Processing Returned Checks

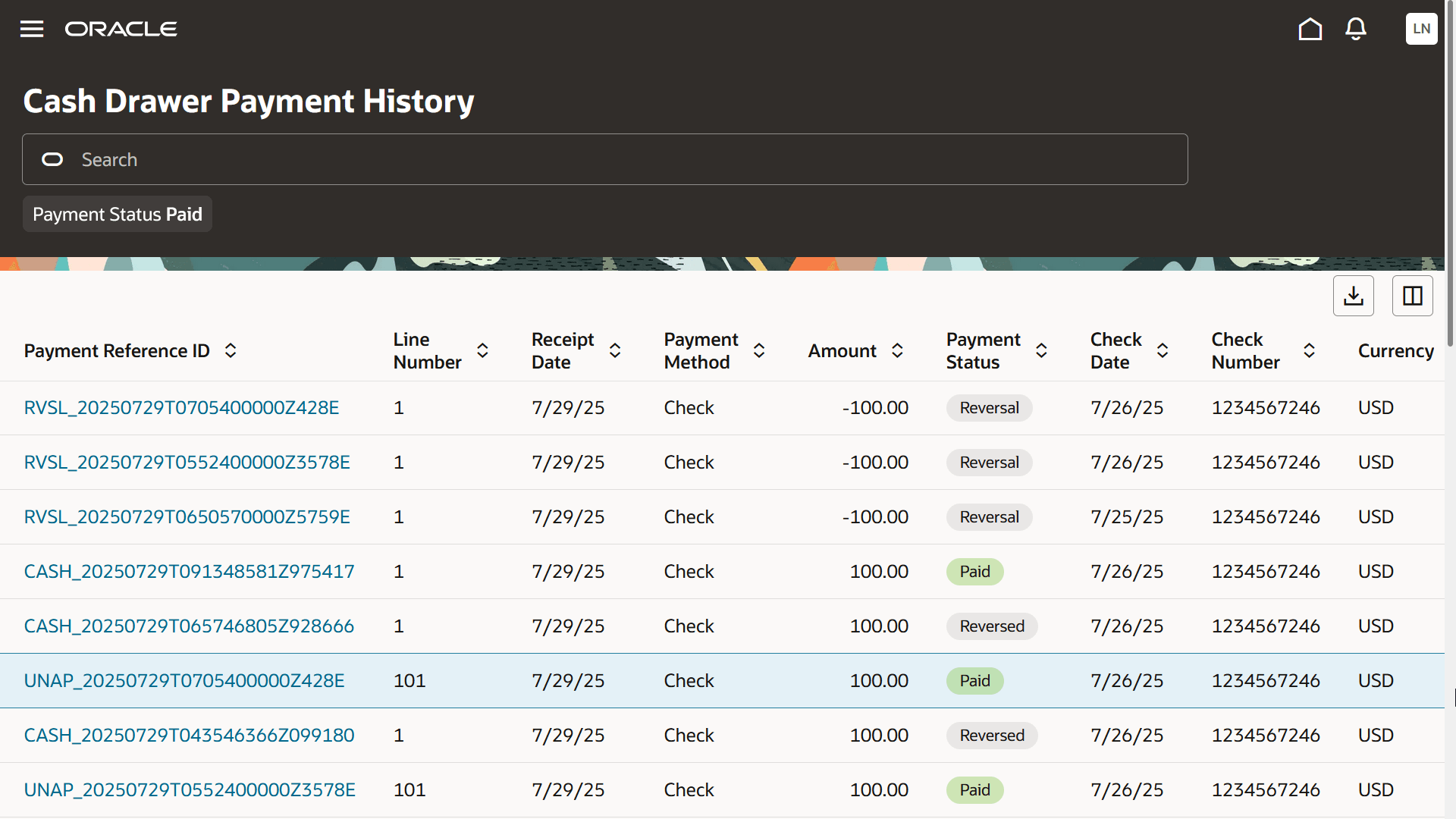

Use the Cash Drawer Payment History page to reverse a payment associated with a returned check.

The enhanced user experience is now available for the Cash Drawer Payment History page. The enhanced user experience streamlines the look and feel of this page.

This example shows the Cash Drawer Payment History page.

Reversing or Voiding Payments

-

Select page in the navigator.

-

Search for the check and select it to view the Cash drawer payment detail drawer.

-

Turn on the Want to Reverse the Payment? switch and click the Reverse Payment button.

-

In the Cash drawer line details section, select a Reversal Reason and specify if a returned check fee should be charged.

-

Click Submit.

If agency payment options are configured to reinstate fees, then agency staff will see the Reverse Payment button on the Cash drawer payment detail drawer. If agency payment options are configured to not reinstate fees, then agency staff will see a Void Payment button on the Cash drawer payment detail drawer.

The following activities happen when agency staff reverses a payment for a check return:

-

The original fee paid rows are reversed and new fee rows are created with a due status.

-

A fee record is created for the returned check fee amount.

-

A recovery fee record is created if the overpayment associated with the payment has been refunded. This is to recover the funds.

-

A refund for an overpayment amount is voided if it is initiated, but not yet processed when the associated payment is reversed.

-

The original payment record is reversed.

The following activity happens when agency staff void a payment for a check return:

-

The original payment record is marked as void.

For more information, see Setting Up Agency Payment Options.