Property and Equipment Leases for Japanese GAAP

Property and Equipment Leases for Japanese GAAP

Maintain lease contracts in a single repository and generate amortization schedules according to the Japanese GAAP. Once a contract is defined, Lease Accounting provides touchless capabilities to manage and process leases.

The booking process generates transactions for initiating the right-of-use asset and lease liability balances for expense leases. The lease accruals process periodically generates transactions for the lease liability expense and right-of-use amortization, which reduces the initial liability and right-of-use asset balances. For revenue operating leases, the lease accruals process generates transactions to recognize revenue evenly over the revenue recognition term.

Generating accounting in the primary ledger under the Japanese GAAP, and in the secondary ledger under another GAAP, ASC 842 or IFRS 16, is available for multinational organizations.

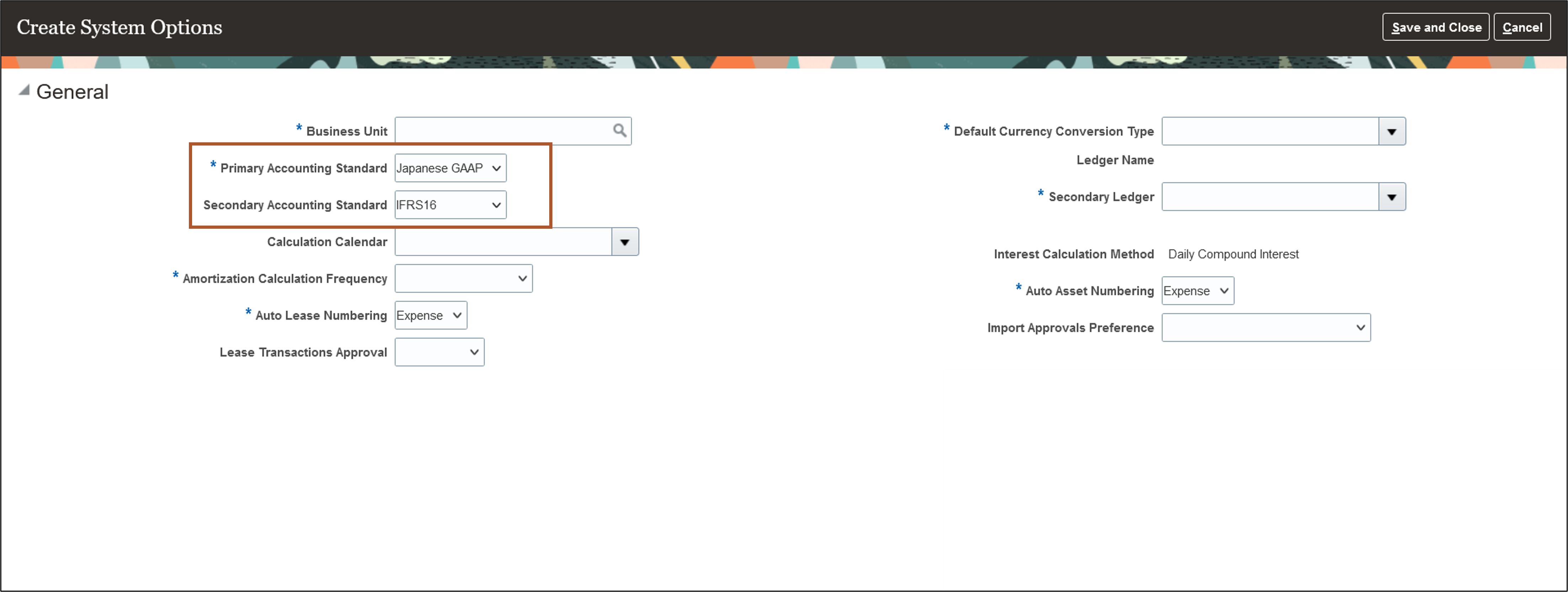

Configure lease system options to define Japanese GAAP as the primary or secondary accounting standard.

Configure System Options

Business benefits include:

- Enforcement of lease accounting policies consistently across the organization.

- Automation of Japanese GAAP, ASC 842, and IFRS 16 lease processes, increasing productivity and reducing the risk of error.

- Standardization of lease information in a single repository via actionable user interfaces.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 24D

Access Requirements

You do not need any new role or privilege access to set up and use this feature.