Global Indirect Tax Automation with Avalara

Automate the tax partner onboarding for Avalara. This provides a seamless experience to implement Avalara globally for tax partner processing in Oracle Tax.

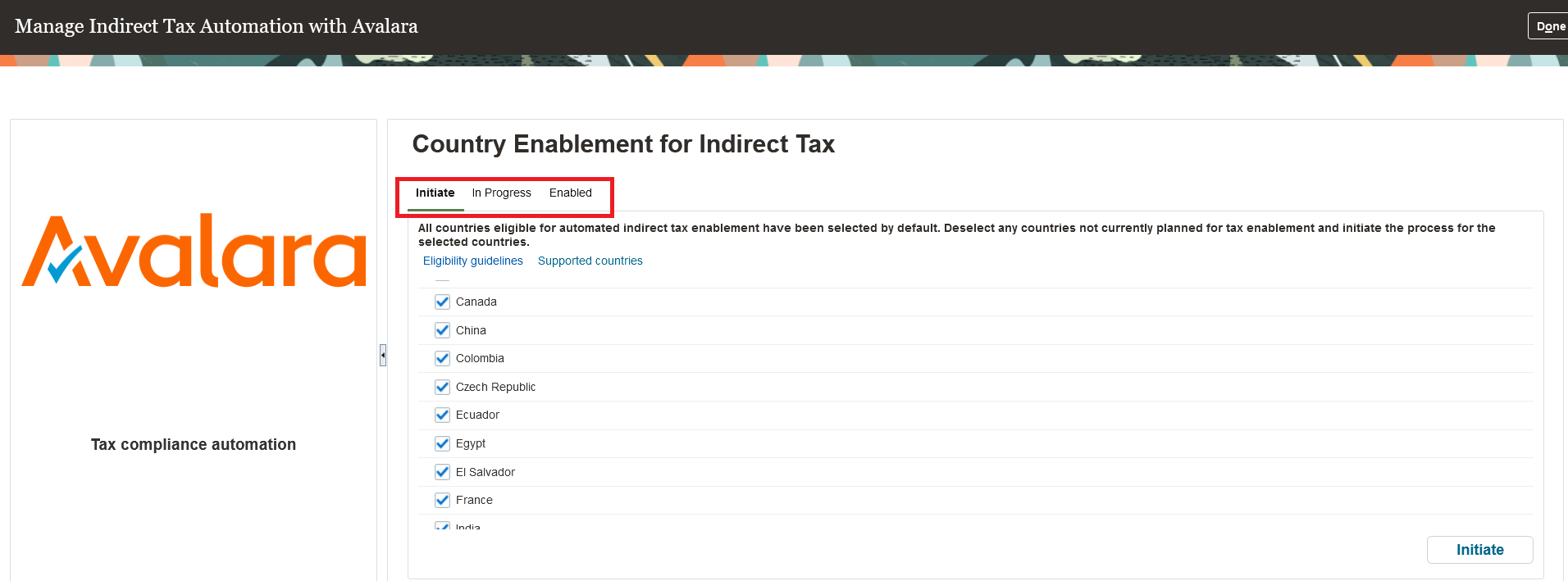

Use the Manage Indirect Tax Automation with Avalara page to initiate Avalara enablement and track the status of each individual task.

You can now initiate the enablement for multiple countries that are supported by Avalara. It was earlier available only for the United States.

