Prospective Accounting Treatment for Performance Obligations Using Point-in-Time Revenue Recognition

Use the prospective accounting treatment to reflect minor volume changes, pricing changes, or additions of performance obligations defined with a point-in-time revenue recognition satisfaction measurement model.

Certain contract amendments involve minor changes in volume or price. These changes are future oriented with no impact on the recognized revenue. You can now account these changes using prospective accounting. This feature extends the prospective accounting treatment to performance obligations with a point-in-time revenue recognition model.

For immaterial changes in quantity, unit selling price, or unit list price of an obligation with a satisfaction measurement model of quantity and percentage, the changes are now reflected in the revenue by reallocating the unrecognized revenue on the open performance obligations of the contract. This applies to current and future periods only doesn't impact the revenue that has already been recognized.

In addition, if you add a new point in time performance obligation to an existing contract, this can also be considered as an immaterial change to trigger prospective accounting.

The changes are reflected from the contract revision date. The date on which the immaterial changes occur is sent to Revenue Management as the contract revision date.

All performance obligations that are not fully satisfied are open performance obligations and the remaining transaction price is allocated among all open obligations. This includes the obligations that have the satisfaction measurement model as Quantity and Percent.

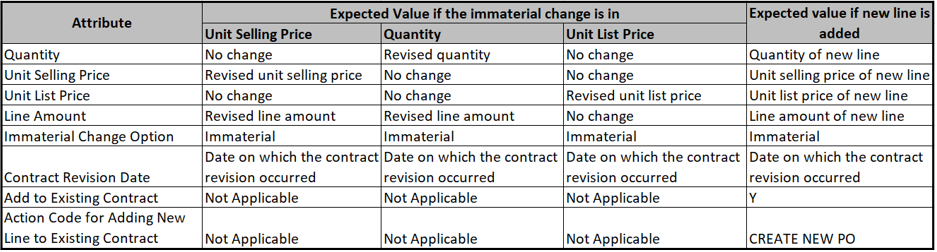

Key Attributes

This table shows the key attributes that should be populated for each scenario:

Key Attributes

Example

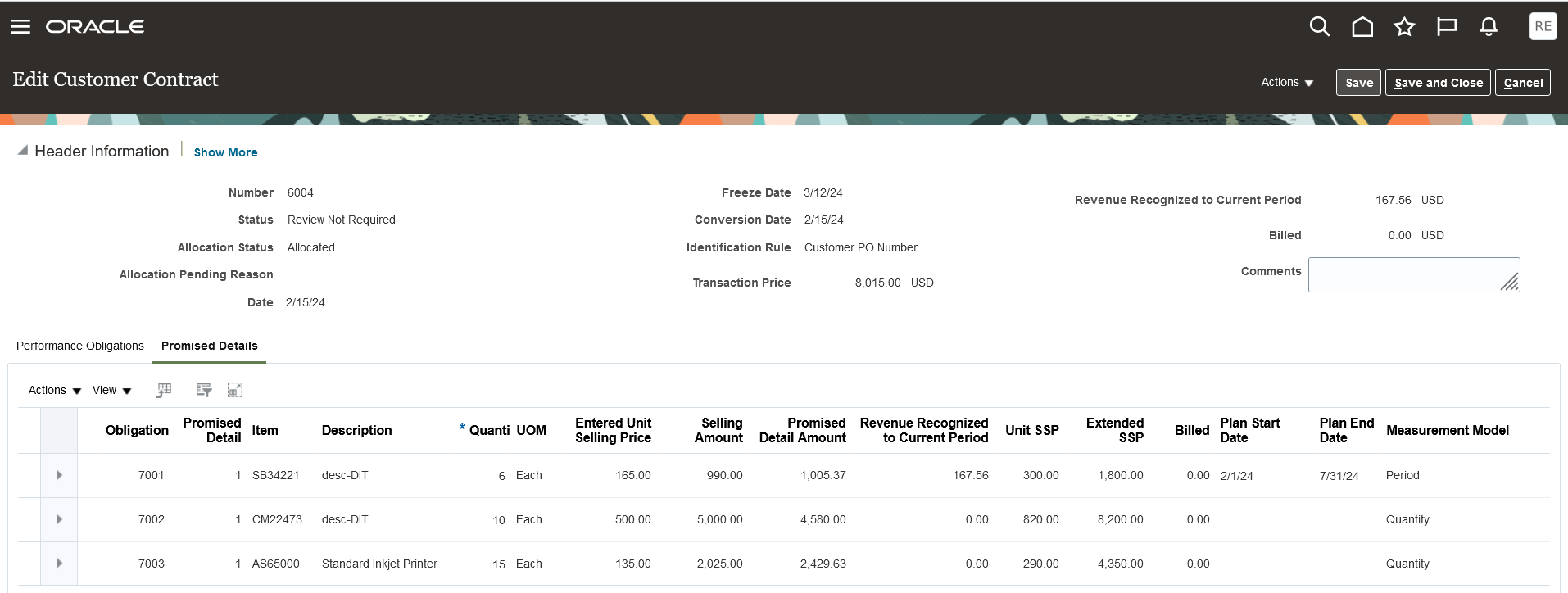

You create a customer contract with three performance obligations, two of them with satisfaction measurement model of Quantity and one with satisfaction measurement model of Period. This screenshot shows the initial customer contract created, along with allocated amount and recognized amount:

Initial Contract

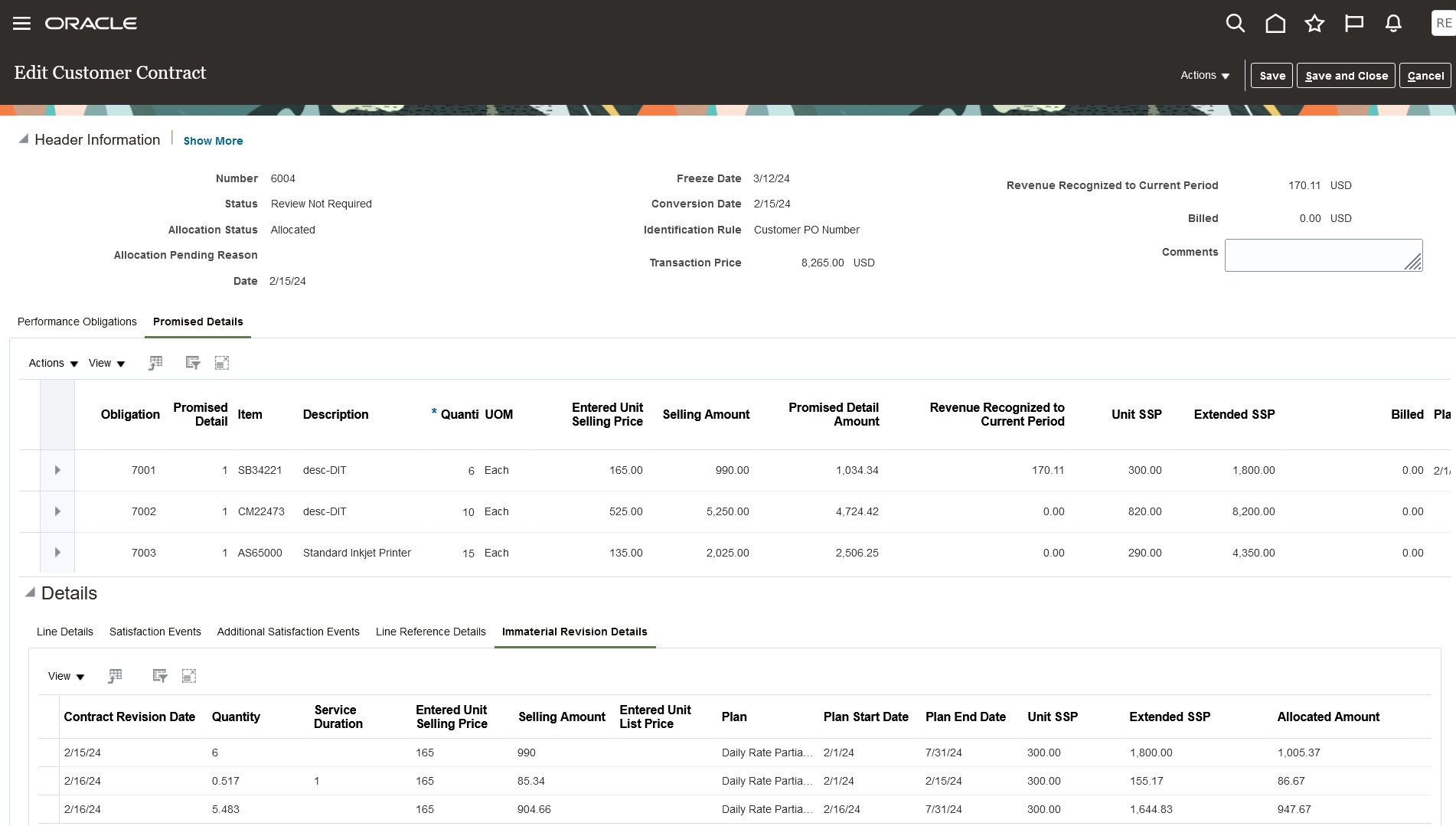

There is a change in the unit selling price of the item CM22473 from 500 USD to 525 USD with a contract revision date of 16-Feb-2024. You import the contract modification with an immaterial change type of Immaterial. The Identify Customer Contracts process triggers prospective accounting. After prospective accounting, the contract looks like this:

Contract after immaterial price change

You can see that the revenue recognized until 15-Feb-2024 (the day before the contract revision date) is intact while the reallocation of the new transaction price takes place from the contract revision date. The details of the allocation before and after the contract revision date are displayed in the Immaterial Revision Details sub tab.

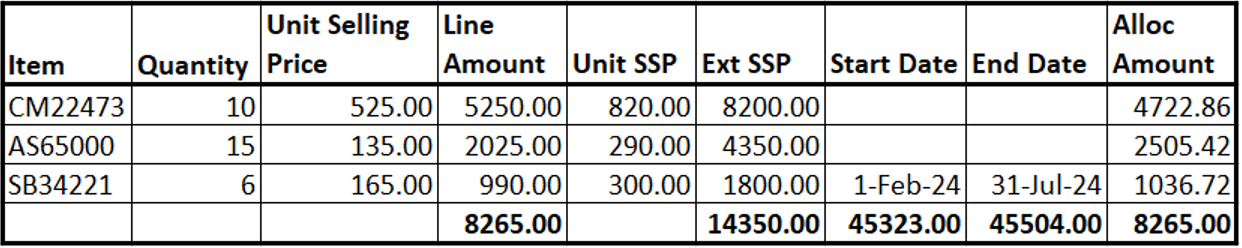

When the contract modification triggers retrospective accounting, the allocated amounts of each obligation look like this:

Allocation of the contract if the price change undergoes retrospective accounting

For immaterial changes in the volume or price of point-in-time performance obligations, the revenue reallocation impacts only current and future periods. Revenue that has been recognized up to the contract revision date is not impacted.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

-

This feature is available only for data imported through third party sources.

- For integrated ready-to-use Cloud applications, use the new Source Document Lines REST API to update the required attributes to trigger prospective accounting.

- If the contract has a performance obligation created out of a performance obligation template, then prospective accounting is not triggered.

- You can't discard customer contracts that have undergone prospective accounting.

-

Source document lines that fail the validation by the Validate Customer Contract Source Data process can be corrected through the error correction spreadsheet.

-

The default value for the Immaterial Change Type field of the Manage Source Document Types page also applies to point-in-time performance obligations.

-

Returns will be processed as retrospective accounting.

-

If multiple lines or versions of a contract are processed together, the contract will undergo retrospective accounting whenever some lines have the Material option and some lines have the Immaterial option.

Key Resources

- Refer to the Revenue Management documentation for further information on processing immaterial changes and how to import revenue data using the Revenue Basis Data Import file-based data import template.

Access Requirements

No new role access is needed to use this feature.