Revenue Allocation and Recognition in Transaction Currency

Allocate revenue for contracts in the transaction currency for nonledger currency-denominated transactions. This enables accounting of recognized revenue using current exchange rates.

Organizations engaged in commerce in currencies other than their local currency can model their revenue contracts in its transaction currency when it is the contract currency. You can use the transaction currency consideration value as the basis for the revenue allocation and recognition of both ledger and nonledger currency-denominated revenue contract performance obligations. When modeling, the transaction currency values of the transaction price and standalone selling prices are used to drive the allocation. It is in that currency, that the revenue contract is modeled and displayed.

This feature allows organizations engaging in multicurrency commerce to:

- Enable accounting of recognized revenue, receivables, assets, and liabilities using current exchange rates, and facilitates compliance with ASC 830 and IAS 21.

- Indicate the foreign currency treatment of performance obligations as monetary or nonmonetary.

- Use native Oracle General Ledger revaluation functionality to derive and record unrealized foreign currency gains and losses when truing up your balance sheet to current rates.

- Support comparison analysis by providing flexibility to change the ledger’s assigned Allocation Currency Basis system option and Foreign Currency Treatment performance obligation identification rule without reconfiguring a new ledger or creating new performance obligation rules. Changes are applied to new and unprocessed revenue lines.

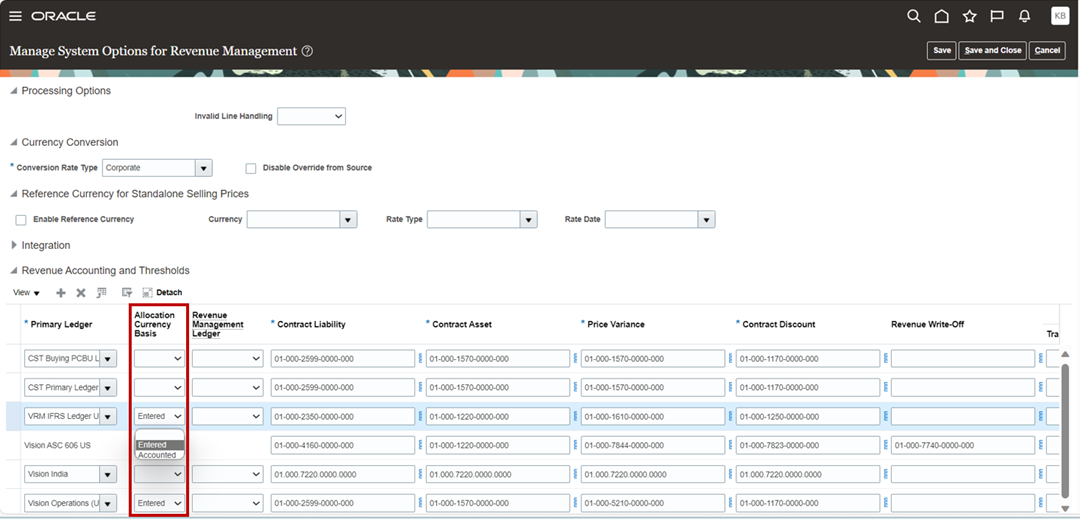

Allocation Currency Basis

Use the newly introduced ledger level Allocation Currency Basis option to designate the currency basis to use to drive your revenue allocation and recognition calculations.

When you set this option to Entered, revenue contracts and the underlying performance obligations are modeled using the transaction currency amount of the source document lines as the driving values for the allocations. The application establishes and allocates the contract and performance obligations in the transaction currency amounts. This applies to both ledger and nonledger currency-denominated transactions for the selected ledger.

Billing and receivables activities are deemed monetary and use current rates. Performance obligations are committed and expected future deliverables are valued at the expected consideration amount and unknown exchange rates are also valued at current rates. However, when the revenue value allocated is billed or collected in full and not subject to further change, an obligation may be nonmonetary and is converted at the rate of the initial recognition.

Therefore, when the revenue contract’s entered currency is a nonledger currency-denominated, the billing accounting distributions are converted using the conversion rate as of that transaction’s date. Revenue recognition is valued at the rate for the period in which the revenue occurred. Alternatively, if the performance obligation is determined to be nonmonetary, revenue can be recognized at historic rates. That is:

- When the performance obligation is designated as monetary, invoicing and satisfaction date rates, are the current period base rates.

