Before you Begin

This 30-minute tutorial shows you how to integrate Projects data with Capital. The sections build on each other and should be completed sequentially.

Background

You can integrate data for capital projects from Projects to Capital. When you create a capitalizable project in Projects, you can map both driver-based and directly-entered project expenses either partially or in full to expense accounts and asset classes in Capital, and push the data to Capital. You can allocate a project expense across multiple accounts and asset classes. You can also calculate depreciation.

What Do You Need?

An EPM Cloud Service instance allows you to deploy and use one of the supported business processes. To deploy another business process, you must request another EPM Enterprise Cloud Service instance or remove the current business process.

- Have Service Administrator access to an EPM Enterprise Cloud Service instance. The instance should not have a business process created.

- Upload and import this snapshot into your instance.

Note:

If you run into migration errors importing the snapshot, re-run the migration excluding the HSS-Shared Services component, as well as the Security and User Preferences artifacts in the Core component. For more information on uploading and importing migration snapshots, refer to the Administering Migration for Oracle Enterprise Performance Management Cloud documentation.Creating a Capitalizable Project

In this section, you add a capitalizable project for upgrading a facility. You then add project expenses.

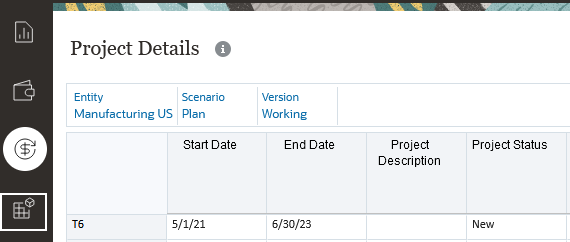

Adding a Capitalizable Project

- Sign into planning with Service Administrator credentials.

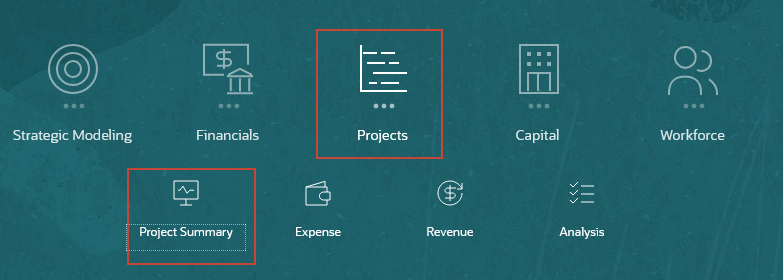

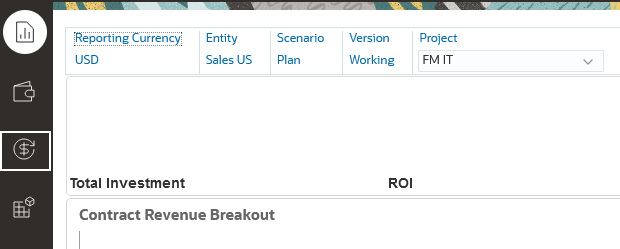

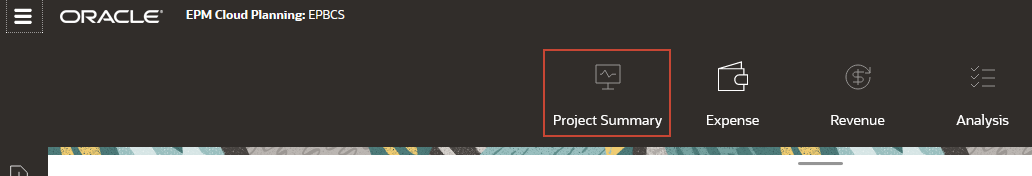

- From the Home page. select Projects and then Project Summary.

- Click the Capital vertical tab.

