Credit Transactions Accounted in Partner Contributions

Process credit transactions through partner contributions. Use the Assign and Draw Partner Contributions process to add cost transactions with credit amounts to a partner contribution.

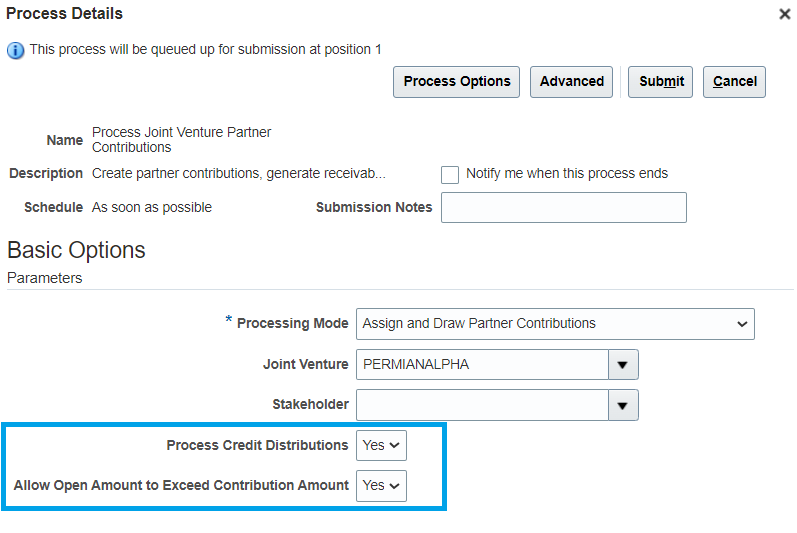

To include credit cost distributions in a run of the Process Joint Venture Partner Contributions process, select Assign and Draw Partner Contributions in the Processing Mode parameter. Then enable one or both of the Process Credit Distributions parameter and the Allow Open Amount to Exceed Contribution Amount parameter.

Set the Process Credit Distributions parameter to Yes to add credit costs to partner contributions, resulting in an increase in the open amount.

Set the Allow Open Amount to Exceed Contribution Amount parameter to Yes to let the open amount exceed the partner contribution amount when creating credit distributions for partner contributions.

Parameters for the Process Joint Venture Partner Contributions process

When a credit cost distribution is reversed, the amount will be subtracted from the partner contribution it was originally added to if the amount is available to draw.

Business benefit:

This ensures that credit cost transactions are accurately accounted for and reflected in the partner contribution balance.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, refer to

- Implementing Joint Venture Management guide and

- Using Joint Venture Management guide.

Access Requirements

- Joint Venture Accountant