- When the obligation is designated as nonmonetary, the satisfaction transaction date and rate date is the performance obligation’s initial performance date.

In contrast, when modeling using the Accounted option, the application invokes the existing functionality, in which nonledger currency-denominated contracts are translated at contract inception to the ledger currency. The application established the contract consideration in the ledger currency. This amount is used as the basis for revenue allocation and recognition.

When using this feature, the Revaluation process in General Ledger is configured to revalue the contract asset account balances and the performance obligation account balances. The Revaluation process operates at the portfolio (general ledger balance) level, and its foreign exchange entries are visible only in General Ledger.

Upon uptake of the release, in support of backward compatibility, the Allocation Currency Basis for existing ledgers is set to Blank. The value of Blank indicates that Revenue Management is using the original logic for treating non-ledger currency denominated revenue contracts.

When adding new ledgers, the allocation currency basis is set to Entered, because this approach provides organizations the benefit of both methods. If you set the Allocation Currency Basis option to Entered and the Foreign Currency Treatment to nonmonetary on the performance obligation, you receive the same results as if modeling using the existing Revenue Management functionality, in which the contract consideration is converted using a single rate and held constant. The only difference is that the rate used is the performance obligation’s initial performance date rather than the contract’s inception date across all performance obligations. If you want to continue using the original approach, you can modify the default setting.

If you are unsure which approach is appropriate to achieve your revenue policies, you can run a test data set of contracts in a test environment, and then switch the setting and discard and reprocess the contracts. This allows you to compare the accounting results between the two different approaches and determine which is more aligned with your needs without impacting your existing contracts, because the change is only applied to new and unprocessed lines.

Contracts created before activation of this feature will continue to be processed under that method until the end of their life cycle or when you discard the contract.

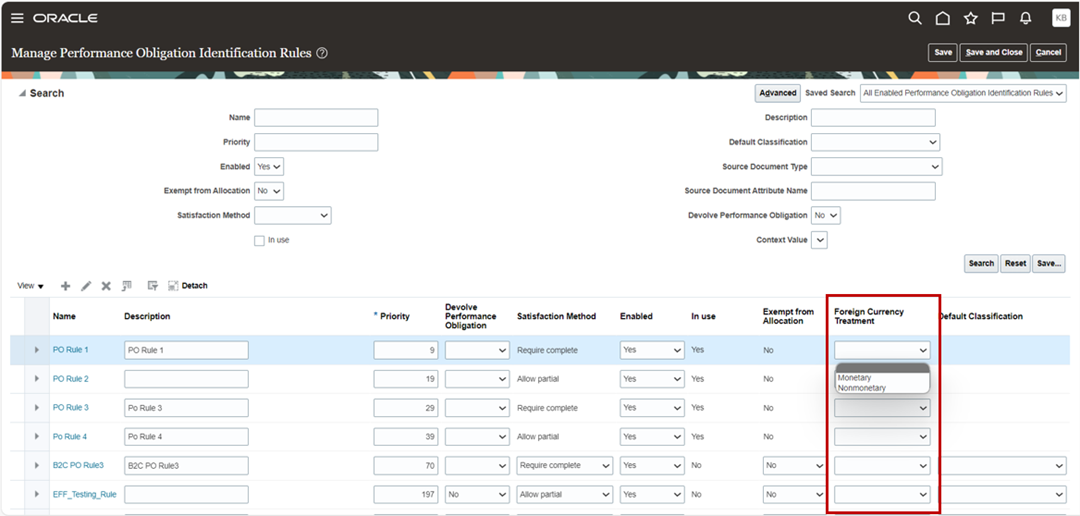

Foreign Currency Treatment Designation

For organizations who engage in agreements where the terms and conditions dictate that payment of goods and services are made in advance in full for their nonledger currency-denominated contracts and their revenue policies interpret ASC 606 Section: 830-20-30-01 as requiring the obligation contract balances to be treated as non-monetary, a new option is available to address this requirement.