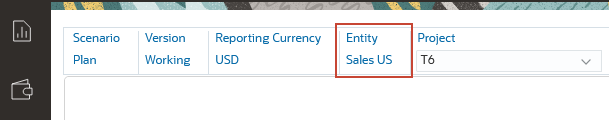

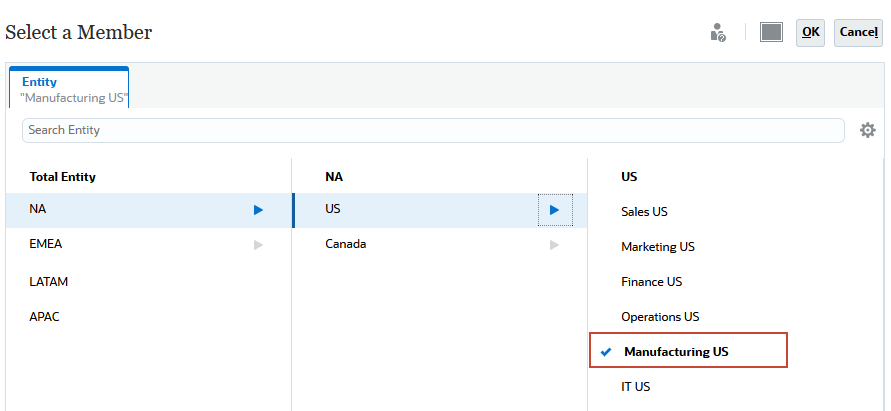

- In the point of view bar, click Entity.

- Expand US and then select Manufacturing US.

- Click OK.

- In the tabs at the bottom of the page, select Project Details.

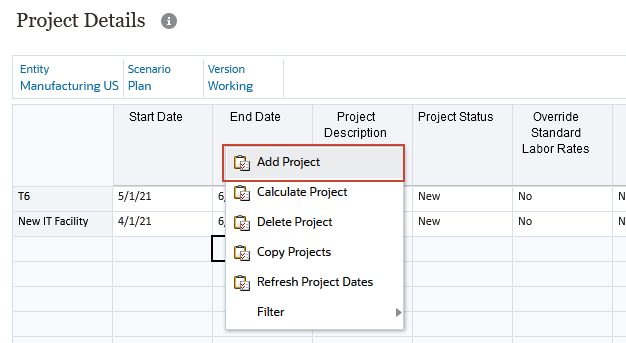

- Right-click a cell in the form and select Add Project from the context menu.

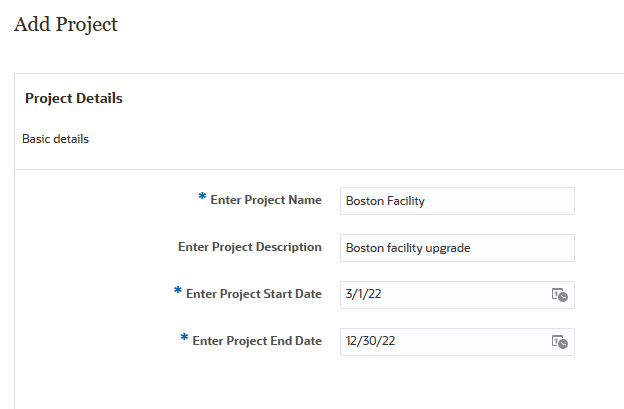

- Enter the following information:

Property Value Enter Project Name Boston Facility Enter Project Description Boston facility upgrade Enter Project Start Date 3/01/22 Enter Project End Date 12/30/22 - Click Launch.

- At the information prompt, click OK.

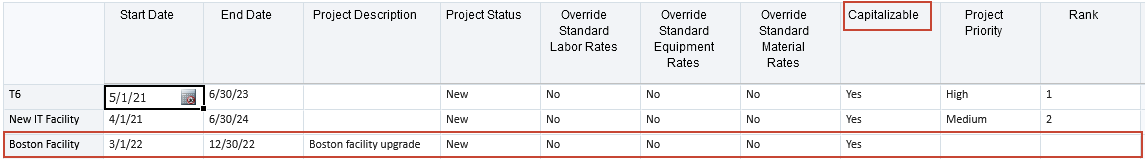

A row for the new project is added to the table. Notice that value in the Capitalizable column is Yes.

