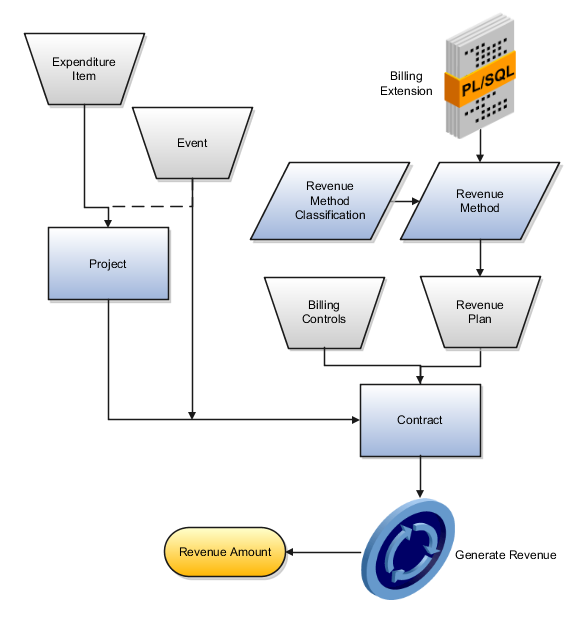

How Project and Contract Revenue Components Work Together

Project and contract components work together to create revenue distributions. The contract contains the instructions for calculating revenue amounts, and the associated project contains the cost transaction details. When you generate revenue, revenue distributions are created for the contract.

Revenue Method Classification

Assign a predefined revenue method classification to a revenue method. The revenue method classification determines whether the revenue amount is calculated based on rates, amounts, or progress.

Revenue Method

Create revenue methods for revenue plans to use for recognizing revenue. The revenue methods contain revenue recognition instructions in the form of the revenue method classification and rate definition schedule types.

You must assign a revenue method to a revenue plan, which will give the revenue recognition instructions to a specific contract or contract line. A revenue method can be used by more than one revenue plan.

Revenue Plan

A revenue plan contains a set of instructions for recognizing revenue on a contract or contract line. Create a revenue plan within a contract that uses the revenue method you require. Assign the revenue plan to one or more contract lines that are enabled for billing.

Billing Control

A billing control defines the type of permitted transactions (using billing resources), transaction date range, and maximum invoice and revenue amounts for a contract or contract line. Create a billing control within a contract at either the contract or contract line level. The revenue amount can't exceed the hard limit amount of a billing control. If the revenue amount exceeds the soft limit, revenue recognition will still occur, but you will receive a warning.

Expenditure Item

The project and task for an expenditure item are matched to the associated contract line during revenue generation. Revenue recognition can occur if the transaction date and billing resource for the expenditure item pass the contract billing controls.

If the expenditure item is mapped to more than one eligible contract line, the processing order is determined as follows:

-

The contract billing sequence determines the processing order of multiple contracts.

-

The contract billing controls determine the processing order of multiple contract lines within a single contract.

-

The contract contribution percentage determines the eligible amount of revenue to recognize for each contract line.

Oracle Fusion Project Billing creates a billing transaction for each unique combination of expenditure item and contract line. The billing transaction is the source for creating revenue distributions.

Event

Revenue events are automatically created during revenue generation if the revenue method is percent spent or percent complete.

Manual events are also processed during revenue generation. Oracle Fusion Project Billing creates a billing transaction for each event. The billing transaction is the source for creating revenue distributions.