You can now designate the desired treatment as part of the performance obligation identification process. A new attribute, Foreign Currency Treatment, is available in the Manage Performance Obligation Identification Rules page.

With this setting, you can designate the contract balance accounts for the resulting performance obligations as monetary or nonmonetary in accordance with your business practices.

You can use an extensible attribute to capture this information as part of the ordering process and use it when identifying your performance obligations to designate the foreign currency treatment for the contract accounts.

The application converts accounting distributions for nonmonetary performance obligations to the accounted currency using the exchange rate as of the initial performance date of the obligation, regardless of the date of occurrence. The premise is that the obligation is paid in full and the amount of revenue to be recognized is fixed and not subject to fluctuation in changes in exchange rates.

Conversely, for performance obligations that are not paid in full up front, the contract account balances are designated as monetary and the balances are converted using current rates.

This treatment affects the accounting of the contract liability accounts and revenue entries only.

Invoicing and billing is always converted using current rates.

Because performance obligation identification rules are not ledger specific and are shared across ledgers, you can continue to use your existing rules.

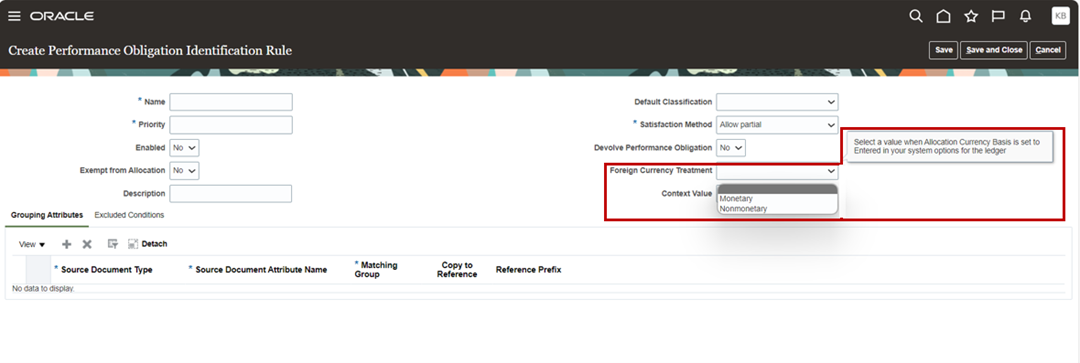

Alternatively, when creating new performance obligation rules, you can select the Foreign Currency Treatment by navigating to the attribute in the header region of the Create Performance Obligation Identification Rule page.

Because the designation is only applicable when processing source document for ledgers with the Allocation Currency Basis assignment set to Entered, you can set the designation on your existing In Use rules as long as your existing rule definitions support the appropriate grouping criteria. The setting is applied when processing new and unprocessed source documents from that point forward.

When processing source documents for ledgers where the Allocation Currency Basis assignment is Accounted or Blank, the designation is ignored.

After contract and performance obligation identification, if the accounting treatment is not in line with your policies, you can change the assignment in the performance obligation rule and then discard the contract. Upon re-identification of the contract, the application applies the latest performance obligation identification rule settings.

Conversion Rate Type and Rates

The feature works in conjunction with the existing available options for defining which conversion rate type is used. The application uses the existing settings for the Conversion Rate Type and the Disable Override from Source option that you specified on the Manage System Options for Revenue Management page. Revenue Management uses the conversion rate types and rates defined and maintained within the General Ledger daily rates structure.

During the Recognize Revenue for Customer Contracts process, accounting distributions are created and converted if necessary. If a conversion rate is not defined in the General Ledger daily rates table for the conversion rate type and date, the accounting distributions are not converted and a warning message is logged in the output file of the process. The next time the process is executed, the unprocessed distributions are reprocessed until a rate is available to convert the distribution. At this time the unprocessed distributions are eligible for processing by Oracle Subledger Accounting and posting to General Ledger.

Thresholds - Application and Evaluation

Revenue Management supports three types of thresholds. Revenue Management displays the revenue contracts that meet the thresholds in the applicable Revenue Management work area tab.