Your screen should match the following:

Entering Project Expenses

In this section, you review driver data, and then enter expense data for equipment and materials.

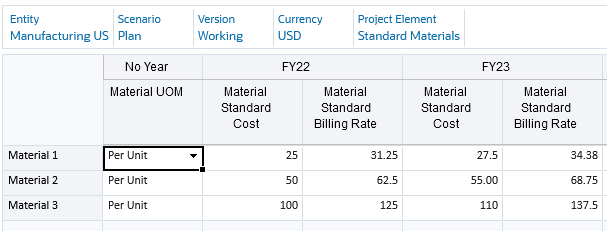

- Select the Assumptions vertical tab.

- If it is not already selected, select the Standard Rates tab at the bottom of the page.

The tab shows the rates for material for the Manufacturing US entity.

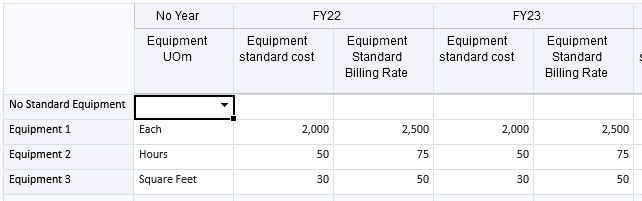

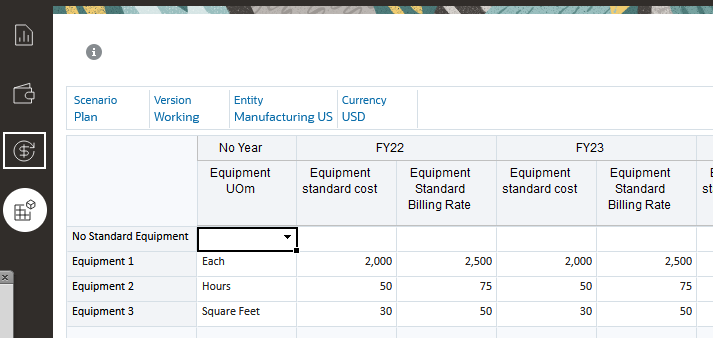

- Select the Standard Rates for Equipments tab at the bottom of the page.

The tab shows the rates for equipment for the Manufacturing US entity.

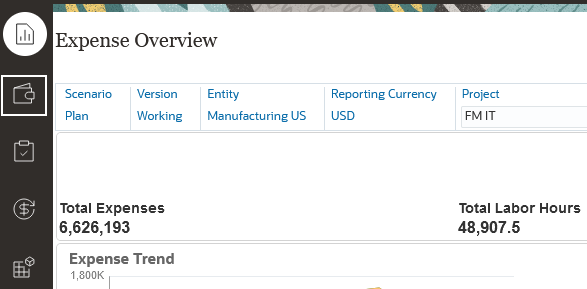

- Click the Expense card.

- In the vertical tabs, click Driver Based.

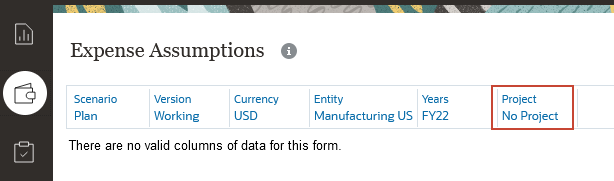

- In the Point of View bar, click Project.

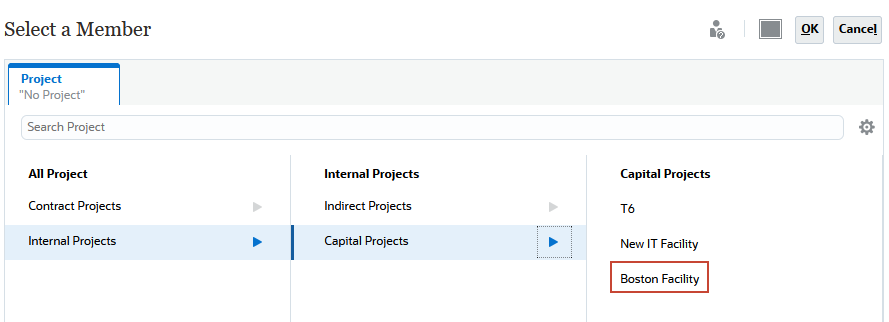

- Expand All Project, and then Internal Projects, and then Capital Projects, and select Boston Facility.

