Example of Defining Burden Structures

The following scenario illustrates the relationship between expenditure types and burden cost codes in a burden structure. This relationship determines what burden costs Oracle Fusion Project Costing applies to specific raw costs.

Burden Structure

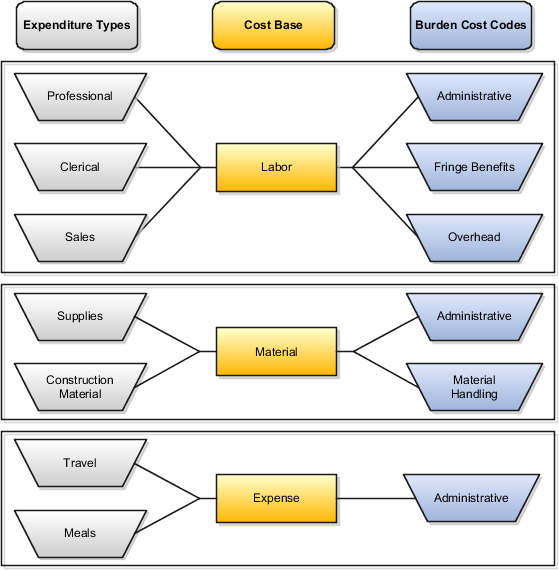

The following graphic shows an example of the expenditure types and burden cost codes that are assigned to the Labor, Material, and Expense burden cost bases.

The following table is an alternative to the graphic to explain expenditure types and burden cost codes that are assigned to the Labor, Material, and Expense burden cost bases.

|

Cost Base |

Expenditure Type |

Burden Cost Codes |

|---|---|---|

|

Labor |

Professional, Clerical, Sales |

Administrative, Fringe, Overhead |

|

Material |

Supplies, Construction Material |

Administrative, Material Handling |

|

Expense |

Travel, Meals |

Administrative |

The following table shows an example of the multipliers that are used to calculate burden costs for raw costs in the Labor, Material, and Expense cost bases. This is an additive burden structure that applies each burden cost code to the raw costs in the appropriate cost base. Multipliers are defined on the burden schedule.

|

Burden Cost Base |

Raw Cost Amount (USD) |

Administrative Cost Code Multiplier |

Labor Fringe Benefit Cost Code Multiplier |

Labor Overhead Cost Code Multiplier |

Material Handling Cost Code Multiplier |

|---|---|---|---|---|---|

|

labor |

1,000 |

0.20 |

0.20 |

0.40 |

0 |

|

material |

500 |

0.20 |

0 |

0 |

0.25 |

|

expense |

400 |

0.20 |

0 |

0 |

0 |

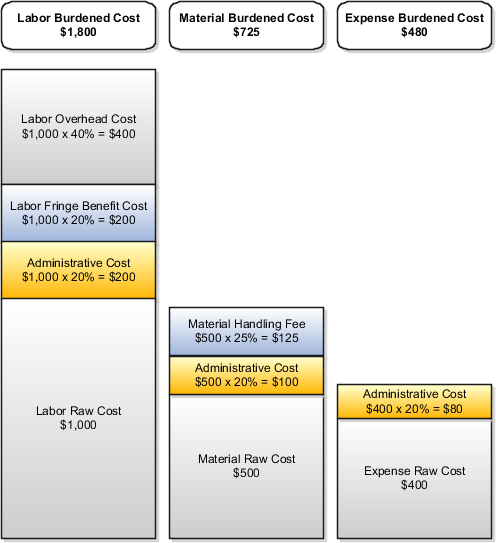

The following graphic shows an example of the resulting burdened costs for labor, material, and expenses.

-

The following example shows the resulting burdened costs for labor.

The following example shows the resulting burdened costs for labor.

labor burdened cost = labor overhead cost + labor fringe benefit cost + administrative cost + labor raw cost

labor overhead cost = $1000 * 0.40 = $400

labor fringe benefit cost = $1000 * 0.20 = $200

administrative cost = $1000 * 0.20 = $200

labor raw cost = $1000

labor burdened cost = $400 + $200 + $200 + $1000 = $1800

-

The following example shows the resulting burdened costs for materials.

materials burdened cost = material handling fee + administrative cost + material raw cost

material handling fee = $500 * 0.25 = $125

administrative cost = $500 * 0.20 = $100

material raw cost = $500

materials burdened cost = $125 + $100 + $500

-

The following example shows the resulting burdened costs for expense.

expense burden cost = administrative cost + expense raw cost

administrative cost = $400 * 0.20 = $80

expense raw cost = $400

expense burden cost = $400 + $80