For the initial release of this feature, threshold application and evaluation will continue to be based on the applicable accounted amount of the contract derived using the conversion rate at contract inception. The amount entered in the threshold parameter is to represent the ledger currency equivalent.

- Transaction Price Exemption Threshold - Uses accounted transaction price at inception.

- Transaction Price Revenue Threshold - Uses accounted transaction price at inception.

- Discount Threshold - Uses accounted allocated amount at inception.

Accounting

Subledger Accounting Source - Foreign Currency Treatment Indicator

To facilitate the General Ledger Revaluation process, use the performance obligation level Foreign Currency Treatment indicator Subledger Accounting source to customize you accounting rules to designate which contract liability balance sheet account your monetary and nonmonetary journal entries are booked. This allows you to direct your accounting distributions to a separate contract liability account within your General Ledger in support of the Revaluation process, because a performance obligation’s contract liability balances designated as nonmonetary are exempt from revaluation.

Billing – Price Variance

The calculation of the price variance is a measurement of the pre-recognition changes due to foreign exchange on the obligation before the allocation valuation is done, when creating the obligation and asset. As such, it is out of ASC 830 or IAS 21’s scope for foreign exchange gain or loss accounting.

Realized Gains and Losses

As the Internal Revenue Service and other tax authorities do not authorize the inclusion of realized gains and losses for revenue and contract assets in the deductible realized gain number for tax reporting, this calculation is not required in Revenue Management or its supporting accounting within Revenue Management. The General Ledger Revaluation process handles the calculation of foreign currency gains and losses and the accounting .

General Ledger Revaluation

Revaluation is a process of adjusting the accounted value of foreign currency denominated balances according to current conversion rates. Revaluation adjustments represent the difference in the value of the balance due to changes in conversion rates between the date of the original journal entry and the revaluation date. The adjustments are then posted through journal entries to the underlying account with the offset posted to an unrealized gain or loss account.

All debit adjustments are offset against the unrealized gain account and all credit adjustments are offset against the unrealized loss account. If you specify the same account in the Unrealized Gain Account and Unrealized Loss Account fields, the net of the adjustments is derive and posted.

The purpose of revaluation is to true-up the liability or asset accounts that may be materially understated or overstated at period end using a month end exchange rate.

When using this feature, ensure that you included this process as part of your period close when your revenue contract portfolio consists of nonledger currency-denominated contracts.

See Oracle General Ledger – Accounting Period Close Process for more details.

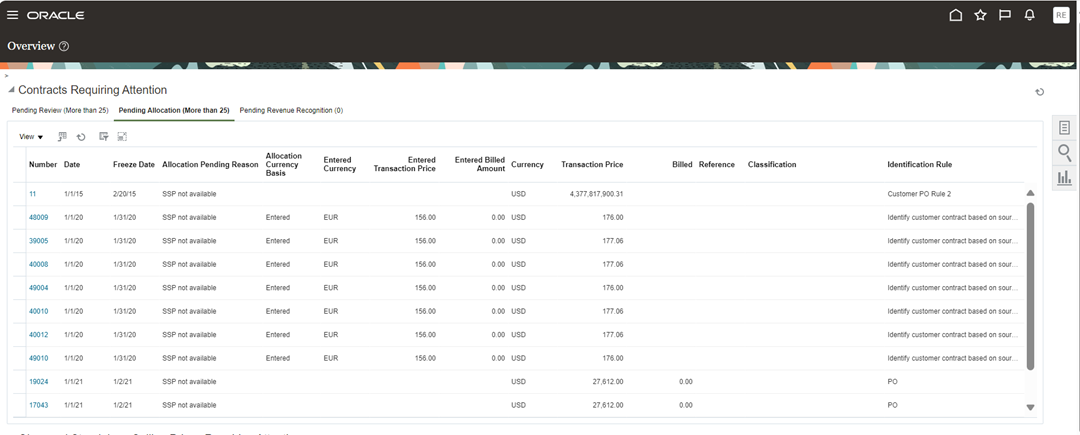

User Interface Enhancements

In support of this feature, the Revenue Management Overview work area is expanded to include the new attributes. When viewing the contracts, the work area now displays the allocation currency basis for the contract, its foreign currency treatment indicator, and the relevant entered currency amount details.