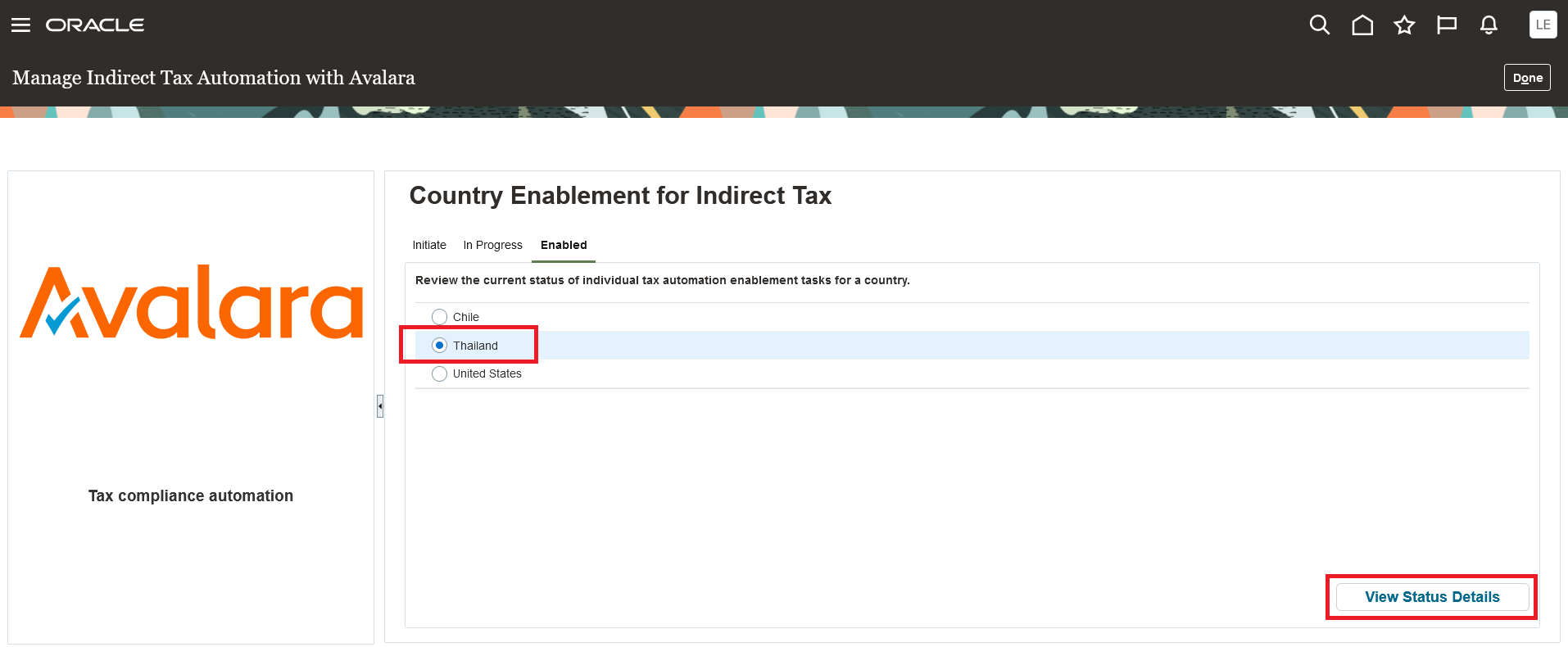

The page displays the countries for which enablement can be initiated, countries for which it is in progress and countries for which it is complete under three different tabs.

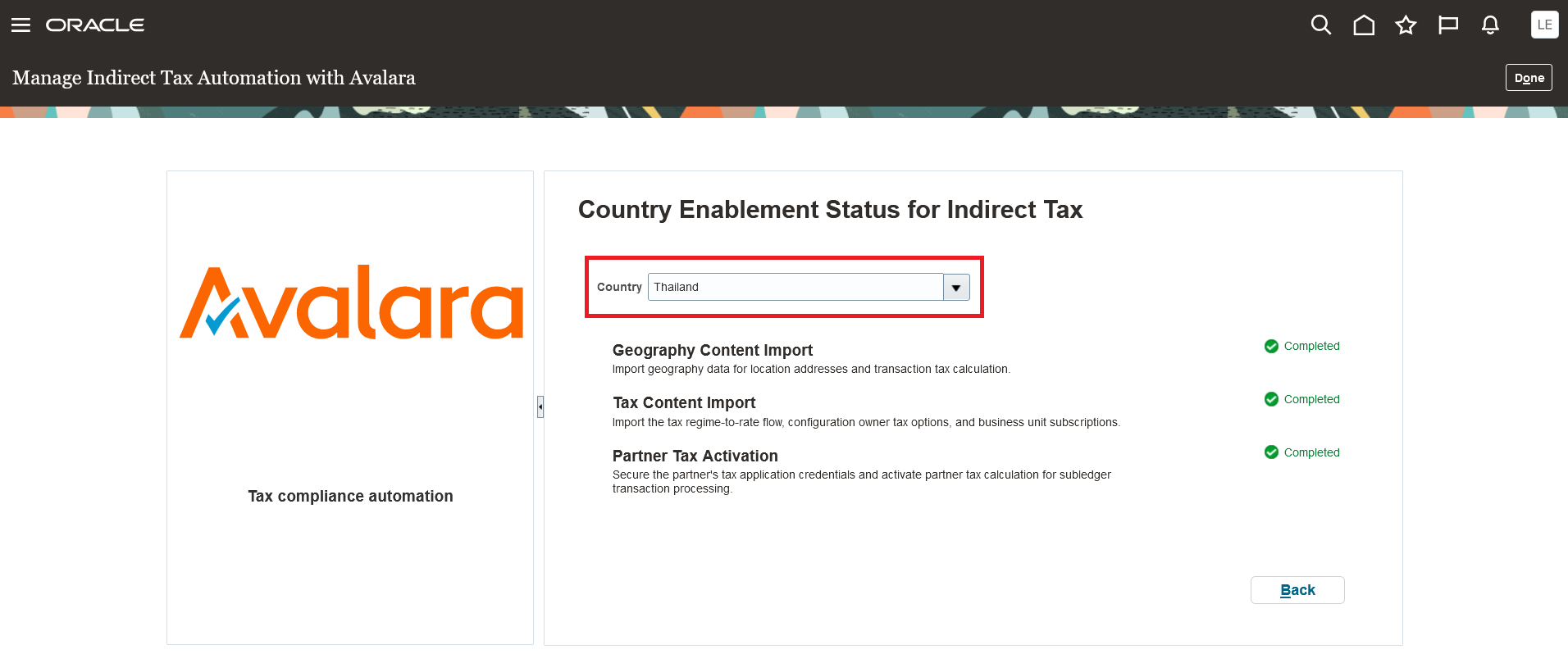

You can view the status for each individual task for countries for which enablement is in progress or is complete by choosing the country and clicking on View Status Details.