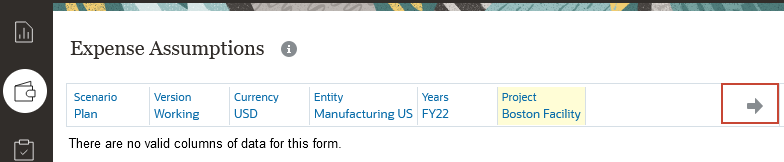

- Click OK.

- Click the arrow at the end of the Point of View bar to refresh the form.

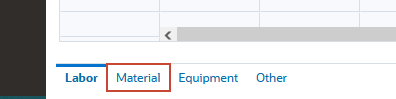

- In the tabs at the bottom of the form, select Material.

- In Line 1, make the following selections:

Column Value Phase No Stages Material Material 1 Expense Cash Flow Incidence Same Month Units 800

Your screen should match the following:

- Click Save.

- At the Information prompt, click OK.

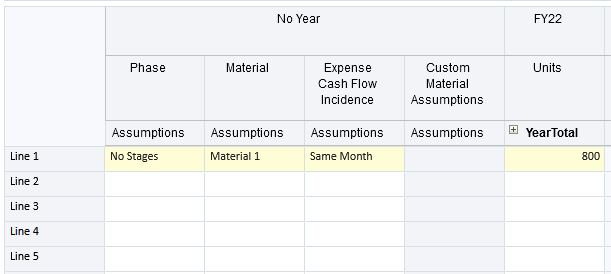

- In the tabs at the bottom of the form, select Equipment.

- In Line 1, make the following selection:

Column Value Phase No Stages Equipment Equipment 1 Assignment Start Data 3/1/22 Assignment End Data 12/30/22 Units 100

Your screen should match the following:

- Click Save.

- At the Information prompt, click OK.

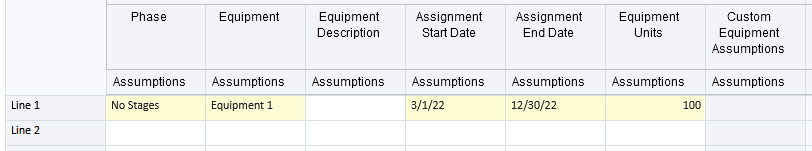

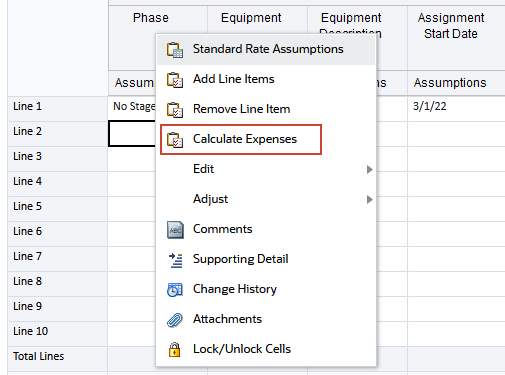

- Right-click a cell in the form, and select Calculate Expenses.

- At the Information prompt, click OK.

Mapping and Pushing Project Expenses to Capital

In this section, you map project expenses from Projects to expense accounts and asset classes in Capital. You map both equipment and materials expense to the Acquisition Costs expense account in Capital. You map 70% of the equipment expense to the Office Equipment asset class and the remaining 30% to the Machinery and Equipment asset class. You map 100% of the materials expense to the Buildings asset class. You push the data from Projects to Capita.l

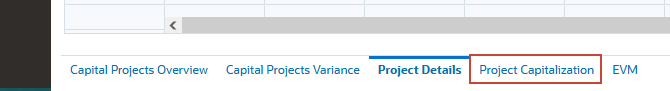

- Click the Project Summary card.