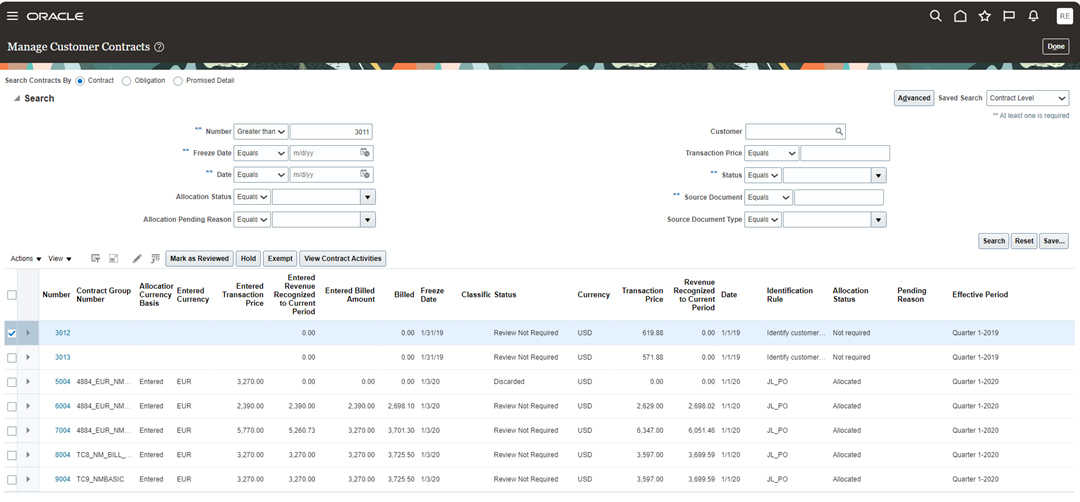

The Manage Customer Contracts page now displays the entered currency-related details, in addition to the new attributes, so that you can distinguish the allocation basis and foreign current treatment of the contract. These attributes are also available when you perform an advanced search.

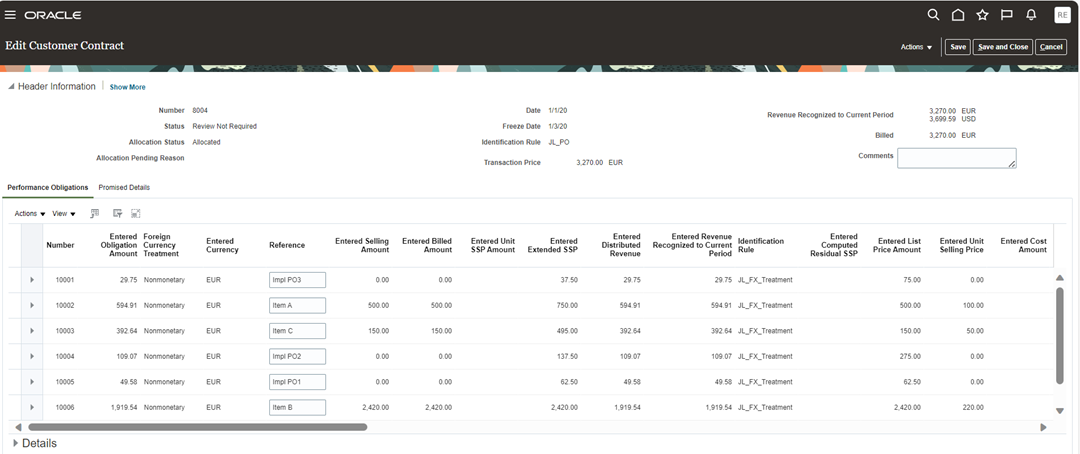

When the contract is modeled using the Entered Allocation Currency Basis, the Edit Customer Contract page displays only the applicable contract details in the entered currency, because the accounted versions are no longer applicable. In the contract header, the revenue recognized to current period attribute displays the revenue recognized in both the entered and accounted currencies. This number represents the amounts that are final accounted and posted to the subledger.

