Simultaneous Usage of Multiple Payment Gateways

Use multiple payment gateways simultaneously in a single environment for tokenizing customer credit cards. This provides the funds capture setup greater versatility and allows customers to use alternative payment gateways owing to the constraints of each payment gateway, such as geographic coverage, supported currencies, supported industries, and cost disparities.

Use the Tokenization and Transaction Routing Rules region in the Manage Routing Rules page to configure credit card instruments. Along with the existing business unit parameter, you can configure multiple merchant identifiers based on a variety of business parameters, including currency, payer, payer country, business unit country, and source product. By first configuring multiple tokenization payment systems and payment system accounts, and then configuring the routing rules based on the combination of business unit and other parameters, multiple payment gateways and associated merchant identifiers can be used concurrently.

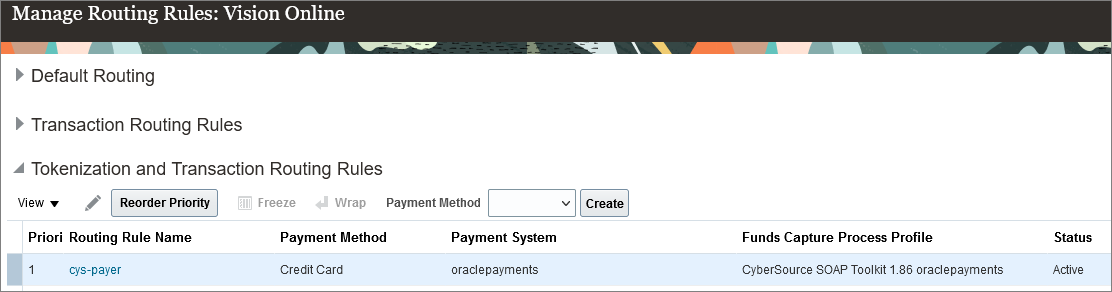

Tokenization and Transaction Routing Rules

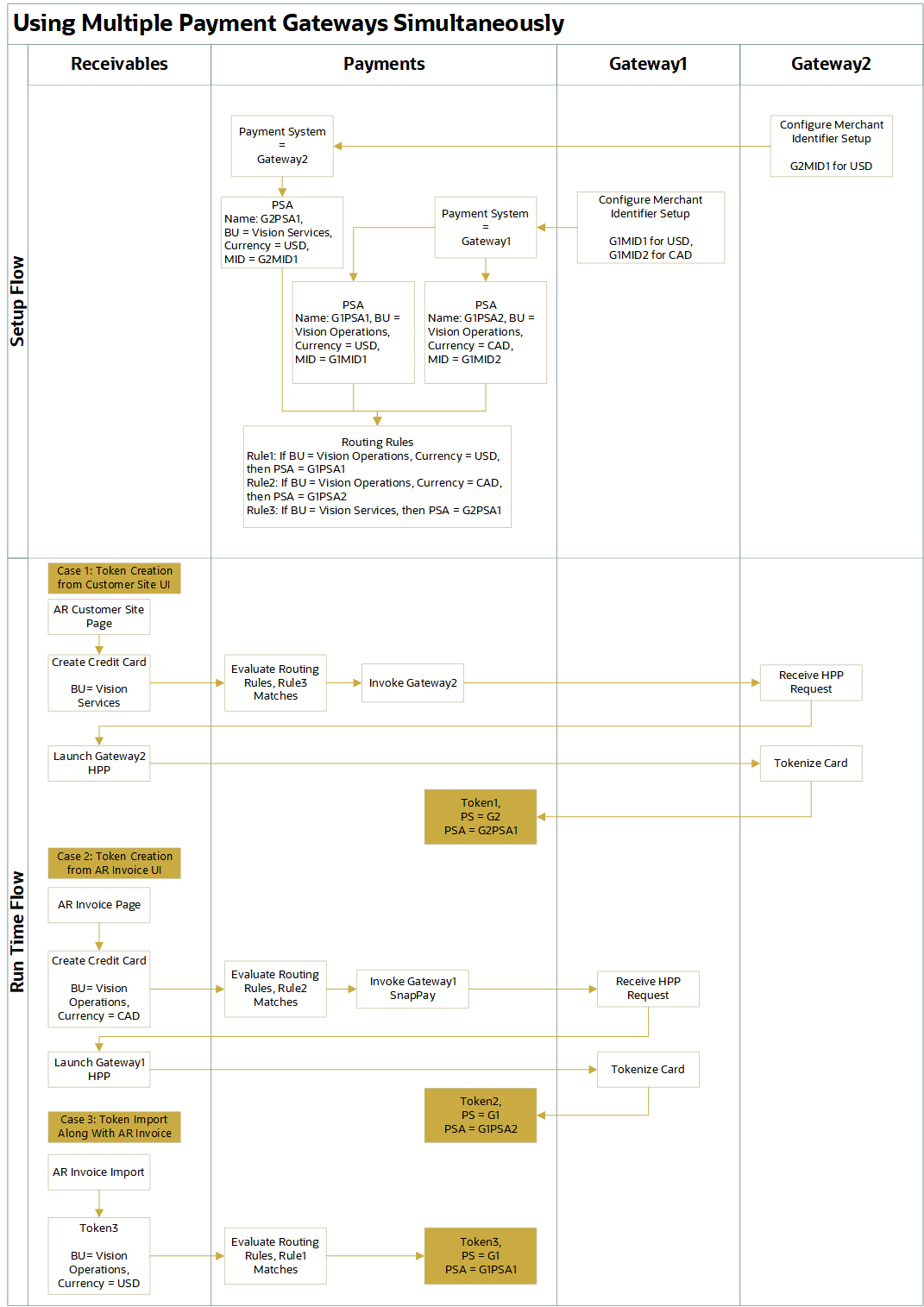