- Select the Capital vertical tab.

- In the tabs at the bottom of the page, select Project Capitalization.

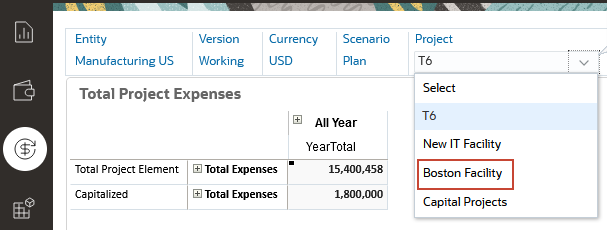

- In the Project drop-down list, select Boston Facility, and then click

at the end of the POV bar to refresh the form data.

at the end of the POV bar to refresh the form data.

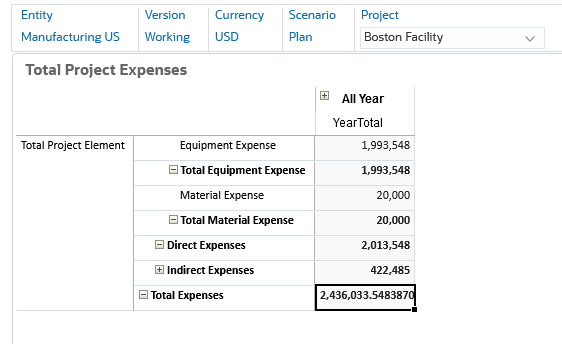

- In the Total Project Element area, expand Total Expenses, and then Direct Expenses. Expand Total Equipment Expense and Total Material Expense.

The expenses calculated for material and equipment for the Boston Facility project are displayed.

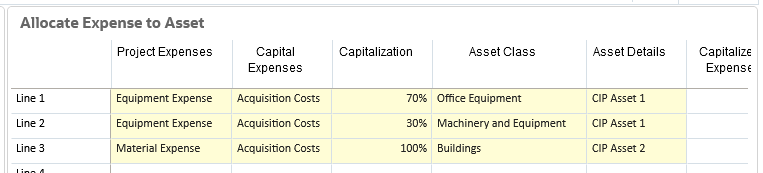

- In the Allocate Expense to Asset table on the right side of the form, make the following selections for Line 1 (note that in the Asset Detail list you may need to scroll down and then scroll up to display the item):

Column Value Project Expenses Equipment Expense Capital Expenses Acquisition Costs Capitalization 70% Asset Class Office Equipment Asset Details CIP Asset 1 - Make the following selections for Line 2:

Column Value Project Expenses Equipment Expense Capital Expenses Acquisition Costs Capitalization 30% Asset Class Machinery and Equipment Asset Details CIP Asset 1 - Make the following selections for Line 3:

Column Value Project Expense Material Expense Capital Expenses Acquisition Costs Capitalization 100% Asset Class Buildings Asset Details CIP Asset 2

Your screen should match the following:

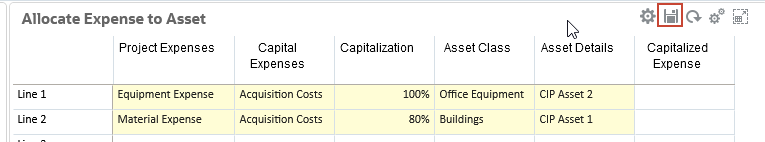

- Hover the cursor in the upper right corner of the Allocate Expense to Asset table to display the tool bar, then click Save.

(Note that the Save process may take a few moments because a business rules runs after the save.)

- At the Information prompt, click OK.

