Audit of Commute Distance Deduction in Mileage with HCM Address Information

Audit of Commute Distance Deduction in Mileage with HCM Address Information

Use employee HCM home and office address information to verify the commute distance entered on mileage reimbursement during expense report audit. This is helpful where company mileage policy requires deducting commute mileage between home and office from the overall trip distance.

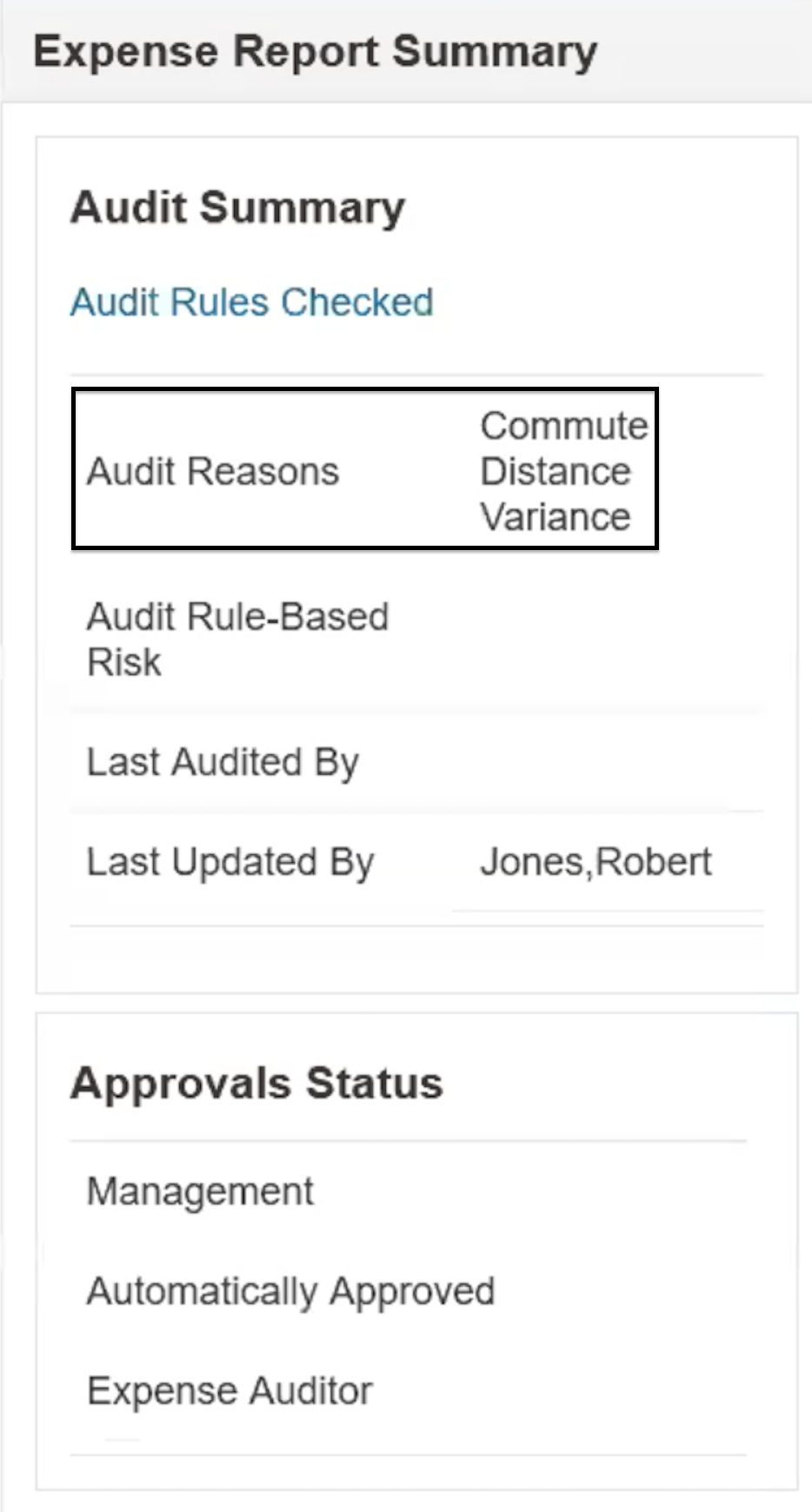

When an employee creates a mileage expense with a different home and/or office address than what's on the Contact Information page of HCM, the corresponding expense report is selected for audit with 'Commute Distance Variance' as the reason.