To understand the functionality, consider a scenario in which a deploying organization uses two payment gateways, i.e., Gateway1 and Gateway2. There are two merchant identifiers with Gateway1 and one with Gateway2, each dedicated to transactions involving certain business units and currencies. The flow diagrams below illustrate the process of determining the appropriate payment system and payment system account using the tokenization routing rules during token creation.

Example of Tokenization Routing Rules

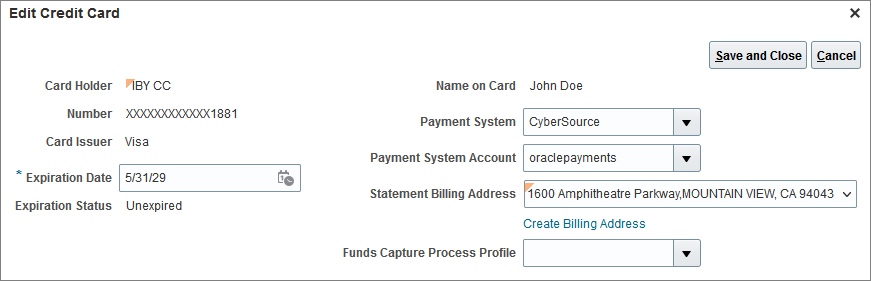

The tokenized credit card now permanently stores the payment system and payment system account. The transaction routing rule evaluation simply determines the funds capture process profile using the credit card token's payment system account and transaction contextual attributes. The credit card LOV on transactions now only displays filtered tokens based on real-time routing rules executed on transaction contextual attributes.

Edit Credit Card Page

Routing rule evaluation based on transaction contextual attributes determines the payment system account of tokens imported with orders or invoices in Order Management or Receivables. The legacy tokens import spreadsheet template allows for the direct specification of the payment system account when migrating existing tokens from the legacy system. If it is not specified, the payment system account is determined by evaluating routing rules using transaction contextual attributes.