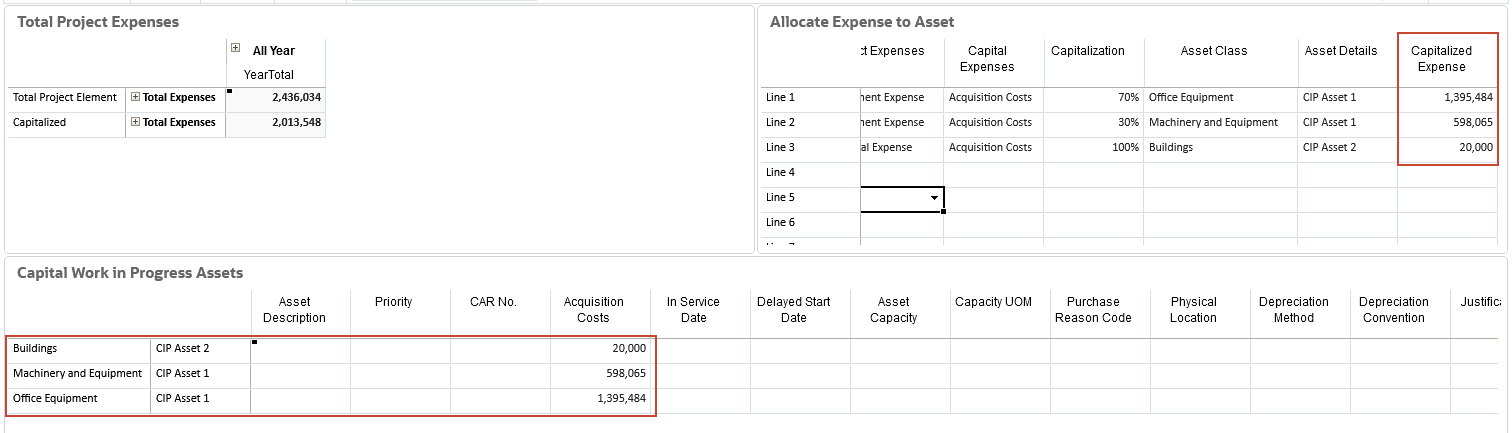

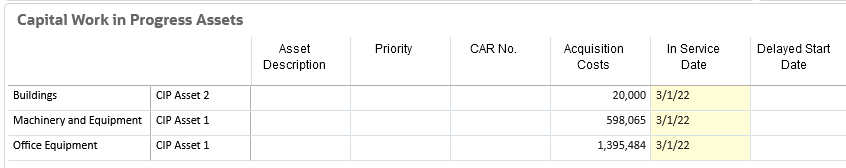

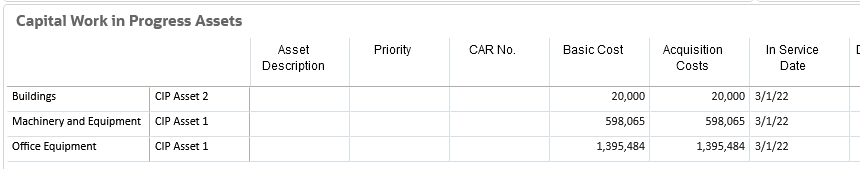

The Capitalized Expense column displays the amount calculated for each asset class based on the capitalization percentages you entered. The data has been pushed to Capital as well. The Capital Work In Progress Assets table contains line items for the asset classes. You use the table to calculate depreciation.

- In the Capital Work in Progress Assets table, in the In Service column for Buildings, Machinery and Equipment, and Office Equipment, enter 3/1/22 as the in-service date.

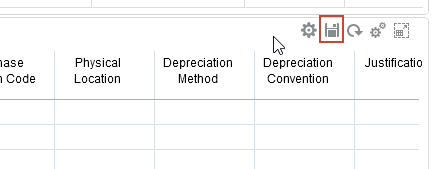

- Hover the cursor in the upper right corner of the Capital Working in Progress table to display the tool bar, then click Save.

- At the Information prompt, click OK.

