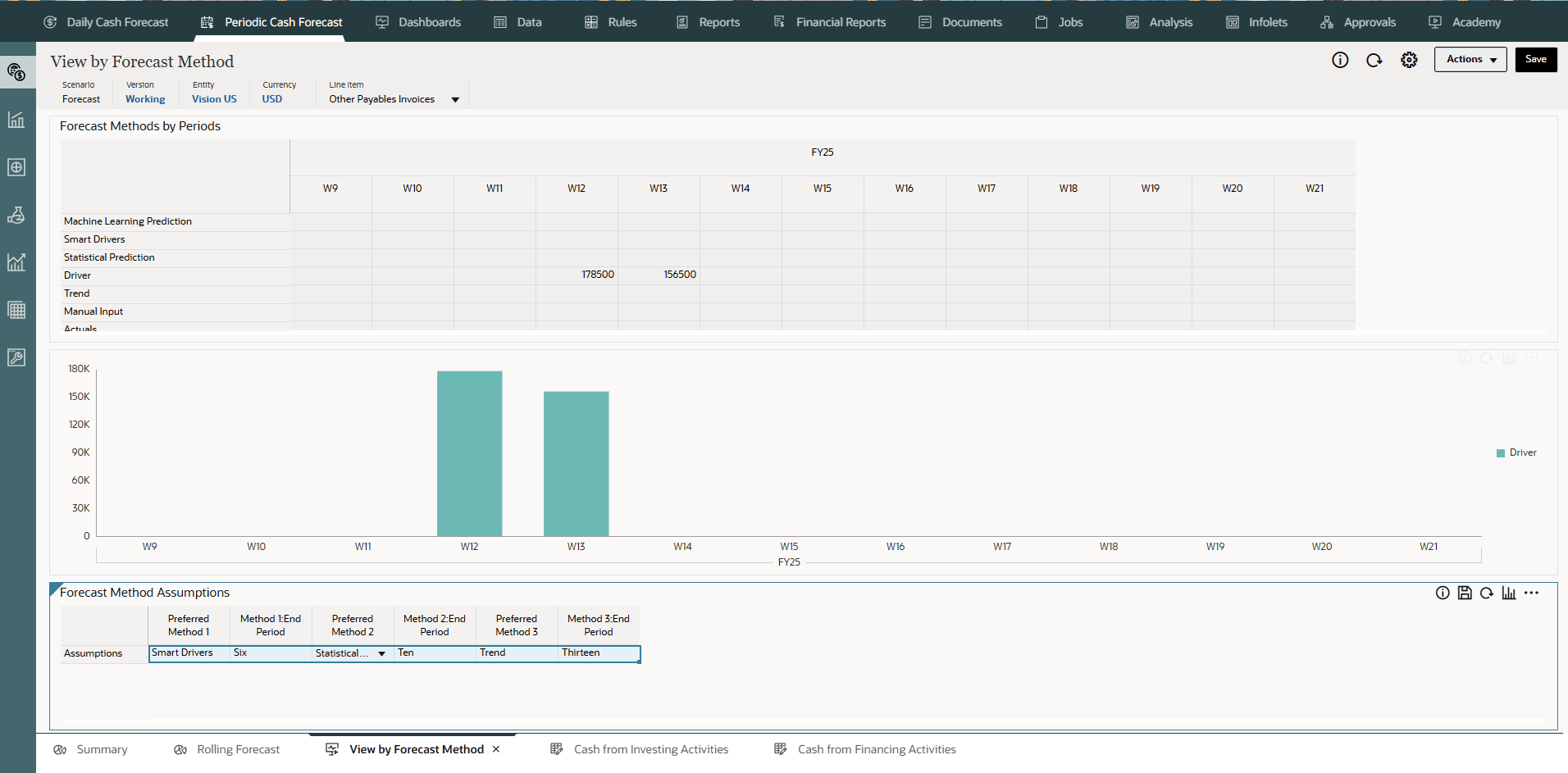

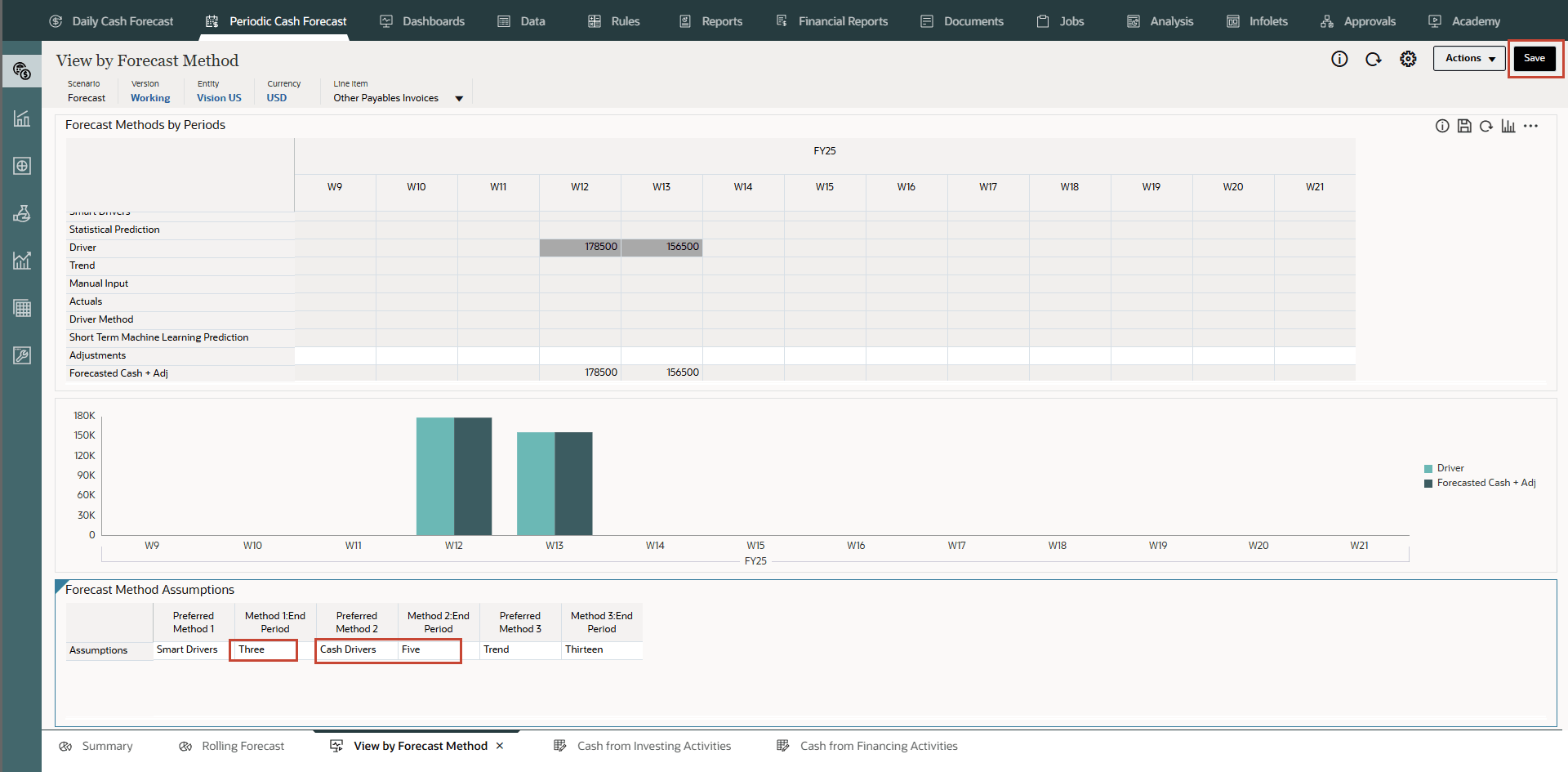

- You can also right click on Other Payables Invoices line item and select View by Forecast Method to see the forecast method used by system to derive the cash forecast results for this line item.

- At the bottom, in Forecast Method Assumptions change the Assumptions to use Smart Drivers method until Period 3, Cash Drivers method until Period 5 and then Trend method until Period 13 as shown below:

You can now see that Other payables invoices amount for Week 12 and Week 13 are derived using Cash driver method – DPO as driver.

Related Links

- Documentation: Administering Predictive Cash Forecasting

- Oracle EPM Tutorials YouTube Channel

- Video: Overview: Forecast Methods in Predictive Cash Forecasting

- First tutorial: Creating PCF Applications

- Second tutorial: Loading Metadata and Data in Predictive Cash Forecasting

- Third tutorial: Setting up Users, User Groups, Roles and Security in PCF

- Other tutorials in the series (in sequence):

Setting up Forecast Methods and Configuring Driver Methods in Predictive Cash Forecasting

G32653-01

July 2025