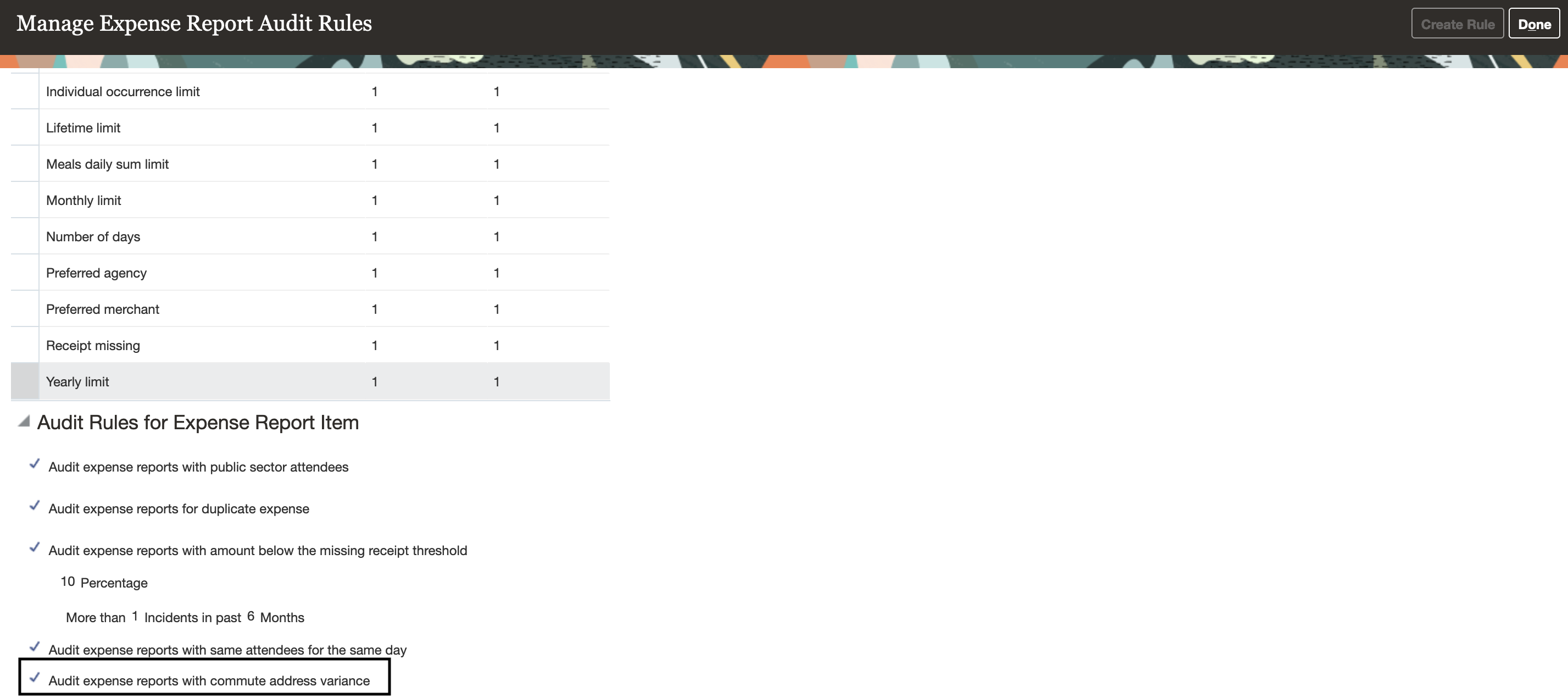

To use this feature enable the new audit selection rule "Audit expense report with commute address variance" in Setup and Maintenance.

Business benefits include:

- Enhanced visibility for auditors regarding mileage information within the print preview PDF report.

- Prevention of inaccurate or fraudulent mileage claims by expense users.

- Reduction of risk of approval of non-compliant expense reports.

- Reduction of potential over-payments by the company.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Audit Selection Rules

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 679390