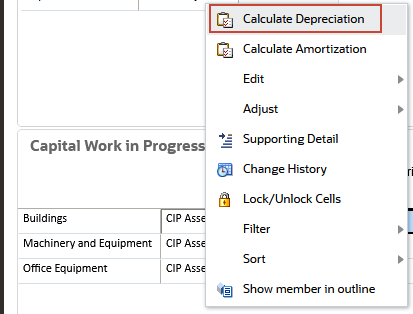

- Right-click a cell in the Buildings row of the Capital Work In Progress table and select Calculate Depreciation from the context menu. This calculates depreciation for Buildings and pushes the data to Capital.

- At the Information prompt, click OK.

- Repeat the above two steps to calculate depreciation for the Machinery and Equipment and Office Equipment rows.

Your screen should match the following

- Click

(Home) to return to the Home page.

(Home) to return to the Home page.

Reviewing the Results in Capital

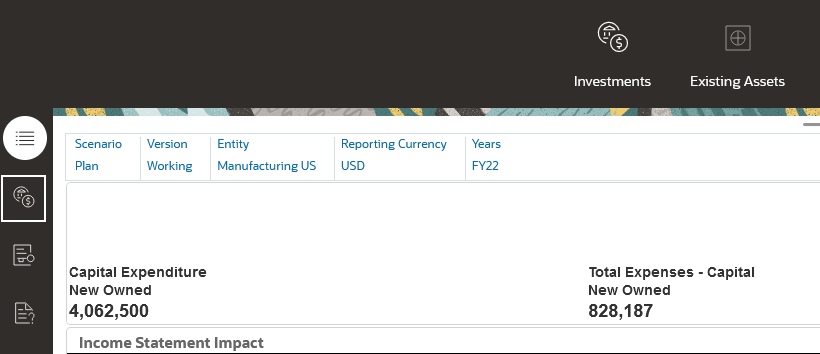

- From the Home page, click Capital, and then Investments.

- Click the New Asset Planning vertical tab.

- In the tabs at the bottom of the page, select New Assets from Projects.

