How Burden Structure Components Work Together

You define the project cost buildup using a burden structure. A burden structure determines how you group expenditure types into burden cost bases and establishes the method of applying burden costs to raw costs.

Before creating burden structures you must define expenditure types, cost bases, and burden cost codes, which are the main components of a burden structure.

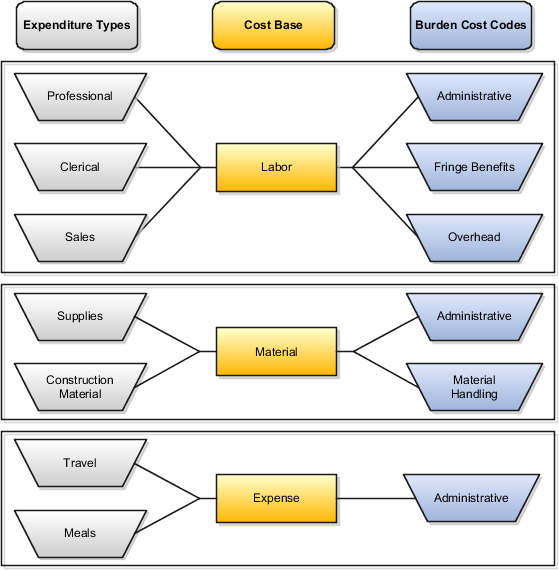

The diagram illustrates a burden structure with the following cost bases.

-

Labor

-

Includes the expenditure types Professional, Clerical, and Sales.

-

Is assigned the burden cost codes Administrative, Fringe Benefits, Overhead.

-

-

Material

-

Includes the expenditure types Supplies and Construction Material.

-

Is assigned the burden cost codes Administrative and Material Handling.

-

-

Expense

-

Includes the expenditure types Travel and Meals.

-

Is assigned the burden cost code Administrative.

-

Cost Bases

Cost bases are the groups of raw costs used for applying burden costs. You assign cost bases to burden structures, and then specify the types of raw costs, represented by expenditure types, that are included in the cost base, and the types of burden costs that are applied to the cost base.

Burden Cost Codes

Burden cost codes represent the distinct type of burden to apply to raw costs. For example, if labor costs receive both fringe benefits and overhead burden, then define a cost code for each type of burden. Assign an expenditure type to each burden cost code that Oracle Fusion Project Costing processes as separate, summarized expenditure items. The assigned expenditure type becomes the expenditure type for that type of burden cost.

Cost Base Types

Cost base types refer to the use of cost bases. Oracle Fusion Project Costing provides the following cost base types.

-

Burden Cost: Assign to cost bases that are used to calculate burden costs.

-

Other: Assign to cost bases that are used for other purposes than to calculate burden costs.

You can define additional cost base types to use for non-burden transactions.

Expenditure Types

Expenditure types classify raw costs and burden cost codes classify burden costs. The relationship between expenditure types and burden cost codes within each cost base determines what burden costs are applied to specific raw costs, and the order in which processing applies the burden costs.

In a burden structure, each expenditure type can belong to only one cost base with a cost base type of Burden Cost. This restriction ensures that Oracle Fusion Project Costing doesn't burden an expenditure type more than once. If you don't assign an expenditure type to a cost base, then burden costs aren't applied to the raw costs with those expenditure types. In other words, the burdened cost for these transactions is the same as the raw cost of the transaction.