Amortized Liability Balance Method for Lease Liability Reclassification

Amortized Liability Balance Method for Lease Liability Reclassification

Automatically account for short-term and long-term lease liability. The IFRS 16 and ASC 842 accounting standards require breaking out the lease liability into short-term and long-term for disclosure reporting.

In addition to the lease liability classification option based on the present value method, Lease Accounting offers an alternate option to classify lease liability based on the amortized liability balance method. In this method, the long-term liability is calculated by discounting cash flows starting from the 13th month. The short-term liability is then calculated as the difference between the total discounted lease liability at the current month-end and the long-term liability.

Lease administrators can automatically generate accounting entries to classify the lease liability into short-term and long-term, and account for the periodic movements from long-term to short-term.

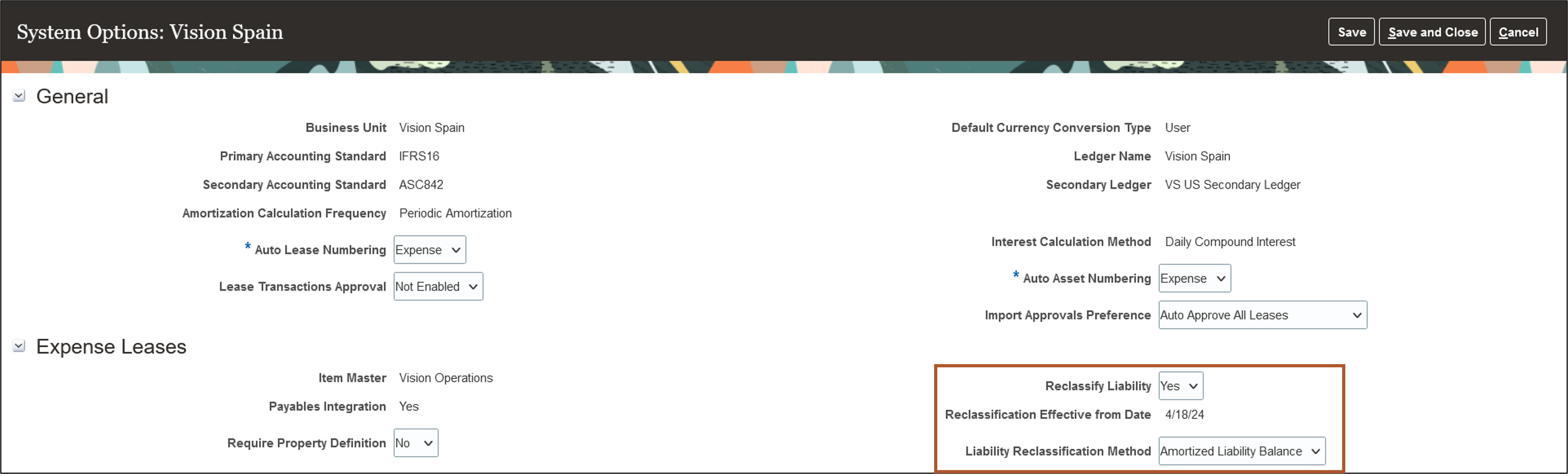

Configure lease system options to use the Amortized Liability Balance method for lease liability classification.

Configure System Options

Business Benefits:

- Simplify compliance with IFRS 16 and ASC 842 lease liability accounting.

- Increase efficiency and reduce the risk of manual errors with automated period-end processes.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 25A

Access Requirements

You do not need any new role or privilege access to set up and use this feature.