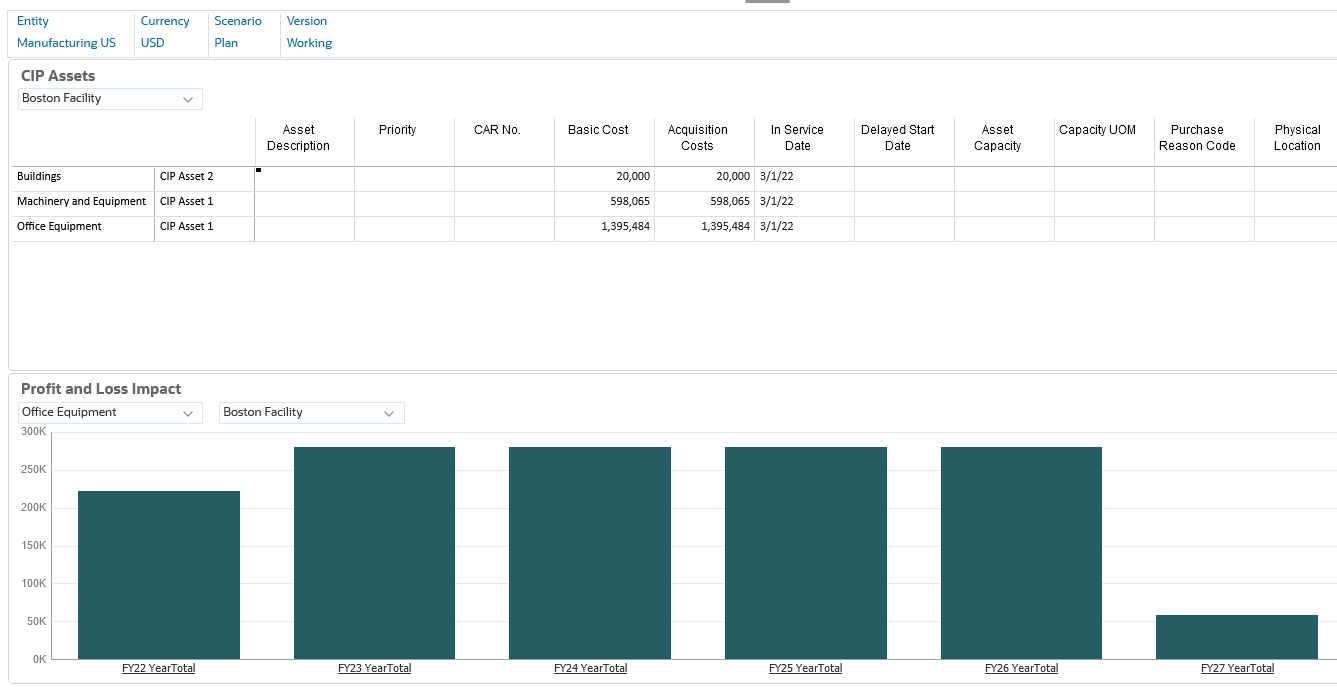

- Verify that the point of view is set to Manufacturing US, USD, Plan, Working. In the CIP Assets area, verify that Boston Facility is selected for project.

The CIP Assets area shows the data for the Buildings, Machinery and Equipment, and Office Equipment asset classes that was pushed from Projects. The Profit and Loss Impact area shows a chart of expense and depreciation information for the selected asset class. You can drill on the bars in the chart to view more detail.

Learn More

Integrating Projects Data with Capital

F54496-02

April 2022

Copyright © 2022, Oracle and/or its affiliates.

This 30-minute tutorial shows you how to integrate Projects data with Capital.

This software and related documentation are provided under a license agreement containing restrictions on use and disclosure and are protected by intellectual property laws. Except as expressly permitted in your license agreement or allowed by law, you may not use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish, or display any part, in any form, or by any means. Reverse engineering, disassembly, or decompilation of this software, unless required by law for interoperability, is prohibited.

If this is software or related documentation that is delivered to the U.S. Government or anyone licensing it on behalf of the U.S. Government, then the following notice is applicable:

U.S. GOVERNMENT END USERS: Oracle programs (including any operating system, integrated software, any programs embedded, installed or activated on delivered hardware, and modifications of such programs) and Oracle computer documentation or other Oracle data delivered to or accessed by U.S. Government end users are "commercial computer software" or "commercial computer software documentation" pursuant to the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, the use, reproduction, duplication, release, display, disclosure, modification, preparation of derivative works, and/or adaptation of i) Oracle programs (including any operating system, integrated software, any programs embedded, installed or activated on delivered hardware, and modifications of such programs), ii) Oracle computer documentation and/or iii) other Oracle data, is subject to the rights and limitations specified in the license contained in the applicable contract. The terms governing the U.S. Government's use of Oracle cloud services are defined by the applicable contract for such services. No other rights are granted to the U.S. Government.

This software or hardware is developed for general use in a variety of information management applications. It is not developed or intended for use in any inherently dangerous applications, including applications that may create a risk of personal injury. If you use this software or hardware in dangerous applications, then you shall be responsible to take all appropriate fail-safe, backup, redundancy, and other measures to ensure its safe use. Oracle Corporation and its affiliates disclaim any liability for any damages caused by use of this software or hardware in dangerous applications.

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners.

Intel and Intel Inside are trademarks or registered trademarks of Intel Corporation. All SPARC trademarks are used under license and are trademarks or registered trademarks of SPARC International, Inc. AMD, Epyc, and the AMD logo are trademarks or registered trademarks of Advanced Micro Devices. UNIX is a registered trademark of The Open Group.

This software or hardware and documentation may provide access to or information about content, products, and services from third parties. Oracle Corporation and its affiliates are not responsible for and expressly disclaim all warranties of any kind with respect to third-party content, products, and services unless otherwise set forth in an applicable agreement between you and Oracle. Oracle Corporation and its affiliates will not be responsible for any loss, costs, or damages incurred due to your access to or use of third-party content, products, or services, except as set forth in an applicable agreement between you and Oracle.