The page displays three required tasks.

- Geography Content Import - Loads the geography data which is used for addresses and transaction tax calculations.

- Tax Content Import - Loads the regime-to-rate flow setup, configuration owner tax options and business unit subscriptions.

- Partner Tax Activation - Activates partner tax calculation for subledger transactions.

Oracle customers need real-time access to tax compliance solutions as part of their ERP. Oracle and Avalara have pre-wired and pre-configured the two systems to streamline and automate the integration between them and reduce ERP implementation efforts and costs. This integration which was available for the United States is now available for all countries supported by Avalara.

Steps to Enable

You don't need to do anything to enable this feature. However, you must complete some pre-requisite setups before you can initiate the enablement from the Manage Indirect Tax Automation with Avalara page.

- Complete the registration process with Avalara and get the login details.

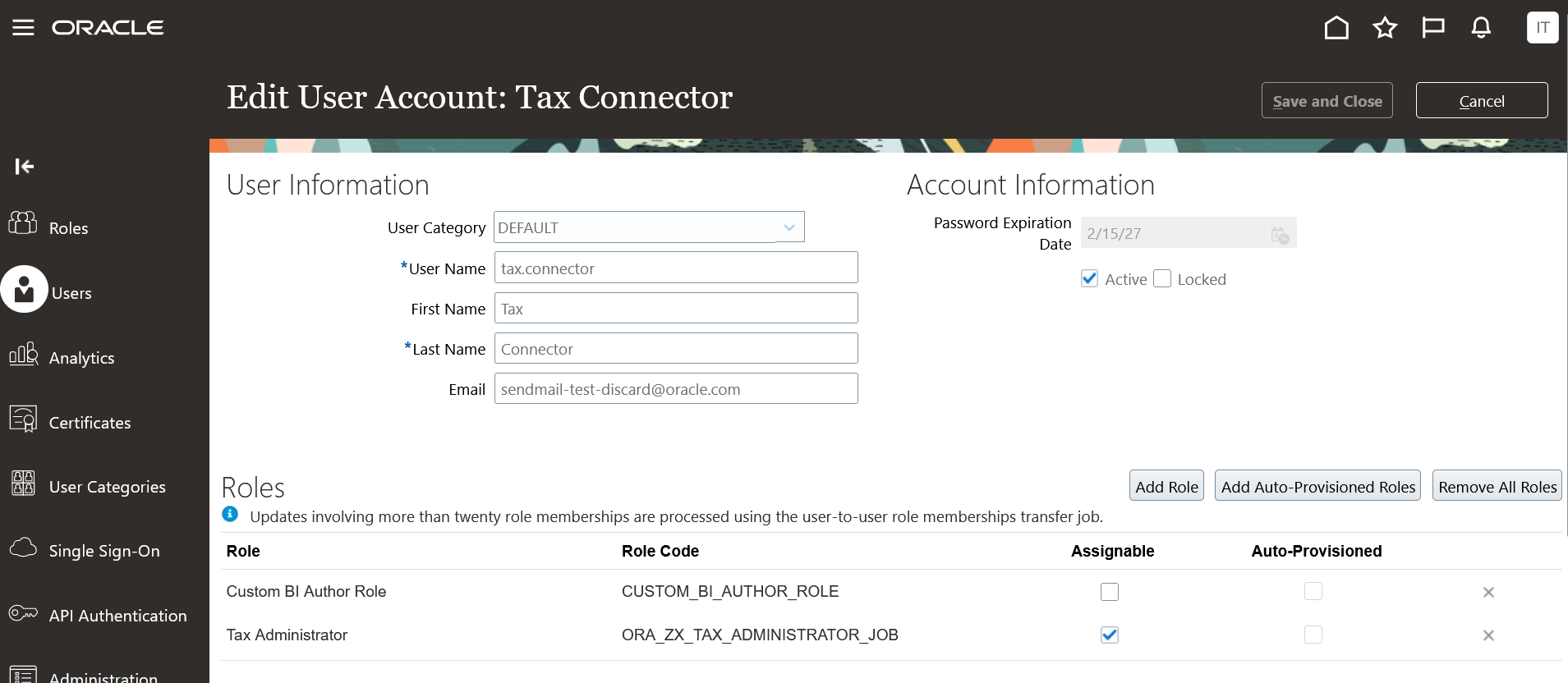

- Create a new Oracle user and assign the Tax Administrator role to the user.