After enabling this feature, existing credit card tokens will be automatically updated with payment system and payment system account information. The data update process begins automatically, either when defining the tokenization and transaction routing rules or while performing the settlement process, whichever occurs first after enabling this feature. The Import Security Credentials process will update the tokens when it is started after configuring tokenization and transaction routing rules, whereas Submit Offline Transactions process will update the tokens if the settlement occurs first after enabling this feature.

Business benefit:

Concurrent use of multiple payment gateways with multiple merchant identifiers can be configured based on various business parameters to meet unique business, industry, or geography requirements.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Before enabling this feature, the credit card common architecture and settings described in the Payment Gateway Integration and Credit Card Processing guide at the link below must be enabled in the environment as a prerequisite.

https://www.oracle.com/webfolder/technetwork/docs/fin-pci-compliance/PaymentGatewayIntegration.pdf

Use the following steps to perform the additional required configuration -

- Navigate to Setup and Maintenance.

- Select the Setup Offering: Financials.

- Click on the Functional Area: Payments.

- Click on the Setup Task: Manage Internal Payee.

- Enter the name of internal payee and perform search.

- Select the payee record in the search results and click on the button: Manage Routing Rules.

- Navigate to the region: Tokenization and Transaction Routing Rules.

- Select Credit Card payment method from the dropdown and click on create button.

- Following page opens: Create Routing Rules.

- Create routing rule with Business Unit as one of the rule criteria and save and close.

- Use Reorder Priority button to change the priority of various routing rules.

- Save the changes.

Tips And Considerations

-

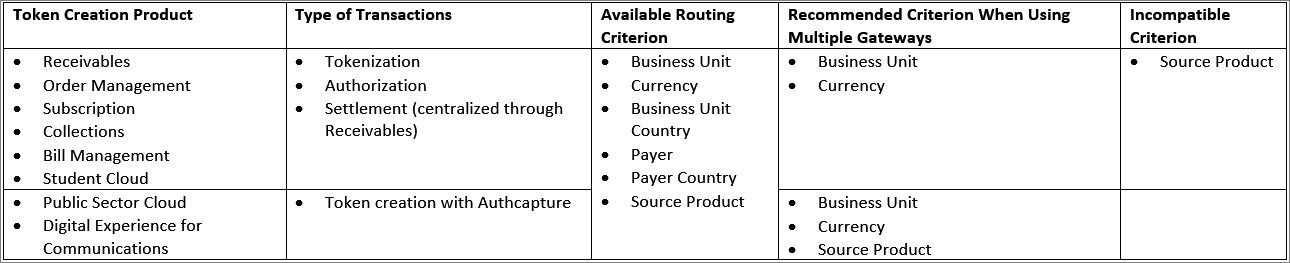

Before using this functionality, the deploying organization should determine the criteria for multiple merchant identifiers. As the business unit is a payment system account attribute, it is recommended that separate merchant identifiers and routing rules be based on the business unit. If multiple payment gateways are used to cover different countries and currencies, the currency should be added as a criterion for multiple merchant identifiers. Following table presents available and recommended parameters when using multiple payment gateways.

Recommended Criterion for Routing Rules

- The source product should not be used for two-step or card-on-file transactions initiated by products such as Order Management, Subscription, Receivables, Bill Management, Collections, and Student Cloud, where authorization and settlement can occur within a product other than the source product that tokenized the credit card.

-

If currency is used as a routing rule criterion, token creation directly on the customer site through the user interface should be avoided since currency is not available as a parameter when creating tokens at the customer site level.

-

If a business situation necessitates the ability to avoid the routing rule review during authorization, this can be accomplished by supplying the value of the funds capture process profile on the token via the user interface.

-

As a best practice, the routing rules should be tested in the test environment with all of the deploying organization's token creation and authorization business flows, such as import, creation, or selection via LOV on the user interface, before enabling them in the production environment.

Key Resources

- Routing Rules

- Use the following guides to learn more about credit card payment processing in Payments:

Access Requirements

No additional access requirements are needed to use this feature.