Improved Reporting

Contract Activity Details Report

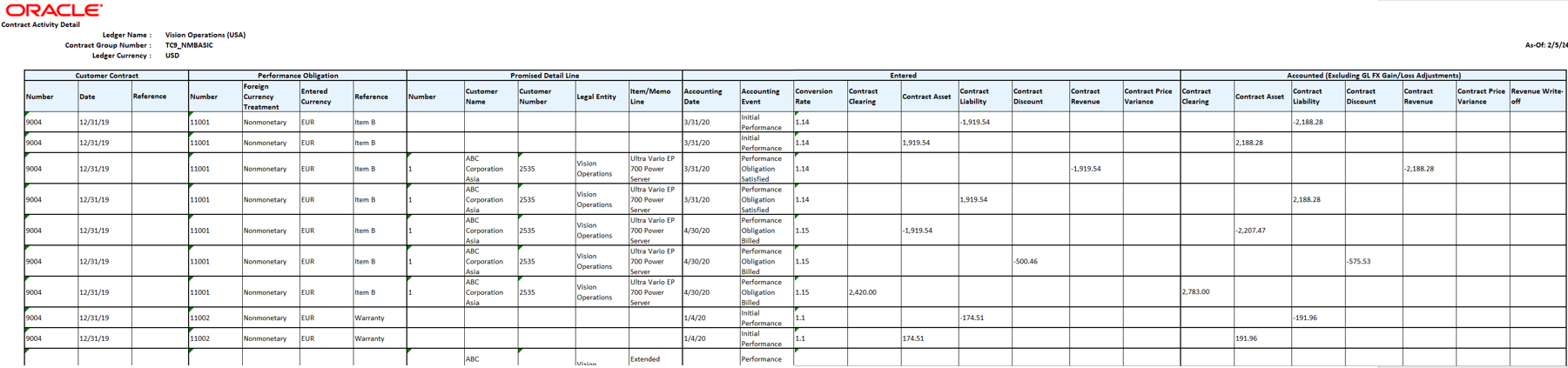

The Contract Activity Details report now displays both the Entered and Accounted contract account balances for the revenue contract. The report is expanded to include the conversion rate date and rates used for the accounting events. Only accounting distributions that are final accounted are displayed.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Backdated Transactions:

- If a contract has undergone an immaterial change and then subsequently receives a transaction that is dated earlier than the immaterial change date, the transaction is applied as a current dated transaction against the current contract value.

- For nonmonetary performance obligations:

- The exchange rate as of the established initial performance event date is used.

- Once the initial performance event date is established, it is used for the life of the performance obligation.

- The exchange rate does not change due to receiving an earlier dated billing or satisfaction event.

- You can revise the exchange rate only if the contract has not undergone an immaterial change by discarding the contract and recreating it.

- Ledger and nonledger currency-denominated immaterial change accounting contracts are not eligible for processing by the Discard Customer Contracts process.

- Returns

- Returns are processed as material changes. The transaction is reflected and converted as of the transferred source document line date or if blank, the system date.

- This date is used as the rate date when the performance obligation is monetary.

- The application creates a negative satisfaction event to undo any recognized revenue for the returned item and the revenue converted using the exchange rate for that date.

- The corresponding applicable credit memo is converted as of the credit memo date.

- Returns are processed as material changes. The transaction is reflected and converted as of the transferred source document line date or if blank, the system date.

- Performance obligations created from templates are treated as monetary.

- Only ledger currency denominated contracts can be devolved.

- The application retrospectively accounts revisions of performance obligations when the satisfaction plan name is Fixed or Variable Revenue Rate, Daily Rate Full Periods.

- The application retrospectively allocates revisions for accounting contracts that were allocated based on residual standalone selling priced performance obligations.

Key Resources

- Revenue Recognition and Allocation in the Transaction Currency

- Accounting for Revenue Recognition and Allocation in the Transaction Currency

- How the General Ledger Revaluation Process Works for Revenue Recognition

- Guidelines for Recognizing Revenue in the Transaction Currency

- For more information on General Ledger Revaluation, refer to the following:

- Oracle General Ledger – Accounting Period Close Process for more details.

- You can assign currency conversion rates by system options or import them from upstream source systems. Review the following What’s New content for details on these options and their default assignment logic.

Access Requirements

No new role access is required to use this feature.