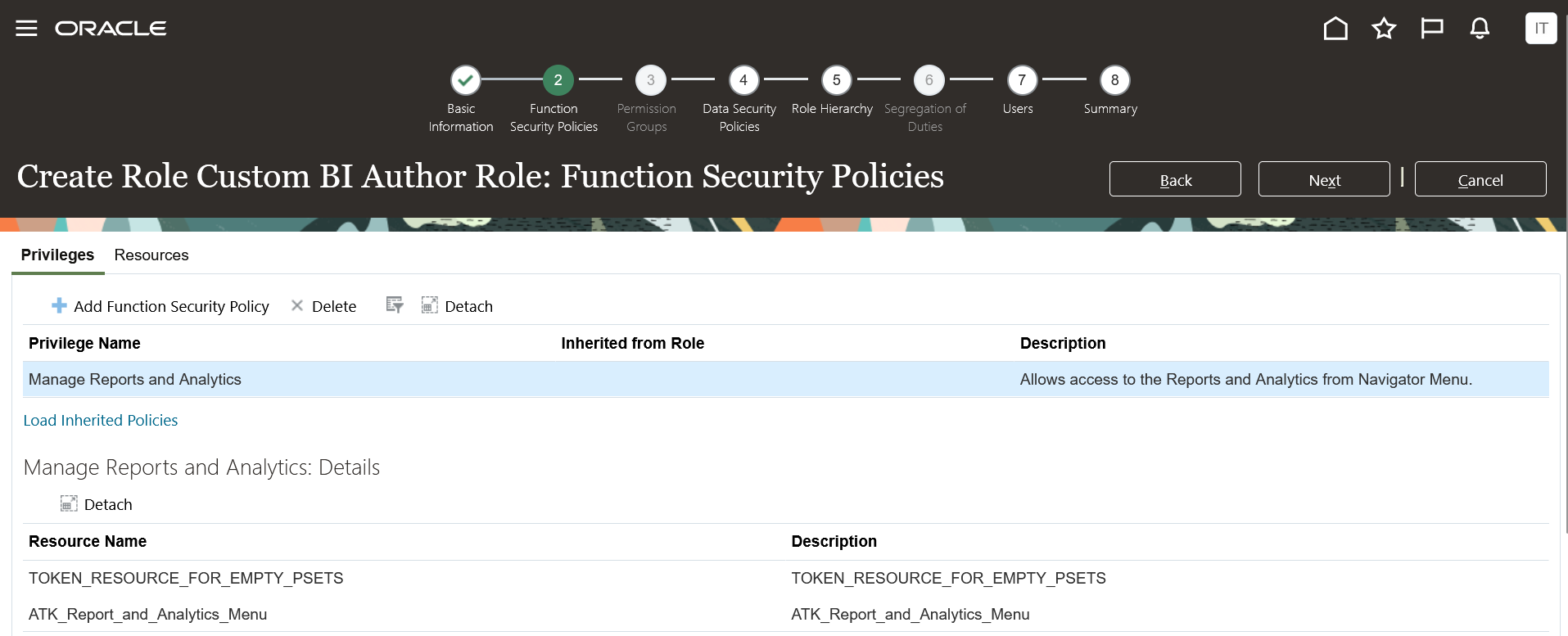

- Create a new custom role with Role Category of BI - Abstract Roles. Add the Manage Reports and Analytics privilege to the role and add the user created in the previous step to this role.

- Role Name – user defined value

- Role Code – user defined value

- Role Category – BI – Abstract Roles

- Description - user defined value

The user should now have both the roles assigned.

- Run the Retrieve Latest LDAP Changes process followed by Send Personal Data for Multiple Users to LDAP process.

You can use this user to initiate the enablement and provide the same user to Avalara on the Oracle Readiness for Avalara Enablement page. It is displayed once you initiate the enablement and login using your Avalara credentials for the first time.

Tips And Considerations

- The Oracle Fusion Cloud ERP customers who are also Avalara customers can take advantage of this automated enablement process. There may be limitations on using this process. Contact Oracle for assistance.

- The automated enablement process is only for initial configuration. For incremental updates, you should use your existing processes.

Key Resources

- For an overview of tax partner integration and processing refer to the following topics on the Oracle Help Center.

Access Requirements

You need to have a job role assigned that has the privilege Manage Tax Partner Configuration (ZX_MANAGE_PARTNER_CONFIGURATIONS_PRIV) to access the Manage Indirect Tax Automation with Avalara page. The Tax Administrator role has this privilege so you can access the page if you have this role assigned.